What is FlowX Finance? FlowX Finance is a DEX platform built on Sui Blockchain. FlowX delivers notable improvements in efficiency, speed and flexibility. So how does FlowX work? What’s different about this platform? Join the Weakhand team to find out below in this article!

To understand more about FlowX, you can read the following articles:

- What is Sui (SUI)? Sui Cryptocurrency Overview

- What is Decentralized Exchange (DEX)? The Role of Decentralized Exchanges in DeFi

- Sui Ecosystem & The First Pieces of the Ecosystem Puzzle

What is FlowX Finance?

Overview of FlowX Finance

FlowX Finance is an AMM built and developed on Sui Blockchain. Here users can trade, yield farm, provide liquidity. This AMM platform will also use the popular formula of Uniswap V2 which is x*y=k.

Users will need SUI tokens to pay gas fees for transactions on FlowX.

Mechanism of action

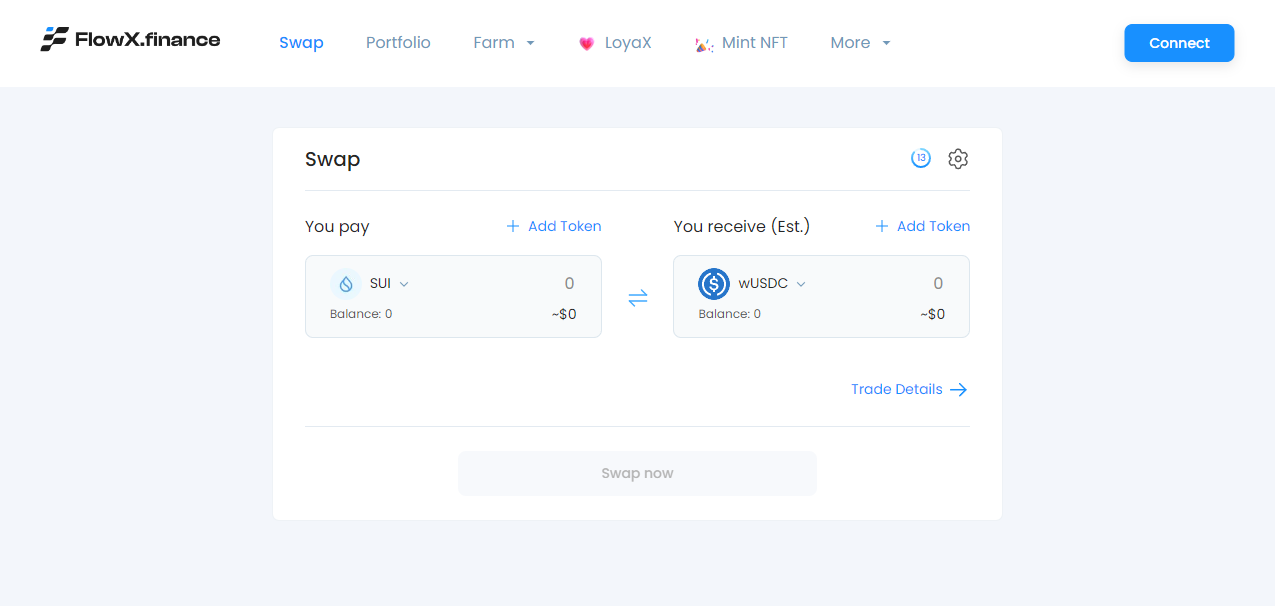

FlowX Swap

This is the core product of FlowX, by leveraging the flexible features of the Move programming language, FlowX delivers a superior user experience when compared to other AMMs:

- Allows swapping from one token to many other tokens and vice versa.

- Aggregate liquidity from other DEXs in the Sui ecosystem to optimize prices and reduce slippage.

Liquidity Pools

FlowX Finance offers the following liquidity pools:

- Stable group: This is a stable liquidity group (similar to Curve) among asset classes with low volatility in value compared to other groups. For example, USDT vs USDC,… Stable asset pairs will maintain a 1:1 ratio.

- Volatility group: This is a liquidity pool for asset pairs with high volatility such as SUI vs. ETH, USDT vs. SUI, etc. Volatile asset pairs are formed by combining different assets and using Using the x*y=k model of Uniswap V2.

Manage

FlowX will provide a comprehensive monitoring tool that allows liquidity providers and users to easily monitor their portfolios. Users can conveniently track their portfolio using a single platform, including tokens, Yield Farming rewards, liquidity pools.

Outstanding features available on FlowX Finance

Outstanding features available on FlowX:

- Trading multiple tokens: FlowX provides users with the ability to swap from one token to many other tokens and vice versa.

- Liquidity Management: Here users can easily monitor the estimated value of their liquidity pairs as well as the value on other AMMs.

- Move location: FlowX Finance allows users to easily move their Liquidity Positions between AMM DEXs while ensuring minimal slippage.

- DEX Aggregator: FlowX Finance optimizes user trading by providing superior pricing, lower transaction costs, and reduced slippage.

- Users can also farm on the platform to earn more profits.

Development Roadmap

FlowX Finance’s development roadmap is divided into 2 phases:

Quarter 3 – 2023

- Create trading contests.

- Launch of liquidity migration.

- Create a stable liquidity pool.

- Open sale of IDO FLX.

- Launching Yield Farming feature regularly.

- Create Liquidity Mining for FLX.

- Launch of DEX aggregator

Quarter 4 – 2023 – Community oriented

- Introducing administration features.

- Launched Divided Room .

Investor

Update, ..

Core Team

Update, ..

Tokenomics

FlowX token overview

- Project name: FlowX Finance

- Token code: FLX

- Token classification: Update, ..

- Blockchain: Sui

- Smartcontract: Update, ..

- Total supply: 10,000,000

Currently the project’s token has not been released, above is just some information about the token that the project mentioned.

Project Information Channel

- Website: https://flowx.finance/

- Twitter: https://twitter.com/FlowX_finance

- Telegram:

Summary

Above is all the information about the FlowX Finance project that the Weakhand team learned. Hopefully the above information can help you in your research process.