Lending and Borrowing are always an indispensable piece for an ecosystem to become complete and attract cash flow. Understanding that, Lendle xyz is the first pioneering project in the Lending and Borrowing segment on the Mantle Network ecosystem. To better understand the project, let’s find out in this article!

Overview of Lendle xyz

What is Lendle xyz?

Lendle xyz is a Lending and Borrowing project on Mantle Network. Lendle xyz is an important piece in the Mantle ecosystem in circulating cash flow and optimizing profits. Users can put their idle assets into Lendle xyz to earn more profits, while borrowers can mortgage assets to borrow out the assets they desire.

Lendle xyz is an important piece in supporting leverage for users.

Mechanism of action

Basically, the operating mechanism of the Lendle xyz project is quite similar to other borrowing and lending projects.

People can deposit accepted assets into the project to receive interest and LEND token incentive. When depositing assets into the protocol, people will receive back the L-token version of that asset, the L-token is pegged with the sent token at a 1:1 ratio and the accumulated interest will be distributed to the L-token .

For borrowers, they will mortgage their assets to borrow other tokens. In addition, when borrowing, people will also receive an incentive called Lend tokens, the project allows a mortgage/loan ratio of 80 %, meaning people are only allowed to borrow up to 80% of the value of the mortgaged property.

When people’s assets drop to 85% of their value, the collateral will be liquidated. To encourage people to use the product while reducing Lend supply, the project developed two features for the Lend token:

- Stake Lend: When staking Lend, everyone will share profits from the protocol and can unstake at any time. The reward from the transaction fee will be distributed in the form of tokens such as USDT, USDC, BTC, ETH, Mantle.

- Lock Lend: When locking Lend, everyone will be locked for 3 months and if they want to unlock before the deadline, they will be charged a penalty fee of 50% of the normal portion. The reward when people lock Lend is a share of the protocol’s revenue and the penalty fees of those who unlock it early.

The protocol’s revenue comes from:

- Loan fees

- Liquidation fee

- Penalty fees from those who unlock rewards early

Core Team

Update…

Investors

The project received funding from Mantle Blockchain, but the specific amount has not been disclosed. In addition, the project also announced that they are partners of projects such as Pyth, FundionX, Stratum Exchange, Rivera, SourveHat.

Tokenomics

Project token information

- Token name: LEND

- Total supply: 100,000,000

- Blockchain: Mantle Blockchain

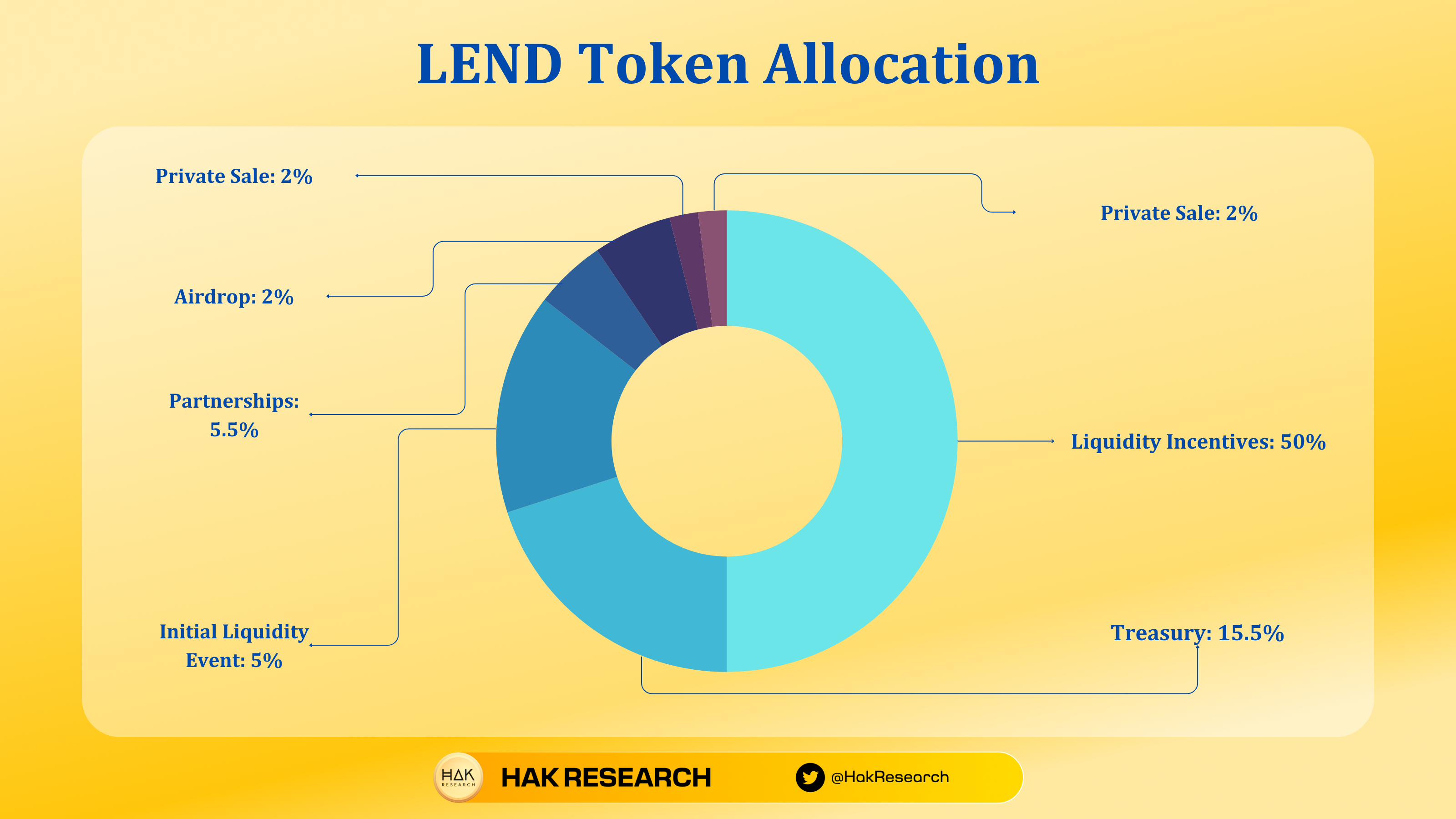

Token Allocation

- Liquidity Incentive: 50%

- Team: 20%

- Reserve Treasury: 15.5%

- Initial Liquidity Event: 5%

- Partnerships: 5.5%

- Airdrop: 2%

- Private Sale: 2%

Exchanges

People can now own Lend tokens through the Funsion X exchange, or borrow and lend assets on the protocol to receive Lend Incentives.

Project Information Channel Lendle xyz

- Website: https://www.lendle.xyz/

- Twitter: https://twitter.com/lendlexyz

- Discord: https://discord.com/invite/wWNbcMnjSE

- Medium:

Summary

Lending and Borrowing are an important and indispensable piece in a blockchain ecosystem. With the advantage of being the leader on Mantle, it is hoped that Lendle xyz will dominate the market in the future when Mantle receives large cash flows from the market.