Stablecoins are always a market share that most big players want a share of. While centralized Stablecoins were dominated by names like USDT and USDC, with the collapse of UST (Rerra), the decentralized Stablecoin market is becoming a derelict land, where most DeFi projects are. want to win. So today you and I will learn about a project in this area, Bucket Protocol.

To better understand Bucket Protocol, people can refer to some of the articles below:

- Noteworthy Decentralized Stablecoins In The Near Future

- What is Maker DAO (MKR, DAI)? Maker DAO Cryptocurrency Overview

- What is Angel Protocol (ANGLE)? Angel Protocol Cryptocurrency Overview

- What is Vesta Finance (VST, VSTA)? Overview of Vesta Finance Cryptocurrency

Bucket Protocol Overview

What is Bucket Protocol?

Bucket Protocol is a Stablecoin project built and developed on the ecosystem of Sui Blockchain, the project creates a decentralized Stablecoin supported by valuable assets on the market such as BTC, ETH, LSD and SUI.

Similar to other decentralized Stablecoin projects, people can deposit BTC, ETH, LSD Token into Bucket Protocol as collateral to borrow BUCK – Stablecoin of the project. When borrowing BUCK, users can generate more profit by putting BUCK into DeFi with many different strategies such as Liquidity Provide, Lending & Borrowing, Derivatives, Yield Farming,…

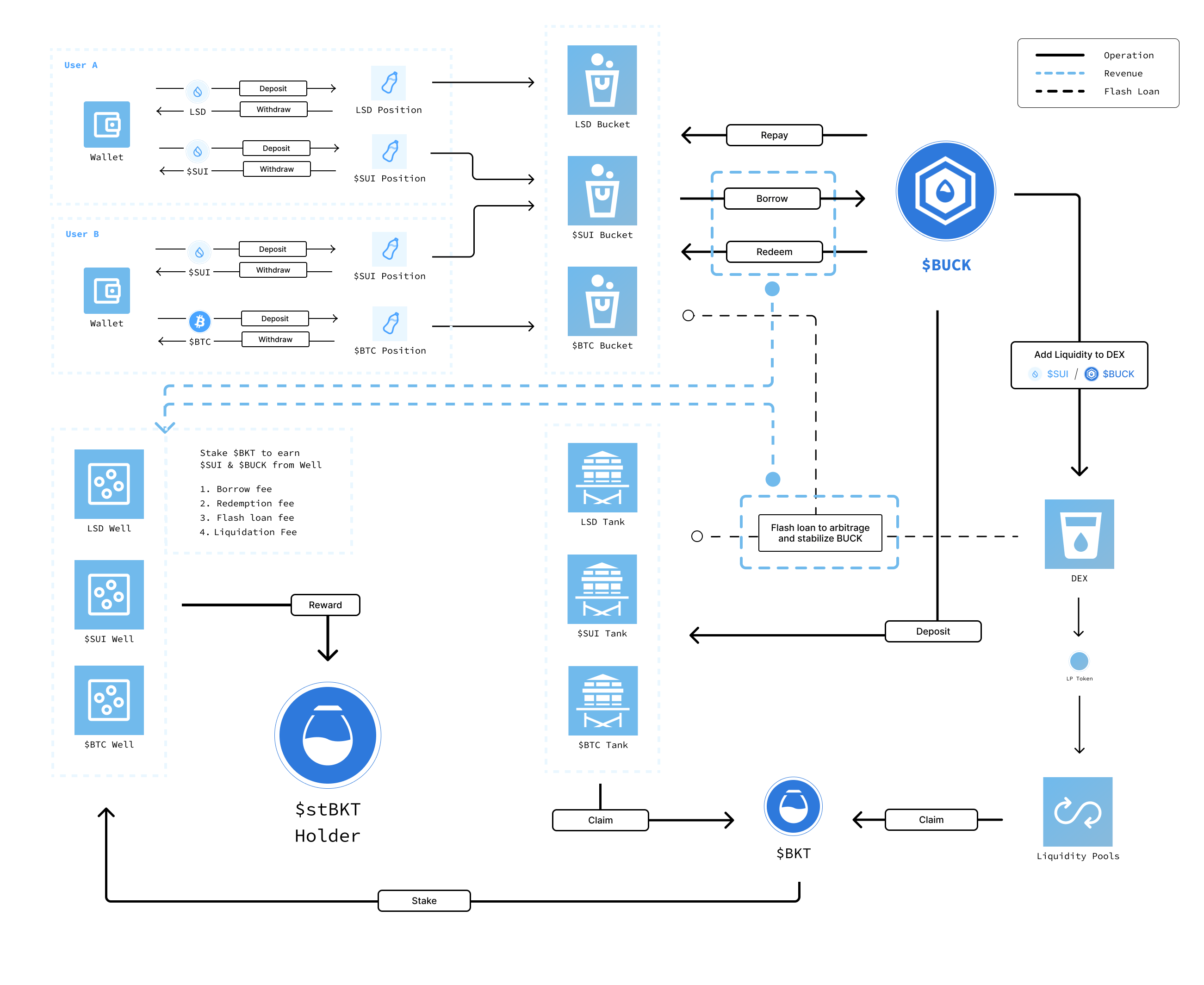

Operational mechanism of the project

First, people deposit their assets into Bottle (this place will be used to store users’ collateral assets) and borrow BUCK. The project accepts a minimum mortgage rate of 110%. That is, when people mortgage $100 BTC, they will be able to borrow a maximum of about $90 BUCK.

The loan fee is calculated by the project as (basic interest rate + 0.5%) * Loan amount.

For example: The current base interest rate is 1%, with $100 BTC, if you borrow $90 BUCK, the loan fee will be equal to: (1% + 0.5%) x 90 = $1.35. When you repay your loan, you will pay for the project $90 + $1.35 = $91.35.

After borrowing BUCK, people have two options, one is to use BUCK to provide liquidity to the BUCK/SUI pool to receive Incentive as BKT (the project’s Native Token).

The second way is for people to deposit BUCK into the Tank. Tank is a place to store assets used for liquidation when the mortgage rate in the Bottle drops below 110%. When you deposit BUCK into the Tank, each time you participate in asset liquidation you will receive a liquidation fee and also receive the project BKT. You can use BKT to lock into Well and receive stBKT in return. By holding stBKT you will share profits from (Loan fees, repayment fees, liquidation fees and fees for Flash loans).

The project will use assets in Bottle and Tank to lend Flash Loan and Arbitrage to earn more profits for the protocol.

Liquidation mechanism: When the collateral drops to 110%, Tank will burn BUCK and receive the user’s collateral. In case there is no BUCK in the Tank, the protocol will divide the liquidation and debt equally among other Bottles.

Development Roadmap

Update…

Core Team

Update…

Investor

The project cooperates with many projects such as: Cetus, Aftermath, Typus, Navi, Umi, OmniBTC, ComingChat, Suia, Releap, Somis.xyz.

Tokenomics

Update…

Exchanges

People can buy the project’s BKT by providing liquidity to the BUCK/SUI pool or depositing BUCK into the Tank.

Project Information Channel

- Website: https://bucketprotocol.io/

- Discord: https://discord.gg/nYCnNJE6Tr

- Twitter: https://twitter.com/bucket_protocol

- Telegram:

Summary

Stablecoin is always a very competitive market, projects need to have more improvements than just applying the same model, only then can the project become different and attract more users. Sui Blockchain is a potential Layer 1 Blockchain and not many projects have developed on it, this will be a great opportunity for projects like Bucket Protocol to get ahead and take a part in this Stablecoin pie. .