What is Compound (COMP)? We will learn about this cryptocurrency together in today’s article!

DeFi Summer in 2020 was an extraordinary event that completely changed the way people view cryptocurrencies in general and DeFi in particular. Countless pioneering protocols in this field began to grow exponentially at that time, namely Uniswap, Yearn, SushiSwap, Aave, ….

However, Compound is the most pioneering project. In May 2020, Compound launched a liquidity mining program for the COMP token, significantly incentivizing users to participate in the protocol and bootstrap Compound.

So what is Compound (COMP)? How did Compound successfully attract investors to the project? You will find the answers to these questions in the following article.

What is Compound?

Compound Finance (COMP) is a leading lending protocol that allows users to borrow and borrow popular cryptocurrencies such as Ether, Dai, and Tether. Compound is built on the Ethereum Blockchain, a decentralized finance (Defi) platform.

Sex interest rates are adjusted according to the supply and demand of the underlying asset. No partners or compromises are required in the process, making Compound decentralized.

Compound Difference

Compound currently has many advantages that need attention:

- COMP coin has a finite supply

- Compound’s TVL value gradually increases over time

- Compound opens the doors of Defi to all cryptocurrencies

Mechanism of Action

We have briefly learned what Compound is? So how does this project work? Continue watching below:

Compound was created to meet the need to borrow and borrow in DeFi (Decentralized Finance). Special:

- Long-term investors can deposit their idle assets into Compound to earn additional profits.

- Ethereum Dapps (Decentralized Applications) can take advantage of the massive liquidity that Compound provides.

- On the other hand, users are willing to borrow assets because they do not want to sell their tokens, since they bought those tokens in an excellent position. Their needs may be: Taking advantage of profits, price differences, etc

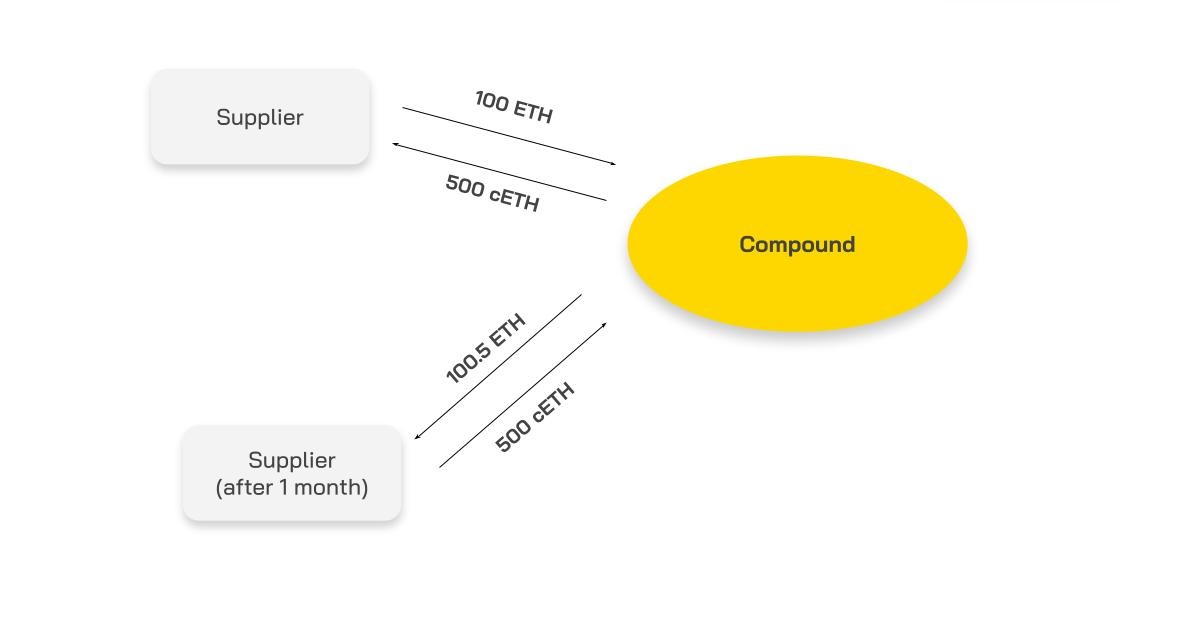

The offering process is simple: You deposit your assets into Compound. In return, you will receive a number of cTokens – ERC-20 standard tokens that represent the underlying asset. You can earn interest simply by holding cTokens, whether the cTokens are held in your wallet or transferred to another wallet.

Compound calculates interest by accumulating the cToken exchange rate, which determines how many underlying tokens you can swap back using cToken.

Let’s clarify this through an example: Let’s say you deposit 100 ETH and the exchange rate is 0.2. You will receive 100 / 0.2 = 500 cETH. Over time, let’s say 1 month, the exchange rate will increase and reach 0.201. If you want to redeem your ETH at that time, you can redeem your cETH to receive 500 * 0.201 = 100.5 ETH.

As you can see, just by holding cETH, you can get another 0.5 ETH after a month. However, the example above uses arbitrary numbers, so the actual profit is completely different.

To borrow, you must first follow the process provided to receive cTokens before using them as collateral. Each market has a collateral ratio ranging from 0 to 1. Borrowing capacity = value of the underlying asset * collateral ratio. Users can borrow up to the value of their borrowing capacity and no more. If the value of the loan exceeds the borrowing capacity, the liquidation process will take place.

It’s also important to note that Compound accepts accredited institutions looking to earn 4.00% APR on a minimum balance of $100K.

Tokenomics

Overview information about COMP token

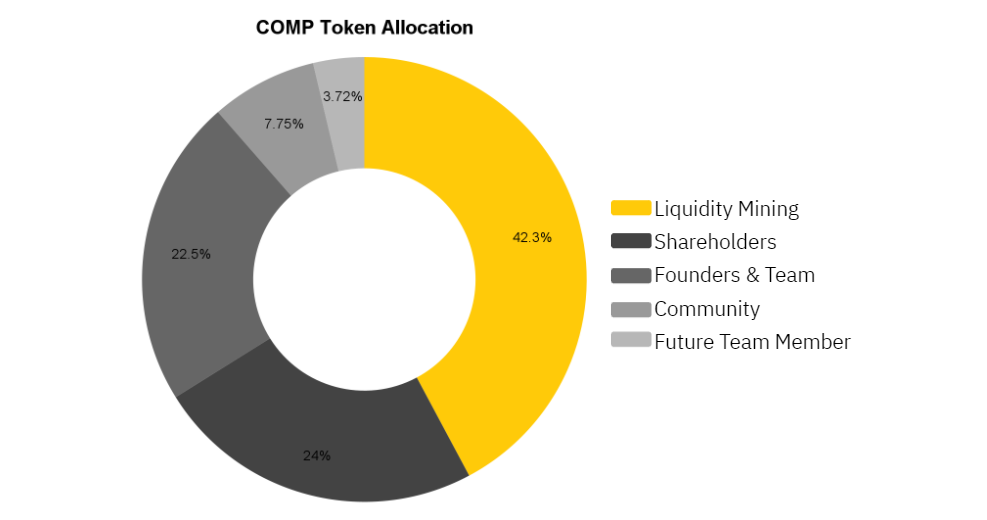

Token Allocation

COMP Token Sale

Compound has not held any token sales yet. However, Compound has raised a total of $33.2 million through Seed Equity ($8.2 million) and Series A ($25 million).

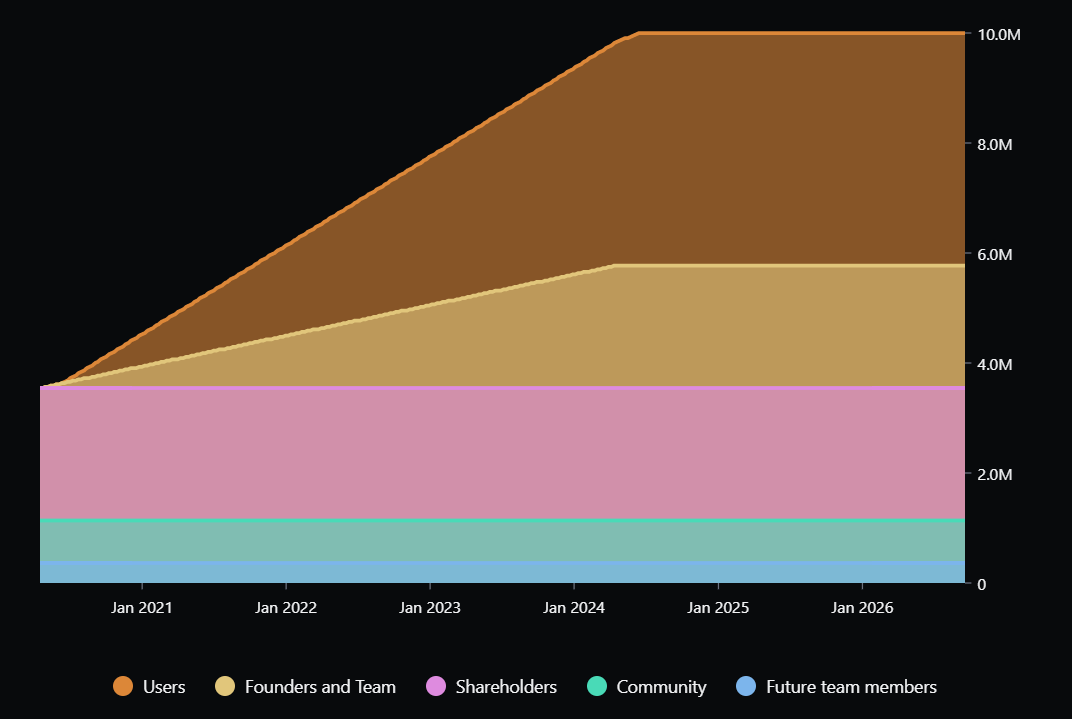

COMP Token Release Schedule

COMP Token Use Cases

Currently, COMP is only used as a governance token. Users can stake COMP to vote on proposals such as:

- New cToken market list.

- Modify the interest rate model.

- Modify oracle address.

And more in the future as Compound fully becomes a DAO (Decentralized Autonomous Organization).

Compound Roadmap

Currently, Compound is building a project called Gateway (Composite Chain). Gateway is a different blockchain built on top of Polkadot and is currently in the testnet process. Although Gateway uses a different native token – CASH, it could be a game changer that expands Compound’s operations into another space, thus propelling Compound forward in the competition with Aave and MakerDAO.

The same thing happened with Aave when Aave was deployed on Polygon. This event boosted TVL in Aave by over $4 billion, instantly catapulting Aave to the #1 spot. If Gateway is complete and running smoothly, we can expect a big turnaround from Compound. Let’s follow the development of the project and see if this is the case.

Team, Investors and Partners

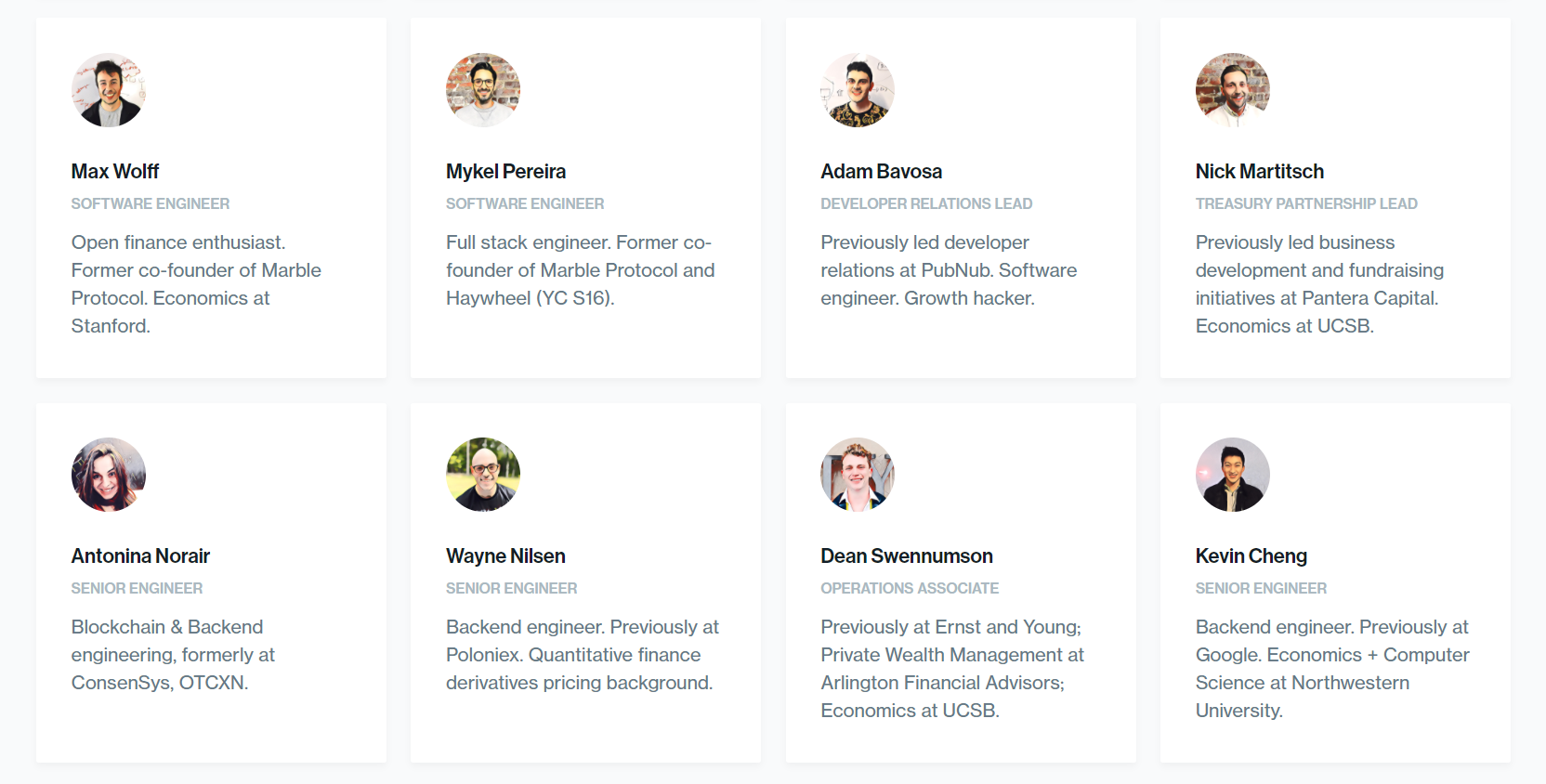

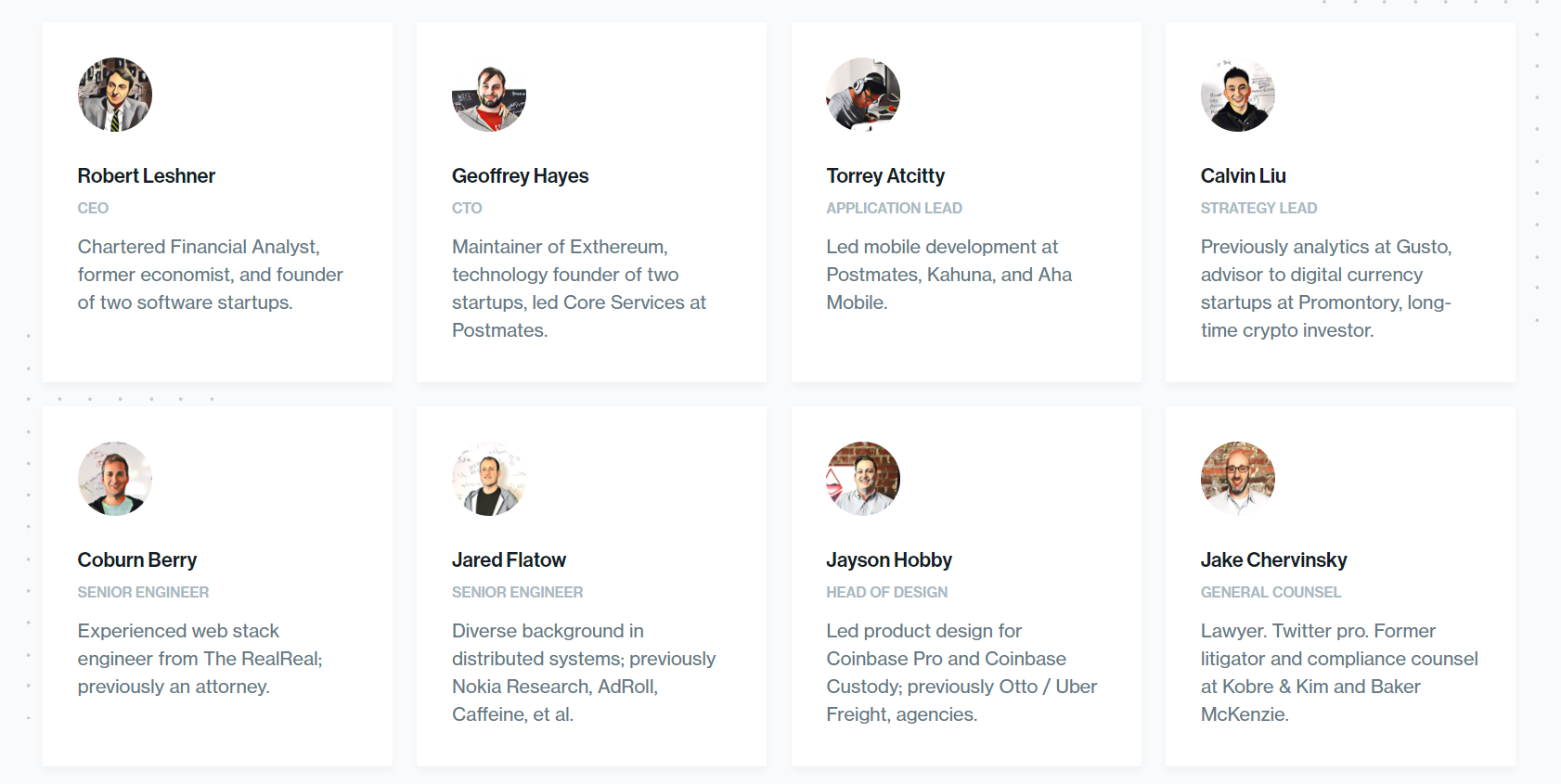

Team

Compound was founded in 2017 by Robert Leshner and Geoffrey Hayes. Their full team has now grown to a large number of members.

Investors

Partners

Partners cooperate on different projects with different purposes:

- Institutions: Coinbase, Ledger, Curv, Bitgo, Anchorage, Fireblocks.

- Earn: OKEx, Binance, Zapper, Exodus,…

- Manage: InstaDapp, Eidoo, Ankr,…

- Reporting: Lumina, Tokentax, Cointracker,…

Compound also partners with Chainlink to update their price feed as accurately as possible. This is a must in a Lending protocol as it has a strong influence on liquidation.

Exchanges

Compound is currently traded on exchanges such as:

- DEXs: Uniswap, Sushiswap, 1inch,…

- CEXs: Coinbase, Binance, Huobi,…

Compound’s Information Channels

- Website: https://ens.domains/

- Twitter: https://twitter.com/ensdomains

- Medium: https://medium.com/the-ethereum-name-service

- GitHub: https://github.com/ensdomains

Total keh

We have learned what Compound is and its COMP token. Hopefully it has helped you gain valuable insights into this project and understand its potential.

If you want to know more about Compound (COMP), please leave a comment below and join the HakResearch Community for further discussion!