Arbitrum is an outstanding Layer 2 ecosystem that we cannot deny, but the game in this ecosystem is almost built around the Derivatives segment in general and GMX in particular. So how is the real game going on on Arbitrum being built? Everyone, let’s find out through this article!

Growth Dynamics on Arbitrum

We have spent a lot of time analyzing the growth drivers on Arbitrum in the near future when the project officially launches the token. From my perspective, Incentive and the Real Yield movement will still be two keywords that help the project gain momentum for rapid and sustainable growth. Everyone can read the articles below to get information before we go into a deeper topic on Arbitrum.

The Arbitrum Ecosystem: When Growth Dynamics Become Clear

What is Real Yield? New Breeze For DeFi Market

The Game Is Built Around GMX

GMX is known as the leading Derivatives platform on Arbitrum’s ecosystem. And what GMX needs most right now is similar to DeFi projects in particular and the Crypto market in general, which is “Liquidity”.

And the game that is being built next on GMX is GLP’s game. GMX and projects continue to create games in Lending & Borrowing, Farming,… with the asset GLP.

What is GLP?

GLP is the token users receive when providing liquidity on GMX.

Simply put, GLP is an index that represents the total liquidity pool on GMX including assets such as Bitcoin, Ethereum, Uniswap, Chainlink, USDC, USDT, DAI and FRAX. We can divide into 2 types: stablecoins including USDC, USDT, DAI and FRAX and crypto assets including Bitcoin, Ethereum, Uniswap, Chainlink. Because crypto assets have fluctuating prices, GMX’s pool is always fluctuating, so GLP is also constantly fluctuating. Providing liquidity on GMX is essentially loss-free because it provides single assets and has no Impermanet Loss.

Users who stake GLP will receive 70% of the platform fees which can be ETH or AVAX depending on the blockchain the user provides liquidity to.

Risks when holding GLP

There are two main risks for liquidity providers on the Arbitrum ecosystem:

- Traders who have profits withdraw money from the pool. However, data has proven that in most cases traders lose money.

- Because GLP represents a liquidity pool, if BTC, ETH, UNI, LINK decrease in price, GLP will also decrease in price.

Setting up Use Cases for GLP

Collateral on Vesta Finance

Instead of staking GLP on GMX to share revenue from the platform, users can deposit GLP on the Vesta Finance platform to receive profits in ETH or AVAX depending on the blockchain the user participates in. Although the profit is lower than users can borrow stablecoin VST to participate in DeFi activities on Arbitrum.

At the time of writing, staking GLP on GMX has an APR of about 30%, but depositing on Vesta Finance earns an APRR of about 25%, in addition to the opportunity to earn more profit from DeFi activities with VST.

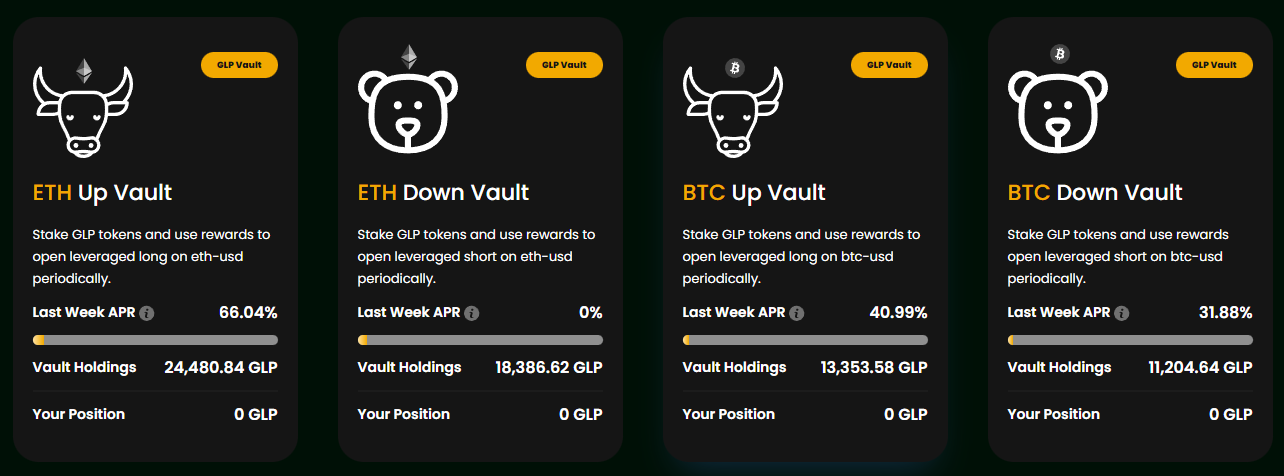

Collateral on Vovo Finance

Vovo Finance accepts GLP as collateral. Vovo Finance’s strategy is to use collateralized assets to provide liquidity on Curve Finance, GMX or any platform with a large yield source. Vovo Finance will ensure the safest user collateral, and for the profits, Vovo Finance will open Long/Short positions with x15x leverage on GMX for more profits.

Delta Neutral Yield Strategy

What is Delta Neutral?

Delta Neutral is an investment strategy that makes all your investment positions almost risk-free or zero-sum (no profit or loss). If you invest without profit or loss, what is the point of investing?

Example: Use the Delta Neutral strategy to participate in IDOs on Raydium.

You need 500 RAY to participate in the Star Atlas project IDO and the price of RAY right now is $10, which means you need to spend $5,000 to buy RAY, but if you stake RAY to play IDO and RAY is reduced by 50%, that means you lose $2,500. and if IDO Star Atlas brings in a profit of $2,500 then you break even, if more then you make a profit and less then you make a loss.

After research, you decide to apply the Delta Neutral strategy by still buying $5,000 RAY normally but you open an additional Short order of 500 RAY at $10 to deposit $10,000 and not use leverage.

At this time, the Delta Neutral index is 0, meaning you are not taking any risk.

If RAY increases, you will have a profit from the hold to compensate for the loss from the Short and vice versa.

By applying the Delta Neutral strategy, you buy RAY with no risk and the profit you make 100% comes from the profit of buying IDO Star Atlas.

However, Delta Neutral remains risky with highly volatile products For example, before the IDO takes place, the price of RAY skyrockets, causing your Short order to be liquidated and you cannot unstake because the IDO day has not yet arrived. Then after the day of the IDO, the price of RAY drops sharply, there are a number of risks involved.

Rage Trade’s new Delta Neutral Vaults product aims to reduce the risk of GLP

Rage Trade is a Perpetual specializing in the ETH/USDC trading pair. Besides the 80/20 vault, in the near future, Rage Trade will launch a new vault called Delta Neutral.

The nature of GLP’s increase and decrease comes from volatile products in the pool such as Bitcoin and Ethereum. And the fluctuations of Bitcoin and Ethereum are really big, not small numbers. There was a time when the loss often fluctuated at 10 – 35% if we take this loss plus the profit received from the protocol around 20 – 30%, LP will have a low profit and sometimes a loss.

And Rage Trade is preparing to launch its Delta Neutral Vault product.

A very simple way to eliminate the risk of GLP is to eliminate volatile assets in the pool such as Bitcoin and Ethereum.

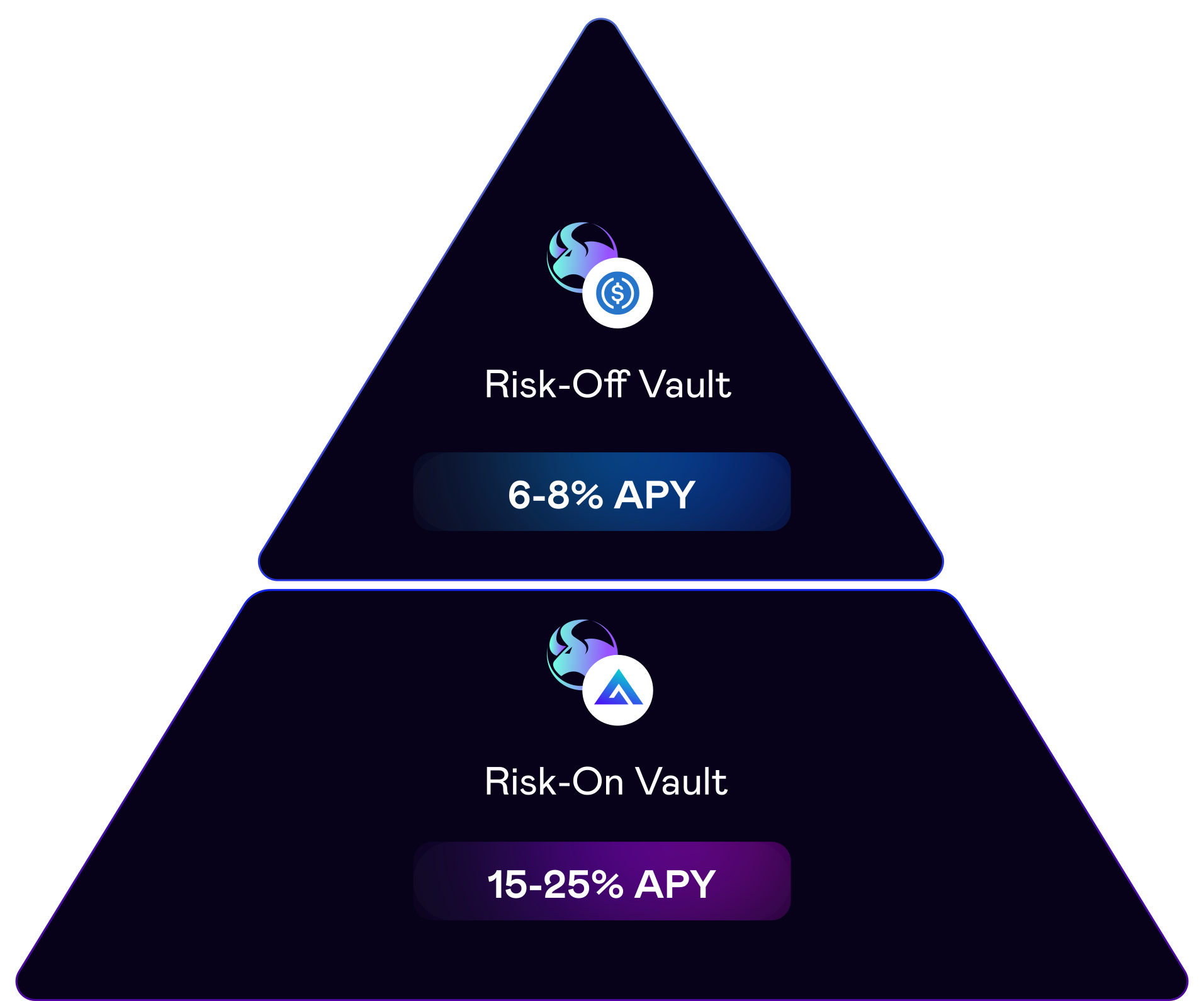

Regarding the operating mechanism, here we will have 2 vaults: Risk – On and Risk – Off.

Some characteristics of Risk – On Vault that is:

- Users can deposit GLP and USDC into the Vault.

- Enjoying a high profit comes with high risk.

- Earn more profit as ETH.

Some characteristics of Risk – Off Vault that is:

- Low but safe profits for USDC Vault.

- Earn more profits by depositing USDC on AAVE.

- Shared part of the profits is ETH from Risk – Off Vault

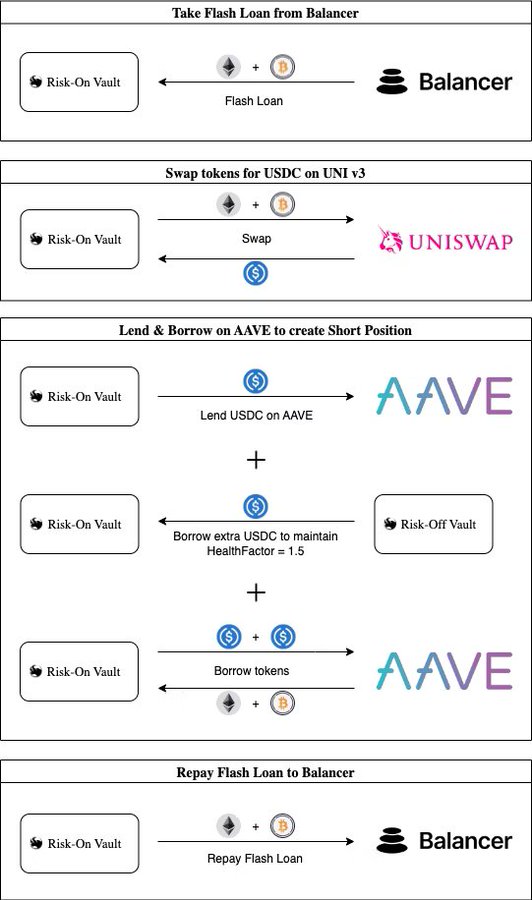

GLP’s risk elimination mechanism takes place as follows:

- Step 1: Risk – On Vault Flash Loan of Balancer’s BTC and ETH assets.

- Step 2: Transaction conversion from BTC and ETH to USDC on Uniswap V3.

- Step 3: Risk – On Vault will send this USDC to AAVE.

- Step 4: Risk – Off Vault sends more USDC to Risk – On Vault.

- Step 5: Risk – On Vault will send the above USDC to AAVE.

- Step 6: Risk – On Vault borrows a sufficient amount of BTC and ETH.

- Step 7: Risk – On Vault repays the Flash Loan on Balancer.

Flash Loan here is considered to borrow and repay in the same block.

Therefore, users deposit GLP into Risk – On Vault, but Risk – On Vault always sells Bitcoin and Ethereum, so users depositing GLP into the vault will not suffer losses.

With the implementation of 2 vaults, Risk – On and Risk – Off, it helps eliminate risks for GLP holders. The APR of GLP in Risk – On Vault fluctuates according to the APR of sake GLP on GMX itself.

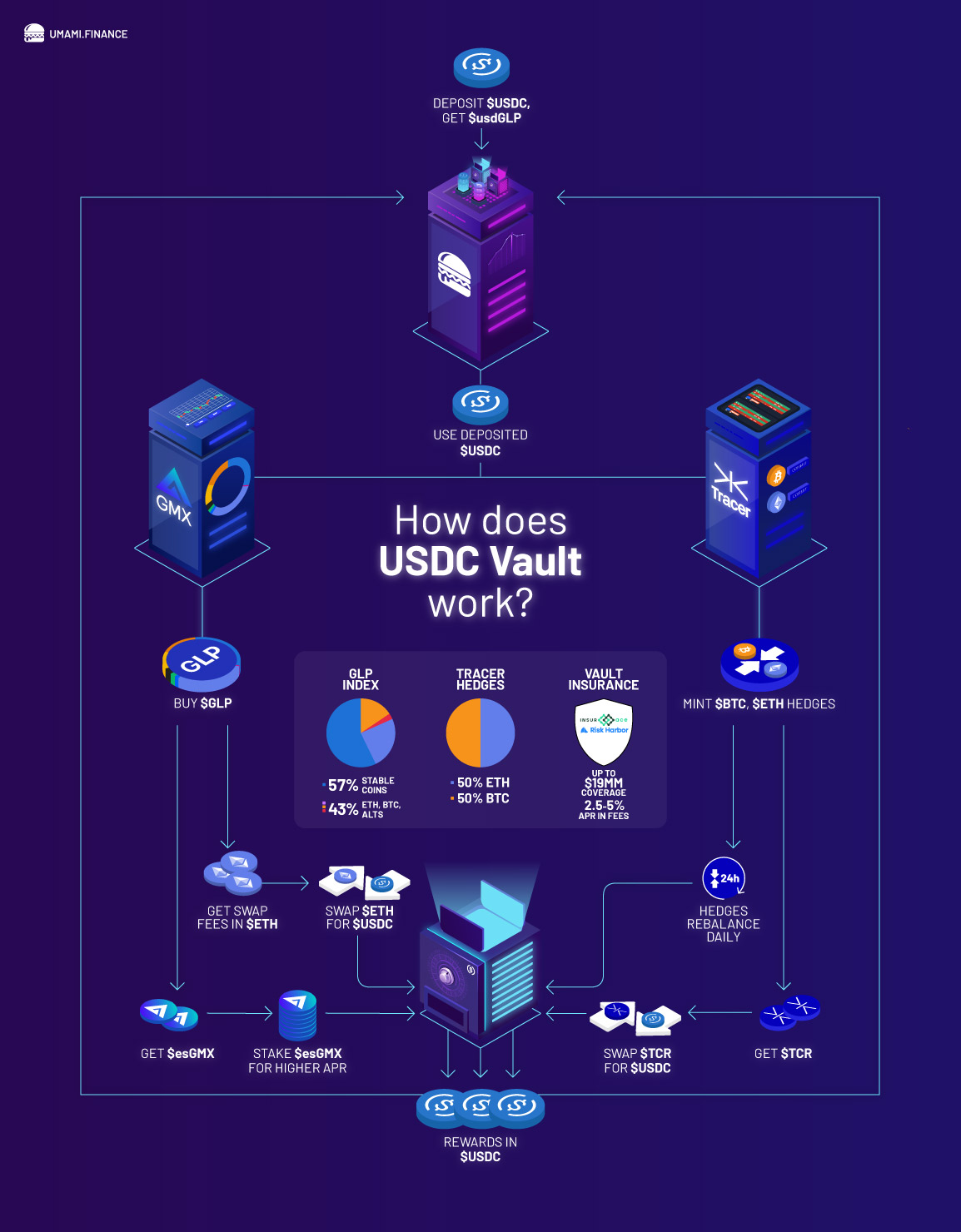

Umami entered the game earlier

Umami Finance’s product is called Delta Neutral USDC Vault. The operating mechanism of Delta Neutral USDC Vault is as follows:

- Step 1: Users deposit USDC into Delta Neutral USDC Vault to receive USDGLP (representing assets in the pool)

- Step 2: A part of USDC is used to buy GLP to receive esGMX, this esGMX continues to be staked to earn more profits, part of the revenue from the platform is ETH which will be immediately swapped into USDC.

- Step 3: The remaining USDC is brought through Tracer DAO (Derivatives platform) to open 3x leveraged orders for Bitcoin and Ethereum. Opening leveraged orders on Tracer DAO helps the platform earn Tracer DAO’s TCR tokens, which will be converted into USDC.

According to this product Delta Neutral USDC Vault helps users enjoy up to 20% APR for stablecoins with low risk.

Besides, USDGLP can be traded on Uniswap and become collateral on some Lening & Borrowing platforms. And finally, Delta Neutral USDC Vault will also be audited and insured by third-party projects.

Jones DAO also went to war with Gamma Delta

According to Jones DAO, Delta Neutral models still have many problems such as too many transactions causing large transaction costs, smart contract risks,…

With the above weaknesses Jones DAO introduces the Gamma Delta strategy including 2 vaults: jUSD (where users deposit USDC) and jGLP (where users deposit GLP). The operating mechanism of these two vaults is as follows:

- Step 1: jGLP will borrow USDC from jUSDC with subprime collateral.

- Step 2: jGLP will use USDC to buy more GLP on GMX.

- Step 3: Because jGLP has more GLP, the profit earned from the protocol is ETH and esGMX even more.

- Step 4: jGLP pays interest to jUSDC for borrowing USDC from this platform.

However, from Jones DAO side, they have not shared that they will minimize risks, so how will BTC and ETH decrease in price? Gamma Delta is expected to have more information and be launched in Q1 2023.

Summary

Improve liquidity for GLP

If projects on the Arbitrum ecosystem successfully implement the Delta Neutral strategy, liquidity providers on GMX will almost not bear any risk, they can be willing to provide longer-term liquidity and with a larger quantity.

The thicker the liquidity, the smoother the interaction on GMX, leading to users using GMX more and more. When GMX has more users, the platform has more revenue and the project has more revenue, leading to LPs sharing more revenue and they continue to provide more liquidity.

It creates a closed circle that helps the project grow.

Attract TVL of the market

Delta Neutral strategies have products surrounding USDC (stablecoin). In the downtrend, users hold the most stablecoins. If they see a project that offers a high, sustainable APR, they are highly likely to use it. So it can be concluded that stablecoins from many ecosystems flock to the Arbitrum ecosystem and especially projects applying the Delta Neutral strategy for GLP.

Besides USDC, there will be many stablecoins from other ecosystems participating in the Arbitrum ecosystem, but the vaults only apply to USDC because DAI, USDT, and FRAX need a stableswap to be able to convert to USDC. So will stableswaps benefit?

How do Delta Neutral protocols profit?

When Delta Neutral protocols use strategies, they also deduct a portion of the profits from their strategies and then pay them to users.

Projects that adopt the Delta Neutral strategy will attract attention on the Arbitrum ecosystem and it is likely that the price of native tokens will also benefit.

What are the risks?

We do not yet know what GLP’s APR is for Delta Neutral protocols to break even and from what level or higher they will start to make a profit.

Besides, there are many activities around this strategy, so risks related to smart contracts and hacking still need to be paid attention to in the near future.