What is dHEDGE? dHEDGE is a decentralized asset management protocol that helps investors optimize profits through the strategies of fund managers. So what’s special about dHEDGE’s model? Let’s find out through the analysis below.

To better understand the project, people can refer to some of the articles below:

- What is Yield Farming? Make Profits As People Become “Farmers” In DeFi

dHEDGE Overview

What is dHEDGE

dHEDGE is a decentralized asset management protocol that helps investors optimize profits through the strategies of fund managers. dHEDGE is a place that connects fund managers who want to manage a sum of money with investors who have an amount of assets who want to increase it. dHEDGE is built on Layer 2 of Ethereum which is Polygon and Optimism.

Highlights

Here are the highlights of dHEDGE:

- No detention: users retain ownership of their assets, fund managers cannot “run away” with users’ assets.

- Decentralization: dHEDGE wants to create a safe, stable protocol for both investors and fund managers.

- Transparent: All activities in the fund are recorded on Blockchain, from depositing, withdrawing, selling, buying any type of asset, users can look up.

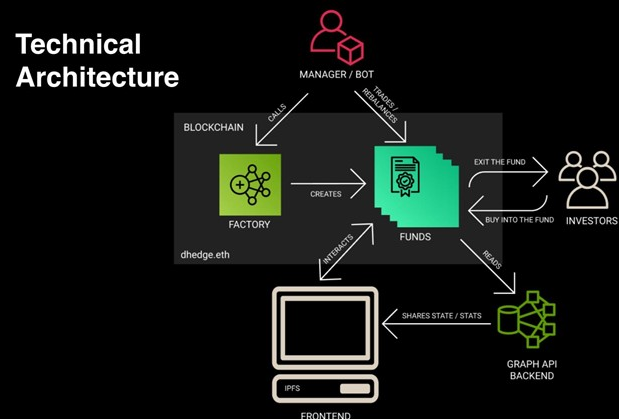

Mechanism of action

- Step 1: Fund managers can create Vaults through dHEDGE on Polygon or Optimism.

- Step 2: When investors deposit money into the Vault, they will receive back that Vault’s token representing the amount deposited.

- Step 3: When you want to withdraw money, the Vault token will be burned and returned to the investor along with the profit of the original token. One thing to note is that when lokc tokens enter the Vault, you must wait 24 hours before you can exchange them again.

For Vaults with good performance, they will receive a reward from the protocol in the form of DHT tokens. All activities in the Vault such as transactions, deposits, withdrawals, and profits are publicly available to investors.

Development Roadmap

Update…

Investor

- dHEDGE has raised an amount of $2,000,000 USD by investment funds such as Mask Network, IOSG Ventures, Framework Venture, BlockCapital Venture…

Core Team

Ermin Nurovic: Co-Founder

- In 2008, he graduated with a degree in electricity and electronic machines from Murdoch University. Then started working for 5 years at Honeywell as a System Management Engineer. In 2014, he worked as a Process Management Engineer at INPEX for 5 years.

- In August 2019, he co-founded Upstreet. In March 2020, he and his colleagues founded dHEDGE DAO.

Tokenomics

Overview of DHT tokens

- Token name: DHT

- Code: DHT

- Blockchain: Ethereum

- Token classification: ERC-20

- Contract: 0xca1207647ff814039530d7d35df0e1dd2e91fa84

- Total supply: 100,000,000

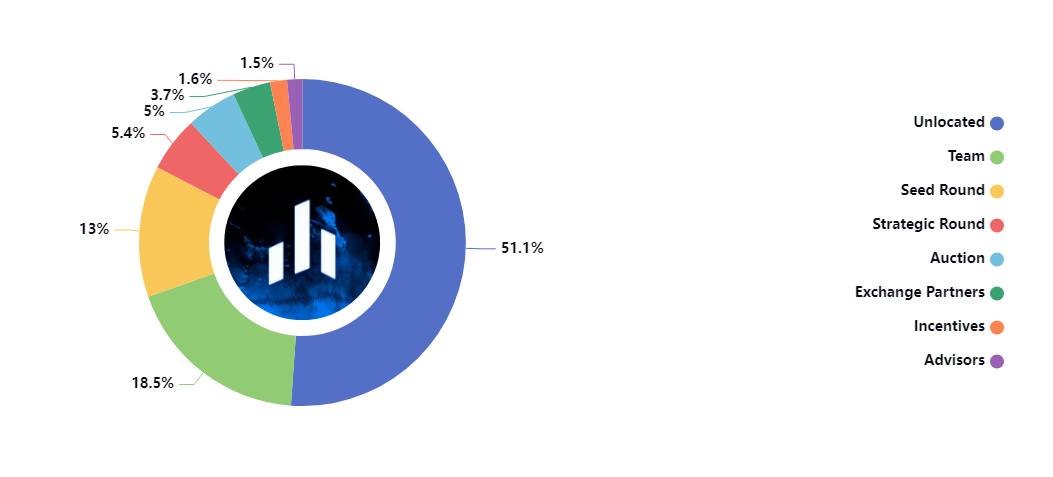

Token Allocation

DHT Token Allocation

- Unlocated: 51.1%

- Team: 18.5%

- Seed Round: 13%

- Strategic Round:5.4%

- Auction: 5%

- Exchange Partners: 3.7%

- Incentives: 1.6%

- Advisors:1.5%

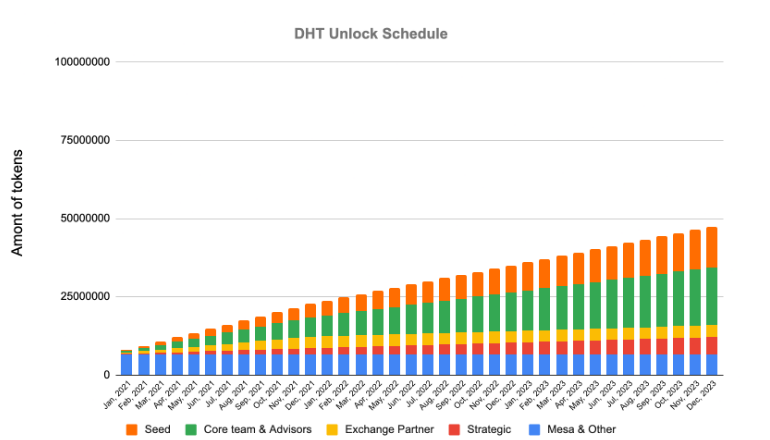

Token Release

DHT Token Release Schedule

Token Use Case

DHT tokens can be used for the following:

- Used to reward Vaults that operate effectively.

- Used to vote on proposals in dHEDGE DAO.

Exchanges

Currently, people can buy DHT tokens at DEX exchanges such as: Uniswap V2, Shushi Swap, Velodrome,…

Project Information Channel

- Twitter: https://twitter.com/dHedgeOrg

- Website: https://dhedge.org/

- Telegram:

Summary

Through this article, I hope to provide you with general information about the dHEDGE project. Weakhand’s team will continuously update everyone with the latest information about the project.