What is crvUSD? crvUSD is a Stablecoin issued by the Curve Finance protocol. crvUSD is the card for Curve to conquer the Stablecoin and CDP segment after dominating the Stableswap segment for a long time. Curve Finance’s advantage is that it has a large number of regular users and abundant liquidity to hold Peg for crvUSD.

So what is crvUSD? What advantages does crvUSD have to compete with other competitors? Let’s find out in this article!

To understand more about crvUSD, you can read the following articles:

- What is MakerDAO (MKR, DAI)? MakerDao Cryptocurrency Overview

- crvUSD And What You Need To Know About This Blockbuster Stablecoin

- What is GHO? With Stablecoin GHO Can AAVE Take Maker DAO’s Market Share?

What is crvUSD?

crvUSD is a centralized Stablecoinphi issued by the Curve Finance protocol. The issuance of Stablecoin crvUSD is based on collateral positions under the CDP mechanism. crvUSD is supporting the Ethereum network and will expand multi-chain support in the future, especially Layer 2 such as Arbitrum, Optimism, Polugon, Zksync Era,…

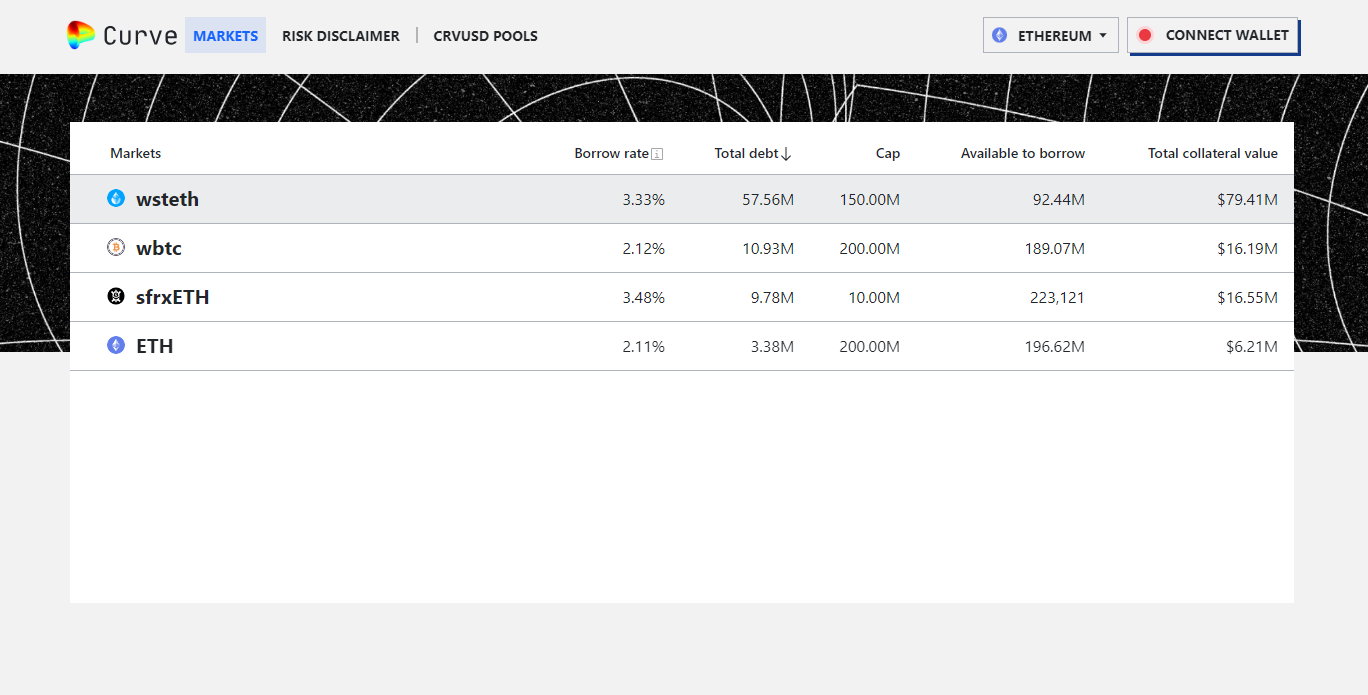

crvUSD supports mortgage assets with high safety and low risk such as ETH, BTC, especially crvUSD allows mortgage of LST assets such as wstETH, sfrxETH,… Curve plans to integrate many LST assets further to attract participants in the LSDfi game.

crvUSD’s liquidity is very deep, with nearly $200 million and distributed across many pools. The multi-Pool mechanism can help keep Peg for crvUSD quite well and bring a diversity of Swap assets for users to freely swap according to their needs.

Highlights of crvUSD

- Benefit from the number of regular users on Curve Finance, easily reaching customers.

- Peg holding mechanism with multiple Pools and support for diverse Swap assets.

- Liquidity is very deep, with crvUSD’s total pools having nearly $200 million in liquidity.

- Support LST assets, help compete better because LST assets bring a lot of profit.

- Partial liquidation helps reduce selling pressure as well as price slippage.

Mechanism of Action

Like other CDP protocols, Curve allows users to collateralize with ETH, BTC or as wrap, especially supporting LST to mint/borrow crvUSD. When borrowing crvUSD, the borrower must pay an annual interest rate. Borrowers can get their collateral back by paying back the original crvUSD loan. If a person’s position exceeds the allowable limit, it will be liquidated and the collateral will be completely lost.

When borrowing crvUSD, your collateral is spread across a series of liquidation prices (liquidation price zones). If the asset price falls within this range, you will enter soft liquidation mode. In soft liquidation mode you cannot add collateral, the only action you can do is repay your loan with crvUSD or liquidate yourself.

If the position is in soft liquidation mode and the collateral continues to decrease in price, your position will be subject to a hard liquidation, which works just like a normal liquidation, where your position is erased and you lose all entire mortgaged property.

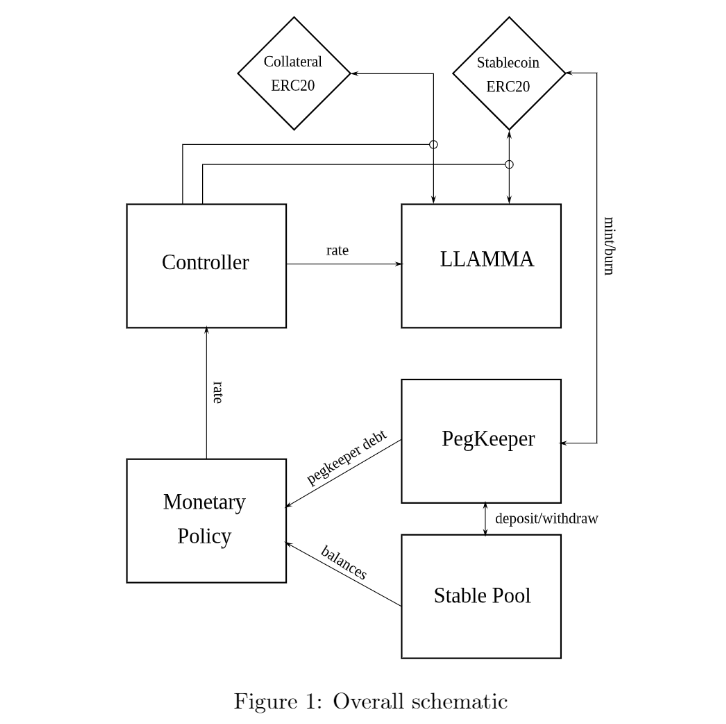

Lending-Liquidating AMM Algorithm (LLAMMA)

LLAMMA (Lending-Liquidating AMM Algorithm) is a fully functional AMM with all the functionality you would expect. LLAMMA helps liquidate positions automatically. Within crvUSD, when you lend initial collateral, your portfolio has a balance consisting of 100% collateral. If LLAMMA observes that the price of this collateral is decreasing, it will automatically liquidate your portfolio gradually into crvUSD.

When mortgaging assets to borrow crvUSD, the borrower can set a liquidation zone (including price ranges). If the price range is wide, it means the position will begin liquidation soon, and if the price range is narrow, it will be liquidated. later. When the position begins to hit the liquidation zone, LLAMMA will begin to gradually sell the collateral until the order is completely liquidated.

Collateral assets will be distributed evenly across price bands. When the price reaches any band, the assets in that band will be liquidated. When the position is partially liquidated but then the collateral price increases again, LLAMMA will buy back the collateral for the borrower in the same way as the original liquidation.

Compare crvUSD with GHO and DAI

I have created a comparison table between crvUSD, GHO and DAI in the article “What is GHO? With Stablecoin GHO Can AAVE take over the market share of Maker DAO”.

Personal Projections About crvUSD

crvUSD has many strengths in competing with other CDP Lending protocols. Thanks to frequent customer visits, the crvUSD peg holding mechanism with very deep multi-pool liquidity and the automatic liquidation mechanism using LLAMMA help reduce selling pressure in a short period of time.

With not yet diverse asset support but having LST makes crvUSD stand out from other major Stablecoins. With these points, crvUSD will be a big competitor of DAI in the near future even though DAI is leading in the field.

Regarding decentralization, crvUSD and GHO are much higher than DAI. GHO is a big competitor as it also has a huge user base from Aave and Aave’s product is very close to CDP. Although GHO does not yet support LST assets, it does support many assets, especially Altcoins, and another competitive point is that borrowing from GHO incurs very low interest rates.

Summary

crvUSD is a very secure decentralized Stablecoin and has many innovative mechanisms to secure Peg. crvUSD is a strategic card for Curve Finance to continue to expand into areas such as Stablecoin and Lending CDP. But this segment is also quite competitive by large and small competitors.

So I have clarified what crvUSD is? What are the highlights of crvUSD? Hope this article brings you a lot of useful information!