What is KTX Finance? KTX is a decentralized Derivatives exchange built on the BNB Chain and ecosystem Mantle Network. Can KTX develop and surpass GMX, or even dYdX? Together Weakhand Learn more about KTX in the article below.

To understand more about the dormitory, people can refer to some of the articles below:

- What are Derivatives? Powerful profit tool for Crypto winter

- What is dYdX? dYdX Cryptocurrency Overview

- What is GMX (GMX)? Overview of GMX Cryptocurrency

Overview of KTX Finance

What is KTX Finance?

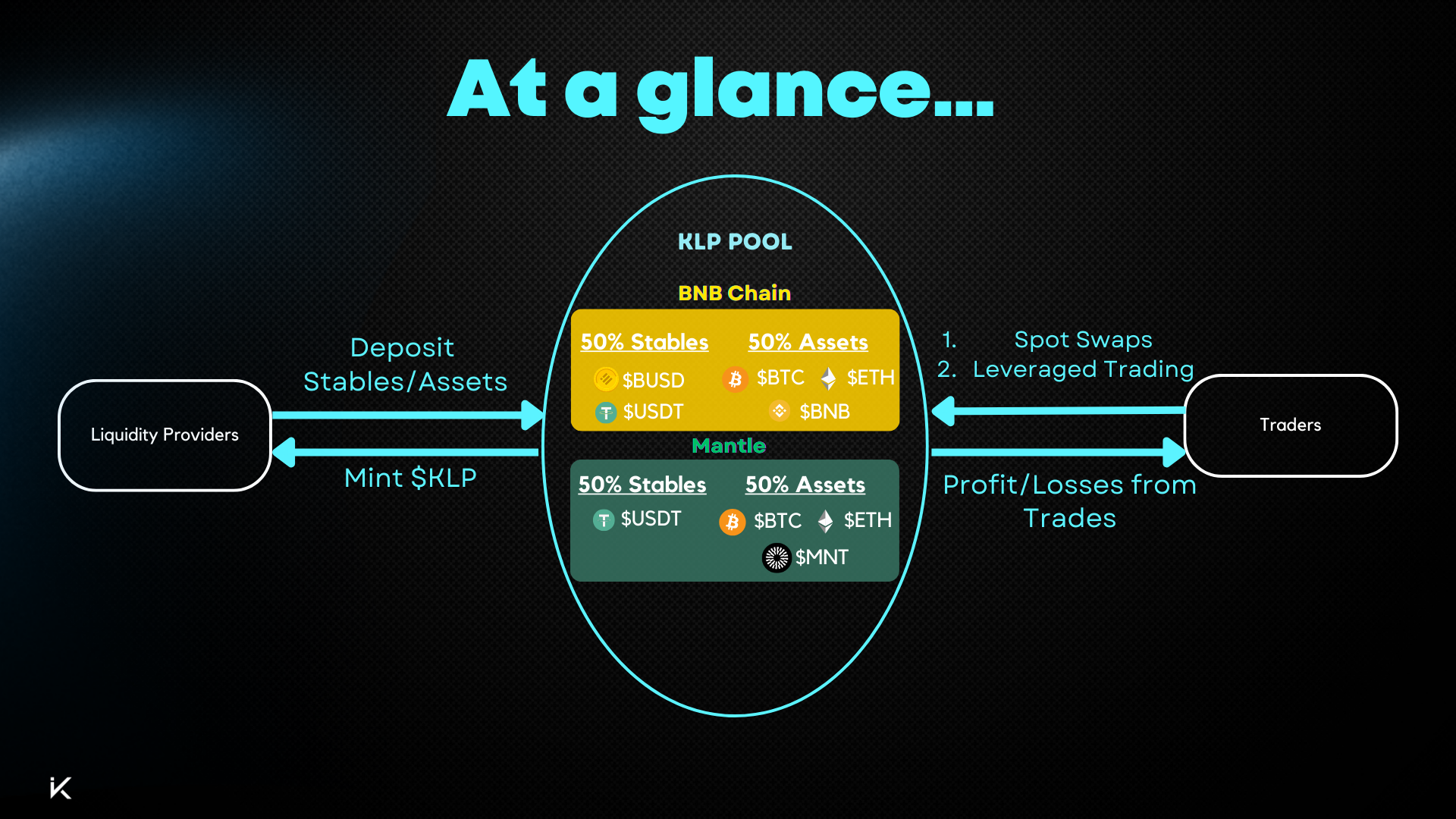

KTX Finance is a DEX Derivatives that offers products for Spot and Perpetual trading with low swap fees, fast order execution and no slippage. KTX is built on BNB Chain and Mantle Network.

With KTX, users can Long – Short different types of assets such as BTC, ETH, BNB, MNT,… with leverage up to 100x.

Initially, KTX was built on HST BNB Chain, then KTX continued to be built and developed on HST Mantle Network

Characteristics of KTX Finance Trading Floor

- KTX uses a single multi-asset pool (KLP Pool) ensure high efficiency in capital use, low swap fees and minimized counterparty risk.

- Friendly interface.

- Fast order matching speed.

- Building on the BNB chain & Mantle Network makes transaction fees on KTX relatively cheap.

- Huge leverage up to 100x.

Limitations of KTX Finance trading platform

- The number of currently supported asset types is quite small, with little diversity in its assets.

- There are not enough tools that traders require such as Stoploss, Trigger, Partial Liquidation,…

Products of KTX Finance Trading Floor

KTX provides 2 main products including Spot & Derivatives.

- Spot Trading: Users can swap BTC, ETH, BNB, MNT, BUSD, USDT asset pairs with low swap fees, no slippage.

- Derivatives Trading: Allows users to play Long – Short with many different types of assets, with leverage up to 100x.

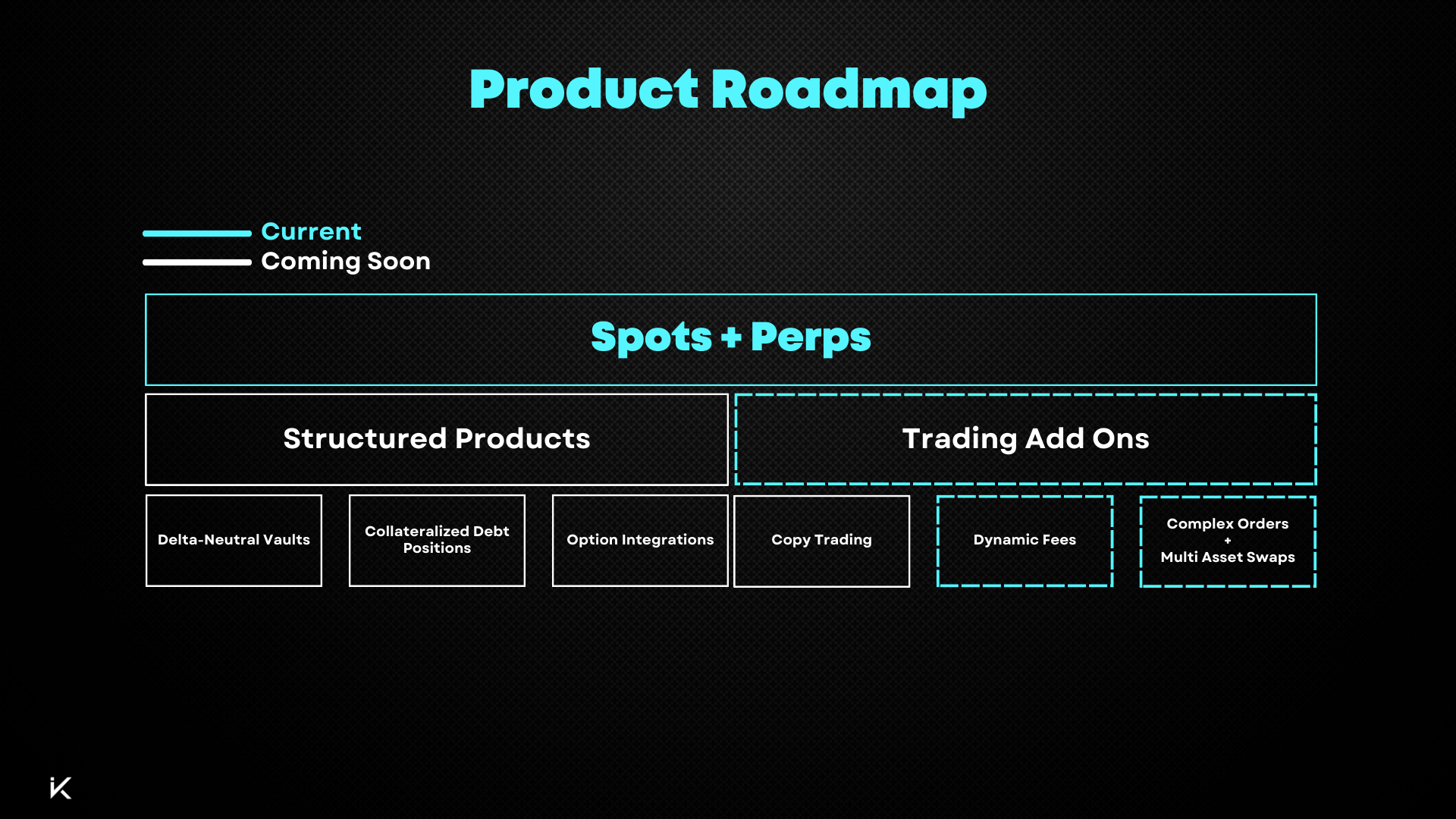

Development Roadmap of Dormitory

- Sport & Perpetual Trading

- Structured products: Delta Neutral Vaults, Collateralized Debt Prositlens, Option Intergrations

- Trading Add Ons: Copy Trading, Dynamic Fees, Compiex Orders Muilti Asset Swaps.

Core Team

Update…

Investor

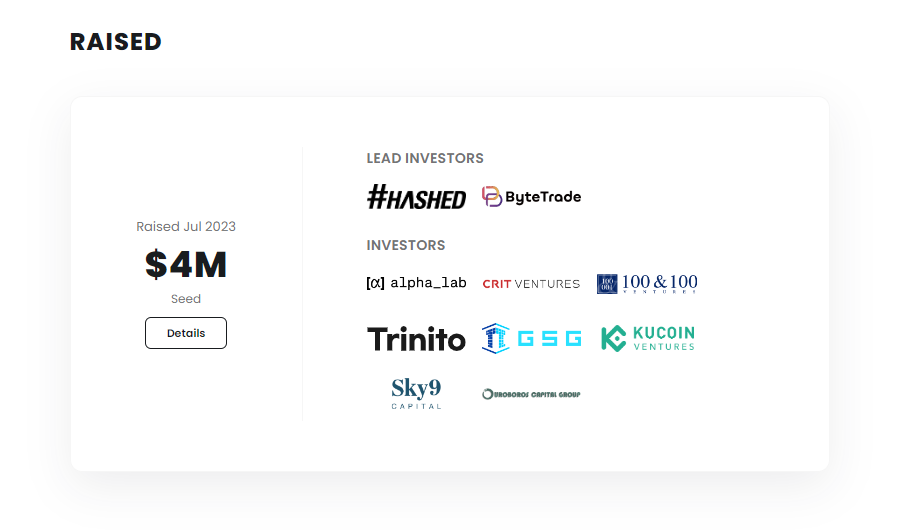

- July 2023: KTX Finance successfully called for $4M in Seed round from many large investment funds such as Hashed, Bytrade, Kucoin Ventures, GSG, Sky9, ….

Tokenomics

KTX operates on a model of 2 tokens: KTC and KLP

Basic information about KTC Token

- Token Name: KTC Finance

- Ticker: KTC

- Blockchain: BNB chain & Mantle Network

- Contract BSC: 0x545356d4d69d8cD1213Ee7e339867574738751CA

- Total supply: 100,000,000

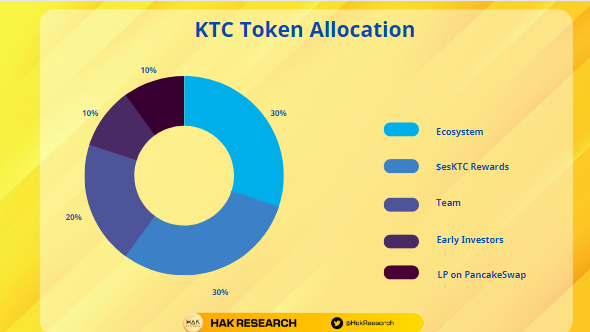

Token Allocation

- Ecosystem: 30%

- esKTC Rewards: 30%

- Team: 20%

- Early Investors: 10%

- LP on PancakeSwap: 10%

Token Release

Update…

Token Use Case

KTC is the protocol’s utility and governance token. KTC token stakers will be rewarded:

- 30% transaction fee protocol distributed in $BNB/$ETH

- Get $esKTC

- Multiplier Points

KLP tokens: KLP acts as a “proof of liquidity” receipt Unlimited supply. By minting KLP, LP is providing liquidity to the included SINGLE liquidity pool 50% stablecoins (BUSD and USDT) and 50% blue-chip assets (ETH, BTC and BNB – MNT).

KLP holders receive:

- 70% of protocol transaction fees are allocated in $BNB/$ETH

- Get $esKTC

KTC Token Exchange

KTC token is currently traded on exchanges: PancakeSwap, XT.com

Dormitory Project Information Channel

- Website: https://www.ktx.finance/

- Twitter: https://twitter.com/KTX_finance

- Discord: https://discord.gg/tAFgvRNxTQ

- Medium: https://medium.com/@ktxfinance

- Telegram:

Summary

KTX is a decentralized Derivatives exchange with a friendly, easy-to-use interface, but there are some limitations: There are not all the tools that traders require, the currently supported asset types are quite few. , less diverse.

Derivative is expected to be an explosive piece in the next cycle. Let’s wait for KRX’s performance in the near future!