What is JustLend? JustLen is the first Lending & Borrowing protocol on the TRON ecosystem. There are two roles in the protocol which are lenders and borrowers. Both interact directly with each other on the protocol to earn more profits. So what’s so good about this JustLend operating mechanism? What stands out from the rest? Let’s find out with Weakhand below in this article!

To understand more about JustLend, you can read more about the following projects:

- What is Venus Protocol (XVS)? Venus Protocol Cryptocurrency Overview

- What is Liqwid Finance (LQ)? Liqwid Cryptocurrency Overview

- DeFi Panorama 101 | Episode 3: What is Lending & Borrowing? The Essential Puzzle Piece in DeFi

What is JustLen?

JustLend is a Lending & Borrowing platform built and developed on the TRON ecosystem. This platform aims to create a currency market based on interest rates determined by an algorithm based on Supply and Demand. JustLend has two main participants: lenders and borrowers, where the two parties will interact with each other on the protocol to optimize profits.

Mechanism of action

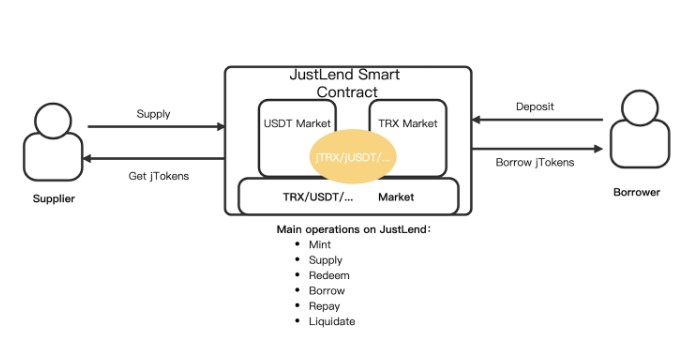

JustLend’s core architecture

- Lender/borrower: Users deposit money into Smart Contracts on the platform, the assets provided are the underlying assets.

- Smart Contract: Distribute jtokens corresponding to the underlying asset to the user’s account at the exchange rate.

- Lender: Provide assets to JustLend’s money market and earn interest on their loans. They can withdraw the underlying assets they have provided at any time.

- Borrower: Here the borrower will over-collateralize an asset that can be borrowed from the protocol. Loan orders will be automatically matched by Smart Contracts, as long as the market has enough liquidity. Borrowers can repay the loan at any time.

- Loan interest: Cumulative over block count. The floating interest rate will be automatically calculated by Smart Contract based on market supply and demand.

- Liquidation threshold: If the borrower’s collateral drops to the liquidation threshold, Smart Contract will automatically trigger liquidation. To avoid liquidation of assets, users can mortgage additional assets or pay off part of the borrowed assets.

Asset supply

On today’s peer-to-peer platforms, borrowers will combine with lenders, and users’ assets will be loaned directly to others. But on JustLend it is different, the protocol will aggregate the supply of each user, helping to increase liquidity and create better monetary balance.

The asset provided to the market is denoted as jToken (TRC token balance – 20). Token holders can receive the corresponding jToken by providing and complying with the relevant rules earning interest. Main relevant cases:

- Users can offer tokens on the platform to earn interest with low risk.

- The assets of Dapps, institutions and exchanges can be valued on the platform.

Loan assets

If a borrower wants to borrow an asset on JustLend, the user first needs to mortgage the asset to the platform and receive jTokens, then exchange the jTokens for any asset on the platform they want to borrow. Loans do not require a repayment date, interest rates are automatically adjusted according to market supply and demand, different assets will have different interest rates. Things to note about loan assets:

- Guaranteed asset value: Borrowers are allowed to borrow up to but not exceeding the value of their collateral to minimize risk to the borrower of the property.

- Payment risk: If the value of the borrower’s outstanding loan balance exceeds the collateral, liquidation will be automatically triggered in the Smart Contract to eliminate risks and ensure the ability to repay debt and provide assets while protecting the borrower. loan.

- Cases of using loan assets: Users can trade the TRC20 tokens they own for other TRC20 tokens. Users can sell off a token before it crashes, so the platform can earn a portion of the profits from the token’s losses.

Interest rate

JustLend’s interest rate is calculated based on the block creation time on TRON (about 3 seconds). Interest rates will be automatically calculated by Smart Contracts according to changes in supply and demand, and loan interest rates may vary between different assets. As borrowing demand decreases, the excess tokens available in the platform will have high liquidity and lower interest rates thus encouraging borrowing. When lending demand decreases, tokens in the platform have low liquidity and interest rates will be higher, encouraging people with assets to lend.

The interest rate model is a core element of JustLend so it will be related to the following items:

- Exchange rate: In JustLend, each asset is a TRC20 standard token and the balance is denoted as jToken, which can be minted by adding to the market or buying back. The exchange rate of an underlying asset will increase over time.

- Usage rate: Usage rate measures how effectively a platform is using its funds.

- Reserve: JustLend sets aside a reserve from the proceeds of each loan based on the reserve coefficient.

- Supply interest rate: Like borrowing interest rate, supply interest rate is determined by the utilization rate.

Oracle Price

The prices of a variety of underlying assets are required to calculate a borrower’s collateral, the value of their borrowed assets.

jTokens

jTokens are known as a receipt that users receive when providing underlying assets to JustLend, such as jTRX, jUSDT, JSUN,… which you receive when providing the corresponding asset. jToken is the TRC20 token in your wallet.

All assets supported on JustLend are held and integrated via smart contract – jToken. Each exchangeable jToken becomes the corresponding underlying asset when a user redeems it.

Development Roadmap

Update ..

Core Team

Update…

Investor

The project successfully raised $4.07M in capital through 2 rounds:

- May 5, 2020: IEO sale project on Poloniex earned $799,920.

- April 2020: The project successfully raised $3.27M from the Seed Round.

Tokenomics

Overview information about JustLend Token

- Token name: Token JustLend

- Ticker: JST

- Blockchain: TRON

- Token classification: TRC – 20

- Contract: TCFLL5dx5ZJdKnWuesXxi1VPwjLVmWZZy9

- Total Supply: 9,900,000,000

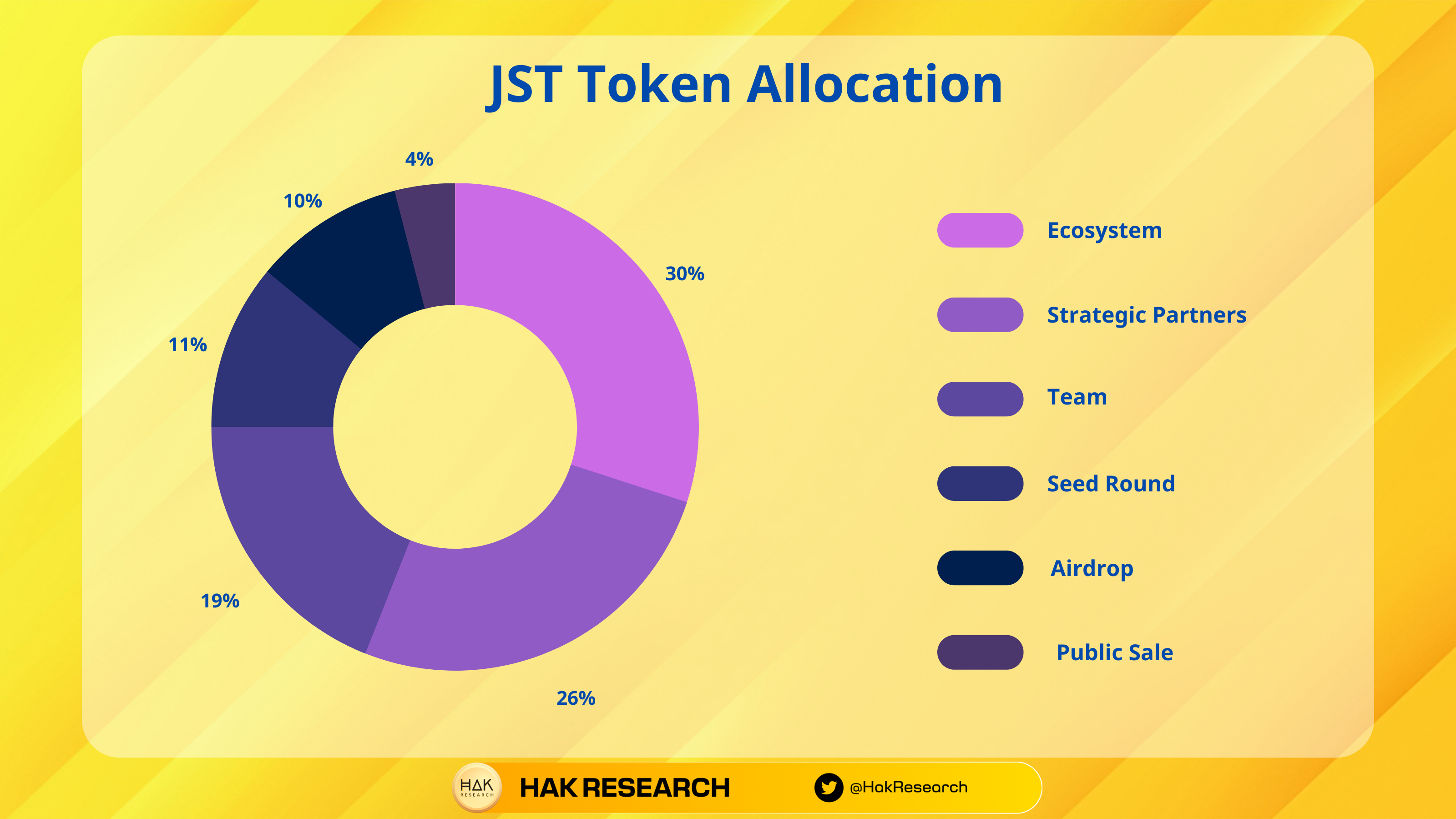

Token Allcation

- Ecosystem: 30%

- Strategic Partners: 26%

- Team: 19%

- Seed Round: 11%

- Airdrop: 10%

- Public Sale: 4%

Token Release

Update ..

Token Use Case

Currently, the JST token is used to vote for related changes and project governance.

Exchanges

Currently, JST tokens are being traded on major exchanges such as Binance, Kucoin, Huobi, etc.

Project Information Channel

Summary

Above is the information about JustLend that Weakhand learned. The project is the first lending platform on the TRON ecosystem and has support from Justin Sun. Currently, the project does not have a clear development roadmap and Core Team, and needs further monitoring.