What is Exactly? Exactly is a decentralized lending platform on Ethereum that allows users to lend or borrow at both fixed or variable interest rates. So what’s special about this project? Let’s find out with Weakhand in this article.

What is Exactly Protocol?

Exactly is a decentralized lending platform on Ethereum. Borrowers’ and lenders’ interest rates are determined by supply and demand and are continuously updated on maturity dates.

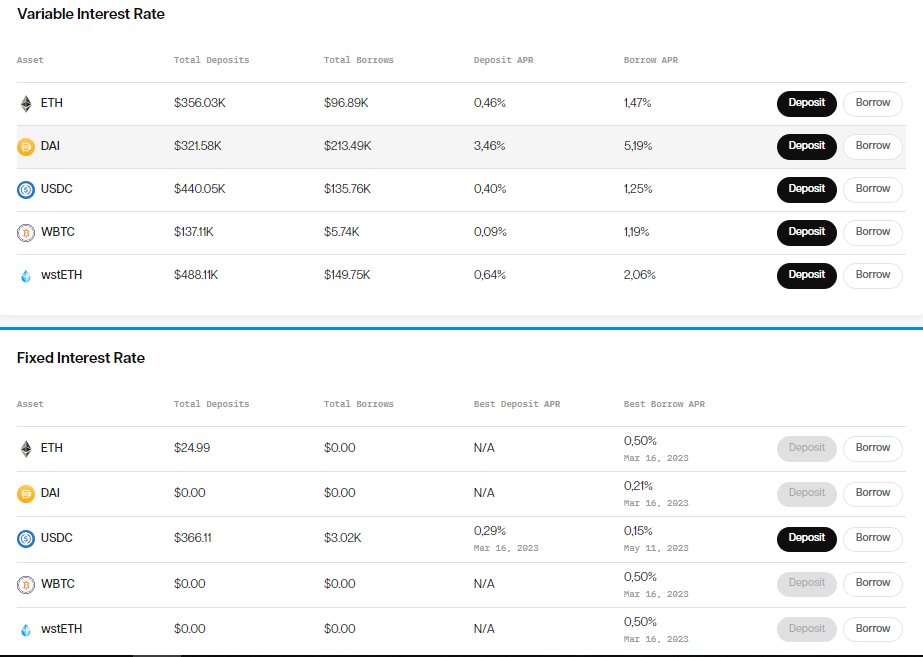

Exactly currently only supports a few asset types such as: ETH, DAI, USDC, WBTC, wstETH. Users can deposit their assets into one of two groups: fixed interest rate group or variable interest rate group.

Interest rate group on Exactly

Main participants on Exactly Protocol:

-

Borrower: Set due date and proceed with loan. The borrower must own it exaToken Only you can apply for a loan on the Exactly platform.

Borrowers can repay the debt at any time. If they pay early before the due date, they will have to pay less interest. If they pay after the due date, they will be charged a penalty rate of 2 days on principal amount.

-

Lender: Set the maturity date and deposit funds into the platform to earn profits. Each deposit will be minted one by one “Exactly token” (exaToken) uses the ERC-4626 standard, which will be provided to users as a voucher for the deposited amount.

These exaTokens are accumulated and increase in value periodically. Users can use exaTokens in exchange for underlying assets or as collateral to borrow an amount of money on the Exactly platform.

Sale: Each user will own an index called health coefficient. If this coefficient is below 1, it means the user’s outstanding loans exceed their total exaTokens.

A portion of the outstanding loan can then be returned by any third party in exchange for the user’s prorated exaToken collateral at a discounted price. In addition, the liquidator will receive a small fee as compensation for debt settlement.

What is the Difference with Exactly Protocol?

Bad debt is a constant danger for Lending platforms. To solve this problem, Exactly will check the audit contract to see how much assets the liquidator can repay, review the borrower’s collateral and calculate the borrower’s position after liquidation. to avoid cascading liquidation and not cause difficulties for borrowers.

After that, Exactly will liquidate the fixed interest rate loans that the borrower has borrowed, first the oldest loans and then continue with the variable interest rate loans. The auditor function will check whether the borrower has any further collateral and in case there is none, it will forward the execution to the function in each Market. This ultimately cleared the debt and apportioned the losses subtracting them from some overall accumulated income.

Core Team

Update…

Investor

- August 12, 2021: Exactly Protocol successfully raises $3M for the first time, led by Kaszek Ventures, with participation from 6th Man Ventures, Baires DAO, 11–11 DG partners, Newtopia VC, NXTP Ventures, Sur Ventures and Latitud. A number of Angel Investors also participated in investing such as Esteban Ordano (Decentraland), JP Thieriot (Uphold), Ariel Barmat (The Graph), Matias Woloski (Auth0) & Marcos Galperin (MercadoLibre).

- January 12, 2023: Exactly Protocol announced the successful call for $2M led by famous individuals in the crypto market such as Kain.eth, Daedalus and Esteban Ordano, with the participation of Bodhi Ventures , Newtopia VC, Kaszek Ventures and NXTP Ventures.

Tokenomics

Update…

Exactly Project Information Channel

- Website: https://exact.ly/

- Twitter: https://twitter.com/exactlyprotocol

- Medium: https://medium.com/@exactly_protocol

- Discord:

summary

Exactly was created to overcome Defi’s shortcomings, helping the crypto market grow stronger. Above is the information about Exactly. Hopefully this article has helped you understand a bit about Exactly.