What is Coinwind? Coinwind is a Defi platform protocol in the Yield Farming segment on Binance Smart Chain (BSC) and Huobi Eco Chain (HECO) and Ethereum Chain (ETH) with a product that automatically pairs tokens together to maximize profits for user.

To understand more about CoinWind and Yield Farming, people can read some of the articles below:

- DeFi Panorama 101 | Episode 4: What is Yield Farming? When People Become “Farmers”

What is Coinwind?

Overview of Coinwind

Coinwind is a Yield Farming Defi platform protocol with added liquidity on Binance Smart Chain (BSC) and Huobi Eco Chain (HECO) and Ethereum Chain (ETH) with a product that automatically pairs tokens together to maximize Maximize profits for users.

Coinwind will help the community solve the problems of low revenue from single-token mining (also known as staking a single coin or token) and limit the highest risk from Impermanent loss.

Coinwind’s operating mechanism

Coinwind’s operating mechanism includes the following products:

- Liquidity: Users can participate by providing liquidity on the currency pair in the respective DEX. The DEX will issue LP tokens, which users can then deposit into CoinWind to generate revenue in the currency. Monetary revenue generated will be reinvested every 5-10 minutes to maximize profits for users

- Staking: Users can exploit staking such as Fil Staking, DOT staking, Stable staking

- Knife: Decentralized autonomous organization where users holding governance tokens (COW) can Participate in future administrative functions.

The Coinwind difference

Coinwind’s differences include the following factors:

- Profit maximization: The project will move cash flow automatically so that users get the best profits.

- Avoid Impermanent loss: With the above method of moving tokens, users do not have to worry about this loss.

- Single token mining: There is no need to deposit two tokens into the Pool like regular AMM projects. At Coinwind, users only need to deposit 1 type of token.

- Quality pools: The project will research to bring users pools with high interest rates but also reputation.

Coinwind development roadmap

Quarter 1/2021:

- Mining HECO single token

- Support BSC chain

- Income redistribution strategy

Quarter 2/2021:

- Launch COW strategy

- Supports dual mining of one token

- Upgrade the 2.0 platform user interface

Quarter 3/2021:

- Supports Ethereum network

- Launch DAO

- Mining fee optimization

- Manage the COW token contract

- Single token high yield growth

- Multi-language support

- Launched on OEC

- ETH main chain supports DAO

Quarter 4/2021:

- Voting and governance (holding a certain COW/COW LP ratio, you can start proposing, voting, participating in platform governance)

- Open source project contract code

- NFT development

Project vision and goals: CoinWind will continue to build a comprehensive platform that integrates the DeFi ecosystem with aggregating revenue, lending, NFT, IDO and other businesses, and will continue to provide users with more choices of top products and services.

Investors

update…

Core Team

update…

Tokenomics

Information about Coinwind tokens

- Token Name: CoinWind Token

- Ticker: COW

- Blockchain: BNB Chain, Heco Chain, ETH Chain

- Token Contract: 0x422e3af98bc1de5a1838be31a56f75db4ad43730 (BSC)

- Token type: Utility, Governance

- Total Supply: 100,000,000

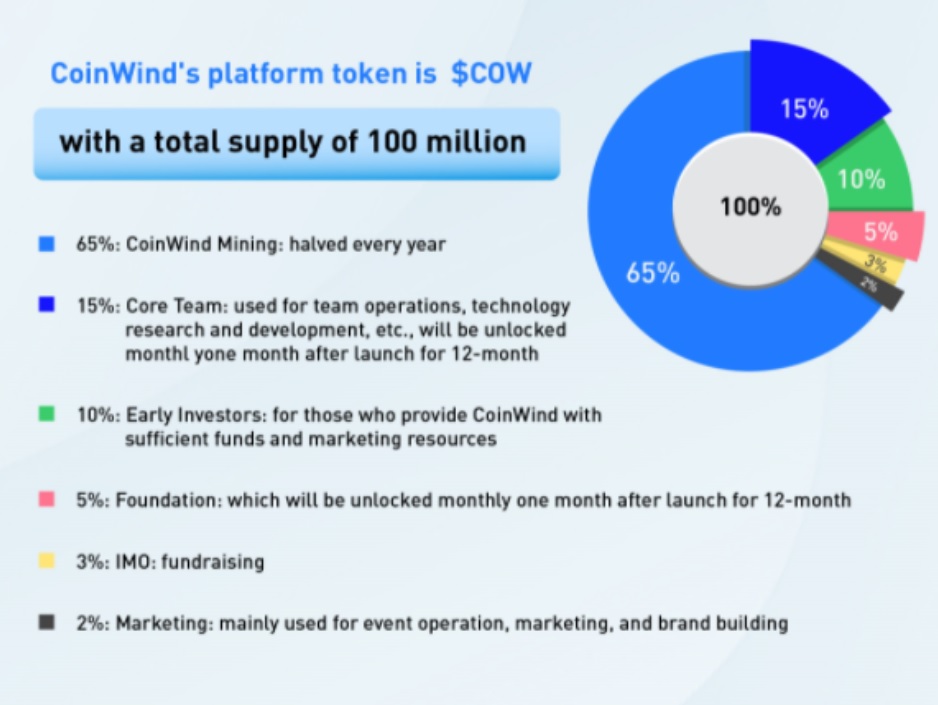

Coinwind Token Allocation

- CoinWind Mining: 65%

- Team: 15%.

- Early Investors: 10%.

- Foundation: 5%.

- IMO: 3%.

- Marketing: 2%.

Token Release

- Team: Unlocks monthly after launch for 12 months

- Foundation: Unlocks monthly after launch for 12 months

Token Use Case

- Users can provide liquidity on the coinwind DEX protocol to receive rewards paid in $COW

- $COW holders have rights propose and vote on on-chain governance proposals to determine future features of the CoinWind platform

- $COW holders can receive airdrops from future projects

Exchanges

Currently $COW tokens are being traded on the exchanges: Mdex, Pancakeswap, Uniswap

Project Information Channel

Summary

CoinWind is a Defi protocol that automatically pairs staked tokens and integrates hedging strategies against temporary loss through smart contracts to maximize user revenue. At the same time, it also effectively solves the problems of low single token mining revenue, high permanent loss for liquidity pool mining.

Through this article, you probably have some basic information about the Coinwind project to make your own investment decisions. Please leave comments and suggestions for me in the next articles. !