What is Fungify? NFTs (Non-fungible tokens) have become increasingly popular with people in recent years. There are many users who have paid millions of dollars to own their favorite NFTs. NFT-related infrastructure projects are also born one after another to meet user needs. Typically, NFT Marketplace projects such as: Opensea, Blur… have attracted millions of users to actively trade on this site.

However, for NFT to reach billions of users and reach Mass Adoption, many infrastructure projects are needed to solve the remaining problems of NFT. So, what problem was Fungify born to solve? Join Weakhand to find out details about this project!

What is Fungify?

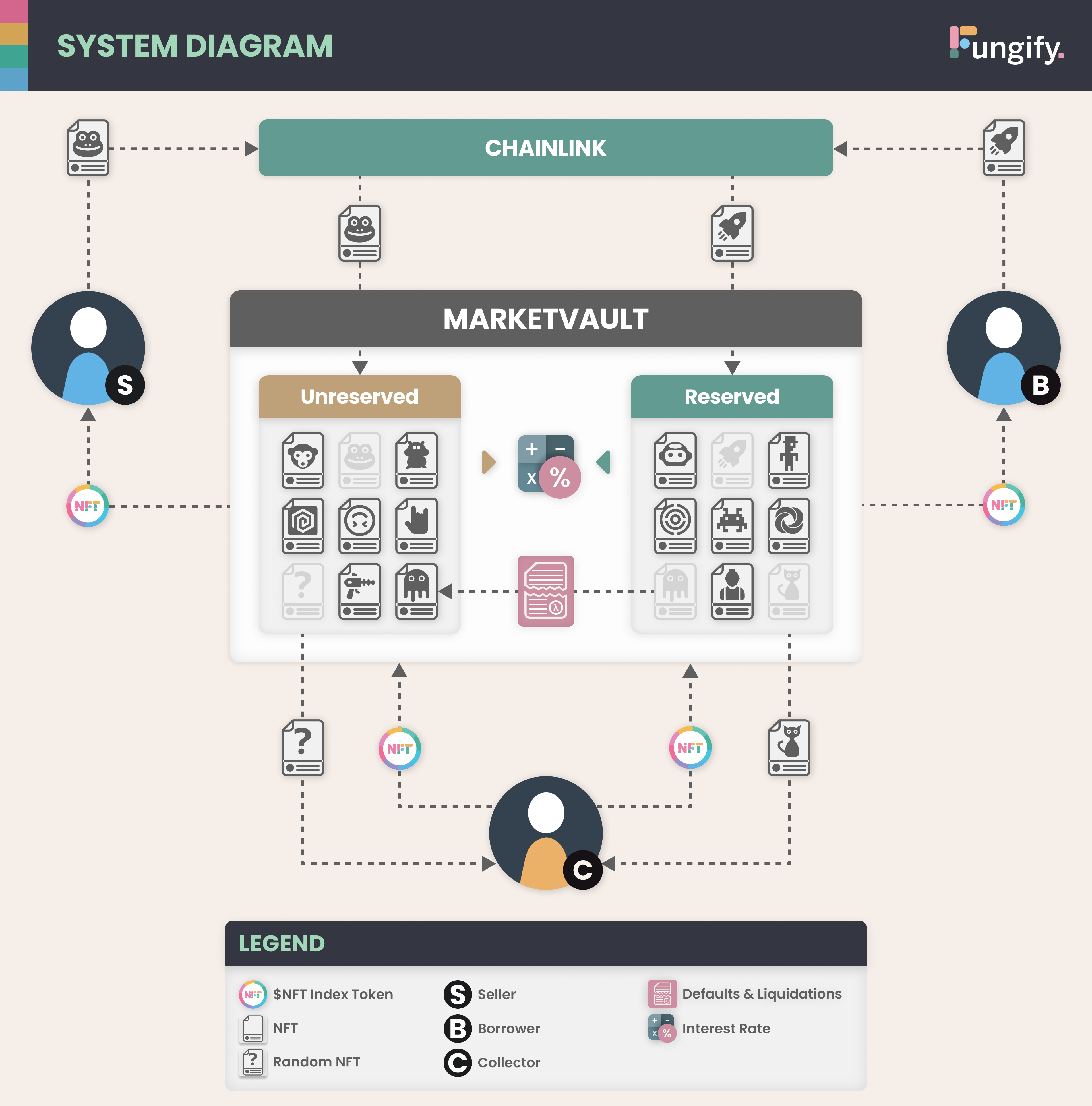

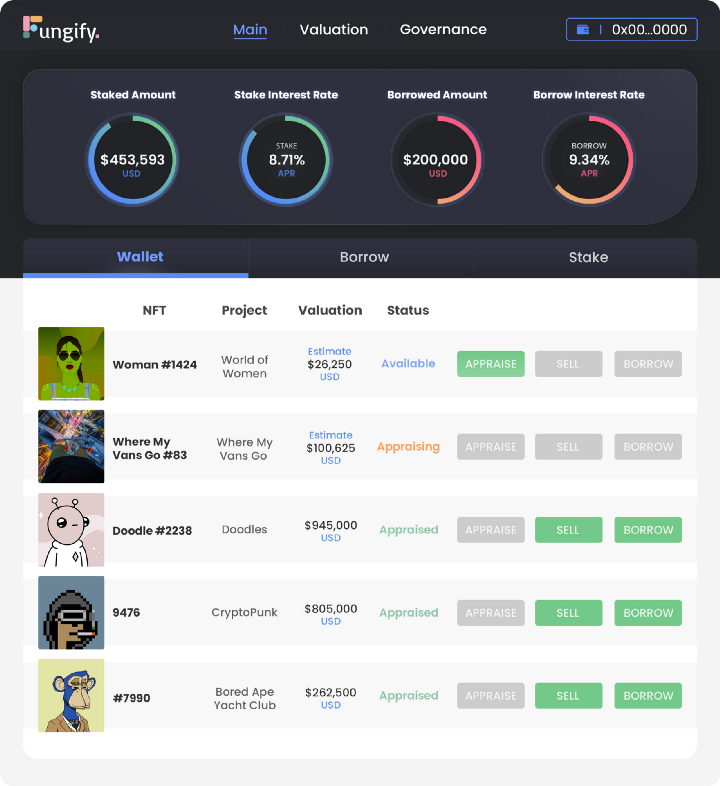

Fungify is an NFTs Lending protocol with a new operating mechanism. Users can sell or pledge their NFTs as collateral through the mechanism MarketVault of project.

MarketVault is the place to store NFTs sold to the protocol or used as collateral. NFTs held by MarketVault can be redeemed by Collectors through the Buy-It-Now or Bid mechanism. This is also where the Minting and Burning mechanism is managed NFT Index Token.

Currently the protocol only supports the following collections:

- Bored Ape Yacht Club

- Crypto Punks

- Mutant Ape Yacht Club

- CloneX

- Azuki

- Doodles

However, more collections can be added later through the project’s governance mechanism.

What is NFT Index Token?

When users sell NFTs to the protocol or use NFTs as collateral, NFT Index Tokens are minted. NFT Index Token represents the Floor Values of that collection.

MarketVault’s Operating Mechanism

Terminology explained

- Seller: These are people who want to sell NFTs directly to MarketVault at Floor Values. These people will take a 2% fee when selling their NFTs.

- Borrower: Someone who just wants to low-cost NFT to borrow MarketVault assets. These people can borrow up to 75% of their NFT value.

- Collectors: Someone who wants to buy NFTs from MarketVault.

- Interest Rate: Interest rate.

MarketVault operates based on 2 Vaults: Unreserved and Reserved

- Unreserved: Is the place to store NFTs of Sellers who sell NFTs directly to the protocol and is also the place to store liquidated NFTs from Reserved.

- Reserved: Is where Borrower’s NFTs are held – People mortgage NFTs to borrow assets from the protocol.

Mechanism of action

- Step 1: Sellers and Borrowers deposit NFTs into MarketVault and receive back NFT Index Tokens representing their assets. Collection prices are calculated through Chainlink. This NFT Index Token can be Staking to earn profits.

- Step 2: Collectors can buy NFTs in MarketVault and have 2 options: Buy-It-Now or Bid – Only happens with NFTs used as collateral, as long as it is higher than the value of the deposit get a loan.

When an NFT has a value higher than the floor price of that collection, how is the protocol handled?

This NFT is called atypical NFTsthese NFTs will not use the usual mechanism but will have their own mechanism.

- Step 1: User submitted atypical NFTs Go to MarketVault and have 2 options: 1/Mortgage and Mint and LUQ Token – the second token of the project. 2/ Accept to sell to the protocol at the floor price.

- Step 2: When you want to get the NFT back, you must return the LUQ Token of equivalent value to the protocol with a fee.

What Are The Highlights Of The Project?

The project designs a smart protocol, providing a source of Real Yield from which it is distributed to Stake Holders (FUNG Stakeholders) and NFT Holders (NFT Index Token Holders).

Benefits of Stake Holders

- Each NFT sold to MarketVault takes a 2% fee. Stake Holder receives 20% of this fee.

- When Redemption (Redemption or redemption of NFT) occurs, there will be a 2.5% fee. Stake Holder receives 20% of this fee.

- In addition, receive an additional 10% from the interest that Borrower must pay for the loan.

Benefits of NFT Holders

- Each NFT sold to MarketVault takes a 2% fee. NFT Holder receives 80% of this fee.

- When Redemption (Redemption or redemption of NFT) occurs, there will be a 2.5% fee. NFT Holder receives 80% of this fee.

- In addition, receive an additional 90% from the interest that Borrower must pay for the loan.

Core Team

Update…

Investor

On February 1, 2023 Fungify announced that it raised $6M under the leadership of CitizenX, with the participation of Infinity Ventures Crypto, Taureon Capital, Anagram, Flow Ventures and a number of other angel investors such as: DCFGod, Joe Eagan (Former President of Polychain Capital), Mark Borsten (Founder of Merit Circle).

Tokenomics

Fungify uses 2 Tokens:

- FUNG: Main token of the project.

- LUQ: Tokens are minted when users deposit atypical NFTs into MarketVault.

Overview information about FUNG Token

- Name: Fungify

- Ticker: FUNG

- Blockchain: Update…

- Contract: Update…

- Total supply: 1,000,000,000

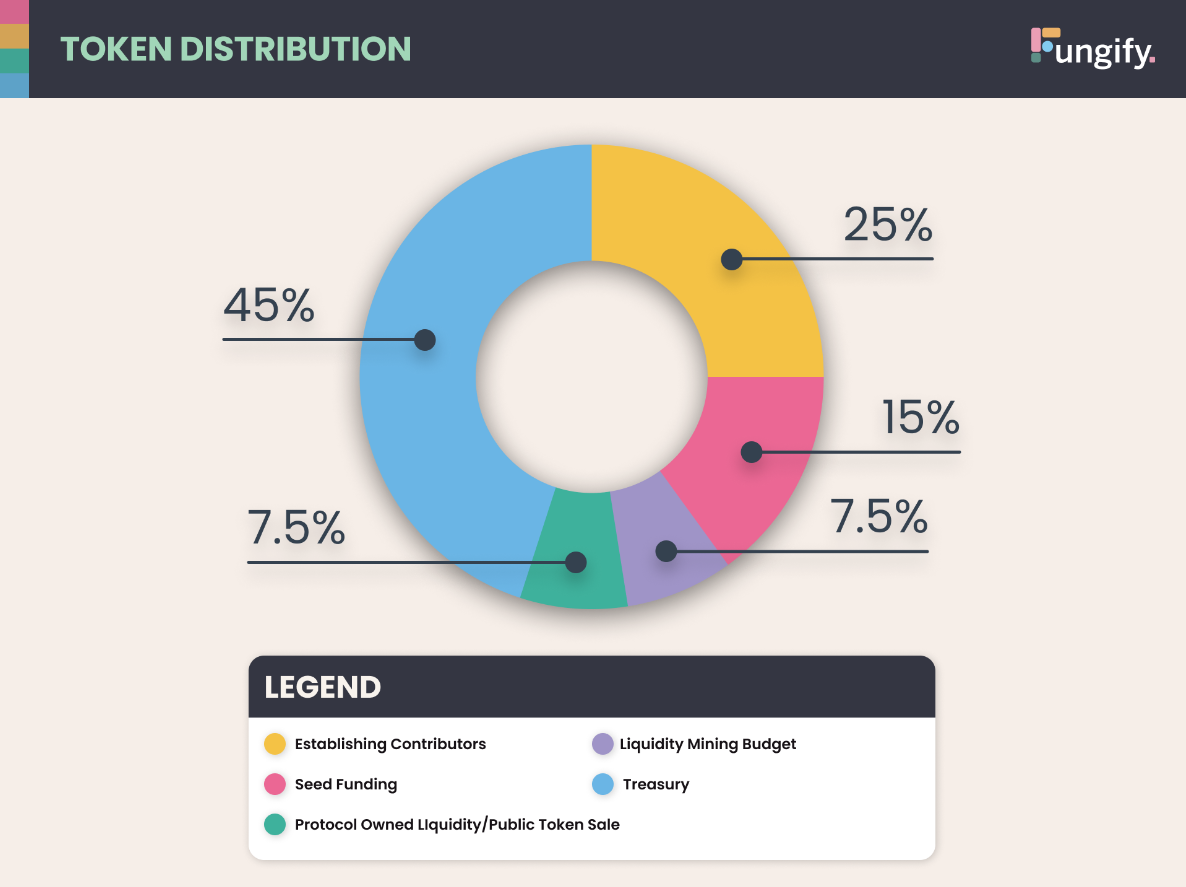

Token Allocation

- Treasury: 45% is in the project’s reserve fund.

- Establishing Contributor: 25% is for those who contribute to the development of the project and receive Vesting within 2 years.

- Seed Funding: 15% for seed round investors and Vesting within 2 years.

- Liquidity Mining: 7.5% is for liquidity miners.

- Protocol Owned Liquidity/ Public Token Sale: 7.5% is used to provide liquidity and sell Public Sale to the community.

Token Use Case

FUNG tokens are used for the following purposes:

- Project management.

- Stake to receive earned protocol fees.

Exchanges

Update…

Project Information Channel

- Website: https://www.fungify.it/

- Twitter: https://twitter.com/FungifyNFT

- Discord:

Summary

Fungify is an NFT infrastructure project, solving some of the problems that NFTs are facing. The project has also raised a fair amount of capital from a number of famous investors in the market, showing that this is a very noteworthy project in the future.

Follow the project’s development in the future with Weakhand!