What is DeltaPrime? DeltaPrime is a decentralized borrowing and investment ecosystem, increasing the efficiency of capital use. So What is DeltaPrime? Let’s find out in this article!

To better understand the project, you can read the following article:

What is Gearbox Protocol (GEAR)? Gearbox Protocol Cryptocurrency Overview

What is DeltaPrime?

DeltaPrime is a borrowing and investing ecosystem that unleashes liquidity by increasing capital efficiency. On DeltaPrime, users can easily send assets and get a loan coins to power their regular DeFi investments. Billion Minimum mortgage rate for loans is 20%.

DeltaPrime operates on the Avalanche chain. Users can deposit their assets into a Liquidity Pool for which the borrower must pay interest. Borrowers in the Pool can invest these funds through a multitude of protocols DeFi . Although these investors are at risk liquidation if they invest poorly, but they can also reap greater rewards by investing well.

Borrowed money can be used for investment protocols are integrated like Trader Joe, Pangolin, Vector Finance, YieldYak,… DeltaPrime will integrates most popular protocols in DeFi, as long as they are highly secure. In the future, DeltaPrime will become tdecentralized autonomous organization (KNIFE)giving full control over protocol integration to users.

When borrow and invest above DeltaPrime, you will receive:

- Add capital to increase profits

- Not checked

- Integrates the best DeFi protocols

When you send money On DeltaPrime, you get:

- Your protocol deposit

- Get bot protection by free liquidation

- There is no risk of losing the label

Integrated protocol achieves:

- Cash flow increase

- TVL increase

Mechanism of Action

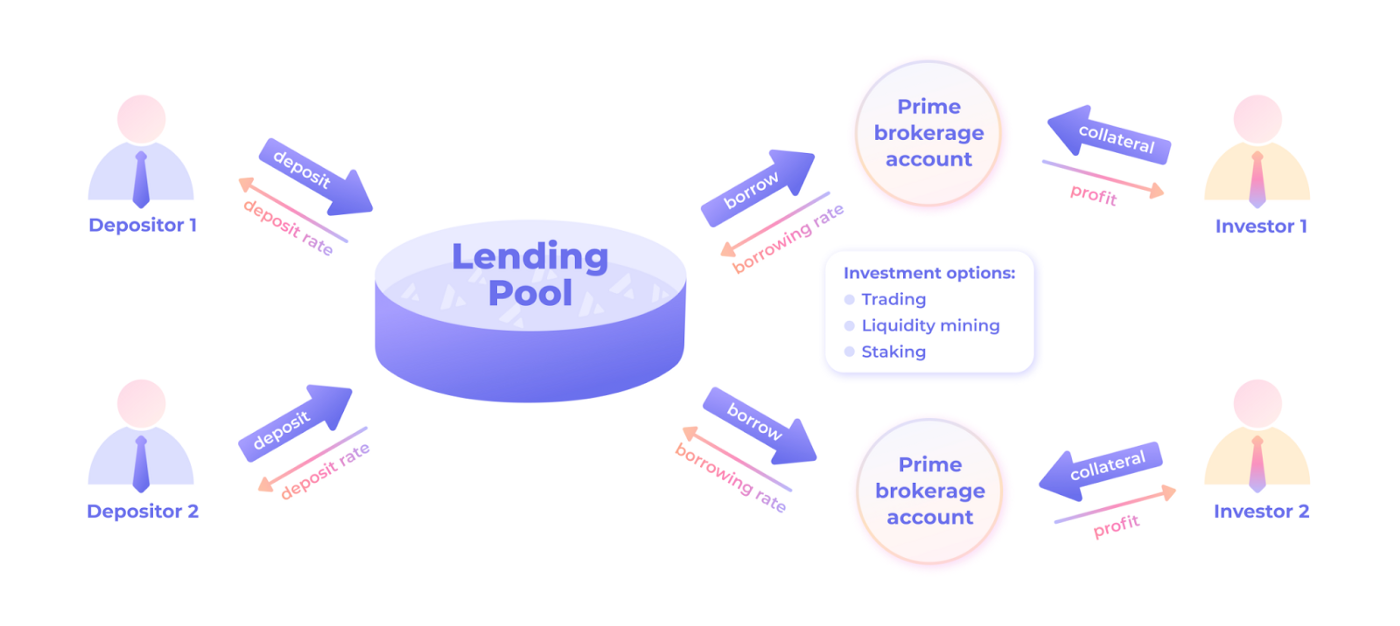

Mechanism of action of DeltaPrime

As shown above, the person who wants to find the interest rate deposits assets into the Pool. Investors borrow assets from the Pool with x5 leverage and pay interest to the Pool. Thanks to asset leverage, Farm investors get more money than on other platforms through DeltaPrime. However, there is still the possibility of losses leading to asset liquidation.

Liquidation mechanism

DeltaPrime uses Bot for liquidation so there will be less fees when liquidated. If the mortgage rate of the property falls below the prescribed level, it will be liquidated. The liquidation process is divided into installments, that is, partial liquidation and a maximum of 25% each time.

This way, borrowers don’t lose all their assets due to price spikes, while depositors are still protected. KWhen the Liquidation Bot successfully liquidates a position, it will receive a liquidation reward as an incentive.

Business model

Currently DeltaPrime does not collect any fees, but future plans will be as follows:

Development Roadmap

2021

Avalabs grant

Received a $300,000 Grant from AvaLabs

Leverage trading

DeltaPrime’s first feature is gLeverage trading . To deliver this, DeltaPrime needs:

- Liquidity group work.

- One decentralized exchange integration.

- Create hDedicated smart contracts efficiently.

Integrated with Pangolin and with borrowing and trading functionality, DeltaPrime is officially a working dApp.

2022

The 1st quarter

- Audited for the first time

- Deploy Testnet

- Mainnet

- Open trading contest

Q2

- Integrate YieldYak to farm leverage

- Expand partners

Q3

- Leverage LP

- Protocol extension

- Expand the community

Quarter 4

- Third audit

- 4th audit

2023

- Token launch

- Multichain development

- Democratization with Dao

Core Team

Piotr Duda | Chief Executive Officer

Kamil Muca | Chief Technology Officer

Gavin Haselbaink | Chief Business Development Officer

Piotr Duda: Chief Executive Officer

- He graduated with a Master’s degree in Mechanical Engineering from Warsaw University of Technology and a Master’s degree in Automotive Engineering at RWTH Aachen University.

- In November 2017, he became a Full Stack programmer at IT Touch. Develop commercial web applications for TVN – a leading public service corporation, affiliated with Discovery Inc.

- After about 1 year working for IT Touch, he moved to Efinity Sp as Full Stack Developer. He is involved in developing and maintaining financial products within the insurance management system used by Lloyd’s.

- When he quit his job at Efinity Sp, he started a business with Standee. That is an e-commerce business. Design, manufacture and online distribution of desk sets for work across the European Union.

- Currently he is the CEO of DeltaPrime. Building a lending ecosystem without mortgaging all assets. Participate in project implementation, smart contract development and user interface creation.

Kamil Muca: Chief Technology Officer

- He graduated in Information Technology from Warsaw University of Technology.

- He specializes in developing with Python language and has worked for companies as Python Developer such as Necrologus Sp, Panowie Programiści, Kourts.

- In September 2019, he was a software developer at GFT Technologies. Worked as a consultant for companies in the financial sector, including the world’s largest banks. In addition to solving and developing big data processing products for FinReg dep.

- Currently, he is the Chief Technology Officer at DeltaPrime. Participate in architectural design, smart contract development and key business decisions.

Gavin Hasselbaink: Chief Business Development Officer

- In 2020, he graduated with a degree in communication science from the University of Amsterdam.

- After graduating, he worked as a freelancer at home. And did some notable work such as iOS App Developer, Private communications trainer for The Green Salesman.

- After about half a year of doing nothing and traveling, at the end of 2021 he began joining DeltaPrime as Business Development Director.

Investors

Updating…

Tokenomics

Updating…

Exchanges

Updating…

DeltaPrime Information Channel

- Website: https://deltaprime.io/

- Twitter: https://twitter.com/DeltaPrimeDefi

- Medium:

Summary

The solution to increase leverage for Farming on DeFi is not new but it still addresses a user need. And although it is a small niche, DeltaPrime is still facing a lot of competition from other projects.

So I have clarified what DeltaPrime is? Hope this article brings you a lot of useful information!