Indigo Protocol is a decentralized synthetic asset protocol built on the Cardano blockchain aimed at connecting to real-world assets. This is a very promising trend in the future, let’s see how the project has been prepared. So what is Indigo Protocol? Let’s find out through the article below.

To better understand the article What is Indigo Protocol, people can refer to some of the projects below to get an overview of Indigo Protocol.

- What is Synthetix (SNX)? Synthetix Cryptocurrency Overview

- What is Kwenta (KWENTA)? Kwenta Cryptocurrency Overview

What is Indigo Protocol?

Overview of Indigo

Indigo allows anyone to create synthetic assets, called iAssets. iAssets can be created with currencies such as stablecoins and ADA. They are like holding assets that have been copied.

There are many advantages in iAsset compared to traditional assets: Users hold them in small shares and trade regardless of time and geography. iAsset is not a wrapped asset, instead iAsset uses Oracle pricing to track the price of the underlying asset.

In addition, users can also use CDP (Collateralized Debt Position) is a liquid staking method that is a unique capability offered by Indigo that allows ADA staking to CDP to continue earning rewards from the protocol.

The difference of Indigo Protocol

- Global Availability: Enables universal availability without any barriers to entry inherent to TradFi (traditional financial instrument) systems.

- Transaction barriers: In TradFi, the process of synthesizing all orders into one transaction will take time. The advent of blockchain allows volumes in fractional order to be expressed as integers, eliminating the aggregation step in the process.

Components that make up the Indigo Protocol

- Stakers: People who deposit INDY tokens for rewards

- Trader: Traders who use iAsset to exchange for assets.

Mechanism of action

- Step 1: Select the iAsset you want to mint

- Step 2: Deposit an amount of ADA as collateral

- Step 3: Choose the collateral ratio

Development roadmap

- Q1/2023: Expand Indigo iAsset, Indigo DEX Aggregator, upgrade CTL v4, optimize transactions, optimize UI/UX.

- Q2/2023: Launch of new iAsset, launch of Distributed UI Admin Module, notification center, expand hidden groups, optimize fee distribution and develop interoperability.

Core Team

- Eric Coley – CEO & Founder: Has 13 years in enterprise technology in storage and technology scaling solutions. Help build and empower people.

- Cody Butz – CTO: 8 years in web and mobile development, worked as a helpdesk specialist at Wirght State University, helpdesk support technician at EHOVE Carrer Center. Currently working full time with Indigo.

- Daniel Short – Community Manager: 4 years of experience in sales and marketing complex customer solutions in the fields of real estate, lending, cybersecurity and data storage.

Investor

Updating…

Tokenomics

Overview information about INDY token

- Token Name: Indigo Protocol.

- Ticker: $INDY.

- Blockchain: Cardano.

- Token Standard: updating.

- Contract: 533bb94a8850ee3ccbe483106489399112b74c905342cb1792a797a0494e4459

- Token Type: Governance.

- Total Supply: 35,000,000 INDY.

- Circulating Supply: 5,144,893 INDY.

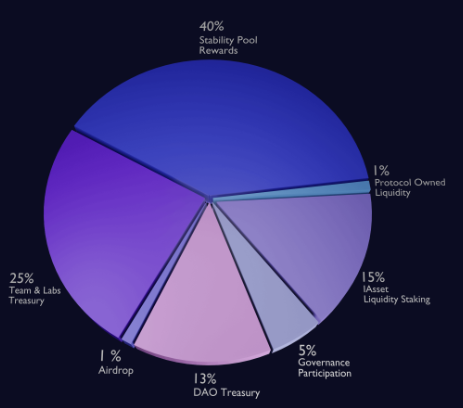

Token Allocations

- Stability Pool Rewards: 40%

- Protocol Owned Liquidity: 1%

- iAsset Liquidity Staking: 15%

- Governance Participation: 5%

- DAO Treasury: 13%

- Airdrop: 1%

- Team & Labs Treasury: 25%

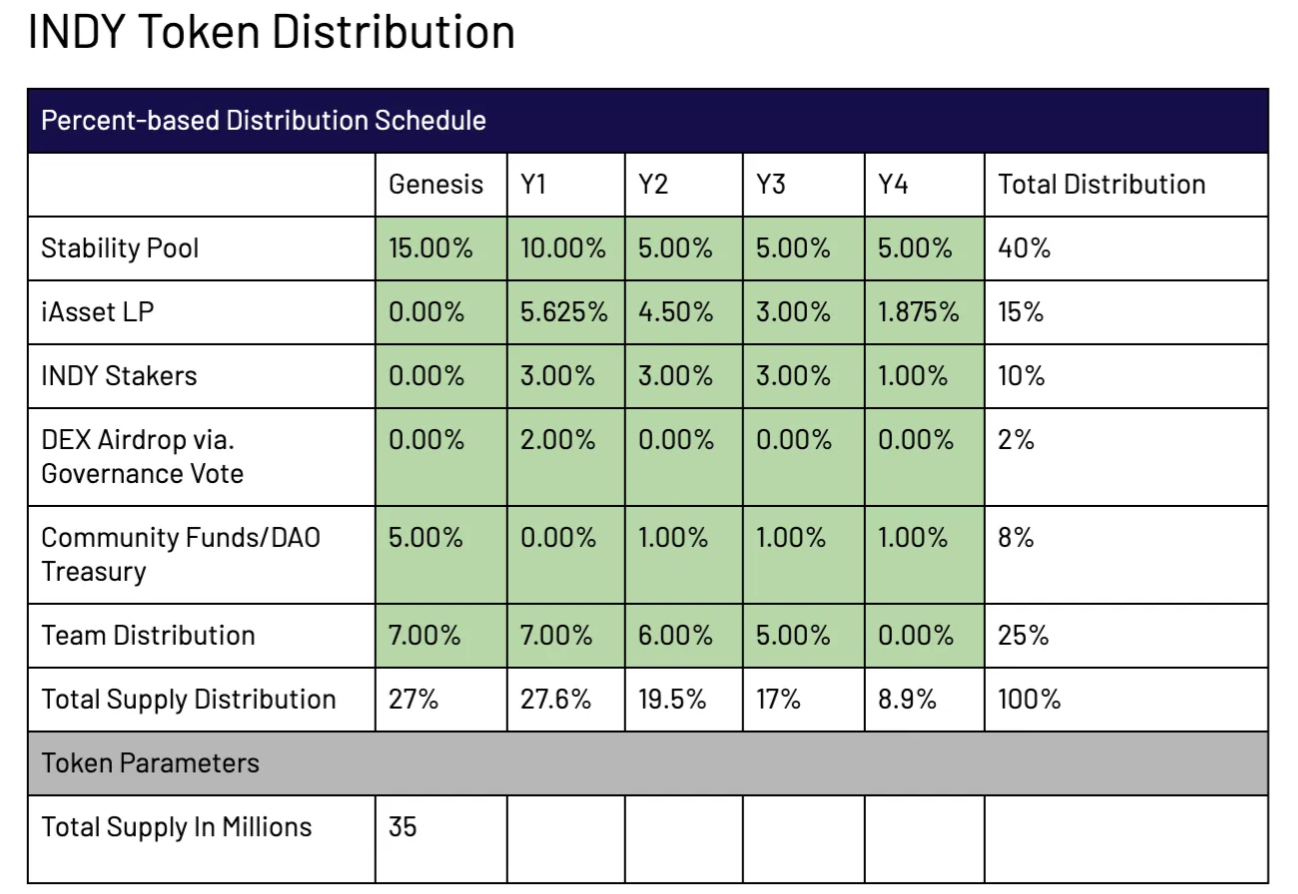

Token Release

Token Usecase

INDY tokens are used to vote and propose changes in the DAO and also pay transaction fees (1.5% on collateral).

Exchanges

There is no centralized exchange that lists Indigo’s tokens. Currently, users can only swap on DEX exchanges in the Cardano ecosystem such as: Minswap, VyFinance, WingRidersDEX, SundaeSwap.

Project information channel

- Twitter: https://twitter.com/Indigo_protocol

- Website: https://indigoprotocol.io/

- Discord:

Summary

Although not as vibrant as other ecosystems over the past year, the Cardano ecosystem has shown how they have built a solid ecosystem and demonstrated a good vision to prepare for the future. Indigo may be very promising in the future, what do you think? Leave your thoughts below in the comments!