What is DropsDAO? DropsDAO is a decentralized peer-to-peer lending platform on Ethereum, users can use their NFTs as collateral and borrow an amount of money instantly.

Let’s find out what is special about this project with Weakhand in this article.

What is DropsDAO?

DropsDAO is a decentralized peer-to-peer lending platform on Ethereum where users can receive instant loans using their NFTs as collateral.

Participating components on DropsDAO:

- Borrower (Borrower): Provide collateral (NFT) to borrow an amount of tokens (FRAX, USDC, ETH) immediately. NFTs are priced at floor prices and are powered by Chainlink. Borrowers can receive loans of 30-60% of the value of their mortgage.

- Lender (Lender): Deposit an amount of your tokens into the platform to receive interest. Currently DropsDAO only supports 3 types of tokens: ETH, FRAX, USDC.

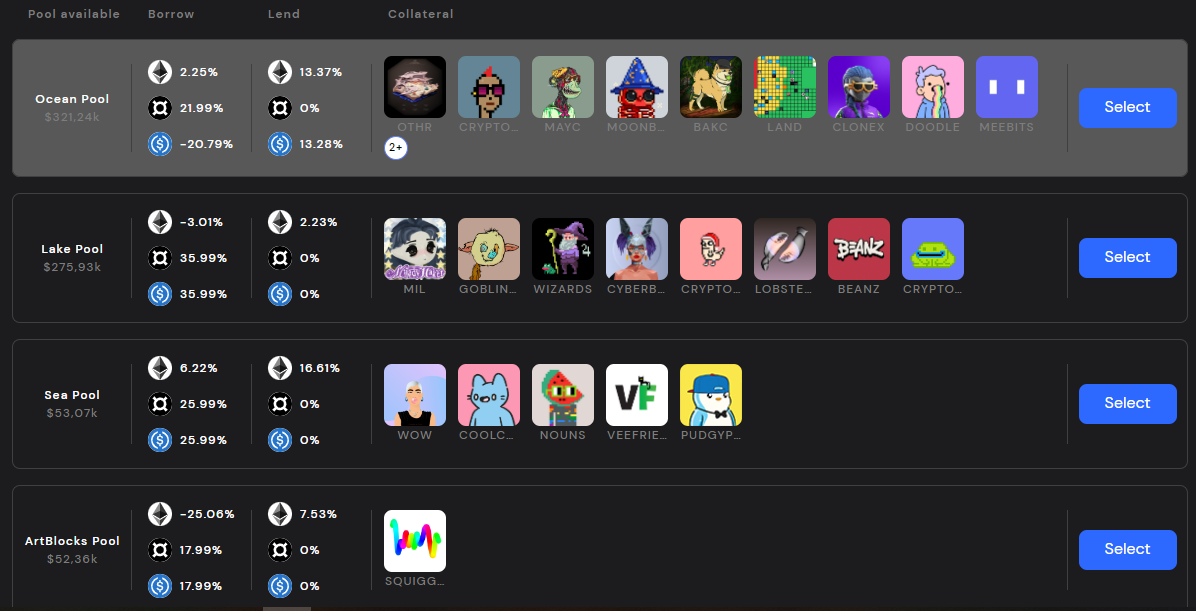

Because the liquidity and volatility of NFTs are very large. Therefore, DropsDAO is divided into many different Lending Pools such as:

Lending Pools on DropsDAO

-

Ocean (Senior tranche) – Blue chip NFTs have the highest liquidity, low risk collateral.

-

Sea (Mazzanine tranche) – Mid-cap NFTs with medium-risk collateral.

-

Lake (Junior tranche) – NFTs have lower capitalization with high-risk collateral.

-

….

The Lender can choose Lending Pools appropriate and deposit your tokens into the Pool to receive interest. Interest rate of Borrower and Lender decided by DropsDAO based on market supply and demand.

Sale: Loans have no maturity date. When the loan falls below the minimum mortgage rate threshold, their assets will be liquidated. The liquidator will buy back the debt from the borrower.

For example: BAYC NFT at 60% LTV with minimum collateral ratio of 166.6%.

Suppose a user borrowed 50 ETH when the value of BAYC was 100 ETH. Liquidation price of this loan: 50 ETH * 166.6% = 83.3 ETH

When the BAYC NFT price drops below 83.3 ETH, the user’s NFT is liquidated.

Find out more:

- What is NFT Finance? The future of NFTs in the crypto market

- What is JPEG’d (JPEG)? JPEG’d Cryptocurrency Overview

What is the Difference of DropsDAO?

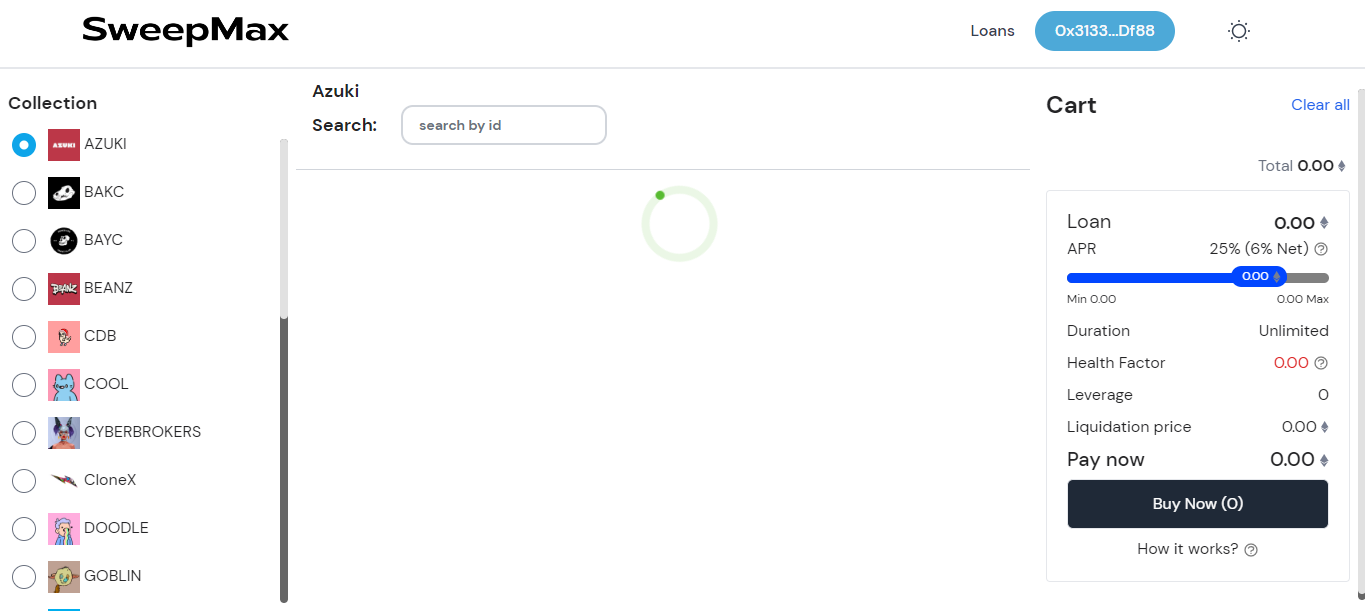

DropsDAO introduces a new function called SweepMax. It allows users to buy NFTs now and pay later. NFTs can be obtained with just a 40% down payment. Users can completely reverse mortgage this NFT into the DropsDAO platform to borrow the corresponding amount of money.

Note:

If the loan ratio reaches this threshold, the NFT will still be liquidated.

NFT purchases on SweepMax have no maturity date and interest is paid in DOP (DropsDAO’s governance token).

Once the loan is fully repaid, the purchased NFT can be withdrawn directly to the buyer’s wallet.

Core Team

Update…

Investor

DropsDAO has not announced any funding round yet

Tokenomics

Basic information about tokens

- Token Name: DOP

- Blockchain: Ethereum

- Contract: 0x6bb61215298f296c55b19ad842d3df69021da2ef

- Token Type: Governance

- Total Supply: 15,000,000 DOP.

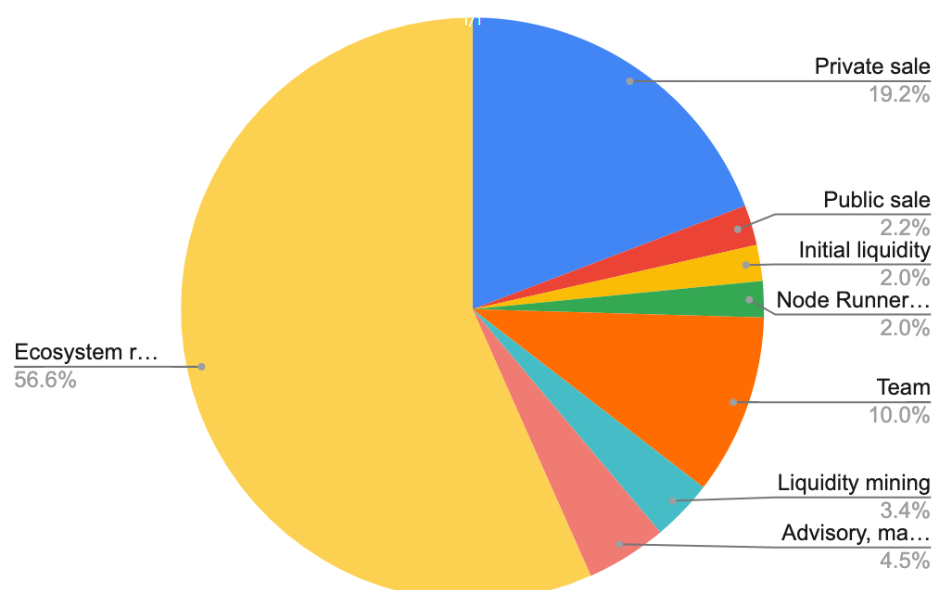

Token Allocation

DOP token allocation

Token Release

- Private Sale: 30% unlocked at listing, paid in installments over the next 9 months

- Public Sale: 100% unlocked at listing

- Team: 2 years vesting

Token Use Case

Lock DOP to receive veDOP. This model is similar to Curve Finance with CRV and veCRV.

With veDOP users can:

- Participate in voting on decisions on DropsDAO

- Staking receives rewards

Exchanges

DOP can be traded on both DEX and CEX exchanges such as: Uniswap, Gate, MEXC, …

Information Channel of DropsDAO Project

- Website: https://drops.co/

- Twitter: https://twitter.com/dropsnft

- Medium: https://dropsnft.medium.com/

- Discord:

summary

Hopefully this article has helped you understand a bit about DropsDAO. The NFT Finance market in general and DropsDAO are experiencing new developments recently, expected to create a boost for the Crypto market and explode in the future.