What is Cega Finance? Cega Finance is an Exotic Derivatives protocol, builds Exotic Derivatives structured products for retail investors that generate superior returns and provide built-in protection against market downturns.

So What is Cega Finance? What’s special about it? Let’s find out in this article!

What is Cega Finance?

Overview of Cega Finance

Cega Finance is an Exotic Derivatives protocol, builds Exotic Derivatives structured products for retail investors that generate superior returns and provide built-in protection against market downturns.

Cega Finance uses USDC assets for the Index Vaults of BTC, ETH, SOL, AVAX. And currently the protocol only supports two networks, Ethereum and Solana. In the future, the project will continue to expand, integrating more networks such as Avalaunch, BNB Chain,… to reach more users.

Cega is developing new capabilities in technology, token contracts and data modeling that will enable the next evolution of DeFi derivatives. Provide leading Exotic Derivatives product suite for investors.

Cega only charges a 15% performance fee on profits. Additionally, a management fee of 2% per year is collected and calculated on a prorated basis for each vault expiration. The calculation is as follows: 2% * total number of days in the life cycle of the vault from the start of deposit to the expiration of the vault / 365).

Mechanism of action

Cega Finance offers 3 main strategies with different risk levels suitable for investors in the market.

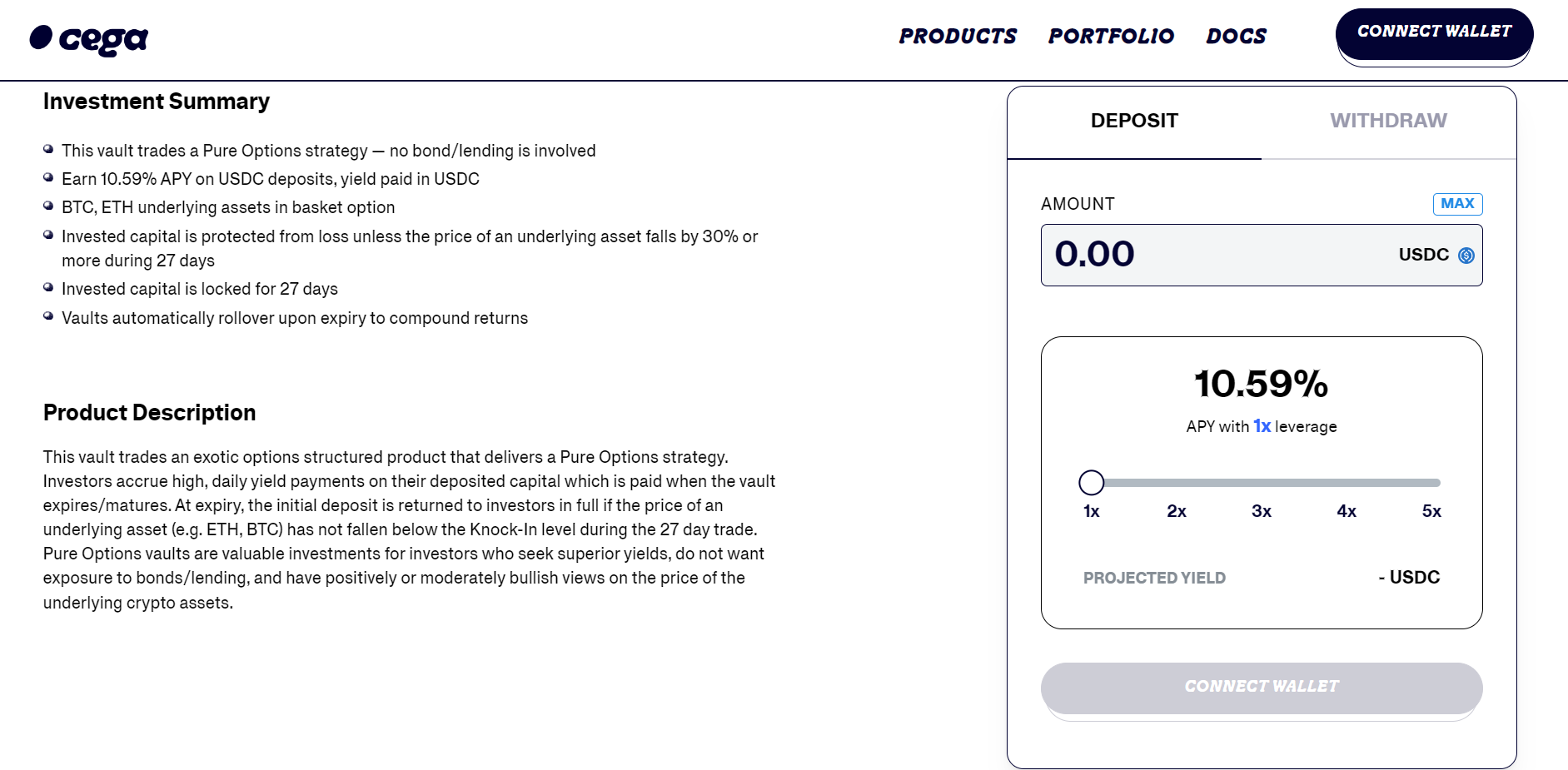

Pure Options Vaults

Generate profits from options premiums without bonds, following several investor strategies

This vault trades an Exotic Derivatives structured product offering the Pure Option strategy. Investors accumulate high daily interest payments on their deposited capital, which are paid out at maturity.

Upon expiration, the initial deposit will be fully refunded to the investor if the price of an underlying asset (e.g. ETH, BTC) does not fall below 50% during the 27 trading days. Vaults are a valuable investment for investors who seek outsized yields, do not want bond/lending exposure, and have a positive or moderate view on the price of the underlying crypto asset copy.

Bond + Options Vaults

This vault offers a Bond + Options strategy by trading an Exotic Derivatives structured product commonly known as a “fixed coupon” in traditional finance. FCNs are a type of Exotic Derivatives that combine equity options and bond-like features.

Investors earn high yields from a combination of option premiums and bond yields from a portion of deposits lent to the market-making counterparty. Investors accumulate daily yield payments on their deposited capital and are paid at maturity. Upon expiration, the initial deposit will be fully refunded to the investor if the price of an underlying asset (e.g. ETH, BTC) does not fall below 90% over the course of 27 trading days.

Leveraged Options Vaults

In essence, Leveraged Options Vaults operate similarly to Pure Options Vault, but here leverage is used to increase capital used to increase profits as well as risk.

These strategies generate higher payouts for users without requiring external liquidity to borrow money for leverage. In short, the USDC import strategy placed users’ bets into multiple baskets instead of one basket (as is the case with Pure Options Vault). Multiple baskets create great yields.

Experienced DeFi users looking to diversify their portfolio and get high returns with just one options position.

Compare strategies on Cega Finance

|

|

Pure Options Vaults |

Bond + Options Vaults |

LEVERAGED OPTIONS VAULTS |

|---|---|---|---|

|

Strategic options |

Fixed discount coupon |

Fixed discount coupon |

Set spread |

|

Deposited assets and profits |

USDC |

USDC |

USDC |

|

APY |

3% to 20% |

5% to 12% |

20% to 109% |

|

Hedges protect when prices fall |

50%

|

90%

|

50%

|

|

Underlying assets |

BTC, ETH, SOL or AVAX |

BTC, ETH or SOL |

BTC, ETH, SOL or AVAX |

|

Risk |

– Bear losses if the asset price surpasses the barrier – Smart contract risks |

– Lending capital to market makers (risk of credit default) – Bear losses if the asset price surpasses the barrier – Smart contract risks |

– Leveraged profits risk larger losses in some cases – Bear losses if the asset price surpasses the barrier – Smart contract risks |

Development Roadmap

Update…

Core Team

Winston Zhang: Co-founder

- In 2014, Winston graduated with a Bachelor of Commerce from Queen’s University.

- After that, he worked as a Management Consultant at Oliver Wyman for 2 years.

- In 2016, he worked as Product Manager at DoorDash.

- In 2020, Winston joined the founding of Orbiter, an automated data monitoring and analysis company.

- Currently, he is a Venture Partner at Pioneer Fund and a Co-Founder at Cega.

Arisa T: Co-Founder & CEO

- Arisa graduated with a Bachelor’s degree in Computer Science and Economics from Northwestern University.

- In 2018, Arisa worked as Product Marketing Manager at Google, implementing and implementing consumer marketing strategy including Google Search, Lens and AR.

- In 2021, Arisa will work as Head of Marketing & Growth at Bitcoin.com, with specific work being corporate strategy consulting and brand analysis.

- Currently, Arisa is an Advisor at Japan Blockchain Association and Co-Founder & CEO at Cega.

Alick Xu: Software Engineer

- In 2015, Alick graduated with a Bachelor’s degree in Computer Science from UC Santa Barbara. He then went on to graduate with a Master’s degree in that same major.

- In 2016, Alick worked as Search Software Engineer at Reflektion.

- In 2018, he worked as a Software Developer at Nextdoor.

- In 2021, Alick works as a Software Engineer at Opendoor.

- In 2022, he worked at Swim Protocol as Software Developer.

- Currently, Alick Xu is Founding Software Engineer at Cega.

Felicia Chen: Co-Founder

- Felicia Chen graduated with a Bachelor’s degree in Computer Science and Economics from Duke University.

- In 2020, she worked as a Software Engineer at Apple.

- After that, Felicia moved to work as a Software Engineer at Anduril Industries.

- Currently, Felicia Chen is a Co-Founder at InstaJam and a Co-Founder at Cega.

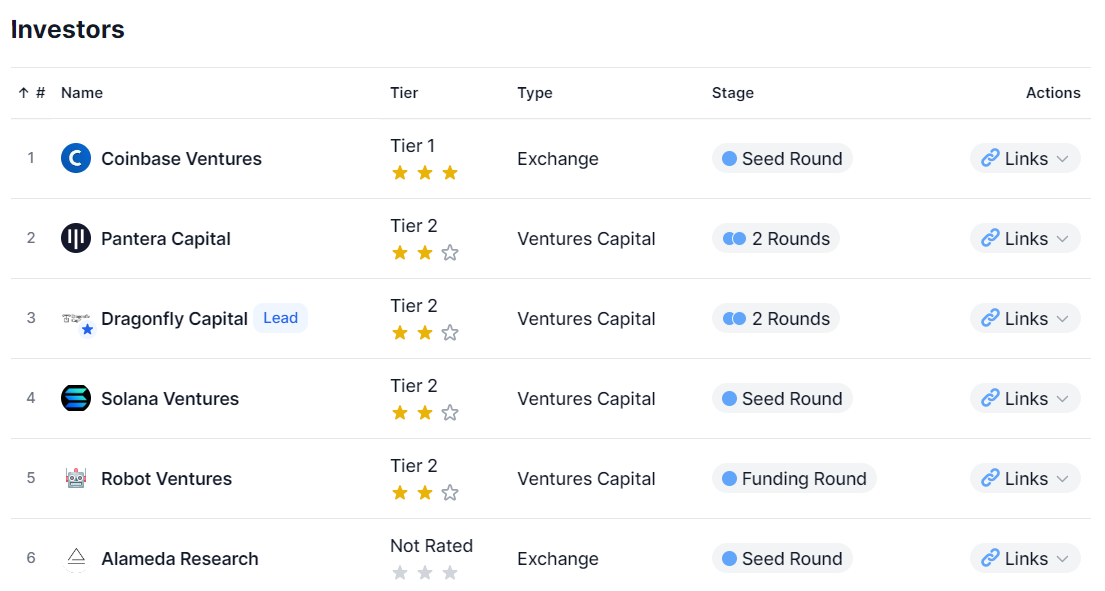

Investors

- March 8, 2022: Seed round successfully raised $4.3M led by DragonFly Capital and also included investment funds Pantera Capital, Coinbase Ventures, Solana Ventures,

Alameda Research. - March 27, 2023: Funding round successfully raised $5M led by DragonFly Capital and with participation from Pantera Capital, Robot Ventures.

Tokenomics

Update…

Exchanges

Update…

Cega Finance’s Information Channel

- Website: https://app.cega.fi/

- Twitter: https://twitter.com/cega_fi

- Medium: https://cegafi.medium.com/

- Discord:

Summary

Cega Finance provides derivative products that bring profits to investors. This segment is very large and has existed for a long time in the traditional market. But with the Crypto market, this segment is still quite young, with many opportunities for development. When the DeFi infrastructure is complete and there are many institutional investors, derivative products will be the focus of the market.

So I have clarified what Cega Finance is? Cega Finance cryptocurrency overview. Hopefully this article helps you gain more knowledge and perspective about the Cega Finance project.