In the context of a rapidly moving cryptocurrency market, optimizing returns from staking tokens in blockchain platforms becomes an important part of the investment strategy. We have witnessed the growth wave of LSD and the birth of a series of LSTs, along with the new niche of Restaking with many projects, the most prominent of which is Eigenlayer with a valuation of more than $2B equivalent to Layer blockchains. 1 large.

However, the traditional Staking model and even Restaking still have limitations, and Liquid itself Restaking Token (LRT) has emerged as a potential solution to these problems. In this article, we will learn in detail What is LRT? and potential projects in this field.

Overview of Liquid Restaking Token

What is Liquid Restaking Token (LRT)?

LRT – abbreviation for Liquid Restaking Token – This is a token that represents the amount of assets staked in the smart contract of the Liquid Restaking Protocol (LRP) protocols.

At this point, we come across another concept that needs to be explained before continuing into the article:

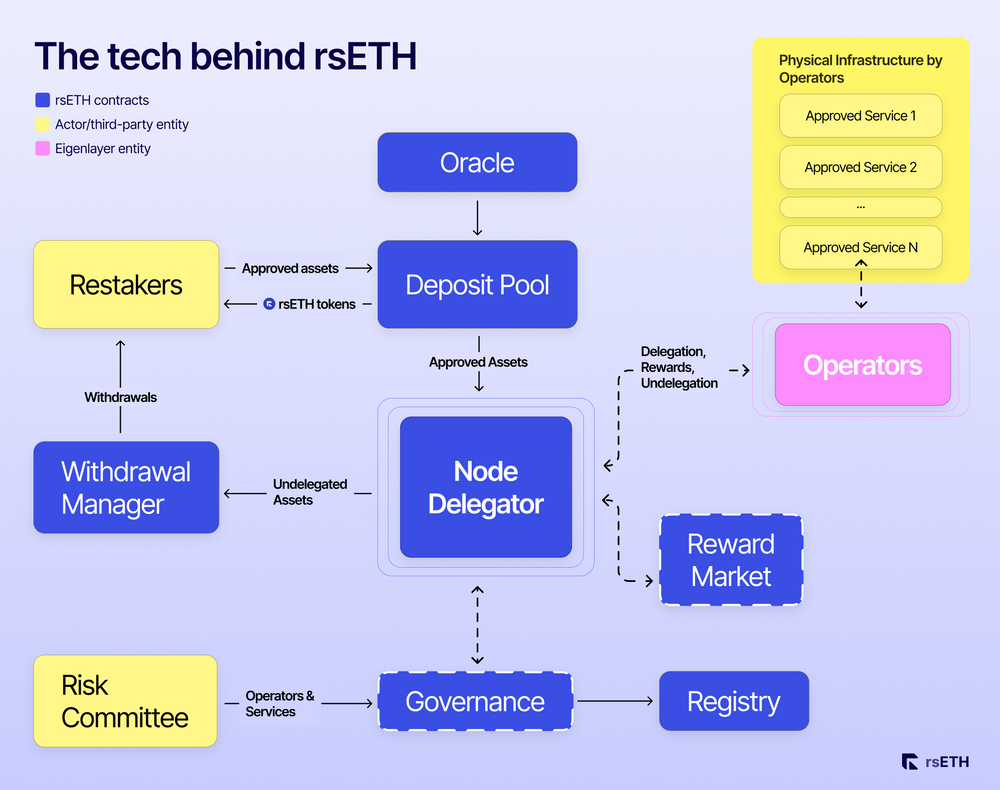

LRP (Liquid Restaking Protocol): These protocols are Built on-top the Restaking project (Eigenlayer), yes intermediary role On behalf of token holders, optimally allocate their assets to validators in the Restaking project & collect a portion of the fees from the generated profits.

Background of Liquid Restaking Token (LRT)

LRT is a new term that was introduced in the middle of Q3/2023 and was quickly widely mentioned in the Crypto community after Eigenlayer, the staking protocol, is receiving great attention in the market but barriers still exist. like:

- Liquidity limits: Model Restake The drawback is that once a user has staked ETH or LST, it means locking capital into the protocol. Restaking projects like Eigenlayer do not create an asset class that represents the amount of ETH and LST staked for users to continue using in DeFi.

- Difficulty in Choosing Validator: Choosing an unreputable Validator will be punished quite heavily, but for a small investor, determining whether a Validator is good enough is relatively difficult due to lack of technical knowledge and insufficient connections.

- Profits are less attractive: In DeFi, users are always hungry for yield, limiting the yield for users of restaking from 2 sources of LST and restaking fees unintentionally reducing the appeal of this niche in the eyes of users.

The above limitations of Restaking are also the reason for the birth of LRT when replacing users to find good Validators to optimize the profits generated, while creating an additional layer of secondary assets, LRT tokens, to further participate in DeFi. Helps increase yield sources, while also increasing liquidity or flexibility for owners when there is a need for capital.

Working mechanism of Liquid Restaking Token (LRT)

The operating mechanism of LRT is relatively simple and quite similar to the Liquid Staking DeFi (LSD) model on the market:

- Users deposit their ETH and LSTs into Liquid Restaking Protocol (LRP) projects and receive a corresponding amount of LRT.

- LRP manages and optimizes returns from Retake on platforms like EigenLayer.

- Users are no longer tied to capital, and they can use the amount of LRT received to participate in DeFi such as farming, lending or selling when there is a need to exit the position.

Some Reasons LRT May Become a Trend

Some of the reasons that could push LRT to become a trend include:

- Attracting large investors: The LRT model has a Ponzi element as it helps investors generate more profits from holding $ETH and can leverage positions through DeFi applications such as lending, which is relatively suitable for the accumulation period before the uptrend. This is something that $ETH whales really like.

- Multi-layered profits: LRT allows users to optimize profits by Stake assets through many layers, creating high profit opportunities to help increase TVL and create FOMO.

- FOMO via native token: Users can receive additional rewards from native tokens as incentives and airdrops from projects like EigenLayer, LRT.

- Competition in the market: The LRT model promises to bring exciting competition between projects, promoting the growth of token prices.

Potential projects in the LRT field

- Stader Labs: This is a long-standing project in the LSD field on many different L1 blockchains. In early 2023, Stalder also introduced $xETH – LST on the Ethereum ecosystem and quickly rose to 12th place according to TVL ($36m). Stader is also one of the first projects to deploy LRT with the $rsETH token currently in the testnet phase.

- Astrid Finance: is an LRP project with Retake capability, the highlight of Astrid is the ability to automatically compound yield to increase profits.

- Inception: Similar to Astrid, Inception currently supports stETH, rETH and cbETH LSTs in the latest testnet.

Conclude

Hopefully this article helps you understand more What is LRT and potential projects in the LRT segment. From a personal perspective, I see the advantage of LRT as solving the liquidity problem for users of restaking platforms while creating a new asset class with good liquidity based on the original asset ETH (layer 2: LST – grade 3: LRT). Those are the points that will probably make LRT a trend. In the opposite direction, the factors influencing LRT will be native staking protocols like EigenLayer – the need for success and widespread adoption. In addition, LRP itself also needs to be carefully audited because this will be the target of Hackers when holding relatively many assets.