GHO is a Decentralized, Collateralized Stablecoin on the Aave Protocol. GHO is a product created from Aave, aiming to capture market share of the Stablecoin segment and compete with other Lending protocols.

So what is GHO? Let’s find out in this article!

To understand more about GHO, you can read the following articles:

- What is MakerDAO (MKR, DAI)? MakerDao Cryptocurrency Overview

- What is AAVE V3? Overview of AAVE’s Latest Updates

- What is crvUSD? Curve Finance Transforms With New Strategy

Motivation for Aave to Develop GHO

Lending is an area that attracts a large number of DeFi users because this demand is huge, even in the traditional market. And Aave is a market-leading lending protocol that supports a wide variety of networks. Already in the number one position in the Lending segment, Aave cannot help but continue to observe the market to develop the project in the best direction.

Looking at the reality, Stablecoin lending and borrowing is a huge need, but if it only supports lending and borrowing demand between users, there will be many limitations. Stablecoin assets are only available for lending during downtrend or gloomy markets, so when the market is vibrant, liquidity is poor because most players use Stablecoins to buy BTC or Altcoins and they have a huge need to use Coins that are currently in use. Hold and mortgage for the purpose of borrowing more Stablecoin to continue investing.

Another problem is that CDP platforms like MakerDAO or other projects that lend Stablecoins at lower interest rates or with more incentives. Thus, the CDP products of the protocols will begin to overwhelm AAve’s market share.

For those reasons, perhaps the Aave team has developed additional CDP products with Stablecoin GHO to continue affirming its number 1 position and increasing the project’s role in the decentralized finance market.

What is GHO?

GHO is a decentralized Stablecoin minted according to the CDP mechanism of the Aave protocol. GHO is a fully asset-collateralized Stablecoin that Aave accepts. Initially built and supported on the Ethereum network, then expanded to other networks, especially Layer 2.

GHO is pegged to the USD price, on the Aave protocol the price of GHO is always recorded as 1 dollar. If the market price of GHO is higher than $1, arbitrageurs can mortgage assets so mint GHO can be sold for profit. If the price is less than one dollar, GHO goes out into the market to pay off debt positions and get assets to sell for profit.

Isolation mode on V3 Aave Governance can limit risk by allowing GHO to be minted against collateral from riskier assets. This is the model of Lending Isolated Pool, meaning each asset will be a separate Pool. If one Pool is attacked by hackers, it will not affect the remaining Pools.

Aave DAO will manage parameters related to interest rates, asset weights, and collateral for GHO. In addition, the interest earned from mint or lending GHO or Flashmint will all go to the DAO and is also Aave’s revenue.

Mechanism of Action

Mint GHO

Users or borrowers can mortgage assets to borrow or mint Stablecoin GHO. Loan positions can be collateralized by one or more different types of assets. Borrowers will pay an interest rate usually at about 1.5%, if they have Stake Token AAVE, the interest rate will be reduced to a maximum of about 1%. This profit will be the protocol’s revenue and transferred to the Aave DAO.

Repay GHO

Rebay GHO means returning the borrowed GHO with interest, then taking back the mortgaged property. When returning GHO, this amount of GHO will be burned by Facilitators. These loans have no term, if the borrower does not repay the GHO loan before the position is liquidated, they will lose all collateral.

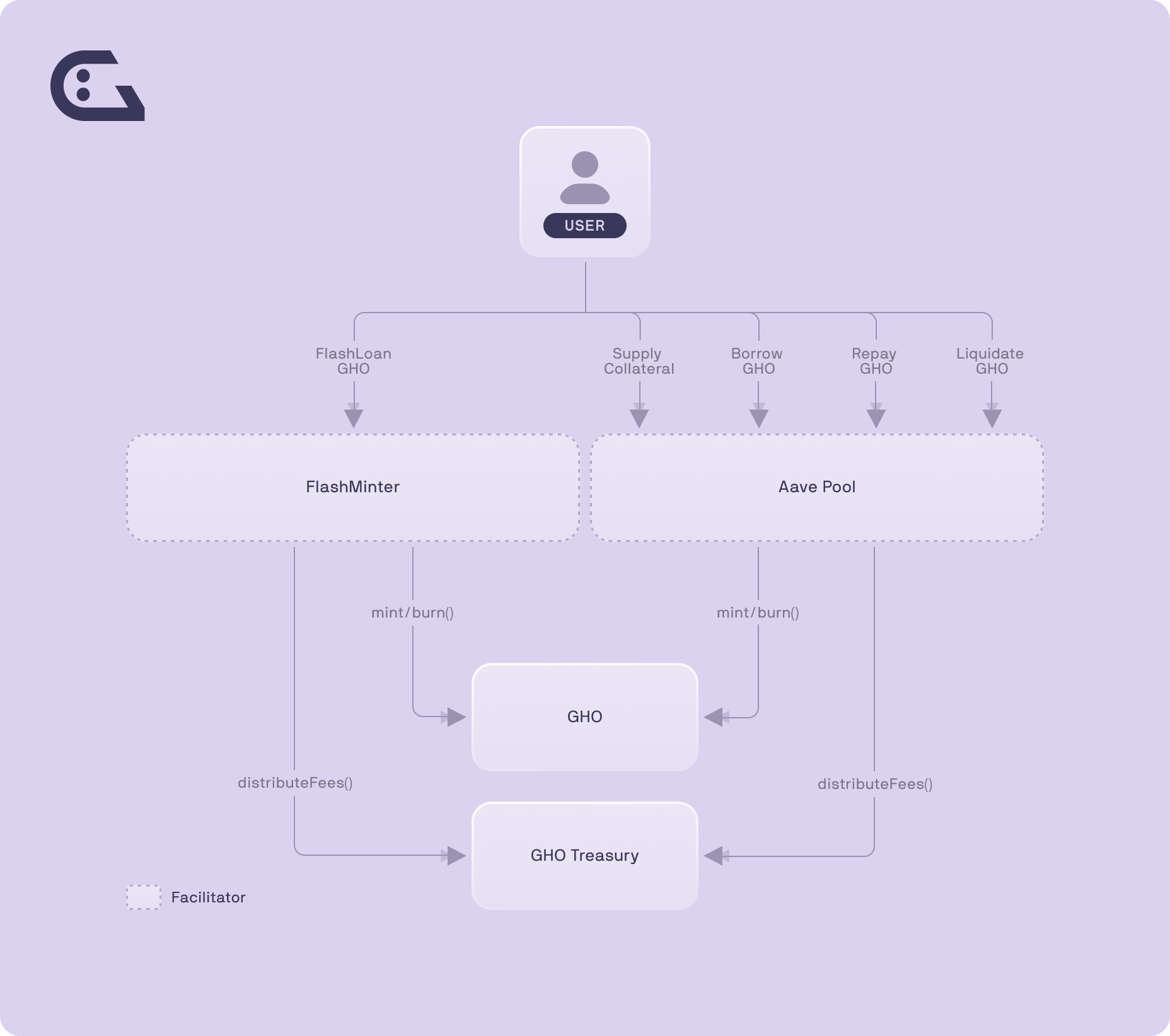

Facilitators

Facilitators, also known as Supporters, are approved and monitored by the DAO. Facilitators are responsible for managing each Pool with a different mint or burn GHO strategy. DAOs can identify and assign Supporters a specific Pool capacity to bootstrap liquidity of GHO and the GHO market.

FlashMint

FlashMint is similar to FlashLoan, giving users instant loans and repayments in a Block. This product helps arbitrageurs stabilize GHO. And help users participate in liquidating excess positions to make profits.

Liquidation

When the loan position reaches the specified threshold to be liquidated, the liquidators will repay the loan on behalf of the borrower for collateral and liquidation rewards. Refunded GHO will also be burned to ensure balance in the value of GHO.

Interest rate

Usually the interest rate will be fixed at 1.5% but parameters related to interest rates can change and these changes are decided by the DAO. Borrowers also receive interest rate discounts, which means reduced loan interest rates when Staking AAVE.

For each stkAAVE, users will receive a 30% interest discount for 100 GHO at an interest rate of 1.5%. If a user deposits 1 AAVE and borrows 100 GHO, the interest rate they will pay is 1.06%. Instead, if a user borrows 200 GHO, that 100 GHO will have an interest rate of 1.06% and 100 GHO will have an interest rate of 1.5%. Their effective interest rate will be 1.28%.

1 stkAAVE will get a 30% interest discount for 100 GHO, and more stkAAVE will get a discount for more GHO. For example, if you have 10 stkAAVE, you will get a 30% interest discount for 1000 GHO.

Revenue

Protocol revenue comes from lending interest or mint GHO and fees collected from Flashmint. This revenue will go to the Aave DAO and there are plans to reward stkAAVE holders.

GHO Highlights

- Take advantage of available liquidity and users from AAve.

- Multi-asset mortgage.

- Collateral is lent out to earn more profit.

- Loan interest is AaveDAO’s revenue

- Low loan interest rate, about 1.5%.

- Staking AAVE reduces loan interest rates.

Compare GHO With crvUSD & DAI

|

|

GHO |

crvUSD |

TOUGH |

|---|---|---|---|

|

Release protocol |

Aave |

Curve Finance |

MakerDAO |

|

Interest rate |

Low, about 1.0%-1.5% |

Medium |

High |

|

Peg retention mechanism |

Medium |

Good |

Medium |

|

Mortgaged assets |

Multi-asset Top coin and Altcoin |

Top coins and LST |

Top coins and Stablecoins |

|

Position |

Multiple mortgages |

Single |

Single |

|

Pool mechanism |

Isolated Pool |

Isolated Pool |

Shared pool |

|

Make profit from mortgaged assets |

Have |

Have |

Are not |

|

Liquidation |

Handmade |

Automatically by LLAMMA |

Handmade |

Personal Projection

GHO is a fully collateralized decentralized Stablecoin, taking advantage of available liquidity from Aave and the Isolated Pool mechanism to support a variety of collateral types along with low interest rates to help Aave compete directly with peers. other lending protocols. In particular, Aave also participates in competition with CDP and Stablecoin.

This is quite the right step for Aave, so that Aave continues to develop and dominate the Lending segment. But Aave will face fierce competition in the CDP and Stablecoin segment when Curve also launches crvUSD, the dominance of DAI’s CDp segment or many other CDP protocols that support LSDfi.

Information Channel About Stablecoin GHO

- Website: https://gho.xyz/

- Twitter: https://twitter.com/GHOAave

- Discord:

Summary

GHO is a decentralized Stablecoin that brings many benefits to Aave and will help Aave grow and compete with other protocols. However, whether this effectiveness can compete with other CDP protocols, especially crvUSd or other CDPs supporting LST and LPT, remains to be seen.

So I have clarified what GHO is? Hope this article brings you a lot of useful information!