What is GRVT? GRVT is a project to build Derivative products (derivative transactions) in DeFi to prepare for the influx of people from traditional markets in the next cycle. The project uses a model or technology that is not new but provides new and very good products for users.

So what is GRVT? What is the special feature of GRVT trading floor? Let’s find out in this article!

Overview of GRVT

What is GRVT?

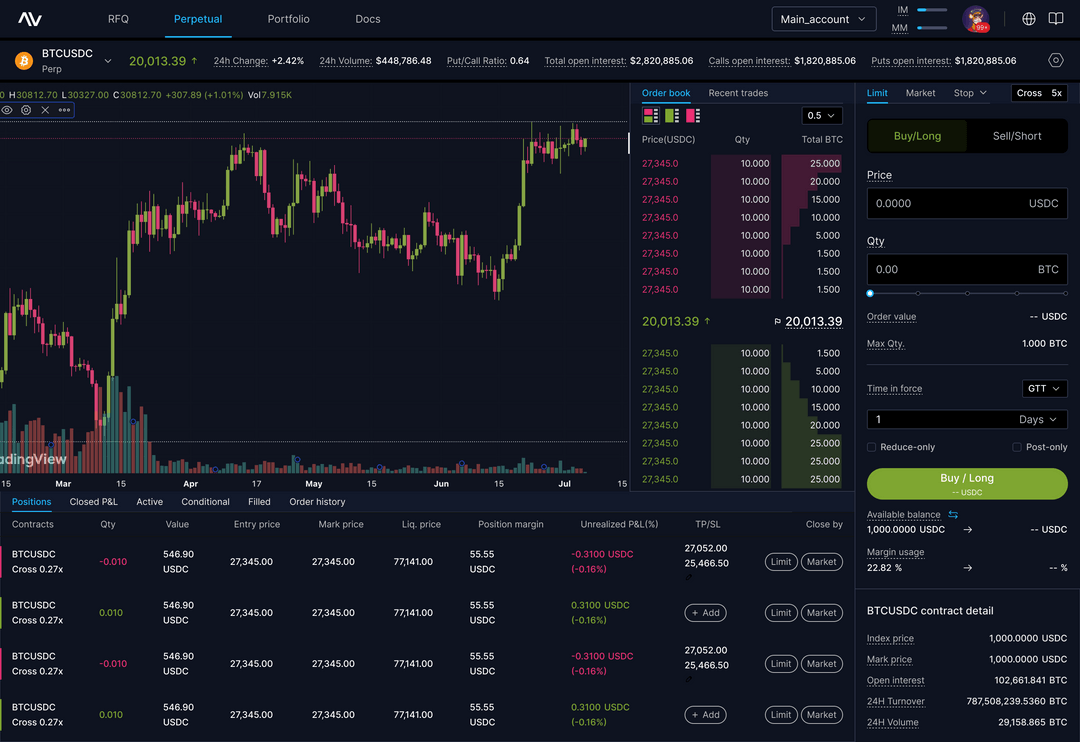

GRVT is a decentralized derivatives exchange built for the future. GRVT is a Hyperchain developed using zkSync’s ZK Stack toolkit. GRVT is considered a series of applications with its own customization suitable for the Derivative environment.

GRVT is a Hyperchain that uses zk-Rollup technology with zkSync’s STARK proof and has a zkEVM execution environment that is compatible with EVMs like zkSync Era. Because it is a Hyperchain, GRVT will store Off-chain data on zkPorter, in Layer 2 Validium style to provide the fastest transaction speed and cheapest fees.

GRVT uses an order book to provide liquidity for trading assets. Like many other DEX Orderbook exchanges, the project uses a centralized, Off-chain order base model, also known as CLOB, to process Off-chain order matching and orders on Onchain, providing a smooth experience like the CEX floor.

To trade on GRVT you need to register an account with Gmail like CEX. Your account also needs to undergo KYC to avoid crime and money laundering. Each registered account is also a wallet address on the chain, which can be connected to Metamask to store assets and transfer money. Money is managed by you and no one knows about your money or orders.

GRVT offers 2 trading modes suitable for new and professional users. The trading floor also targets individual and organizational customers. With high scalability, diverse products and anonymity capabilities, it will be suitable for institutional customers.

GRVT’s anonymity is thanks to data stored Off-chain, which will be encrypted before being posted to Onchain.

GRVT allows margin by portfolio or cross margin to take full advantage of user liquidity.

To minimize the impact of liquidation on clients, GRVT only liquidates the amount necessary to bring the margin to the maintenance level, rather than liquidating the entire portfolio.

GRVT products

Right in early 2024, GRVT will deploy Minnet and provide Perpetual and Option trading services to all customers. With this product GRVT is also competing with a Layer 2 of the Superchain ecosystem, Aevo.

But in the future, around the second half of 2024, the project will provide additional Spot trading products. In addition, the project also pioneered structured product offerings and provided users with many trading opportunities across different asset classes.

Highlights of GRVT

- Lightning-fast order matching: By integrating off-chain order book matching with on-chain payments, we achieved an impressive 600,000 transactions per second with latency under 2 milliseconds.

- Gas-free transactions: Say goodbye to unpredictable gas fees. Our platform is designed for efficient, cost-effective trading.

- Optimal capital management: Make sure your capital is used efficiently with our portfolio margin and cross margin services.

Development Roadmap

From now until the end of 2023, GRVT will deploy all stages of the Testnet process. In early 2024, specifically in January, the project will officially minnet. In the first half of 2024, the project will launch additional products such as Spot trading and support many asset types. In the second half of 2024, the project will launch GVT Token and officially decentralize the project.

Core Team

The GRVT team has extensive experience in data privacy development as well as compliance, operations and traditional finance practices. HongYea, CEO and Co-Founder of GRVT, is an experienced trader and previously held the position of Managing Director at Goldman Sachs in Hong Kong.

Aaron is the Co-Founder and CTO of GRVT, and served as the technology lead for data processing and data privacy frameworks at Meta. Matthew serves as Chief Commercial Officer and Co-Founder, as well as head of research for Blockchain applications in traditional finance and payments at DBS Bank.

Investors

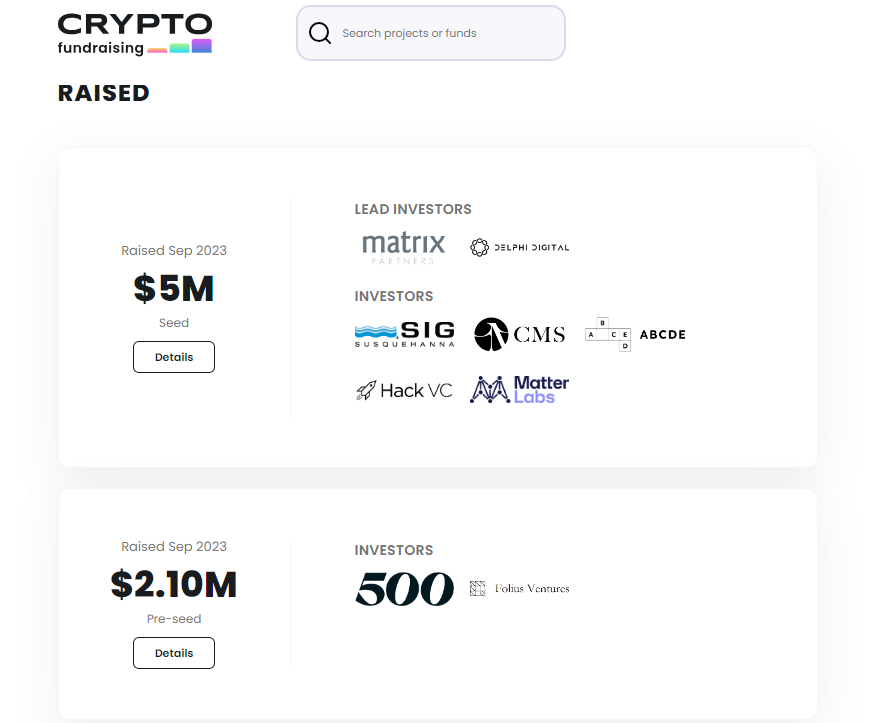

- September 19, 2023: Seed round successfully raised $5M led by Delphi Digital, Matrix Partners and participation from investment funds such as Matter Labs, Hack VC, CMS, ABCDE,…

- October 1, 2023: Pre-Seed round successfully raised $2.1M from Folius Vuntures and 500 funds.

Tokenomics

Update…

Exchanges

Update…

GRVT’s Information Channel

- Website: https://grvt.io/

- Twitter: https://twitter.com/grvt_io

- Blog:

Summary

GRVT is a decentralized derivatives exchange developed to bring DeFi finance within reach of traditional finance through corporate clients. The exchange offers a similar experience to a CEX but inherits the most outstanding features of Blockchain.

So I have clarified what GRVT is? Overview of GRVT cryptocurrency. Hope this article brings you a lot of useful information and knowledge!