What is Flash Loan? Flash Loans are quick loans without collateral that are commonly used by professional traders in the crypto market. So what is Flash Loan and what are its advantages and disadvantages? Let’s find out together in the article below.

What is Flash Loan?

Background of Flash Loan’s birth

Flash Loan was born in 2020 and is developed by the now extremely powerful DeFi protocol AAVE. However, there is a lot of information that Flash Loan was actually born in 2018 by Marble Protocol.

Marble Protocol has a similar idea to Flash Loan, which is Atomic Loan, but in reality, the vision of these two activities is quite similar, but there are differences in the operating mechanism.

Overview of Flash Loan

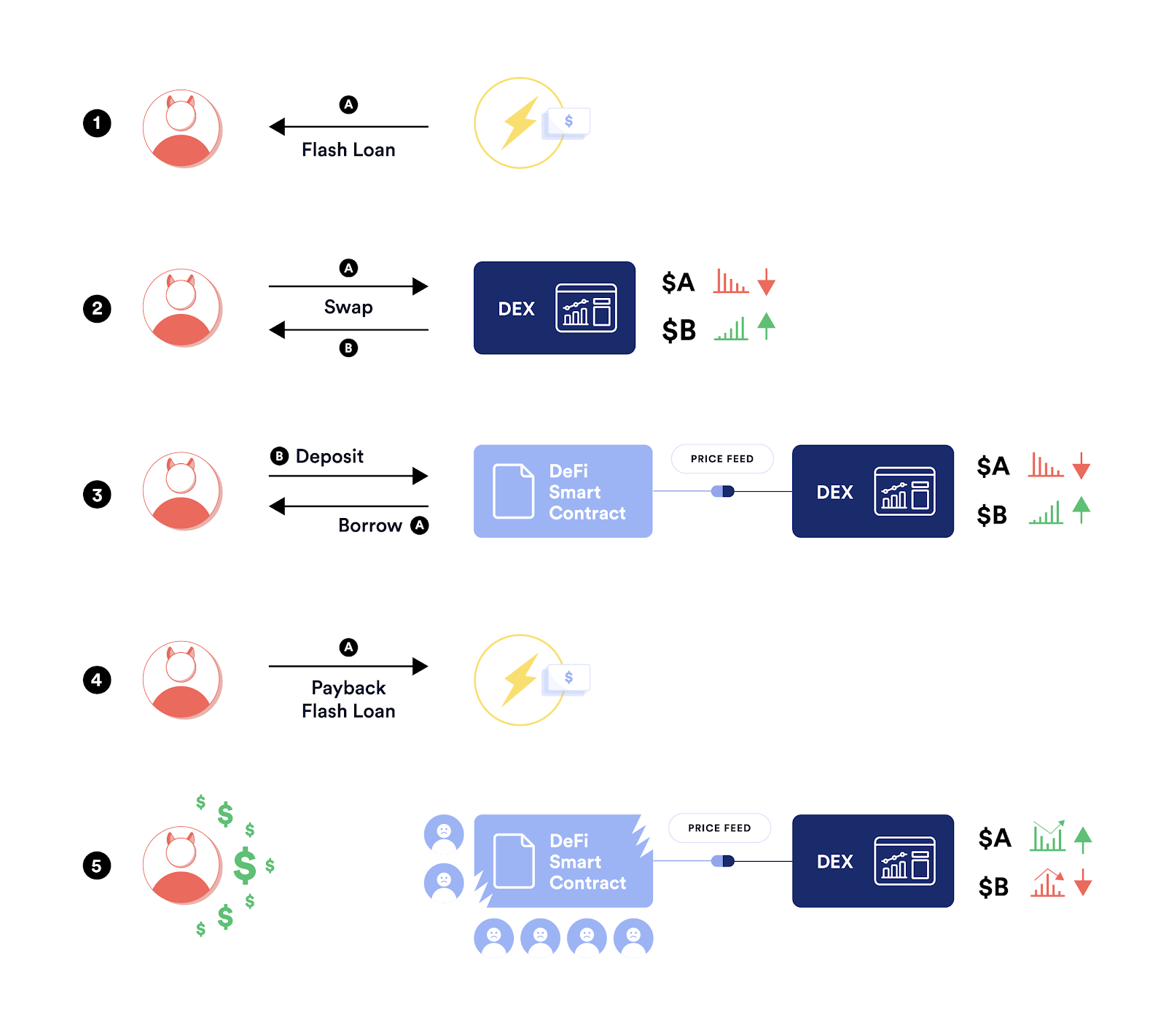

Flash Loan roughly translated: Flash loan refers to a feature of a product that allows users to borrow money without collateral but they need to repay the borrowed money in the same transaction. This means that the user’s borrowing and repayment time must be enough time to complete a block or loan transaction – the debt repayment transaction takes place in the same block.

Flash Loan’s operating mechanism takes place on AAVE in a few basic steps as follows:

- Step 1: Users send a request to AAVE’s Falssh Loan with a Smart Contract including loan information, usually loan amount and interest rate.

- Step 2: AAVE will authenticate transaction information and find loan sources for users.

- Step 3: If AAVE finds a loan source, the transaction will be initiated.

- Step 4: During a block, users must seek profits and repay the loan with the accompanying interest as in the loan conditions in step 1.

- Step 5: If the user cannot repay the loan, AAVE’s Smart Contract will automatically cancel the entire transaction and return the assets to the lender.

Flash Loan looks very easy to deploy, but not every project can develop this product, so there are very few Lending & Borrowing platforms in the crypto market that provide this service. Flash Loan is most famous for its AAVE protocol. Besides AAVE, some protocols also support Flash Loan such as Uniswap, Compound and dYdX.

Some advantages & disadvantages of Flash Loans

Some of the advantages Flash Loan brings to the DeFi market include:

- No need for collateral: This helps borrowers no longer worry about being liquidated and also increases market liquidity.

- Diverse uses: Flash Loan can be used in a variety of services such as Arbitrage, Yield Farming,… Besides, Flash Loan can be combined with many different areas in DeFi such as Trading, Lending & Borrowing, Yield Farming,…

- Fast speed: Borrowers can earn immediate profits and lenders can also earn interest payments in a short period of time.

Besides some outstanding advantages, Flash Loan also has many disadvantages including:

- Smart Contract Risk In fact, many Flash Loan protocols have been attacked and had a lot of money hacked, such as Harvest Finance being attacked and taking $24M and many other cases.

- Flash Loans can involve large amounts of money, which can shake up the DeFi market, which is already very liquid.

Summary

Flash Loan still has a lot of potential to exploit, however, with so many protocols being attacked, Flash Loan makes not too many people trust Flash Loan. Hopefully this short article can help everyone understand what Flash Loan is?