What is Liquidity As a Service abbreviation LaaS? LaaS are projects that consider providing liquidity to protocols, DAOs, etc. as a paid service, in return for projects having abundant liquidity without fear of Liquidity Mining issues. create. So if there is anything interesting about LaaS, let’s find out together in the article below.

To better understand Liquidity As a Service, people can refer to some of the articles below:

- What is Tokemak (TOKE)? Overview of Tokemak Cryptocurrency

- Tokemak V2: Entering the LSDfi & Stablecoin Market

- What is Ondo Finance (ONDO)? Overview of Cryptocurrency Ondo Finance

- What is Conic Finance (CNC)? Overview of Cryptocurrency Conic Finance

Overview of LaaS

Outstanding problems in DeFi

Liquidity Mining is the revolution that makes DeFi explode with the start coming from Compound. It can be easily understood that users participate in using the protocol and receive a reward of the project’s Native Token. It can be said that this is a win-win strategy between the project, users or liquidity providers. But Liquidity Mining is also a double-edged sword that can kill a project before it can mature.

For example, we have the following problem. Project A has just launched and to attract liquidity, TVL project has issued Token A1 to carry out the Liquidity Mining campaign. The deadly Flyweel will take place as follows:

- Step 1: Project A issues A1 tokens to implement the Liquidity Mining program.

- Step 2: Users participate in using the protocol in the form of providing liquidity for the project to operate.

- Step 3: User receives A1 reward from the project.

- Step 4: Most users will sell A1 to exchange for Stablecoins or Altcoins of great value because this is essentially a form of business. This happens with most projects including A1 that have more or less Use Cases.

- Step 5: Token A1 has a strong discount.

- Step 6: Incentive value gradually decreases. For example, the user initially provides a bar of about $10,000 to receive an A1 reward equivalent to $200 per day. But the pressure to sell A1 was so great that $200 dropped to only $150, then $100, then $50.

- Step 7: Too little Incentive leads to users stopping providing liquidity. The project ran out of liquidity and died. If at this time the project continues to pump more Incentive, go back to step 4.

Obviously, Liquidity Mining is a double-edged sword. If you know how to use LM methodically and professionally, the project will be very successful and vice versa. However, one thing is certain: LM has a negative impact on the price of Native Token, which is why LaaS was born.

What is LaaS?

LaaS stands for Liquidity As a Service, roughly translated as Liquidity As a Service, referring to projects that specialize in renting liquidity to other projects. Roughly understood, a project that has just started or has been started for a long time needs to bootstrap liquidity for its pool but does not want to use Native Tokens or does not want to use too many Native Tokens, then it will take money to rent liquidity. from protocols that specialize in this service.

Thanks to LaaS, the project does not have to worry too much about Native Token being dumped too hard, leading to no longer being attractive to liquidity providers. Besides, in the context of a bad market, LPs are hesitant to provide liquidity because of concerns about the risks of Hack, Rugpool, Smartcontract,… so using more Native Tokens to make Incentive is not an option. long-term strategy.

With LaaS, projects immediately get the amount of liquidity they want and are very sustainable without having to worry about all the liquidity evaporating in just a few hours.

Some of the disadvantages of LaaS include:

- Liquidity rental costs will be much higher. This will be suitable for projects that have stable revenue, users, or projects that have successfully called for capital. As for projects that don’t have anything yet, this is a quite difficult product to access.

- Liquidity is rented sometimes more than necessary, which wastes liquidity in a DeFi context that is very thirsty for liquidity.

Some Potential Projects In LaaS Array

Tokemak – LaaS industry leading project

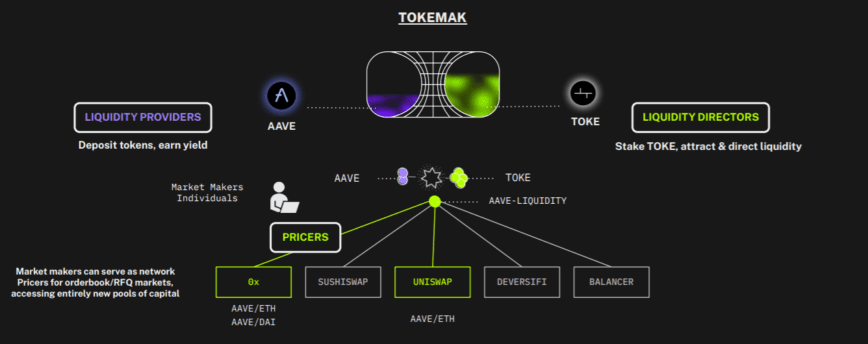

Tokemak is the first project to introduce the LaaS concept. Tokemak’s product launch has received widespread support from the Crypto community with many participating projects such as Balancer, Curve Finance,… Tokemak’s operating model is relatively simple with a few basic steps. as follows:

- Step 1: Users provide liquidity into the same pool (there will be many different pools such as ETH, USDC, DAI,…)

- Step 2: Protocol will come to rent. Too many protocols rent liquidity, for example renting ETH will go through an auction.

- Step 3: The protocol together with Tokemak pairs liquidity on different AMM platforms.

Tokemak is the only project that has so far persistently pursued the LaaS segment with the V2 update. Tokemak continues to optimize and upgrade the product to attract users and protocols. Everyone can refer to the article Tokemak V2: Entering the LSDfi & Stablecoin Market to understand what Tokemak is ambitious to build in the future.

Ondo Finance – Leaving LaaS for RWA

An exception that I want to introduce to everyone is Ondo Finance. But because it is not an industry-leading project, it is possible that Ondo Finance has not been doing business effectively for a relatively long time. In the past, Ondo Finance had the ambition to hold both LaaS and RWA but in reality it did not give them that much choice.

Finally, Ondo Finance eliminated the LaaS product and focused on developing RWA products such as OUSD, USDY, OMMF,…

Conic Finance – LaaS exclusively for Curve Finance

Conic Finance builds a common liquidity pool called Omnipool, which aggregates all user liquidity deposits and then distributes liquidity according to weight into Pools on Curve to earn profits.

It can be said that if Tokemak focuses on distributing to many different AMM platforms such as Curve Finance, Uniswap V3 or Balancer, Conic Finance only focuses on Curve Finance. The Conic project itself is also more or less related to Curve’s development team.

Summary

Although LaaS is a thing of the past in DeFi, it is labeled DeFi 2.0. Can LaaS come back and explode once again with the DeFi market?