What is CLMM? CLMM stands for Concentrated Liquidity Market Maker, also known as centralized liquidity, which is a common development trend of DEX platforms. So what is special about CLMM and what projects are leading the CLMM trend? Let’s find out together in this article.

To better understand CLMM, people can refer to some of the articles below:

- Series 1: Real Builder in Winter | Orca – The Most Different AMM On Solana

- Series 3: Real Builder in Winter | Uniswap – The True Unicorn Cryptocurrency Ever Produced

- Series 4: Real Builder in Winter | Trader Joe – From a Follower to a Leader

What is Centralized Liquidity (CLMM)?

Market context

Recently CLMM stands for Concentrated Liquidity Market Maker, also known as booming centralized liquidity. And from my perspective, there are two relatively clear reasons for CLMM to explode in recent times: the story of solving problems with fork models from Uniswap V2 and the expiration of Uniswap V3’s documents.

Solve the problem of Uniswap V2

It is a fact that although on the market we see hundreds of different AMM projects on many different ecosystems, almost 99% of those projects fork the operating model of Uniswap V3. This means that the projects are only different in name, different in the working blockchain, but in essence, the operating mechanism is almost the same.

So most current AMMs are facing the same situation: ineffectiveness in using capital when providing liquidity for blue-chip assets in the market. We all wrote that Uniswap V2 will provide liquidity for tokens at any price range from 0 to positive infinity, but it is clear that providing liquidity for Bitcoin at a price of a few hundred dollars or a few hundred thousand dollars over a period of time. Short term is not necessary

Uniswap V3 license expired

When Uniswap V3 was born, they shared that they would only open source the V3 version after 2 years of operation, which means that after V3 is open source in 2023, all projects can get the source code of Uniswap. about to upgrade its protocol.

Therefore, when the Uniswap V3 license expired, it created a trend of projects competing to fork the Uniswap V3 model, from which CLMM became a hot keyword in the crypto market.

Overview of centralized liquidity

Centralized Liquidity is derived from Uniswap V3 and we will evaluate and understand Centralized Liquidity through the model of Uniswap V3. But we can define Centralized Liquidity as follows Centralized Liquidity allows Liquidity Providers to choose the price range to provide, thereby pushing liquidity to where it is needed most, reducing Impermanent Loss for individuals and Slippage for users.

To better understand Uniswap V3, it is best for everyone to have knowledge of Uniswap V1 and Uniswap V2, which I have detailed in the article Series 3: Real Builder in Winter | Uniswap – The True Unicorn Cryptocurrency Ever Produced. Everyone go back and read to understand V1 and V2 then come back to this article.

With Uniswap V3 there will be some changes as follows:

- LPs will have the right to choose price ranges to be able to provide liquidity. Normally, the price will run in the price range that many LPs analyze the most to choose to provide liquidity. So the liquidity has come to the right place since then slippage and impermanent loss both decreased.

- LP provides liquidity right where the active asset price will receive the highest fee. This is an advantage for both LP and the protocol because when the price line runs LP will change its strategy to match, so liquidity will always be there. highest level no matter what happens.

- Liquidity will no longer be concentrated at levels that are too different from asset prices at real time.

- LPs will have different strategies & analysis, so in every asset price range there will be liquidity.

Clearly, Uniswap V3 has solved some major problems of current AMM projects such as capital efficiency or slippage during transactions or Impermanent Loss while providing liquidity.

Some advantages and disadvantages of centralized liquidity

|

Advantage |

Defect |

|---|---|

|

Liquidity is brought to the right places where it is needed, not excess at prices that are difficult to reach in a short time. |

Uniswap V3 is only suitable for bluechip assets such as Bitcoin, Ethereum,… |

|

Reduce Impermanent Loss for LP and reduce Slippage for users. |

Uniswap V3 still cannot completely solve many altcoins that Uniswap V2 has not been able to do. |

|

Increase profits for LPs providing liquidity with appropriate and accurate price range strategies. |

It will be relatively complicated for LPs with little experience in the market. |

Each model has its own advantages and disadvantages, so current CLMM models still need to be improved and developed in the future.

Some Outstanding Projects in the Centralized Liquidity Sector

The complexity of Centralized Liquidity is indisputable, so among hundreds of AMM platforms, there are only 3 platforms that develop their own CLMM and each AMM represents a different blockchain like Uniswap. with Ethereum, Orca is tied to Solana and Trader Joe is tied to Avalanche.

Uniswap V3 – Leading & initiating the CLMM movement

It can be said that Uniswap V3 is the first Centralized Liquidity version of the crypto market. Since its inception, the trading volume on Uniswap V3 has far exceeded that of Uniswap V2 even though Uniswap V3 only supports certain trading pairs. This shows how Uniswap’s products have met the needs of the market.

With version V3, it has helped Uniswap dominate the ecosystems where Uniswap develops multichain such as Arbitrum, Optimism, Polygon,…

Orca – AMM on Solana is not to be outdone

After Uniswap launched centralized liquidity, Orca is the next name to develop its own CLMM with the name Whirlpools. Since then, a lot of liquidity on the Solana ecosystem has poured into Orca, helping Orca from a late-born project surpass Raydium to become the largest AMM on the Solana ecosystem.

In just the past 6 months, Orca is the project that has generated 70 – 80% of the transaction fees on Solana with a total transaction volume of $34.7M. From the revenue generated, Orca has called for $1.6M into the environmental protection fund. I wrote a very detailed article about Orca in the article Series 1: Real Builder in Winter | Orca – The Most Different AMM On Solana.

Trader Joe with the Liquidity Pool story

Trader Joe is one of the largest AMMs in the crypto market and at Avalanche, Trader Joe successfully overtook Pnagolin to dominate the AMM DEX market in this ecosystem. Recently, Trader Joe has oriented towards multichain development when present on the Arbitrum ecosystem, since then the volume and users of the platform have continued to increase.

Inspired by Uniswap V3’s CLMM, Trader Joe’s built a version of CLMM with many creative changes to overcome the remaining problems of the Uniswap V3 model.

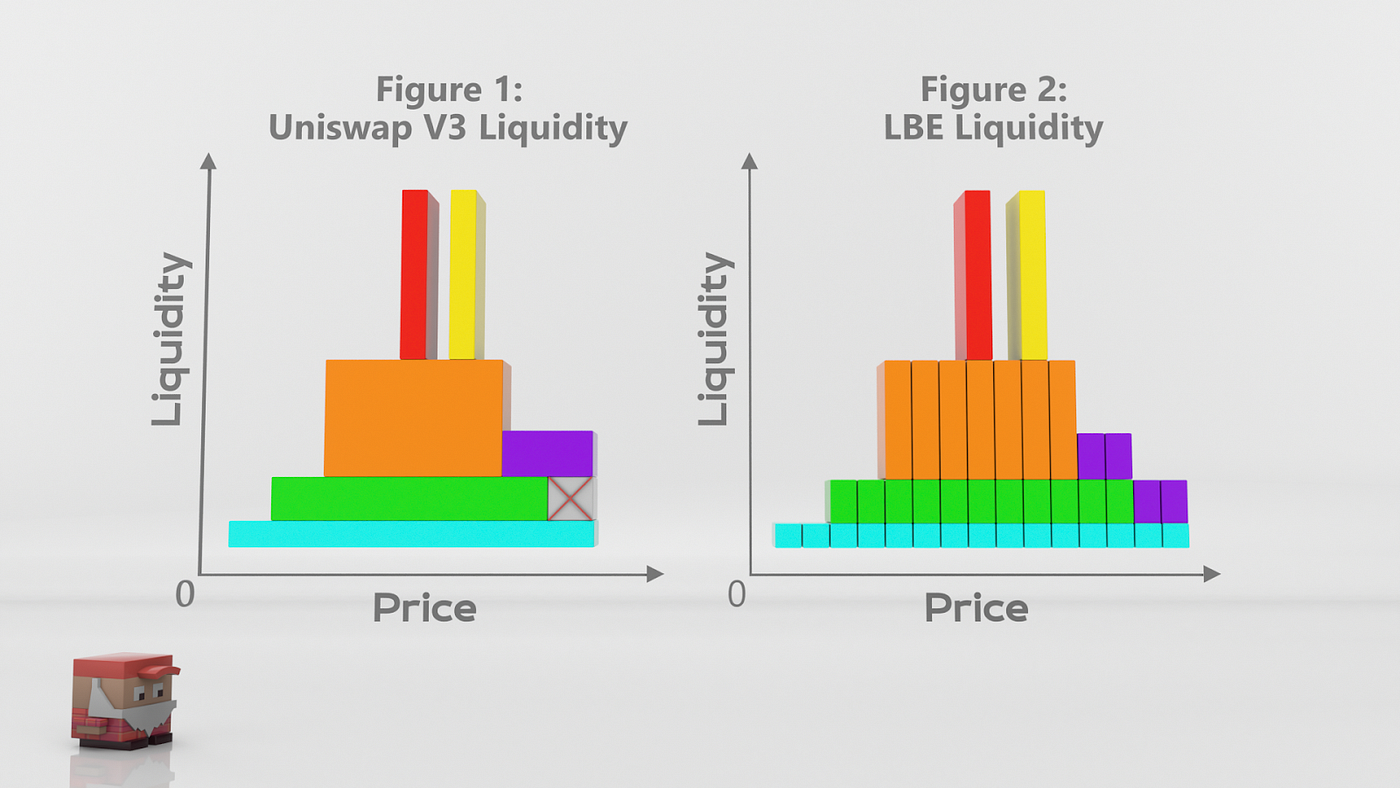

The disadvantage of the Uniswap V3 model is that each time LPs provide liquidity, they only provide on a single price range and if they want to provide multiple price ranges, LPs are forced to use multiple txn, leading to spending a lot of transaction fees.

Trader Joe’s Liquidity Book is different and has the following features:

- Trader Joe will divide the price of the token into many different small ranges called pins.

- LPs can choose as many batteries as they want without fear of encountering problems like Uniswap V3.

The Future of Centralized Liquidity

It is clear that CLMM is the next development future of AMM DEXs if they do not want to go backwards. The biggest evidence shows that PancakeSwap immediately announced the launch of the V3 version, CLMM, right after Uniswap V3’s license expired, which shows that AMM platforms are “thirsty” for the source of Uniswap V3. any.

However, CLMM is not Endgame. Slippage is still there, Impermanent Loss has not disappeared for projects outside of centralized liquidity pools. That will be a problem that developers continue to have to think about.

Summary

CLMM will become part of Crypto but will continue to be upgraded and developed. Hopefully through this article everyone can understand what CLMM is?