We have heard a lot about KYC in Blockchain, some people think that KYC breaks the anonymity of users, some people think that KYC is necessary to manage and promote the market to develop in a good direction. best. So let’s learn about KYC (Know Your Customer) to clarify the above issue in this article!

History

Early 2010s: With the emergence of the first cryptocurrency exchanges, such as BitcoinMarket.com and Mt. Gox, some places started implementing KYC to ensure safety and compliance with financial laws.

2012: Some cryptocurrency exchanges, including Bitstamp, begin requiring registration and verification of user KYC information to meet legal regulations and reduce risks associated with fraudulent activity and money laundering.

2013: The right to review and trace cryptocurrency transactions was further affirmed when FinCEN (Financial News Supervision Bureau) in the US published guidance on the application of KYC and cryptocurrency risk management for cryptocurrency entities. financial institutions.

2017: During ICO-related issues, many cryptocurrency projects required KYC to provide transparency and identity verification for users participating in capital raising rounds.

2019: The Favorable Asset Forwarding Act (FATF) – an international anti-money laundering organization – publishes guidance on the application of KYC in cryptocurrency activities, requiring member states to implement KYC measures to prevent money laundering and terrorist financing.

Currently: Many cryptocurrency exchanges and DeFi projects require KYC to comply with legal regulations, protect users and increase safety. Technologies such as blockchain are also used to improve safety and privacy during the KYC process, by storing data and verifying information in a secure and decentralized manner.

What is KYC?

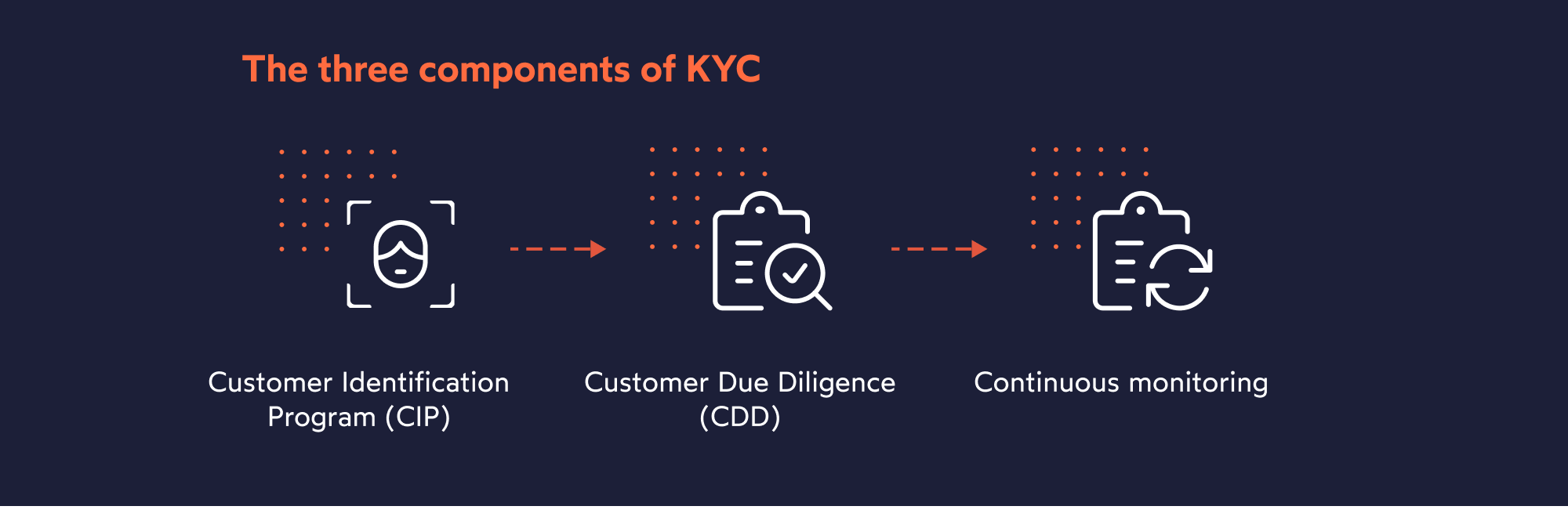

KYC (Know Your Customer) is a process applied in the blockchain and cryptocurrency fields to verify user information and identity. The main purpose of KYC is to prevent fraud, money laundering and dark finance.

The KYC concept requires companies and organizations operating on blockchain to collect, verify and store information about their customers or partners. This information includes personal information, such as name, date of birth, address, phone number and other financial information.

On blockchain, KYC can apply to cryptocurrency exchanges, decentralized trading platforms, ICO (Initial Coin Offering) projects, and decentralized finance protocols such as DeFi (Decentralized Finance). . Organizations that perform KYC are often required to comply with legal regulations to protect customers and comply with anti-money laundering and anti-terrorist financing regulations.

Mechanism of Action

Usually, KYC requires confirming information about the user’s identity using identification documents such as identification, driver’s license, etc. The user will provide that information and the requesting party will automatically authenticate it using Bot or human manual.

Some Applications of KYC in Blockchain

-

Financial transactions: Cryptocurrency platforms and exchanges use KYC to verify the identity of users before allowing them to engage in trading activities, such as buying and selling cryptocurrencies, deposits/withdrawals money and transaction financial products e-sign dimension.

-

Investment funds and ICOs: KYC is applied in investment funds and Initial Coin Offering (ICO) projects to verify the identity of investors, ensuring compliance with regulations on money laundering prevention and anti-terrorism .

-

Peer-to-peer lending (P2P lending): In the form of peer-to-peer lending, KYC helps ensure that lenders and borrowers are verified about their identities and credit conditions before making transactions, creating an environment Lending market is safer and more reliable.

-

Whitelist management: Organizations or platforms use KYC on blockchain to build and manage whitelists, where only users who have completed the KYC process can access the service or product specifically.

-

Digital certificates and key management: KYC in blockchain can be used to verify identity when creating and managing digital certificates and cryptographic keys. This helps increase security and trust in transactions and data exchange on the blockchain network.

KYC applications in blockchain help create a digital environment that is safe, trustworthy, and compliant with legal regulations. It ensures identity verification to prevent money laundering, fraud and illegal activity, while facilitating the development and widespread adoption of blockchain technology and cryptocurrencies.

Advantages and Disadvantages of KYC

Advantage

- Enhanced Security: Blockchain provides a strong and decentralized layer of security for KYC data. Information is encrypted and scattered across a network of nodes, reducing the risk of data leakage or unauthorized access.

- Ownership of personal data: With KYC on blockchain, users have control and ownership of their personal data. They decide to share information with third parties and control access to their data.

- Convenience and speed: KYC on blockchain helps shorten time and effort in the identity verification process. Instead of having to submit paper copies, users can share KYC information from the blockchain based on previous authentication, greatly reducing verification time and reducing user inconvenience.

- Anti-Fraud and Money Laundering: KYC on blockchain helps prevent fraud and money laundering by verifying the correct identity of users before allowing participation in financial activities. This enhances compliance with legal regulations and ensures system security and safety.

- Easy integration: KYC on blockchain can be easily integrated with other applications and services in the blockchain environment. This facilitates the secure and convenient sharing of KYC information between different platforms and networks.

Defect

- Privacy: While KYC on blockchain allows users to control their privacy, sharing information on blockchain can still raise privacy concerns. Some people may not want their personal information stored and shared on the blockchain.

- The problem of inserting initial data: One challenge when applying KYC on blockchain is ensuring the authenticity of the initial data. If the initial KYC data is inaccurate or fraudulent, it can propagate throughout the blockchain system and cause problems related to fake identities or security risks.

- Cost and complexity: Building and implementing a KYC system on blockchain can require some significant costs and effort. Ensuring safety, enhancing security and complying with legal regulations requires resources and technical knowledge.

- Legal restrictions: Some countries or localities have strict legal regulations regarding the sharing and processing of personal information. Applying KYC on blockchain may require compliance with these regulations and compatibility with the existing legal framework.

- Dependence on technology: The success of KYC on blockchain depends on the development and acceptance of blockchain technology. If the technology has problems or is not widely accepted by parties, implementing KYC on blockchain may be difficult.

Some Projects in the Know Your Customer Segment

Civic (CVC): Civic is a decentralized KYC platform based on blockchain. It allows users to control and share their personal data through ERC-20 standard tokens. Civic provides a safer and more secure approach to identity verification, helping to prevent data leaks and reuse of personal information.

SelfKey (KEY): SelfKey creates a complex ecosystem that shortens the KYC process and creates an advanced way of identity verification. SelfKey allows users to control their personal data through the use of blockchain.

Shyft Network (SHFT): Shyft Network creates a blockchain-based decentralized identity data ecosystem. It helps improve security and personal data management for KYC verification, allowing users to control and share data as they wish.

Trulioo: Trulioo is a global identity verification service for companies operating on blockchain. They use blockchain technology and artificial intelligence to provide fast and reliable identity verification for financial services and cryptocurrency platforms.

Blockpass: Blockpass provides a blockchain-based way of identity verification for projects and organizations. It brings convenience and safety to KYC verification, allowing users to control their personal information.

Personal Projection

Although Blockchain is an industry that can develop on its own without management, the participants belong to countries, so management is necessary. But countries cannot interfere with platforms or dApps.

So countries can only manage this user information. The best way is that this information is only accessed and controlled by the state to make the management process easier.

Summary

Although KYC causes many obstacles for users, it is really necessary to manage and protect all user rights, avoiding destructive elements in the Blockchain technology industry.

So I have clarified what KYC (Know Your Customer) is? Hope this article brings you a lot of useful information!