What is BRCFi? BRCFi is a term used to refer to the combination of BRC 20 and Finance. This means bringing Finance elements such as: Lending, Derivative,… into BRC 20 tokens. So what is BRC 20, what pieces are there in BRCFi? Let’s find out with Weakhand in this article. Please write this.

Before jumping into the article, everyone can refer to some of the following articles to understand better.

- What is BRC 20? All you need to know about BRC 20

- BRC 20 brings innovation and breakthroughs to the Bitcoin network

- Summary of potential BRC 20 projects

What is BRCFi?

BRCFi is a term used to refer to the combination of BRC 20 and Finance. This means that we will see Finance elements such as Lending, IDO, Derivative,… appear on BRC 20 tokens. BRCFi appears as a necessity when BRC 20 tokens such as: ORDI, SATS, RATS,… continues to increase and become more and more popular in the market. Therefore, the need for Finance for a market with a market capitalization of billions of dollars like BRC 20 is inevitable.

What is BRCFi?

Although still in its early stages, BRCFi has received a lot of attention from the community and investors in the market. In recent times, we have seen many capital raising deals for BRC 20 projects starting to appear on the market, such as:

- On December 7, 2023, Map Protocol – a project supporting a Cross chain protocol for BRC 20 announced that it has received a strategic investment from DWF Labs and Waterdrip Capital.

- On December 11, 2023, lending platform Liquidium completed a $1.25 million Pre-Seed funding round with the participation of Bitcoin Frontier Fund, Sora Ventures, and several other investors.

- On December 14, 2023, bitSmiley – a decentralized Stablecoin development platform on Bitcoin completed a funding round from ABCDE and OKX Ventures.

- ….

In just two weeks, up to 8 projects related to the Bitcoin ecosystem have received strategic investments from VCs in the market and they are mainly built around Finance services for customers. for new assets such as Bitcoin Ordinals and BRC 20. So, let’s take a look at the prominent pieces in the BRCFi ecosystem.

BRCFi Ecosystem Overview

Similar to the DeFi industry on other Blockchains, BRCFi also has pieces such as Dex, Lending, IDO, Wallet,… Here we go into the outstanding projects:

Decentralized auction platform Bounce Finance (AUCTION) takes off with the help of Bitcoin

Bounce Finance (AUCTION) was originally a multi-chain decentralized auction platform, providing services such as token issuance and NFT auction, simplifying the IDO process, etc. This platform was founded in September 2020 by Jack Lu and Ryan Fang.

Bounce Finance decentralized auction platform

Both of these projects have seen strong growth since the MUBI token, which had an IDO price of 0.00047 USD, is now trading at 0.39 USD – witnessing over 1,000x growth. The BSSB token had an IDO price of 0.27 USD and has now exceeded 9.5 USD, witnessing a growth of about 40 times. With the success of the first two Launchpad projects, Bounce Finance received a lot of attention from investors in the Crypto market and is considered the leading IDO project in the Bitcoin ecosystem.

Not stopping at immediate success, Bounce Finance continues to upgrade, develop and further optimize its products, we can mention some outstanding activities such as:

- On December 6, 2023, Bounce Finance announced a rebrand to Bounce Brand with main products including: Bounce Kit – a series of applications on Bitcoin, Bounce Box – a door to explore Defi applications on Bitcoin and Bounce Auction – an auction platform on Bitcoin.

- On December 19, 2023, Bounce Brand announced that IDO will use the “Two Birds, One Stone” strategy in which two independent projects will jointly issue a token and the project’s identity will be kept secret. . This will increase the element of mystery and anticipation for users in the upcoming launch of the token. This unique launch will use AUCTION and DAII tokens as currencies for participation.

With a keen sense of participating in new trends emerging on Bitcoin, Bounce Finance has successfully transformed from an auction platform forgotten by users into a leading IDO application in the Bitcoin ecosystem. In recent times, the AUCTION token has also seen a strong growth of about 10 times and is currently reaching about 40 USD with a market capitalization of 250 million USD.

Multibit – The first Cross-chain Bridge platform on the Bitcoin ecosystem

Multibit is the first Cross-chain Bridge platform on the Bitcoin ecosystem, supporting BRC 20 and ERC 20 assets. Users can seamlessly switch between assets on EVM networks such as Ethereum, BNB Chain and Bitcoin.

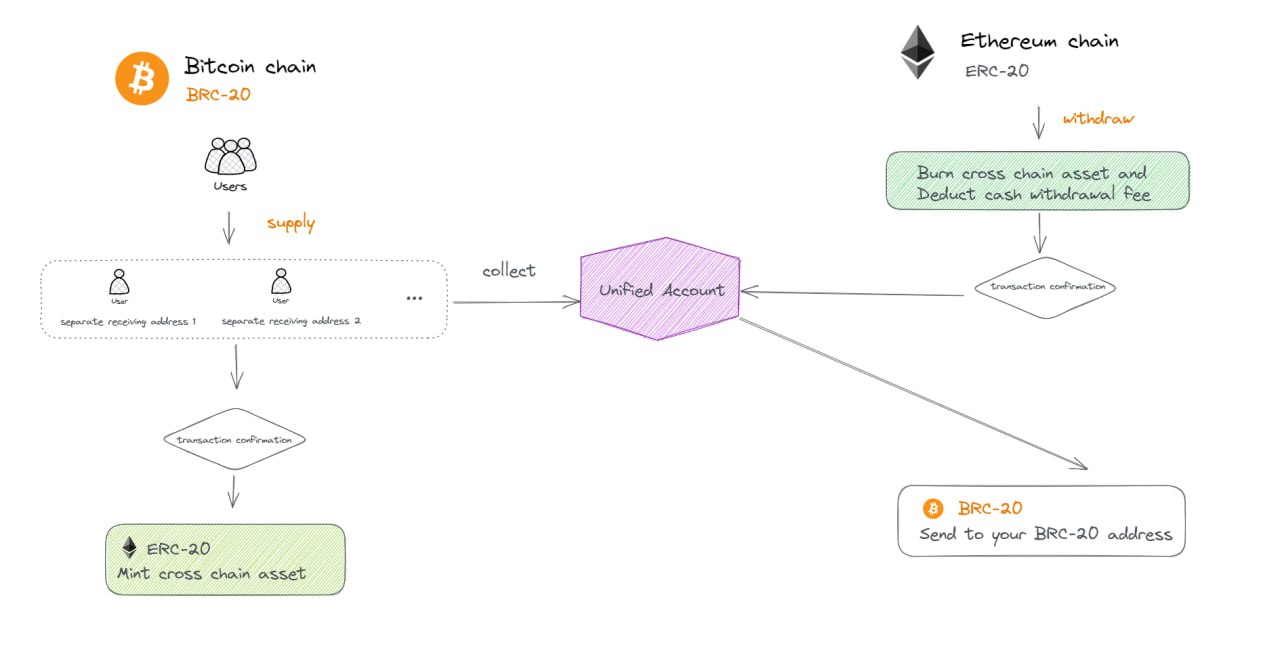

Multibit simplifies the transaction process in which users only need to transfer BRC 20 tokens to the BRC 20 address provided by Multibit. After the transaction is confirmed, Multibit will mint 1 ERC 20 token on the user’s corresponding address on the EVM chain. When the user wants to receive the BRC 20 token back, Multibit will burn the minted amount of tokens and send the BRC 20 token back to the user.

Multibit operating model

However, Multibit’s goal is not only Cross-chain Bridge but also integrating many other tools into its platform such as: yield Aggregator, CDP using ORDI as collateral,…

BitStable – CDP on the Bitcoin ecosystem

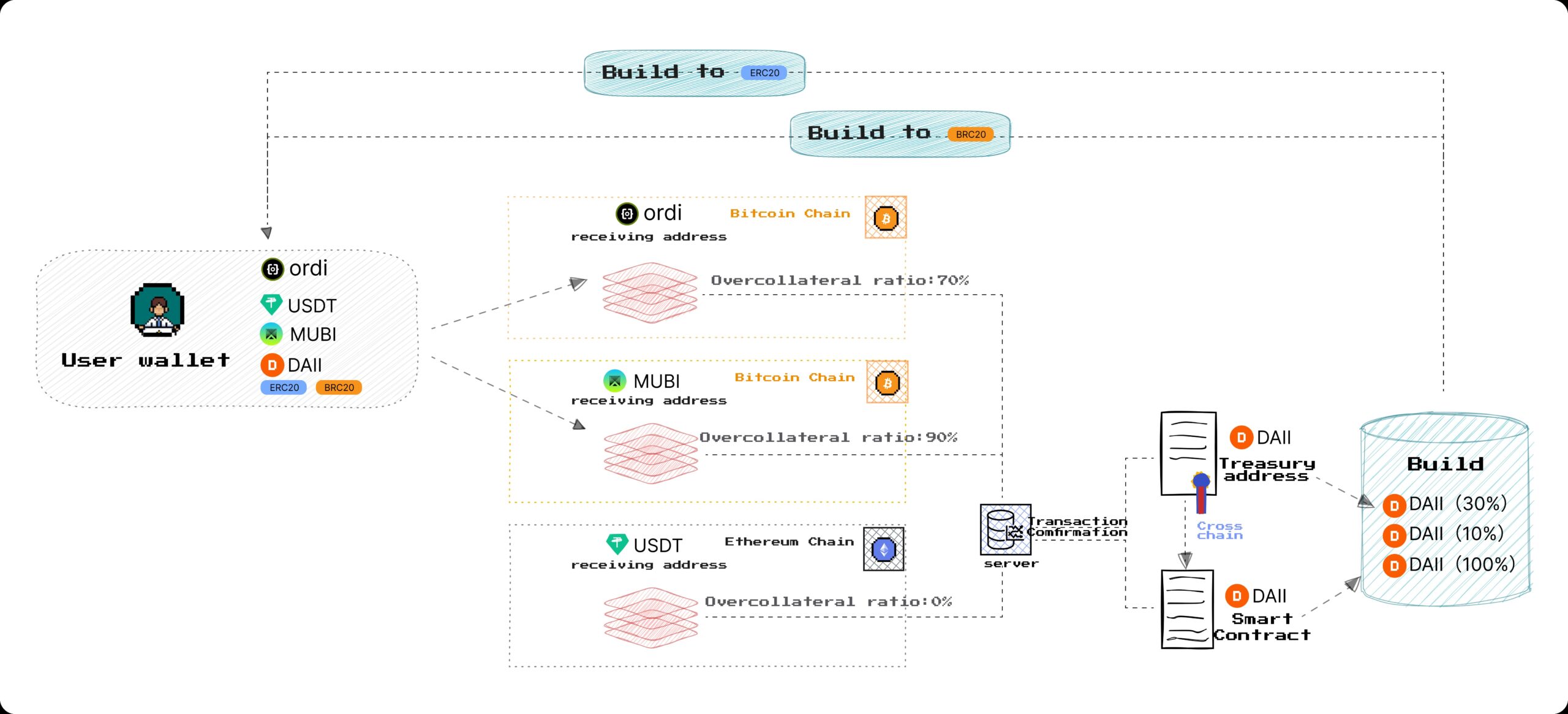

BitStable is a CDP platform on the Bitcoin ecosystem, this application applies a dual token system including BSSB – governance token for users to vote assets as collateral on BitStable and DAII – Decentralized StableCoin on BitStable.

Currently, users can deposit BitStable-supported collateral (currently only supports ORDI, MUBI and BTCB) into the platform to mint Stablecoin DAII. In addition, BitStable also has a DAII to Ethereum Cross chain bridge that allows users to convert from DAII to USDT.

BitStable operating model

As of December 19, 2023, BitStable has generated 30.75 million DAII including 30.54 million DAII in ERC20 form and just 210,000 BRC20. BitStable first appeared when it released the BSSB token on the IDO Bounce Finance platform. The BSSB token has increased about 176% in the past seven days and is currently listed at $7.50. Total BSSB issuance is 21 million with market capitalization reaching 180 million USD.

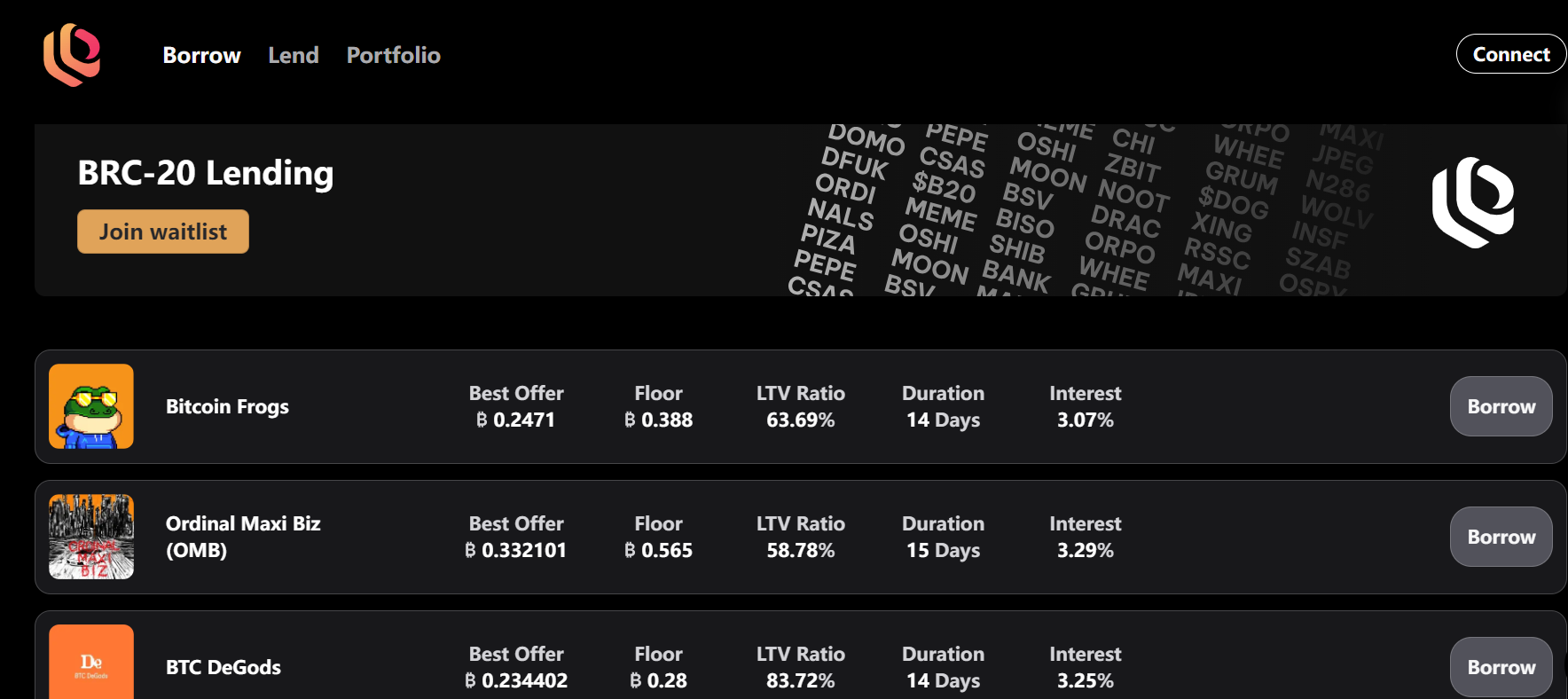

Liquidium – BRC 20 Lending Platform on Bitcoin

Liquidium – P2P Lending platform on Bitcoin

Currently, Liquidium only supports ORDI tokens as collateral and their product is not officially open to everyone but only for whitelisted users. In addition, Liquidium also applies a time-based liquidation mechanism, not price-based liquidation like popular Lending platforms such as Aave or Compound.

TurtSat – Gitcoin on the Bitcoin ecosystem

TurtSat is a community-driven open platform with a mission to be the Gitcoin on the Bitcoin blockchain. TurtSat provides a space for people to build, donate, and is a destination for new BRC 20 projects on the Bitcoin blockchain. TurtSat is committed to creating an active, community-led Ordinals ecosystem and partners with a number of influential organizations to jointly promote the development of the Ordinals protocol and the Bitcoin ecosystem.

TurtSat – Gitcoin version on Bitcoin

TurtSat already supports the BRC 20 and ERC 20 bilateral markets, and BRC 20 users can trade through Unisat and OKX. Since its launch, the TurtSat platform has launched a total of 4 BRC 20 projects including asset protocol CHAX, Crosschain bridge MUBI, Ordinals aggregation platform NHUB, and lending platform Ordinals DOVA. These projects were the first to build BRC 20 infrastructure and had good growth after the project was implemented.

summary

The Bitcoin ecosystem is starting to receive a lot of attention since the ORDI or SATS tokens exploded. There have been many projects and developers starting to pay attention and shift towards building dApps on Bitcoin. Above is all the information I want to introduce about what BRCFi is. I hope everyone has received useful knowledge.