What is Curve? We will learn about CRV cryptocurrency together in today’s article!

As the stablecoin market expands, Curve’s role in the market is also increasingly important. CRV was created to provide stablecoin users with a range of features that are difficult to find anywhere else. So what’s special about this project?

Overview of Curve Finance

What is Curve Finance?

Curve Finance is a decentralized exchange (DEX) and a liquidity provider operating on the Ethereum platform. Curve is specifically designed to provide DeFi services to stablecoin users.

Thanks to its AMM mechanism, transactions on Curve operate based on a pricing algorithm instead of an order book (order book).

Curve Finance is one of the best options to Swap between BTC pairs (renBTC, WBTC, pBTC,..) and exchanges for Stablecoins (DAI, USDC, USDT, TUSD, BUSD and sUSD…).

Mechanism of action

We have briefly learned what Curve is? So how does this project work? Continue watching below:

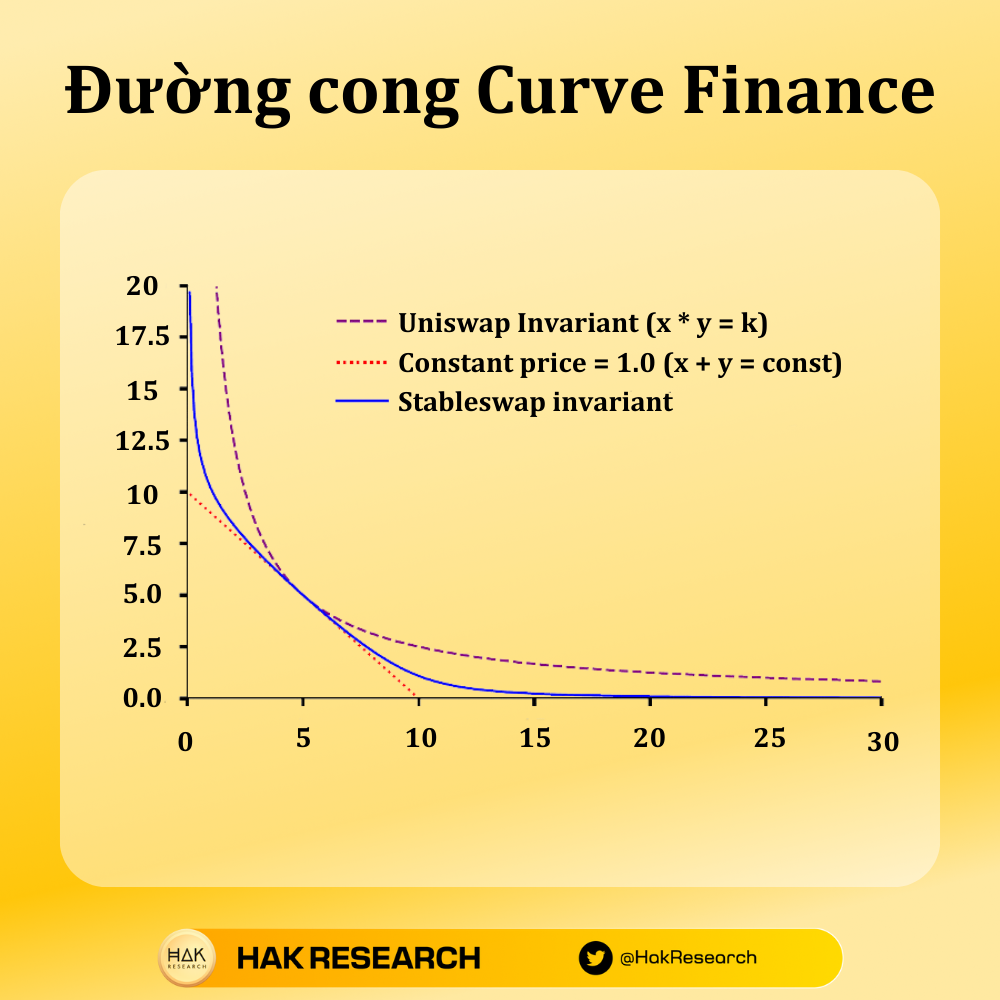

Token prices in Liquidity Pools are calculated based on the AMM algorithm instead of the Order Book. Curve AMM uses a constant product (x * y = const) algorithm like Uniswap and Sushi for Liquidity Pools stablecoins. Therefore, when swapping tokens, slippage is significantly minimized by the AMM without the need for any third party.

In short, like Uniswap, Liquidity Providers deposit their tokens into Curve Liquidity Pools and Traders perform token swaps to determine the price of the token. Furthermore, the key element is the use of Smart Contracts to make the AMM effectively rebalance the token price within a stable range.

Additionally, Curve along with Compound has created a Lending Pool where Lenders deposit their crypto to earn interest on lending as well as transaction fees. However, the higher the interest rate, the more risk the lender faces.

Curve has an incredible workflow for Liquidity Pools with Base and Metapool features for users to have a seamless experience when swapping tokens. That means deposited tokens will automatically be optimized according to Liquidity Pools requirements.

Development Roadmap

Currently, Curve Finance has made great progress in developing a fully functional AMM DEX that provides various financial services to cryptocurrency enthusiasts.

Metapool Factory is a follow-up product from Curve Finance that allows others to create multiple pools in a permissionless manner. Furthermore, Curve Finance has a V2 update to automatically pool liquidity around price to reduce price slippage like Uniswap’s V3. Curve V2 also offers swaps between unlocked crypto assets such as ETH and BTC.

Core Team

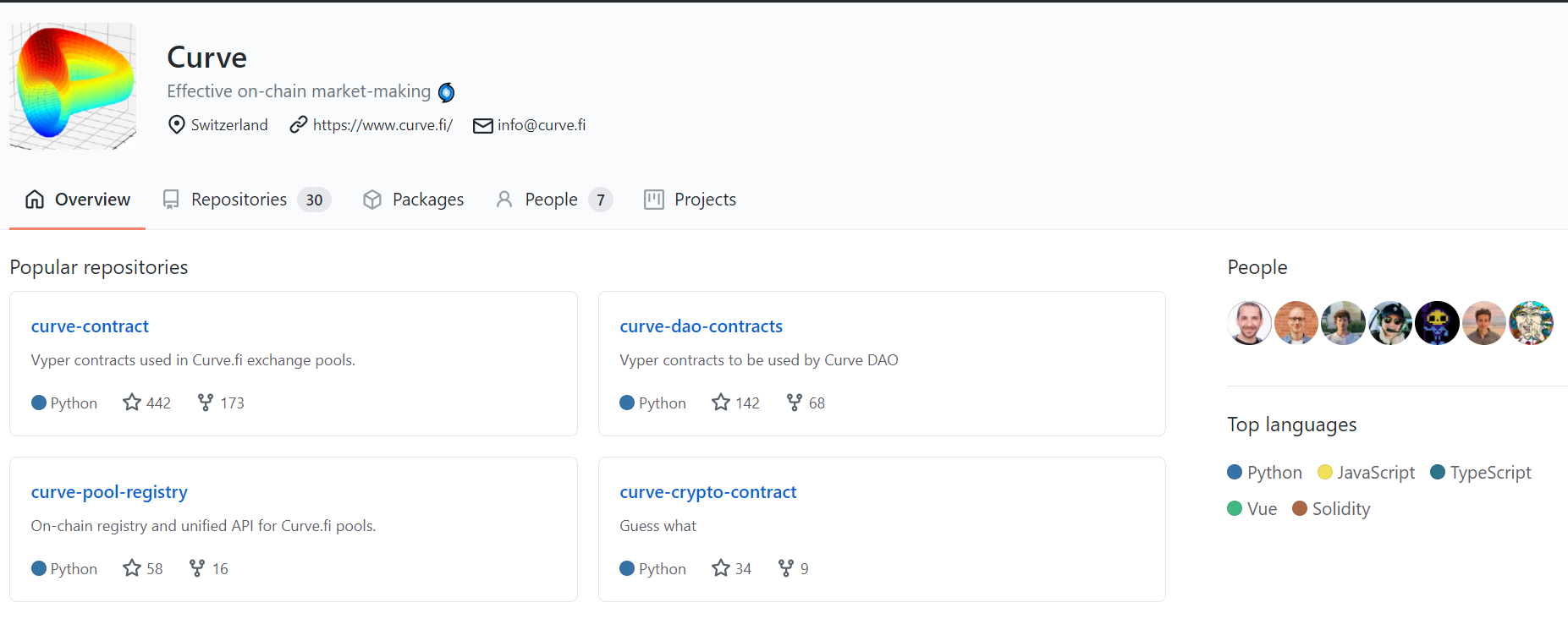

It’s quite difficult to find information about the team behind Curve, but they continuously confirm the code on the Curve Finance Github. In particular, Michael Egorov is the CEO of Curve Finance. He and many other members have contributed many lines of code on Github to build the Curve platform. Furthermore, Andre Conje is a famous developer in the DeFi world. He founded Yearn Finance and started many DeFi projects in the Fantom Ecosystem.

Investors

The CRV project is invested by two VCs: Codex Venture Partners and TrueWay Capital, Curve has performed very well in 2021. Investors own 5% of the total CRV supply in the token allocation. It will be distributed over 4 years, meaning investors will be with the project for a long time.

Additionally, CRV has deep partnerships with many other major DeFi projects that help Curve Finance stay afloat for the long haul. As part of DeFi Legos, Curve and other projects are joining hands to build a large financial ecosystem on the blockchain platform.

Partner

To become a giant in TVL, Curve Finance has formed many partnerships with major projects such as Fantom and Polygon. Additionally, Curve is also an aggregator that receives liquidity from other DEXs (1inch, Zapper, Paraswap, etc.)

Tokenomics

Information about Curve finance’s tokens

Released in August 2020, the CRV token is the utility and governance ERC-20 token of CurveDAO, a Decentralized Autonomous Organization (DAO) running the Curve protocol. Users carrying CRV have voting rights in the governance of the protocol regarding voting weight proportional to the lockup period. When offering tokens in Liquidity Pools, Liquidity Providers can earn CRV tokens with a decreasing distribution rate over the year.

- Token Name: Curve Finance

- Ticker: CRV

- Blockchain: Ethereum

- Token Standard: ERC 20

- Contract: 0xD533a949740bb3306d119CC777fa900bA034cd52

- Token Type: Utility & Governance

CRV Token Allocation

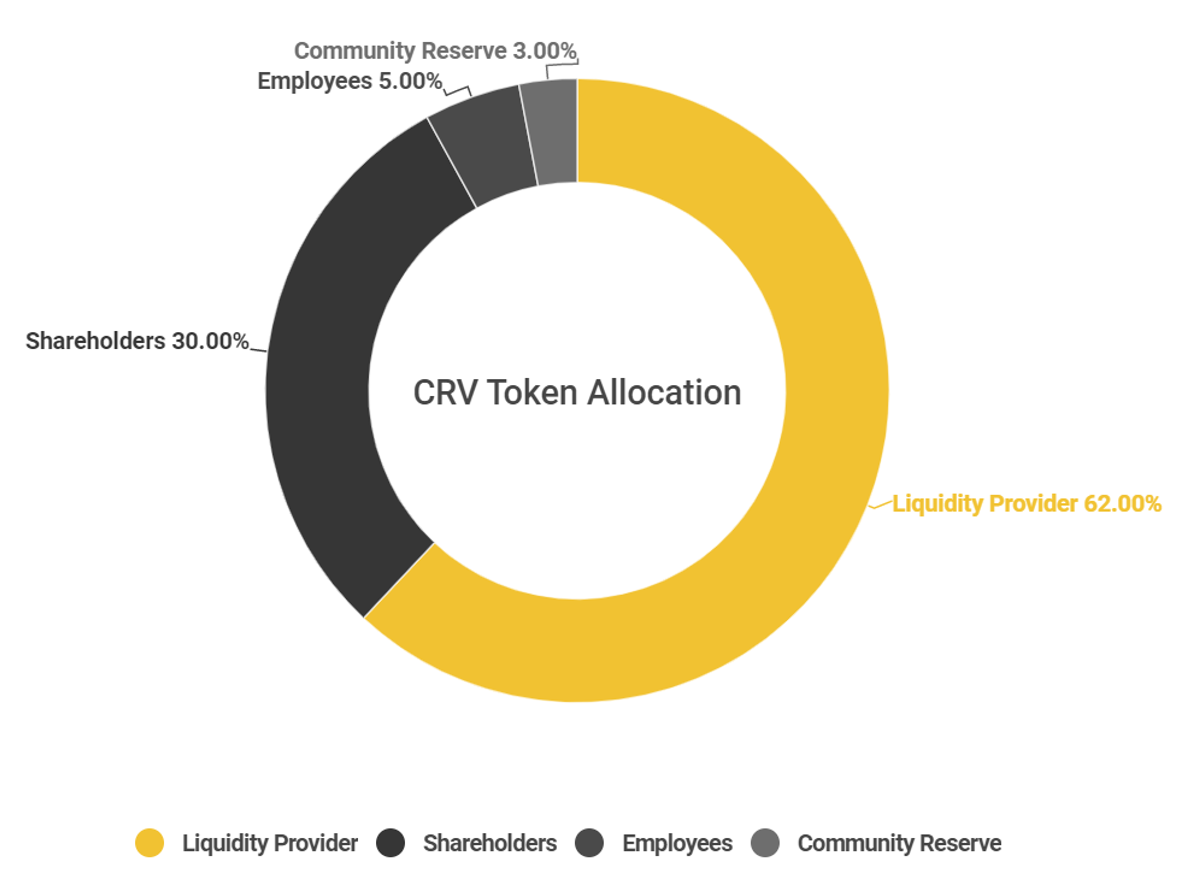

The total supply of 3.03B CRV tokens is distributed as follows:

- Liquidity Provider: 62%

- Shareholders: 30%

- Employees: 5%

- Community Reserve: 3%

Token Use Case

We already know what Curve is, so what is CRV token?

As mentioned, the Curve DAO (CRV) token is a utility and governance token that incentivizes Liquidity Providers on the Curve platform. Currently, CRV is being used primarily in four main ways: Providing Liquidity, Voting, Privatization, and Boosting.

Over time, CRV tokens were gradually distributed as rewards and incentives to attract usage from other DeFi competitors. In the long-term race, Curve Finance has huge potential in the DeFi storm.

- Liquidity Providing: CRV token is currently available on major DEXs such as Uniswap, Sushiswap, etc

- Staking: Users can receive transaction fees by staking (locking) their CRV tokens. That means 50% of the transaction fees are distributed to veCRV holders.

- Boosting: Boosting is the main feature of Curve Finance, where CRV rewards can increase up to 2.5x when users provide liquidity and stake.

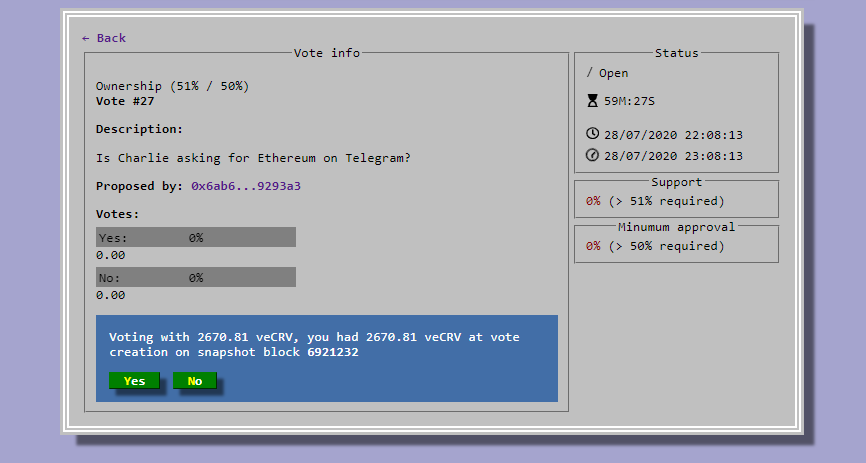

- Voting: veCRV owners can participate in voting on some proposals as well as changes in group parameters.

Exchanges

CRV is currently traded on exchanges such as: Binance, Huobi, Okex, Coinbase, Gate,…

Project Information Channel

- Website: https://curve.fi/

- Twitter: https://twitter.com/CurveFinance

- Telegram: https://t.me/curvefi

- Discord: https://discord.com/invite/9uEHakc

- Github:

Total Keh

Overall, Curve Finance is a DeFi giant running on Ethereum, dominating the market in terms of TVL. By using AMM, Curve enables stablecoins to be swapped with low slippage that can benefit day traders. Therefore, Curve Finance possesses a very high standard for optimizing liquidity.

Over time, CRV tokens were gradually distributed as rewards and incentives to attract usage from other DeFi competitors. In the long-term race, Curve Finance has huge potential in the DeFi storm.

And that’s all you need to know to answer the question of what Curve is and what its CRV token is used for. Hopefully you have obtained the necessary information to better understand the potential of the Curve Finance project.