What is Goku Money? Goku Money a protocol get a loan (borrowing) Decentralization is built on Manta Network, allows users to borrow stablecoin with zero interest rate using various collaterals such as wETH, USDC, USDT, TIA, etc. So what is Goku Money? What stands out about the project? Let’s Weakhand let’s find out.

Overview of Goku Money

What is Goku Money?

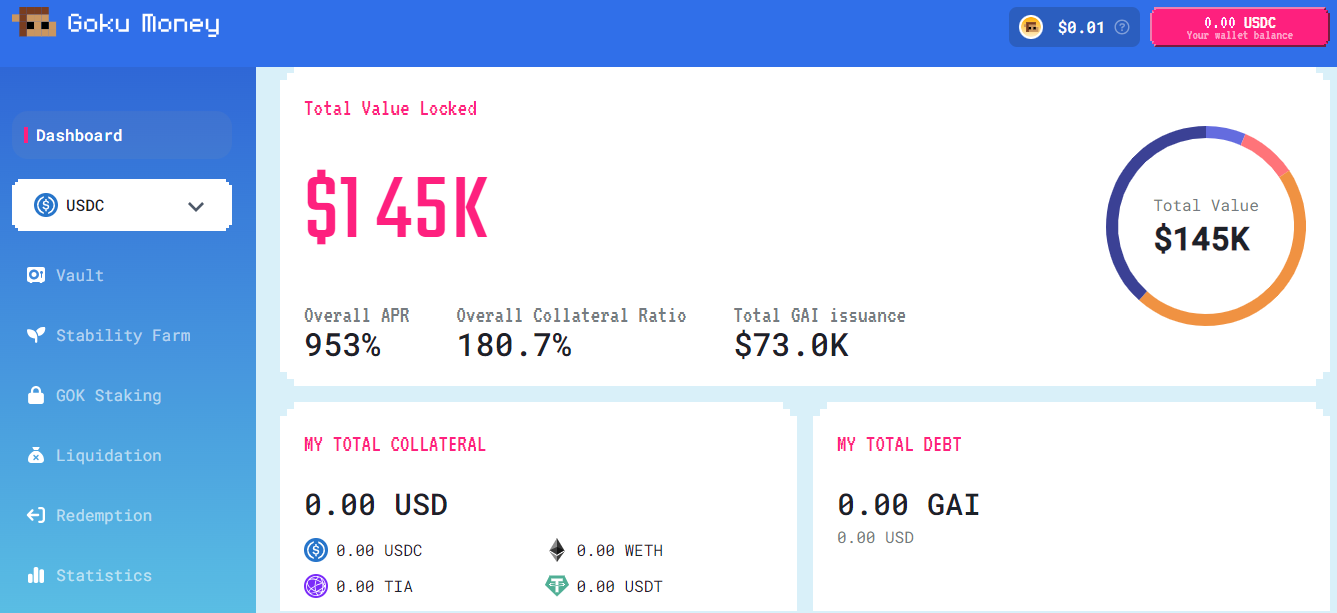

Goku Money a protocol get a loan (Lending Protocol) Decentralization is built on Manta Network, allows users to borrow stablecoin with zero interest rate using many different collateral assets such as wETH, USDC, USDT, TIA,… allows users to borrow stablecoins THORNpegged 1:1 to USD.

Minimum collateral ratio with mortgaged assets: ETH – 110%, TIA – 130%, USDT – 102%, USDC – 102%

Highlights of Goku Money

Some highlights of Goku Money include:

- Goku Money is decentralized and completely decentralized.

- Goku Money supports loans with collateral assets: wETH, USDC, USDT, TIA,…

- THORN is stablecoin pegged in USD used to pay off loans on the Goku Money protocol and can be redeemed at face value for the underlying collateral at any time.

Essential ingredients of Goku Money.

- GAI Stablecoin: GAI is a stablecoin issued by Goku Money and it is stable thanks to its peg to USD.

- Vaults: Vaults Goku Money is a safe place for users’ collateral. Vault is where users withdraw money and maintain their loans. User The amount of each can be changed by adding collateral or repaying debt.

- Stability Pool: Stability Pool is like Goku Money’s fortress, keeping the system safe and strong. When users stake their GAI tokens in the stable pool, they protect the system from unwanted market changes and receive rewards in the meantime.

Mechanism of action

Goku Money’s operating mechanism goes through a number of basic steps including:

- MCR (Minimum Collateral Ratio): Users must have at least this amount in their inventory to borrow some GAI. If your vault does not meet this rule then it can be liquidated, ensuring everything remains stable.

- TCR (Total Collateral Ratio): looks at all the money users put in and compares it to all the money they borrowed. The protocol issues liquidation alerts when the market is volatile.

- Instant liquidation: Goku Money is quick to act when someone’s vault doesn’t have enough money in it. Anyone can liquidate the Vault as soon as it drops below the MCR of that specific collateral.

- Redeem rewards immediately: CThis mechanism allows users to quickly settle their debt when GAI trades below $1, taking advantage of price differences. Instant conversion create a floor price for GAI, ensuring GAI never drops too far below 1 USD. This ensures that vaults with insufficient funds are resolved promptly, which is especially important in volatile market situations.

Goku Money’s Development Roadmap

Update…

Core Team

Update…

Investors

GoKu Money is supported by groups and organizations: Manta Network, Celestia, PeckShield, PYTH, DFG

Tokenmic

Information about Goku Money tokens

- Token Name: GoKu Money

- Code: GOK

- Blockchain: Manta Network

- Contract: 0x387660BC95682587efC12C543c987ABf0fB9778f

- Total supply: 1000,000,000

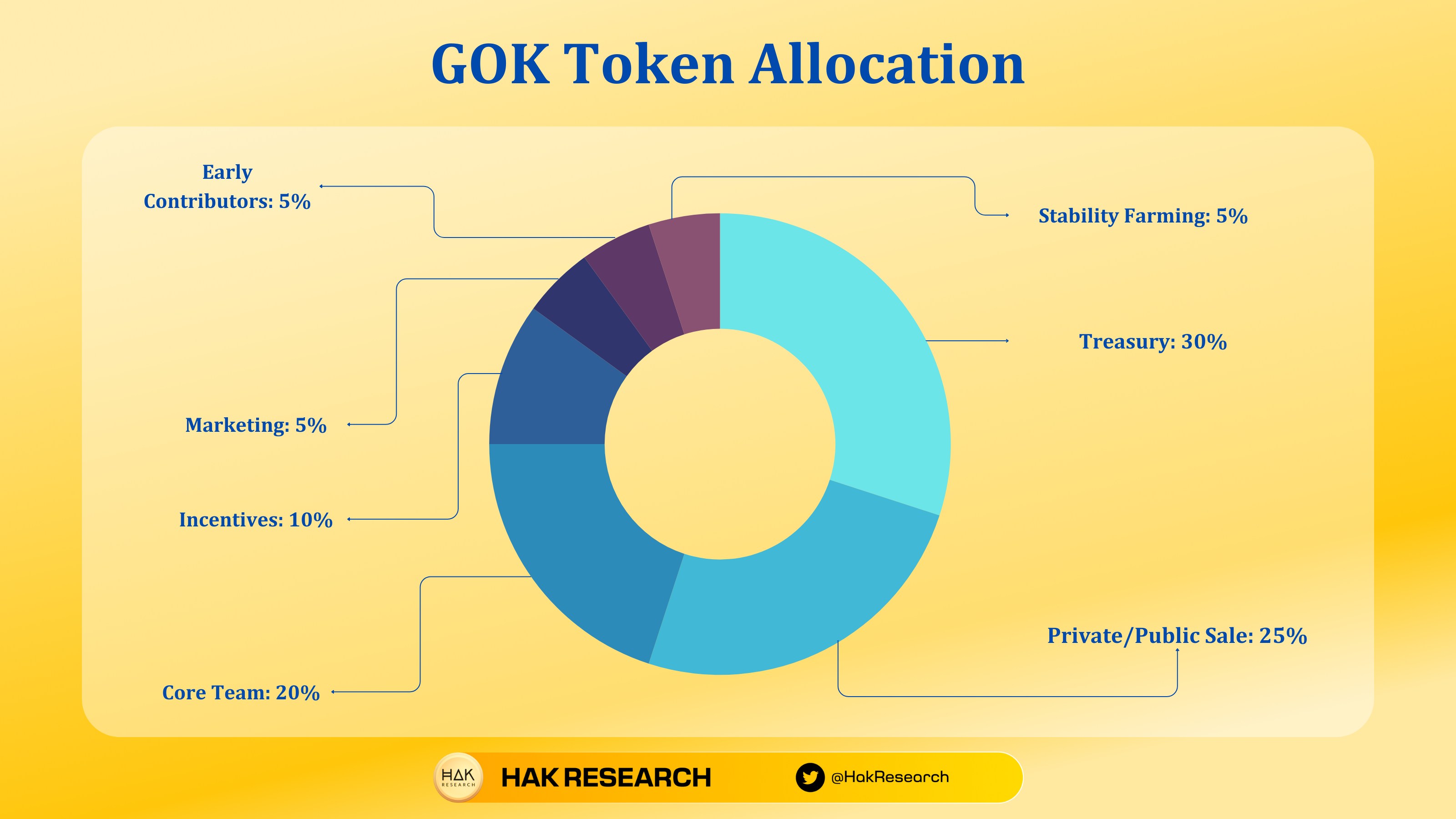

Token Allocation

- On-chain Treasury: 30%

- Private/Public Sale: 25%

- Team: 20%

- Deposit and Staking Incentives: 10%

- Marketing: 5%

- Early Contributors: 5%

- Stability Farming: 5%

Token Release

- On-chain Treasury: Locked for 6 months, vesting for 3 years.

- Private/public Sale: 6 month course, vesting for 2 years.

- Team: 6 month course, vesting for 2 years.

- Deposit and staking Incentives: 6 month lock, vesting for 3 years.

- Marketing: 100% TGE

- Early Contributors: 1 year course, vesting for 3 years.

- Stability Farming: The remaining 20% of GOK tokens will be released each year. 90% of the total GOK tokens used for Stable Farming will be released after 10 years.

Token Use Case

- Lock GOK token to receive veGOK, veGOK represents voting rights and shares transaction fees from the protocol.

- Users can accumulate GOK by depositing GAI into the Stability Pool, leveraging collateral to borrow GAI, or by locking GOK to mint veGOK tokens.

Exchanges

Currently GOK tokens are not traded on exchanges, users can earn GOK tokens by:

- Deposit GAI into the Stability Pool.

- Submit collateral for a GAI loan (as an early adopter incentive).

- Lock GOK to generate veGOK tokens and earn locking incentives.

Project Information Channel

- Website: https://goku.money/

- Twitter: https://twitter.com/goku_stable

- Discord: https://discord.gg/nWW23hHngN

- Telegram: https://t.me/goku_money

- Medium:

Summary

Goku Money a protocol borrowing Decentralization is built on Manta Network, allows users to borrow stablecoins $GAI , hard-pegged to USD, hedges against risky assets with 0% interest rate and minimal collateral ratio. This mechanism allows users to leverage the value in their risky assets without selling them.

The article hopes to provide readers with useful information about the Goku Money project? and GOK tokens.