What is Geist Finance? A lending & borrowing protocol on the Fantom Opera ecosystem. So what makes the project stand out? Let’s find out with Weakhand.

To better understand Geist Finance, please read the articles below:

- DeFi Panorama 101 | Episode 3: What is Lending & Borrowing? The Essential Puzzle Piece in DeFi

- What is AAVE (AAVE)? Overview of AAVE Cryptocurrency

- NFT Lending: Model, Efficiency & Opportunity

What is Geist Finance?

Overview of Geist Finance

Geist Finance a decentralized Lending & Borrowing protocol on the Fantom Opera ecosystem based on one of the largest DeFi lending protocols by AAVE. The staking and fee distribution system is based on Ellipsis Finance, one of the leading DeFi protocols on the Binance Smart Chain.

Highlights of Geist Finance

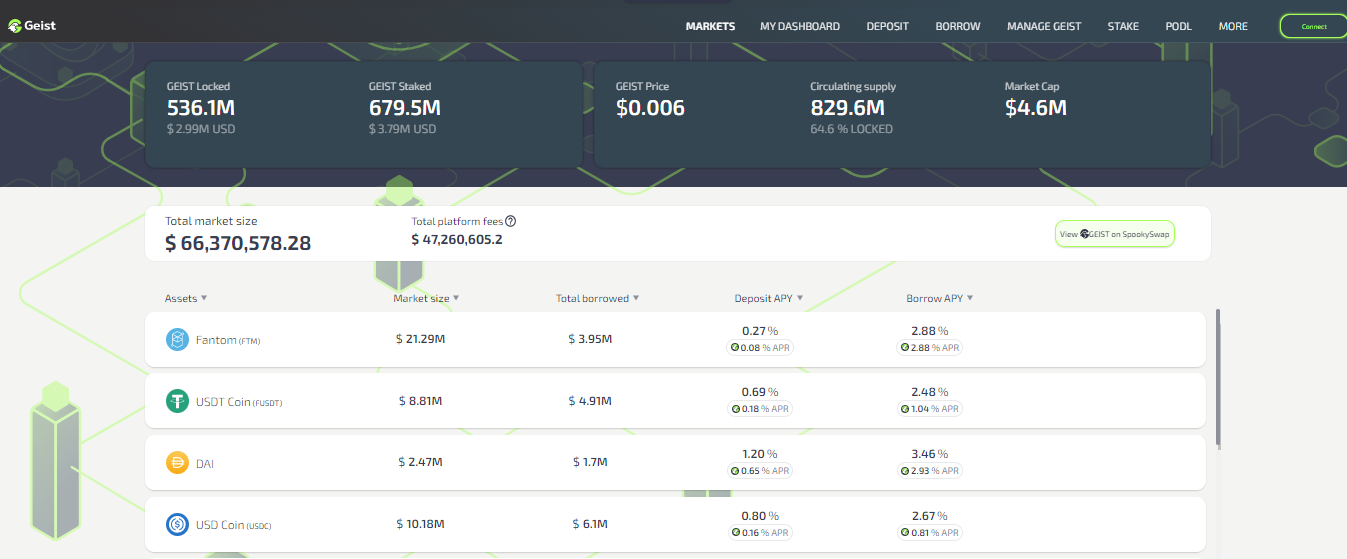

Through Geist Finance, users can lend & borrow many different assets with variable interest rates. These interest rates are determined algorithmically according to the use of the lending pool. Asset valuations are determined using Chainlink and Band oracles.

Users who stake GEIST tokens within 3 months receive 50% of the revenue from the protocol. If the user unstakes before the deadline, they will be penalized and only receive 50% of the reward, the remaining 50% goes to GEIST stake pools. token.

Features of Geist Finance

Geist Finance currently supports crypto assets: FTM, DAI, FUSDT, USDC, ETH, WBTC, LINK, CRV, MIM with annual APY interest rates ranging from 0.31% to 66.40%.

- Deposit: Users deposit crypto assets supported by Geist Finance and receive APY up to 28.72% depending on the asset type.

- Borrow: Users mortgage assets and can borrow crypto assets supported by Geist Finance with APY interest rates ranging from 0.31% to 66.40%.

- Manage GEIST: Users can stake or looks GEIST tokens to receive platform fees or escape penalties.

- Stake: Users stake LP GEISTFTM tokens to earn additional GEIST tokens.

- Podl: This is a DEX Liquidity Module owned by the protocol, users can buy and sell GEISTFTM LP tokens directly with the protocol with a premium of up to 10%.

Development Roadmap

Updating

Core Team

Updating

Investor

Updating

GEIST Tokenomic

Overview information about GEIST token

- Token Name: Geist Finance

- Ticker: GEIST

- Blockchain: Fantom

- Contract: 0xd8321aa83fb0a4ecd6348d4577431310a6e0814d

- Token Type: Utility

- Total Supply: 1,000,000,000 GEIST

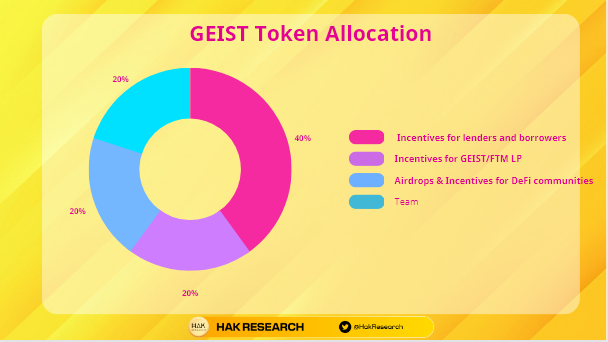

GEITS Token Allocation

- Incentives for lenders & borrowers: Incentive to reallocate to borrowing or lending users: 40%

- Incentives for GEIST/FTMincentives for GEIST/FTM LP: Allocated to users participating in the liquidity supply on the GEIST/FTM pool. 20%

- Airdrops & Incentives for DeFi communities: For Curve, Lobster DAO and Ellipsis communities: 20%

- Team: Allocate 20% as a reward for the Team’s dedicated efforts.

GEIST Token Release

- Incentives for lenders & borrowers: Allocated over 5 years

- Incentives for GEIST/FTMincentives for GEIST/FTM LP: Allocated over 5 years

- Airdrops & Incentives for DeFi communities: Allocated for 1 year

- Team: 20%: Allocated for 1 year

GEIST Token Use Case

- Used for staking in liquidity pools.

- Used as rewards for users participating in providing liquidity to pools, borrowers and lenders, and the community.

- Airdrop for users.

Exchanges

Currently GEIST tokens are being traded on the exchanges: SpookySwap, Soilidly, BKEX

Project Information Channel

- Website: https://geist.finance/

- Twitter: https://twitter.com/GeistFinance

- Medium:

Summary

Geist Finance a decentralized Lending & Borrowing protocol on the Fantom ecosystem, based on AAVE and Ellipsis Finance protocols.

Hopefully this article has partly helped readers understand what Geist Finance is? Information about GEIST token.

Hope everyone has the best information when investing in the project.