What is Diva Staking? Diva Staking is a protocol that supports users to stake ETH, but has improved thanks to Distributed Validator Technology (DVT). So let’s find out what’s special about the project through the article below.

Project Overview

What is Diva Staking?

Diva Staking is a protocol that supports users to stake ETH, but has improved thanks to Distributed Validator Technology (DVT). Rewards from ETH staking will be divided based on the contributions of participants.

Mechanism of action

Diva Staking’s operating mechanism

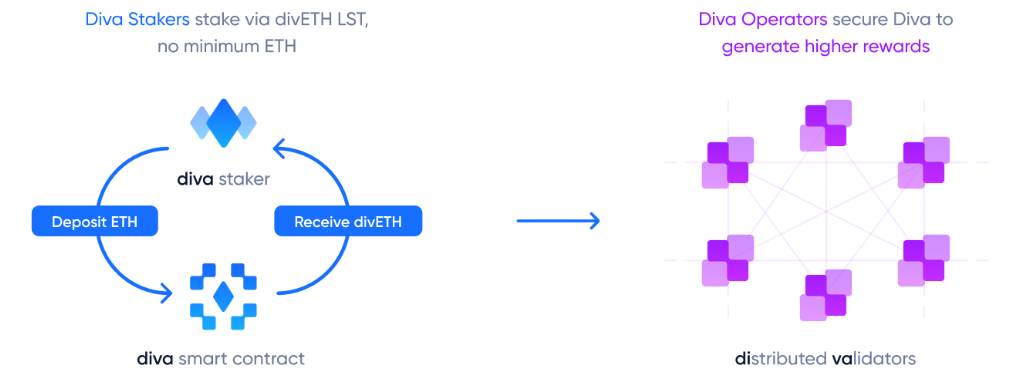

In Diva Staking, there will be 2 roles for users to choose when staking ETH:

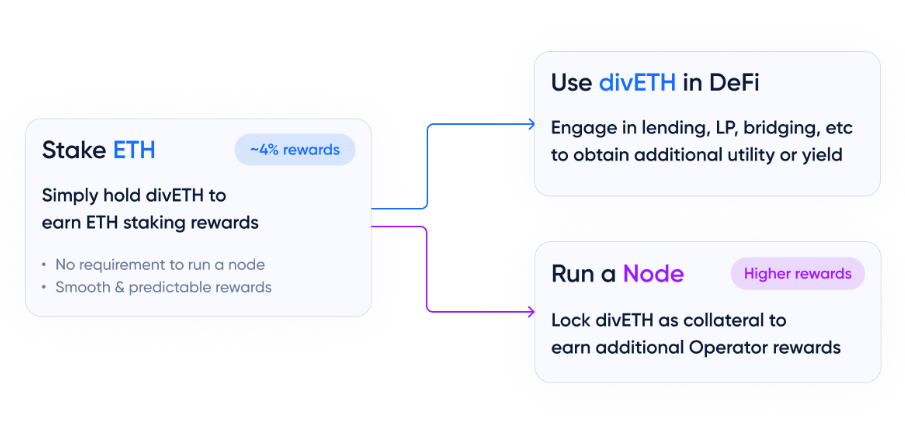

- Liquid Staker: After staking ETH, you will receive divETH, a Liquid Staking Token from the protocol and only receive rewards from staking ETH.

- Operators: Deploy one Distributed Validation node to take on staking tasks and earn additional rewards from becoming Operators, in addition to profits from ETH staking.

Liquid Staker

For Liquid Staker, users just need to deposit ETH into the protocol and then receive divETH back. Users can deposit any amount of ETH into Diva as the protocol does not require a minimum amount of ETH to use the service. The balance of divETH in the wallet will always be updated daily to reflect rewards from ETH staking.

In addition, divETH can also be used to participate in DeFi protocols and can be redeemed at any time through the Diva Staking Smart Contract. divETH is an ERC 20 standard token and can be wrapped into wdivETH.

Operators

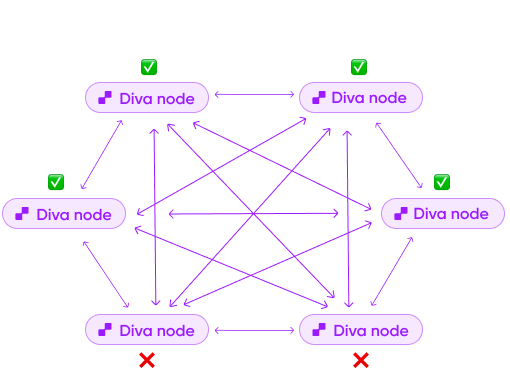

Here there is a concept I want to clarify to everyone: Key Shares. Each ETH Validator created by Diva will have 16 Key Shares. When these 2/3 Key Shares sign together, they form a valid signature to operate ETH Validator.

To become Operators and operate nodes, users must lock up an amount of divETH. For Operators with bad behavior, they can be subject to fines based on the number of divETH they initially locked up to participate in the system. To receive Key Shares, Operators need to provide enough divETH as collateral. The more divETH locked, the more Key Shares they will receive, as well as increasing their ability to receive more rewards.

Diva Staking Highlights

There are 3 main ways to participate in Diva Satking

Diva vs Ethereum Staking

- On Ethereum, to become a Validator, users must stake 32 ETH and run the node themselves. This is quite a large amount of money for many people, not to mention the resources of machinery and equipment.

- On Diva, users can enjoy 2 times the profit. One word stake ETH, one word become Operators. And users also do not need 32 ETH to become a validator on the ETH network.

Non-Custodial

Operators do not have access to user funds. Diva staked all of the user’s ETH into Ethereum Validators. In addition, Operators do not have all the Key Shares of Validatos, so they cannot unilaterally withdraw money.

Protect Staker

If the Operators are offline or have bad intentions that affect the staker’s money (Staker), their divETH will be used as the initial mortgage to compensate. With this mechanism, users can feel secure about their money.

Apply DVT technology

When Validators validate transactions, they need at least 2/3 of the nodes to agree, which makes Diva secure in its operations.

Development Roadmap

Update…

Investor

Investor Diva Staking

- January 17, 2023: Diva Staking completed its Seed round with a raised capital of $3,500,000 USD led by A&T Capital.

Core Team

Pablo Villalba Villar

- He received a bachelor’s degree in aerospace engineering from Universidad Politécnica de Madrid in 2009.

- From January 2007 to March 2009, he was the co-founder of Teras-LMA online courses. In September 2008, he founded Redbooth and became CEO until January 2014. He founded and became the CEO of the fitness app 8 Fit in 2014-2018.

- In January 2020, he and his teammates founded StimuSIL and hold the position of president until now. In June 2023, he became Research Collaborator at The Staking Foundation.

Miguel Prada

- In 2014, he received a doctorate in microelectronics at the University of Sevilla. In 2019, he received a professor’s degree in cryptography in microelectronics at the University of Sevilla.

- In May 2018 – August 2018, he worked as a Research Internship at IBM. From September 2012 to May 2019, he held positions such as researcher, research engineer in the INNPACTO project, PHd Researcher at IMSE-CNM.

- June 2019 – October 2021 He worked as a Postdoctoral Researcher at IBM, then worked as Core Dev at Vortex and Director at Shamir Labs

Raúl Calvo

- In 2005, he graduated with a degree in law from Complutense de Madrid University. He received a doctorate in global law from IE Business.

- Then he co-founded 420ND, Managing Portfolio at thousandnodes from February 2018 to October 2022. In April 2021, he worked as Counsel for Potion Labs. In September 2022, he co-founded Diva Labs. In October 2022, he worked as portfolio and legal manager for KIMCHI.

Tokenomics

Update…

Exchanges

Update…

Project Information Channel

- Twitter: https://twitter.com/divastaking

- Website: https://divastaking.com/

- Telegram:

Summary

DVT is a new technology and is waiting to come to light. You can observe more because it has a close relationship with Narrative LSD, LSDfi. Hopefully through the article, everyone will understand better what Diva Staking is.