Chinlink is the number one Oracle service provider project in Blockchain. Haven’t stopped with Oracle yet, Recently Chainlink launched the product Crosschain is called Cross-Chain Interoperability Protocol (CCIP) to support cross-chain asset transfers according to the Mint/Burn mechanism.

Crosschain is a very necessary area to eliminate barriers between Blockchains, but current technology is not yet sufficient and the risk of being hacked is too high. Chainlink’s Cross-Chain Interoperability Protocol is considered the most advanced cross-chain technology CCTP of Circle and Omnichain of layerZero.

CCIP’s official launch also marked Chainlink’s official participation in the Crosschain segment. This field is extremely potential and will grow very strongly in the future. With the number of users and available technology, Chainlink is a name worth looking forward to helping Blockchain or DeFi develop further.

So what is Cross-Chain Interoperability Protocol? What are the highlights of CCIP? Let’s find out in this article!

To understand more about CCIP, you can read the following articles:

- What is cross-chain? When Blockchains Are “Traded”

- What is Cross-Chain Transfer Protocol? Circle’s Ambition To Acquire Market Share

- LayerZero’s Working Mechanism

What is Cross-Chain Interoperability Protocol?

Cross-Chain Interoperability Protocol (CCIP), also known as cross-chain interoperability protocol, CCIP can be seen as an infrastructure for transmitting messages or transferring cross-chain tokens according to the Mint – Burn mechanism and the Lock – mechanism. Unlock. Basically, CCIP has many similarities with Circle’s CCTP.

CCIP helps transfer assets or Tokens between chains quickly and according to the Mint – Burn mechanism, so there is no price slippage or high fees. Just pay the Gas fee of the original chain and the order will be completed. Based on data and information updated in real time and Chainlink’s own security, CCIP has a very high level of security.

CCIP is supporting the Ethereum, Avalanche, Polygon and Optimism networks. In the future CCIP will continue for most other Blockchains in the market.

With CCIP, DApps can be used to build Cross-chain, DEX Cross-chain or Cross-chain Lending protocols,…

CCIP supports fee payments in LINK and in alternative assets, which currently come in the form of native blockchain Gas coins and their ERC 20 wrapped versions. Payments made in alternative assets will be charged at a higher rate than payments made in LINK. Paying with LINK will be 10% cheaper and part of the fee will be paid for LINK Staking because it uses Chainlink’s Oracle service.

Structure Of Cross-Chain Interoperability Protocol

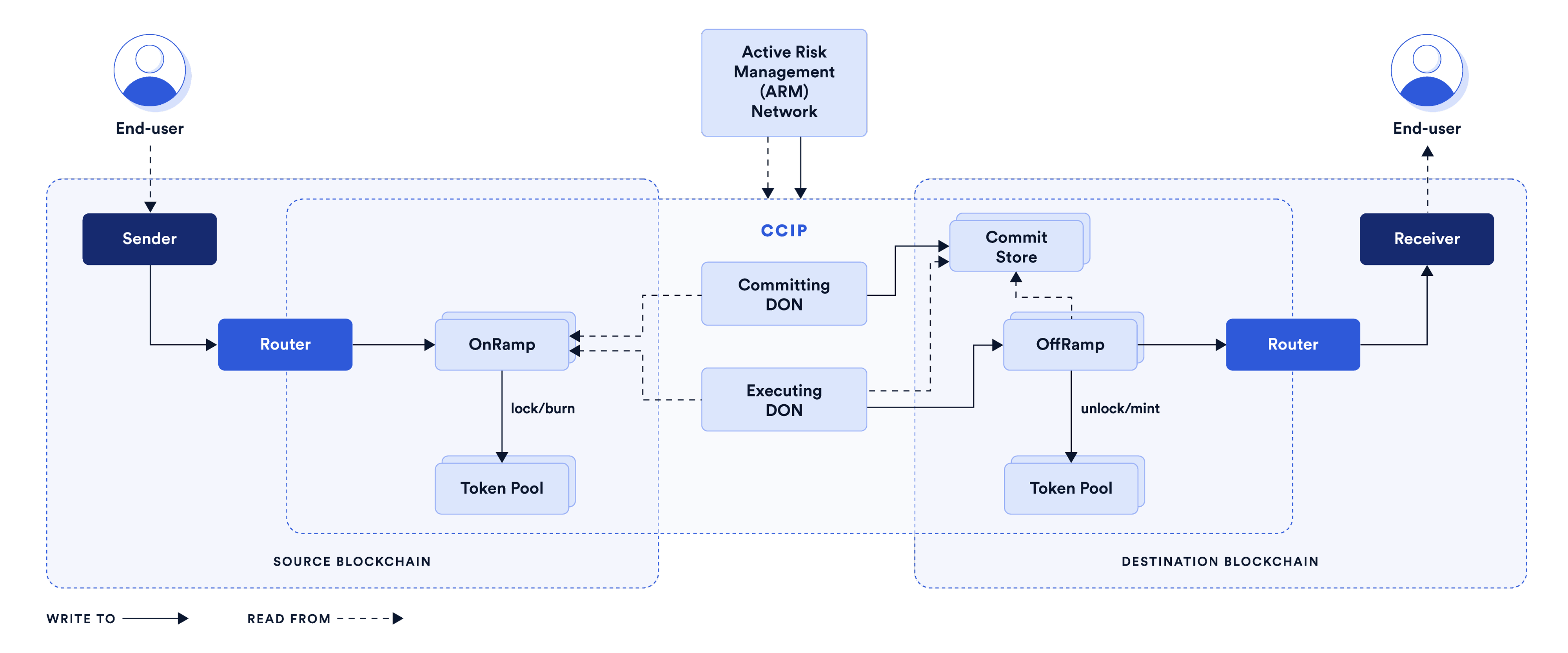

- Active Risk Management (ARM) Network: Is a separate, independent network that continuously monitors and validates the behavior of the main CCIP network, providing an additional layer of security by independently verifying cross-chain activities to detect erroneous activity .

- Commitment (commitment): Is the part that receives the task of reading information or messages from OnRamp on the source chain, then transfers the data to OffRamp on the destination chain.

- Executing: Receive the task of ordering OffRamp on the mint destination chain or transferring Tokens in the Pool to users.

- Ramps: Like a client application placed on networks, when executed on the source chain, it is called OnRamp and on the destination chain, it is called OffRamp. On Ramp, there is a liquidity pool to store assets that support the Lock – Unlock mechanism.

CCIP Highlights

- High security mechanism thanks to ARM Network.

- Supports both Mint – Burn and Lock – Unlock mechanisms.

- Charge with LINK or other Gas Tokens.

- Supports customizable rate limits on the number of tokens that can be transferred in a given period of time.

CCIP’s Working Mechanism

General mechanism of action

Basically, the way to transfer assets of Cross-Chain Interoperability Protocol is very simple. With the Mint – Burn mechanism, the sender’s Token will be burned on the source chain and the Token will be printed on the destination chain and then transferred to the user’s wallet on the destination chain. As for the Lock – Unlock mechanism, it will lock the sender’s Token in the source chain liquidity pool and then transfer the Token in the destination chain pool to the user’s wallet in the destination chain.

The connection between the source chain and the destination chain is interactive through messages passed back and forth. These messages are committed and confirmed by the ARM network in conjunction with data provided from Oracle Chainlink.

Detailed mechanism of action

- When a user sends a Token, the Token will be transferred to OnRamp to be burned or locked into the Token Pool depending on the mechanism being supported.

- Committing will read data from OnRamp after burning or locking the Token and transfer the data to the Commit Store (store of commitments) to perform validation in the next step.

- Active Risk Management (ARM) Network performs re-checking of information by re-reading the data in OnRamp and if the data is confirmed to be correct, it sends the confirmation message to the Commit Store.

- Executing reads information from Commit Store and OnRamp then sends minting or unlocking Token information in the Pool to OffRamp.

- After receiving information from Executing and re-reading data from the Commit Store, OffRamp mints a new token or opens an internal Token to transfer to the user’s wallet address in the destination chain.

Application of CCIP

- Cross-chain tokenized assets: Transfer tokens across blockchains from a single interface and without having to build your own bridge solution.

- Cross-chain collateral: Launch cross-chain lending applications that allow users to deposit collateral on one blockchain and borrow assets on another.

- Cross-chain liquidity staking token: Connect liquidity staking tokens across multiple blockchains to increase their usage in DeFi applications on other chains.

- Cross-chain NFTs: Provide giving users the ability to mint an NFT on the source blockchain and receive it on the destination blockchain.

- Cross-chain account abstraction: Build a smart contract wallet with native CCIP capabilities to improve user experience when making cross-chain function calls. For example, allowing users to approve transactions on any chain using a single wallet.

- Play the inter-chain game: Creating a blockchain-agnostic gaming experience allows players to store high-value items on more secure blockchains while playing on more scalable blockchains.

- Store and calculate cross-chain data: Using data storage solutions allows users to store arbitrary data on the destination chain and perform computations on it using transactions on the source chain.

Some Projects Use Cross-Chain Interoperability Protocol

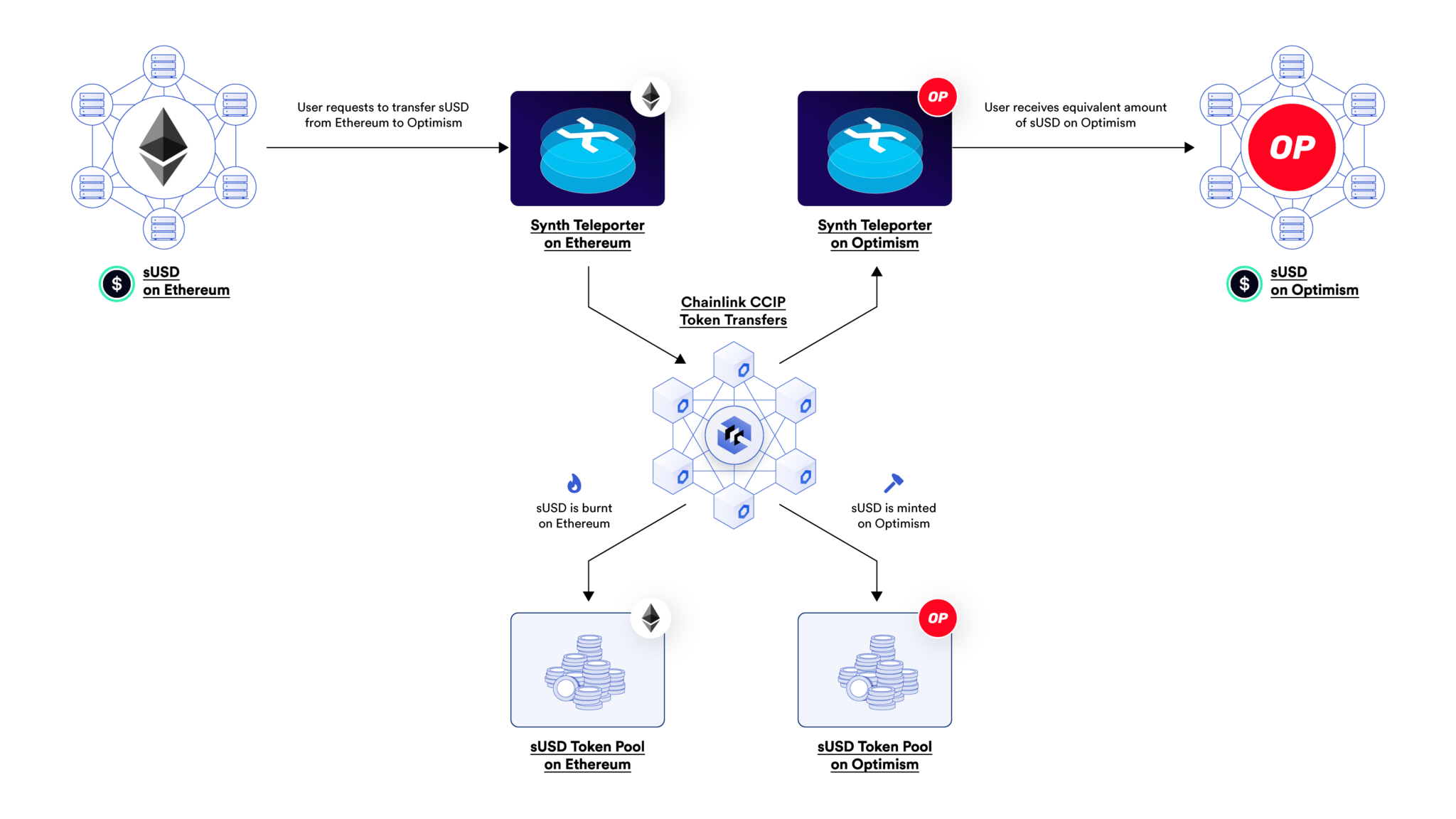

Synthetix

Synthetix is a DeFi protocol that acts as a liquidity layer for an ecosystem of on-chain financial instruments and derivatives. One of the recent additions to Synthetix V3, Synth Teleporter provides users with an affordable method to transfer Synth liquidity between chains. This feature works by burning sUSD (the protocol’s unit of account) on the source chain, then minting an equivalent amount of sUSD on the destination chain.

Synth Teleporter uses Chainlink CCIP to securely and accurately record and mint tokens on chains, ensuring security and reliability. This unique burn and mint model promotes greater capital efficiency without the need for a liquidity pool. In doing so, Synth Teleporters enable Synthetix liquidity to flow to regions with the highest demand, bypassing the constraints associated with traditional token bridges.

Aave

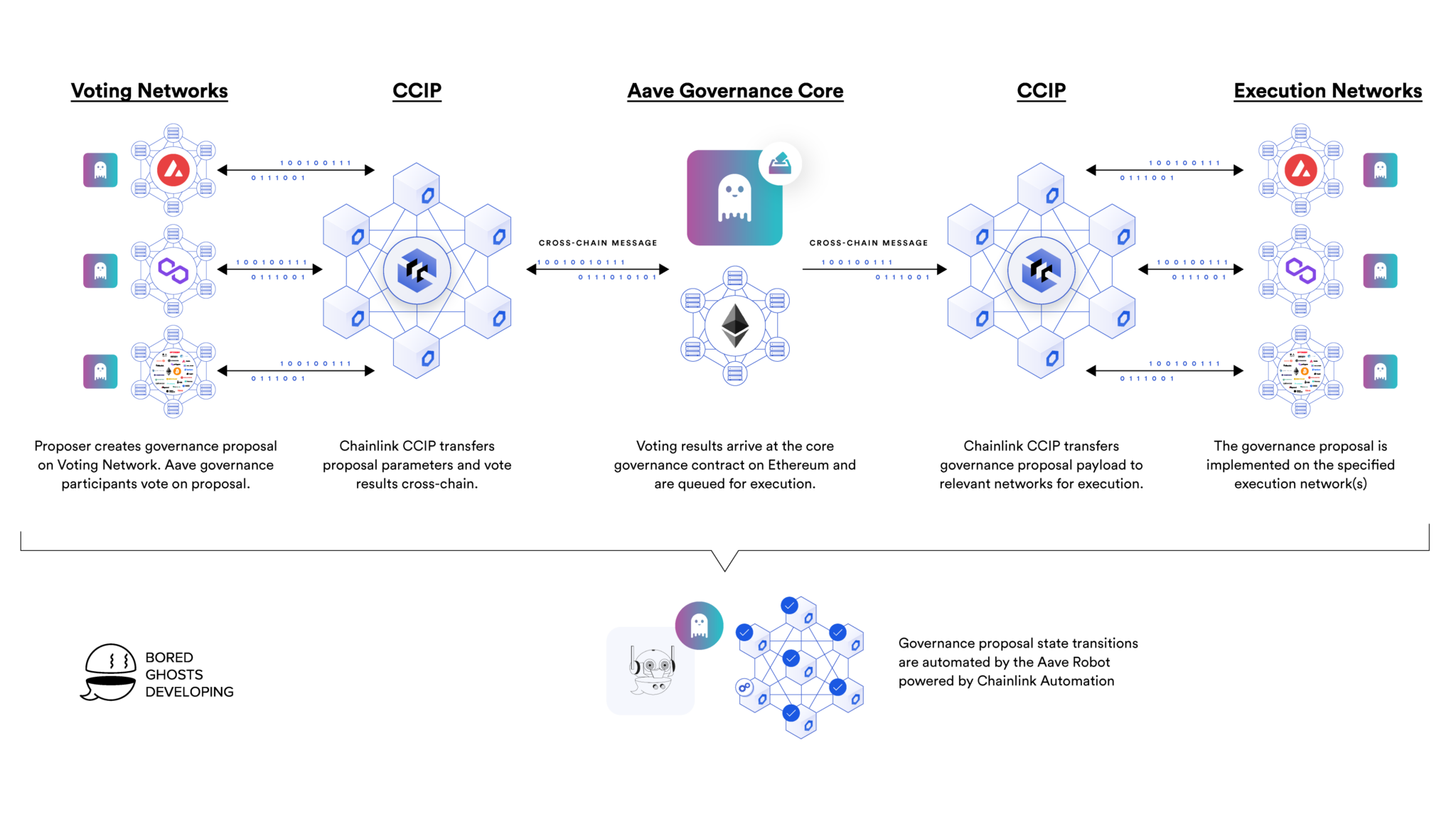

Aave is a non-custodial liquidity protocol that allows users to borrow and lend assets on-chain. Aave previously used several different on-chain root bridges to support its multi-chain governance mechanism and used Ethereum as a voting network. This cross-chain architecture makes voting expensive for participants and creates significant development and maintenance costs.

Once Chainlink CCIP became available, the Aave community voted to integrate the protocol because of its gas-efficient design, time-tested infrastructure, scalability to new networks, and integration capabilities. easy. Therefore, BGD Labs, a Web3 development initiative, is integrating Chainlink CCIP into Aave Governance V3.

Compare CCIP With CCTP

|

|

CCIP |

CCTP |

|---|---|---|

|

Pay the fee |

LINK or other Gas Token |

USDC |

|

Support assets |

Multi-asset |

USDC |

|

Security |

Better |

Worse |

|

Higher applicability |

Suitable for building Crosschain dApps |

Limited because it only supports USDC |

|

Decentralization |

Decentralized because it is managed by the Chainlink protocol |

Concentrated because controlled by the Circle |

|

Customization |

High |

Short |

|

Support mechanism |

Mint/Burn and Lock/Unlock |

Mint/Burn |

Personal Projections About CCIP

CCIP is a quite Trendy product and will be used a lot in the future thanks to its high application and economic benefits it brings. CCIP will also push the DeFi market, especially Omnichain, to become more competitive.

CCIP has many benefits and is very competitive. In terms of applicability, CCIP will have many advantages over Circle. High competition comes from the Omnichain Token standard and LayerZero’s infrastructure.

A special feature of CCIP is that paying fees with LINK will receive a 10% discount compared to paying fees with other Gas Tokens. And part of the fee will go to those who Stake LINK into the Oracle network. Promote long-term LINK holding momentum.

Summary

So I have clarified what Cross-Chain Interoperability Protocol (CCIP) is? Highlights of CCIP, will CCIP, with taking or prioritizing LINK as transaction fees, create a growth driver for LINK in the coming long term? Hope this article brings you a lot of useful information!