What is Eddy Finance? Eddy Finance is a project that first invented the Omnichain AMM to provide the market with an infinite liquidity pool for cross-chain transactions. It allows for seamless asset exchange under a simple interface.

So what is Eddy Finance? What is the difference between Eddy Finance? Let’s find out in this article!

Eddy Finance Overview

What is Eddy Finance?

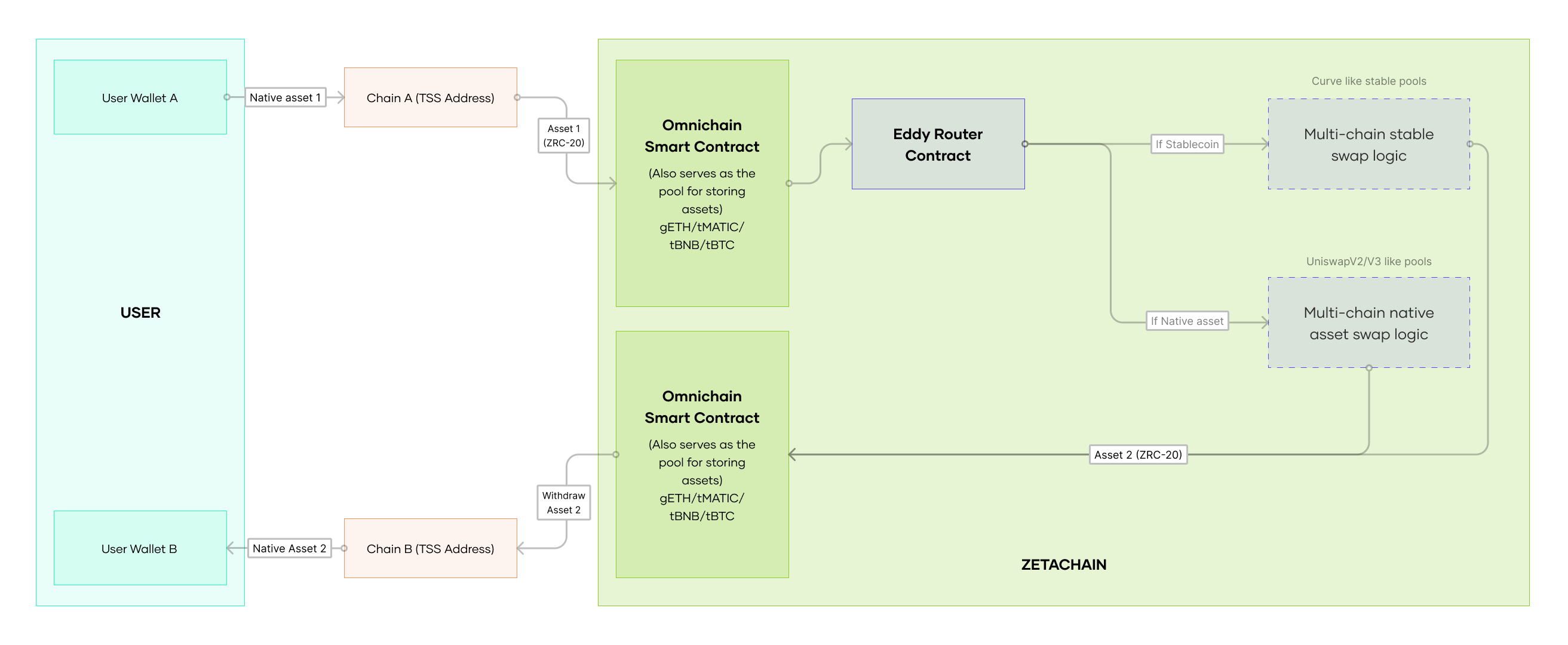

Eddy Finance is an AMM DEX built on Zetachain, the Omnichain Blockchain. Taking advantage of the Zetachain infrastructure’s ability to connect well with Blockchains, Eddy Finance has for the first time developed an AMM DEX Omnichain model, completely eliminating liquidity barriers between blockchains (Chain).

Eddy Finance builds a liquidity pool to support asset transactions on Zetachain. However, this liquidity is also used for cross-chain transactions. This model helps create deep liquidity for the decentralized financial market.

Mechanism of action

Eddy’s AMM Pool contains assets such as BTC, ETH, MATIC, USDC, DAI, USDT, etc. Native assets of other chains will be displayed in Eddy Finance’s Pool as the ZRC-20 standard. For example, BTC on the Zetachain network is called e.BTC, ETH on the Zetachain network is e.ETH.

Eddy uses 2 types of Pools for AMM:

- Pool Stables: Contains major Stablecoins in the same Pool and applies the same formula as Curve Finance.

- Pool Asset: A Pool contains all types of assets including Altcoins and Stablecoins and uses the formula x*y=k. In this way, we can think of this Pool as the Balancer Pool.

Eddy Finance’s AMM pool can aggregate liquidity from multiple chains. People from any chain can add liquidity to the Pool. When adding an asset on the original chain to Pool Eddy, your asset will be locked on the original chain and minted e.Token according to the ZRC-20 standard at a 1:1 ratio.

On Zetachain, it doesn’t matter which chain you transfer assets from. For example, if you transfer USDC from Ethereum to Zetachain, you will use e.USDC. If someone else transfers USDC from Avalanche to Zetachain, they will also use e.USDC. It creates a common consistency for liquidity.

Description of how Eddy Finance works with an example of a user wanting to convert ETH assets on the Ethereum chain into USDC assets on the Arbitrum chain:

- User wallet on Ethereum transfers ETH assets to Pool on Ethereum for locking.

- Then, a similar amount of ETH assets were minted in the form of the ERC-20 standard (e.Token), with the asset being ETH called e.ETH.

- Swap e.ETH assets to e.USDC at the appropriate Pool on Eddy’s Pool. (e.USDC represents the USDC Native asset on Arbitrum.

- The amount of e.USDC received after the swap will be burned and the USDC Native will be unlocked in the Pool on Arbitrum and sent to the user’s wallet address on Arbitrum.

The product that Eddy Finance provides is an AMM swap service. Eddy allows liquidity providers from incoming chains to find yield. Supports transactions on Zetachain and also cross-chain transactions, from one chain to another securely.

Presentation Roadmap

Update…

Core Team

Abhishek Kumar: Co-Founder

- In 2021, Abhishek graduated with a Bachelor’s degree in Construction from Birla Institute of Technology and Science, Pilani.

- During his student years, he spent 4 years working as a Writer at Towards Data Science.

- After graduating, he worked as a full-stack developer for Visit Health and then Flint.

- Currently, he is a Co-Founder of Eddy Finance, he joined in founding the project in January 2023.

Investors

Update…

Tokenomics

Update…

Exchanges

Update…

Eddy Finance’s Information Channel

- Website: https://eddy.finance/

- Twitter: https://twitter.com/eddy_protocol

- Blog:

Summary

Eddy Finance is the first project to develop AMM Omnichain, bringing a common liquidity layer to the entire market. In particular, the project brings the ability to support cross-chain Native asset transfers between chains quickly and safely.

This project could be a Hidden Gem you are looking for for the upcoming Omnichain trend. Hope this article brings you a lot of useful information!