What is Lido Finance? Lido Finance is a decentralized Liquid Staking protocol aimed at multichain development. Lido Finance is currently extremely successful with its position, having captured the majority of the market share on Ethereum and other chains. Join us to learn more about this Lido Finance project!

To understand more about Lido Finance, people can refer to some of the articles below:

- What Are Liquid Staking Derivatives (LSD)? Top 5 LSD Projects with Great Growth Potential

- What is Liquid Staking? Develop Forever with L1 Wars

- Liquid Staking Will Continue to Grow Strongly in the Future

Overview of Lido Finance

What is Lido Finance?

Lido Finance is a decentralized protocol belonging to the Liquid Staking category operated and developed by DAO. Lido Finance solves the liquidity problem for users participating in staking.

Lido Finance is formed by 4 elements:

- Staking Pool: Is where you stake your assets into Lido Finance.

- stToken: Are the derivative assets you receive that represent the assets you deposit into the pool. stToken can be used for lending, collateral, yield farming and is present in many DeFi protocols.

- KNIFE: Lido Finance is maintained and developed by DAO which decides most of the proposals on the project.

- Node Operators: Are partners of Lido Finance. They are professional, experienced staking service providers, ensuring the safety of users and the Lido protocol.

Operating Model

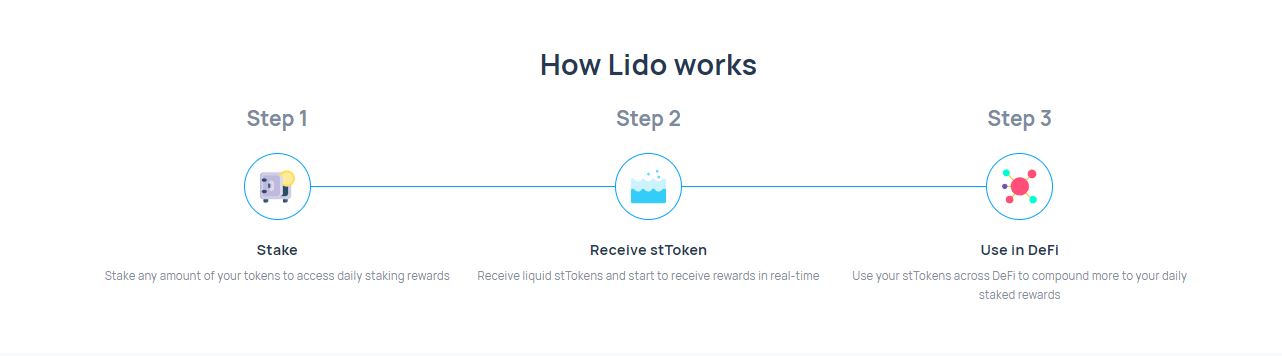

It seems that a relatively simple way of operating model of Lido Finance is as follows:

Normally you own Near, Solana idle in your wallet but you are worried about the risks when participating in providing liquidity with DEXs or participating in lending on Lending & Borrowing platforms and to be safest you choose to participate. staking price. But the problem is that your assets are kept in smart contracts, and if you want to take them out, it can take a few minutes or even a few dozen days.

Liquid Staking projects will relieve this problem for users. For example: When a user participates in staking ETH, the user will receive stETH in an equivalent amount (If you stake 1 ETH, you will receive 1stETH, if you stake 100 ETH, you will receive 100 stETH). Lido Finance will create liquidity and use cases for stETH so that users can use it optimally if stETH can be used as collateral on many Lending platforms on many different chains.

Attention: You will still receive normal staking profits while holding stToken to participate in various DeFi activities (Farming, Lending, Trading,…).

Development Roadmap

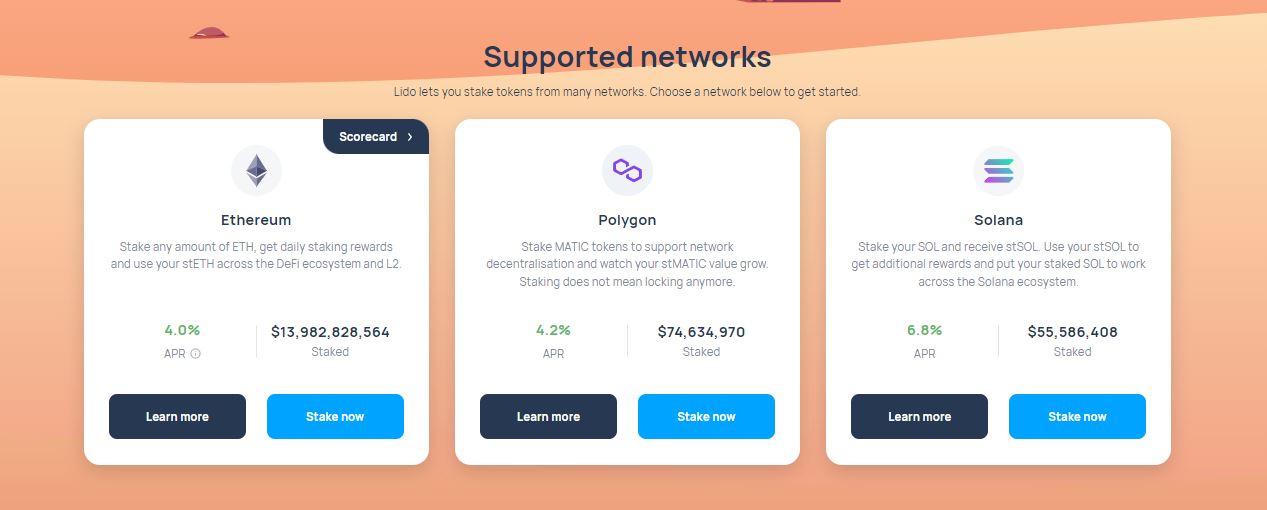

Up to now Lido Finance has supported many platforms such as Ethereum with stETH, Solana with stSOL, Polygon with stMATIC, Polkadot with stDOT and Kusama with stKSM. Previously, Lido Finance also supported Terra (LUNA) with stLUNA, but when Luna – UST collapsed and there was no way to save it, Lido Finance decided to stop supporting Terra through on-chain voting.

In the future, Lido Finance’s plan has 3 specific roadmaps:

- Make stToken assets available and accepted in many DeFi protocols.

- Bring stToken assets to many different blockchains. For example, stETH will soon be available on Arbitrum and Optimism.

- Supports more asset types. In the future Lido Finance is expected to support additional assets such as Near Protocol, Avalanche and more asset types.

Besides, Lido Finance has undergone a number of updates with goals such as:

- May 16, 2023: Faced with problems with Lido Finance making the Ethereum network more centralized when switching to PoS, Lido has released version V2 to solve this problem. To understand more about Lido V2, people can read the article Lido V2: Towards a Perfect DeFi Protocol.

Core Team

The Lido Finance development team is a decentralized autonomous organization (DAO). The initial members who contributed to laying the foundation for Lido Finance are extremely prominent individuals in the market such as:

- Anton Bukov is Co Founder of 1inch (DEX Aggregator platform).

- CryptoCobain is a KOL with more than 500k followers on twitter and is also the Co Founder of Ethereum.

- Banteg is a member of the core team of the yEARN Finance project.

Partner

Lido Finance has an ecosystem that includes partners from the DeFi world and partners from professional staking service providers.

Lido Finance has many partners deploying validators such as Stake Fish, Everstake, Figment, Allnodes, Nethermind, Kukis Global, Chain Safe, Any Block, Rock Logic,…

stToken’s ecosystem includes many projects in the DeFi world such as AAVE, Maker DAO, Sushiswap, Zapper, Yearn Finance, Balancer, 1inch,…

Investor

Lido Finance has had a total of 4 capital calls since 2021 with a total amount raised of $167M.

- May 5, 2021: Lido Finance successfully raised $51M for the first time by Paradigm.

- May 5, 2021: Right at that time, Lido Finance announced its successful call for $22M with the participation of 3AC, Jump Trading, Digital Currency Group, Coinbase Ventures, Alameda Research.

- March 3, 2022: Lido Finance continues to successfully call for $70M from the A16Z investment fund.

- September 14, 2022: Dragonfly continues to invest in Lido Finance with an amount of $24M

Tokenomics

Information about Lido Finance’s tokens

- Token name: Lido Finance

- Code: LDO

- Blockchain: Ethereum

- Token classification: ERC 20

- Contract: 0x5a98fcbea516cf06857215779fd812ca3bef1b32

- Total supply: 1,000,000,000

Token Allocation

- DAO Tresury: 36.3%

- Investors: 22.2%

- Initial Developers: 20%

- Founder & Future Employees: 15%

- Validator & Signature Holder: 6.5%

Token Release

- The development team will be locked for 1 year then gradually opened.

- Investors will not have a specific and clear payment schedule.

Token Use Case

Users holding LDO will have some of the following benefits:

- Participate in voting on important proposals in the protocol.

- LDO is used to make Incentive for Liquidity Providers, Node Operators,…

Exchanges

Lido Finance is currently traded on many exchanges such as Binance, FTX, Kraken, Bybit, OKX,…

Project Information Channel

- Website: https://lido.fi/

- Twitter: https://twitter.com/lidofinance

- Telegram: https://t.me/lidofinance

- Discord:

Summary

Lido Finance is the leading project in the LSD segment in the Ethereum market and the entire Crypto market. So according to everyone, does Lido Finance deserve to be in the investment portfolio of individual investors?