What is Liquidity Mining? Liquidity Mining is a method born in the early development of DeFi, projects often use Liquidity Mining to attract liquidity from users in the market. Up to now, although there have been some changes, Liquidity Mining is still a solution that many projects choose to bootstrap TVL or liquidity.

So what is Liquidity Mining and what attracts users and projects so much? Let’s find out together in the article below.

What is Liquidity Mining?

Current market context

The ICO events of the crypto market have made investors realize that it is an unfair fight where most of the large tokens belong to the Development Team and Investors. Retail Investors like us, also known as Retails, want a fairer game where tokens are used for their intended purpose, which is to develop the protocol.

Besides, the crypto market is also looking for token deployment solutions that ensure fairness for participants and also help the protocol develop. And so Liquidity Minig was born and became an indispensable part of DeFi.

Overview of Liquidity Mining

Liquidity Mining (LM) is an event where users who participate in using the protocol will receive back the project’s native token developed on the platform of DeFi projects in late 2019 and early 2020.. Some easy-to-understand examples are as follows:

- Users borrow and lend on Lending & Borrowing platforms.

- Users participate in providing liquidity on AMM platforms.

- Users participate in staking on Liquid Staking Derivatives (LSD) platforms.

- Users deposit assets into Yield Farming platforms to hopefully earn more profits in the Lending & Borrowing segment.

Thanks to the above activities, users receive the project’s native token as a reward, and the project begins to have its first users, one of whom will be their loyal user, starting TVL. , Volume growth. It can be said that with Liquidity Mining, everyone is happy when everyone achieves their goals.

The concept of Liquidity Mining is very simple, however, the way to implement Liquidity Mining is extremely diverse. We have several implementations as follows:

- Fair Launch: Is a form of releasing 100% tokens to the community through the Liquidity Mining program. Rewards are more or less based on user contributions. Fair Launch will not have a percentage for the core team or investors.

- Bootstrap TVL: Are projects that deduct 20% or more of their tokens to reward their real users. This amount of tokens is determined by the project within how long it takes to pay, so at this time the project’s TVL shows signs of increasing sharply.

Projects leading the Lqiuidity Mining trend

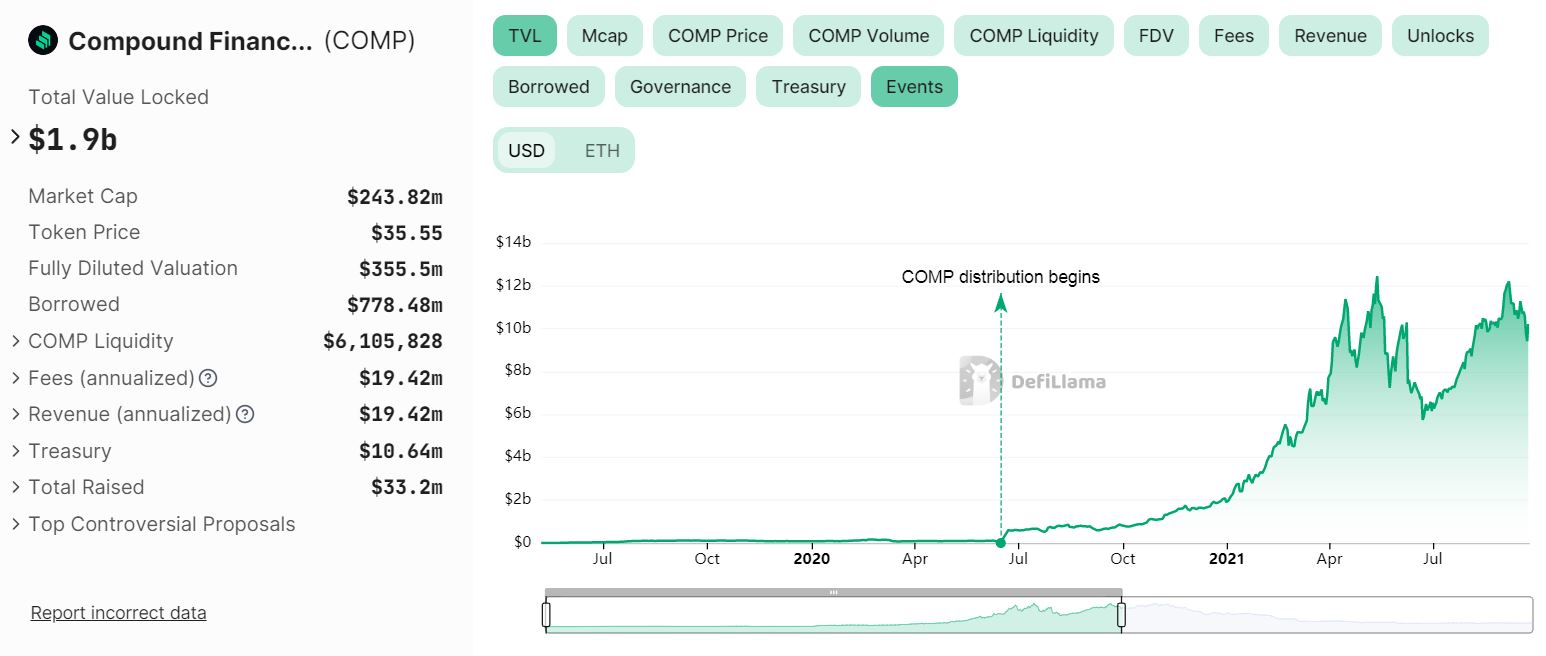

Compound’s TVL explodes after implementing Liquidity Mining

Today, Liquidity Mining has become an indispensable part of the project’s liquidity bootstrap and TVL strategy, but if we go back to history, we will have some of the following problems:

- Uniswap: Being the first decentralized exchange (DEX) to implement the Liquidity Mining strategy, then the liquidity on Uniswap thickened and created a vortex that caused Uniswap to maintain liquidity thanks to increased fees and more people at the same level paying clause. Uniswap starting from September 16, 2020 to November 17, 2020 TVL increased from nearly $1B to more than $3B.

- Compound: Compound’s TVL increased from $91M to $12B by about 131 times. Compund is the first Lending & Borrowing platform to implement Liquidity Mining. Compound started deploying from June 16, 2020.

Compound’s implementation of LM was so successful that new projects took turns learning and implementing it.

Some advantages and disadvantages of Liquidity Mining

Advantages of Liquidity Mining

LM has brought a cool breeze to the DeFi market in particular and Crypto in general, strongly promoting the flow of money into the crypto market. Some outstanding advantages of LM include:

- Everyone is happy: Users get rewards for their efforts and the project gets liquidity, TVL takes the first step in building the project. It can be said that LM creates a fairer game between protocol, project and

- Bootstrap for each project such as the platform’s AMM liquidity segment will become thicker, the TVL of DeFi platforms will increase, also making the project’s reputation greater in the eyes of the community.

- Encourage users to truly participate in DeFi.

- Build a strong and fast community with tangible benefits.

With clear benefits, LM has become a part of DeFi from its inception until now.

Disadvantages of Liquidity Mining

Besides the great advantages and benefits that LM brings, LM also has certain disadvantages:

- Attracting users with benefits, when the benefits end, users also leave the project. TVL and Volume both decrease.

- Farming too many native tokens causes many people to sell tokens, causing the token price to dump => Incentive’s value is reduced => Users leave the project => TVL and Volume both decrease. Or if Incentive is reduced in value => The project increases incentives to compensate for the reduced price => more tokens are farmed => more tokens are sold => Incentive is reduced in value => Users leave the project Project => TVL and Volume both decreased.

- Fierce competition: Too many AMM, Lending & Borrowing as LM makes competition extremely fierce.

- Liquidity fragmentation: Along with fierce competition, liquidity fragmentation leads to greatly limited user experience on the protocol.

- Hack, Rugpool: The fact that there are too many projects using LM causes many scam and fraudulent projects to appear, worsening the image of the original DeFi.

Liquidity Mining Has Changed With Many Variations

The problem arises

LM has indeed helped projects pass the first stage of bootstrapping into accounts & TVL, building community,… but Most projects fail when the LM program ends or when the native token price is dumped too much makes LM no longer effective. Users again jumped to projects with better and more profitable LM programs.

In the next stage, the project needs to have more strategies to reduce Incentive but liquidity must not decrease too much (of course there will still be a decrease but not to pre-LM levels).

Methods for change

Some of the proposed solutions solve LM’s persistent problems as follows:

- Staking: Staking is one of the programs that encourages users to stake native tokens to receive the project’s native tokens. Staking was initially introduced to be effective as long as users did not dump native tokens to stake. However, this is not a long-term solution.

- Lock & Release: This is a method where the user’s rewards will be paid over time in a vesting style instead of a one-time payment to the user. These are currently still many projects being used on the market.

- Lockdrop: This is the method proposed by Delphi Digital and applied to a number of projects that Delphi invests in such as Bastion Protocol or Astroport. With Lockdrop, users will lock liquidity into the protocol and receive rewards. The longer they lock, the higher the reward.

- Build use cases: Protocols will focus on building use cases for native tokens so that native tokens can be used for many different protocols to help users have motivation to hold tokens.

Although many solutions have been proposed, LM is still a double-edged sword in development. Up to now, many projects use LM to create initial motivation and then go into sustainable development, but there are also projects that abuse LM, then the project will certainly not be able to develop. long term.

Some criteria to evaluate projects using LM successfully

Above are some of the personal experiences I have observed with a number of projects using LM and have been relatively successful such as:

- The project must have a core team that truly understands the crypto market and has experience building or working in DeFi projects.

- The project must have MM to solve the liquidity problem for tokens. MM not only provides liquidity but also participates in the token support process.

- The project’s APY can be up to several hundred or several thousand, but only for a short period of time, not for a long period of time.

- The project itself must know how to build use cases for its native token and have marketing strategies to attract investors to join the project.

For example, on Arbitrum there are many projects that use LM to bootstrap project liquidity such as Radiant Capital, Camelot, 3xcalibur, SwapFish, ZyberSwap, SolidLizard, ArbSwap,… however up to now there is only Radiant. Capital, Camelot is to maintain their position. With Radiant Capital’s story, it is the ingenious Marketing strategy, and with Camelot, it is the presence of quality Launchpad.

The future of Liquidity Mining

I firmly believe that at the present time LM has made evolutions to limit its weaknesses and continue to develop. LM will definitely stay and grow with the crypto market. However, everyone should know which projects know how to “use” or “abuse” them so they can know how the project goes to have a suitable investment strategy.

Summary

LM is an irreplaceable part in the history of DeFi and is a great driving force helping DeFi develop strongly to the present time. Minh firmly believes that not only is LM the past but also the present and future of DeFi. Reality proves that many DeFi projects are still successful with LM.