What is Level Finance? The crisis of confidence of CEX exchanges in 2022 along with great success from GMX has opened up a fierce race in the Perp Dex segment. In this article, let’s join HAK Research to learn about Level Finance, the No. 1 PerpDex project on the BNB Chain ecosystem.

What is Level Finance?

Level Finance is a decentralized perpetual contract exchange (Perpetual Dex) that allows investors to trade Crypto with leverage up to x50 times. Level Finance was developed and officially launched mainnet on December 26, 2022 on the BNB Chain ecosystem.

Although inspired by GMX’s Oracle-Based model, instead of simply forking GMX, Level built its own code and improved many points in the operating mechanism.

What is the Working Mechanism of Level Finance?

Liquidity provision and risk management mechanism

Level is inspired by GMX’s operating model, centered on the asset pool used to leverage traders’ positions. When traders make profits, assets in the Pool decrease and vice versa. This model is relatively simple but has a drawback for liquidity providers to the Pool, they cannot customize the level of risk & profit according to their needs. This sometimes becomes a barrier in attracting assets to the Pool.

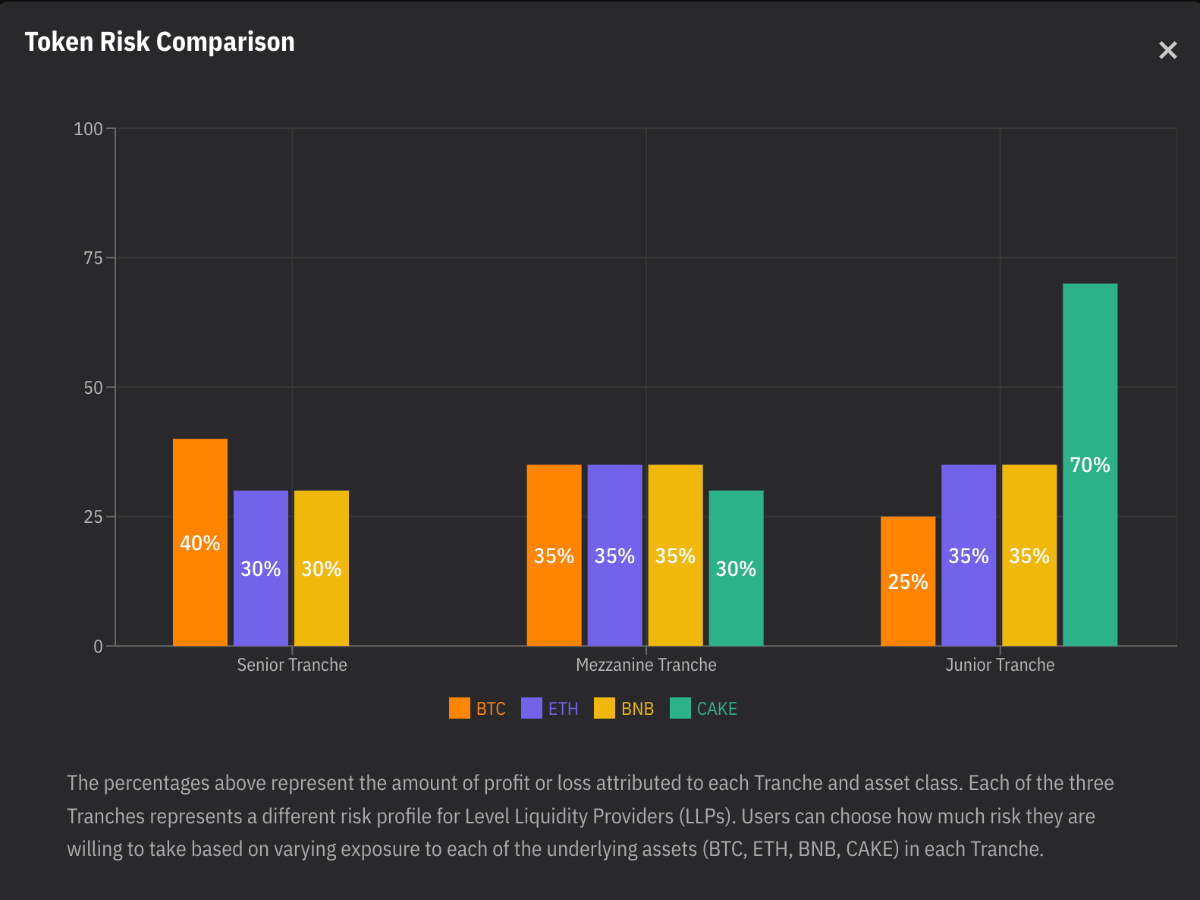

With the advantage of being born later, Level Finance has deployed the Tranches model to help liquidity providers better manage risks and profits. Specifically, Level Finance offers 3 tranches with increasing risk levels as follows:

Senior Tranche (SLP) (Low Risk):

- BTC: 25%

- ETH: 20%

- BNB: 2%

Mezzanine Tranche (MLP) (Medium Risk):

- BTC: 35%

- ETH: 35%

- BNB: 38%

- CAKE: 30%

Junior Tranche (JLP) (High Risk):

- BTC: 40%

- ETH: 45%

- BNB: 60%

- CAKE: 70%

The proportion of assets in each Tranches corresponds to the amount used by traders when they execute orders.

For example: When trader A opens a position of 100 ETH, the asset ratio used in each Pool will be as follows

SLP = 100 ETH * 20% = 20 ETH

MLP = 100 ETH * 35% = 35 ETH

JLP = 100 ETH * 45% = 45 ETH

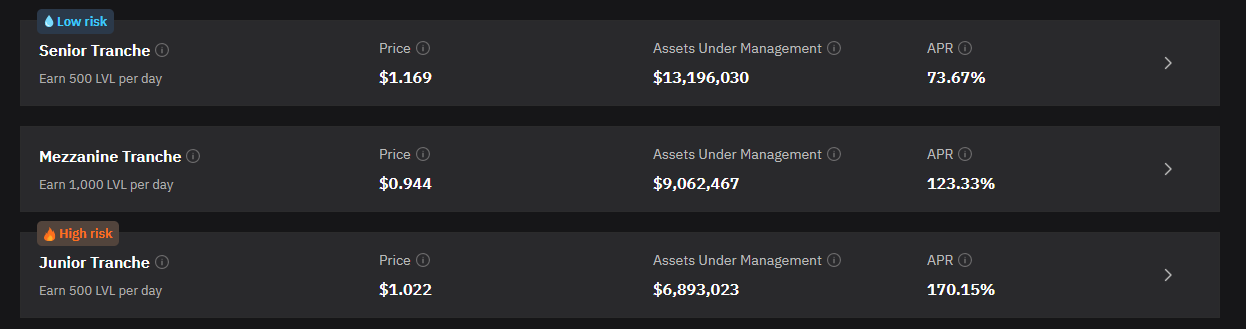

This model ensures that LPs who accept a large amount of risk before the trader’s PnL will at the same time receive a commensurate profit from it. According to actual data from Level, the average profit that LPs receive at each Pool gradually increases from SLP 73%, MLP 123% and finally JLP 170%.

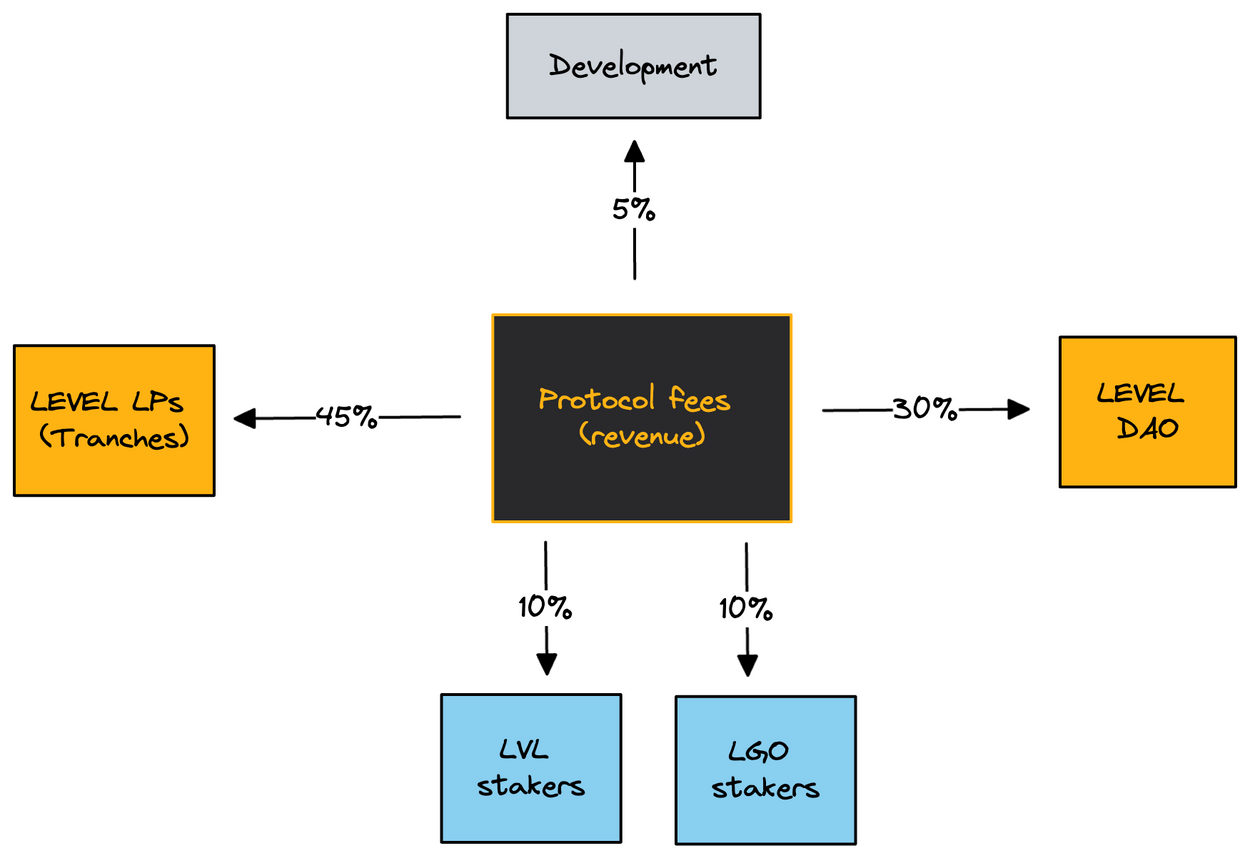

Revenue sharing mechanism

Level Finance’s revenue comes from fees collected during the operation process including: fees for opening and closing trading positions, fees for liquidating positions, trader loan fees when using leverage, swap spot fees and mint/mining fees. burn LP at the tranches.

Level Finance applies the Real Yield model when participating parties’ profits come from actual revenue instead of the project’s token emmission. Specifically, Level collects the above fees and redistributes them according to the following ratio:

- Level LP Fees = 45%

- LVL Stakers = 10%

- DAO Treasury = 30%

- LGO Stakers = 10%

- Development budget = 5%

Development Roadmap

Even though Level Finance only had its mainnet at the end of 2022, it has already achieved significant achievements. Currently, the project has completed the base part and is operating smoothly. In 2023, based on the roadmap, Level will focus on optimizing the incentive mechanism and expanding in the cross-chain direction to attract more users, trading volume and liquidity.

Some notable points in Level Finance’s 2023 Road Map:

- Improved Risk & Reward ratio at Tranches

- Provide more Incentives to traders through LVL Loyalty Program

- Completely decentralized protocol

- Developed into Multichain Aggregator allowing users to trade, swap and borrow easily, smoothly and at low cost.

Core Team

Update…

Investor

Update…

Tokenomics

Overview information about Level Finance tokens

- Token Name: Level Token

- Ticker: LVL

- Blockchain: BNB Chain

- Token Standard: BSC-20

- Contract: 0xB64E280e9D1B5DbEc4AcceDb2257A87b400DB149

- Token Type: Utility

- Total Supply: 49,774,401

- Circulation: 6,049,354

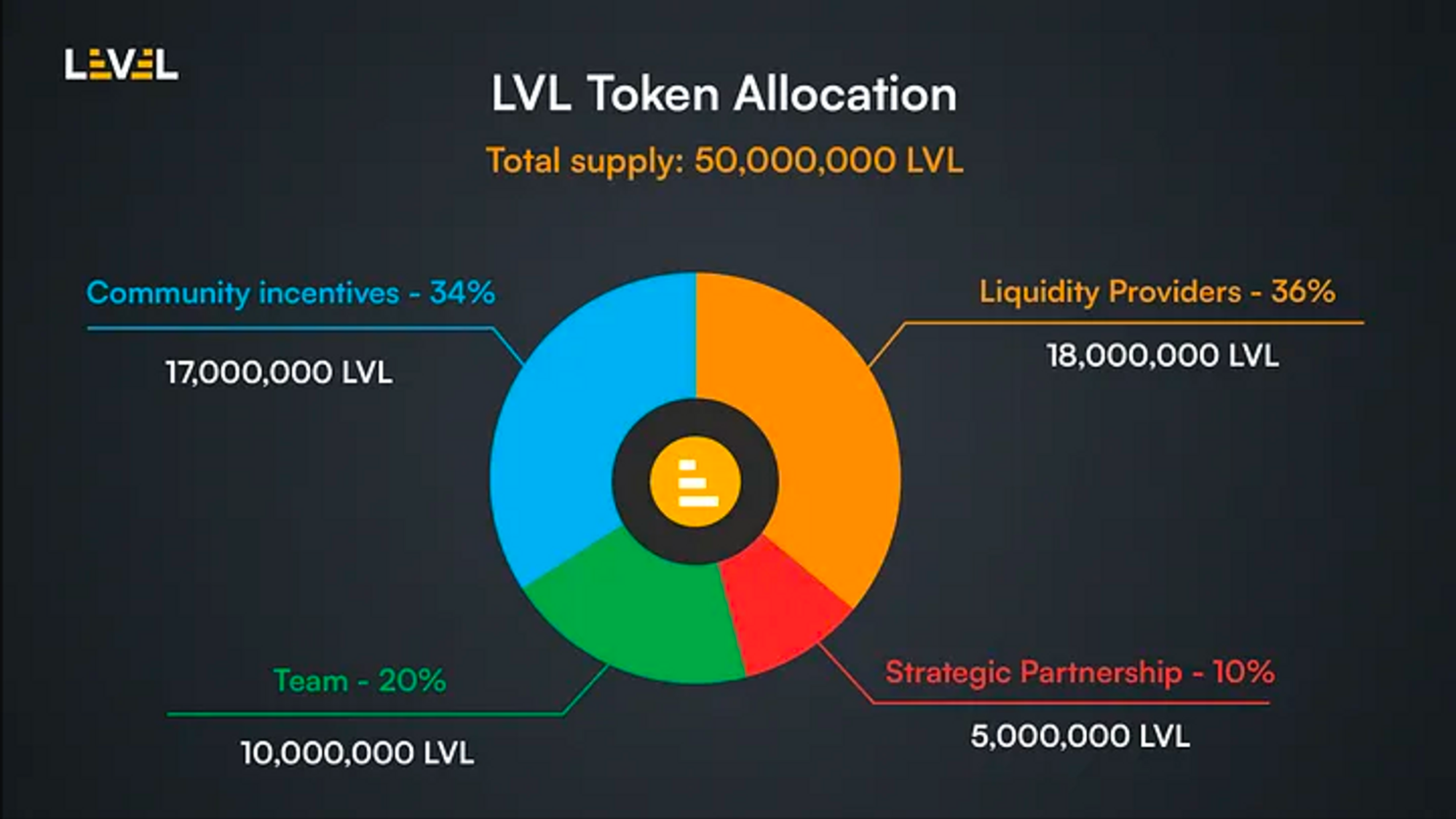

Token Allocation

LVL is allocated according to the following ratio:

- Liquidity Providers: 36%

- Community incentives: 34%

- Team: 20%

- DAO/Strategic: 10%

Use Cases

LVL serves as a utility token in which:

- Used to reward liquidity providers on Tranches.

- Stake LVL in return for LGO to participate in the Level DAO governance process and enjoy a portion of project revenue.

- Pay rewards for customer loyalty programs (Loyalty Program) and user referral programs (Referral Program).

- Stake LVL at Earning Pool to receive % of the revenue paid in the form of Senior Tranche LLP that you can redeem whenever the corresponding assets are released.

Exchanges

You can trade LVL at exchanges: MEXC, CoinEx, Hotbit, Pancakeswap, Uniswap.

Level Finance’s Information Channel

- Website: https://level.finance

- Twitter: https://twitter.com/level__finance

- Discord:

Summary

Hope this article has partly helped you understand What is Level Finance? This is a project whose model and Tokenomics have many improvements compared to GMX. The strong development in early 2023 in both TVL, users and Level’s token price has partly proven that. However, the beginning of 2023 also coincides with a recovery period for the market, so to conclude whether Level is perfect or not, we need to monitor more in the near future.