What is Brahma Finance? Brahma Finance is a Yield Farming platform through Brahma that can easily earn profits in DeFi. So what is outstanding about Brahma’s way of working? Let’s go into the detailed analysis below.

What is Brahma Finance?

First of all, Braham makes a decentralized platform, built with the purpose of activating and managing liquidity across different chains and Dapps.

Products of Brahma

Brahma Vault

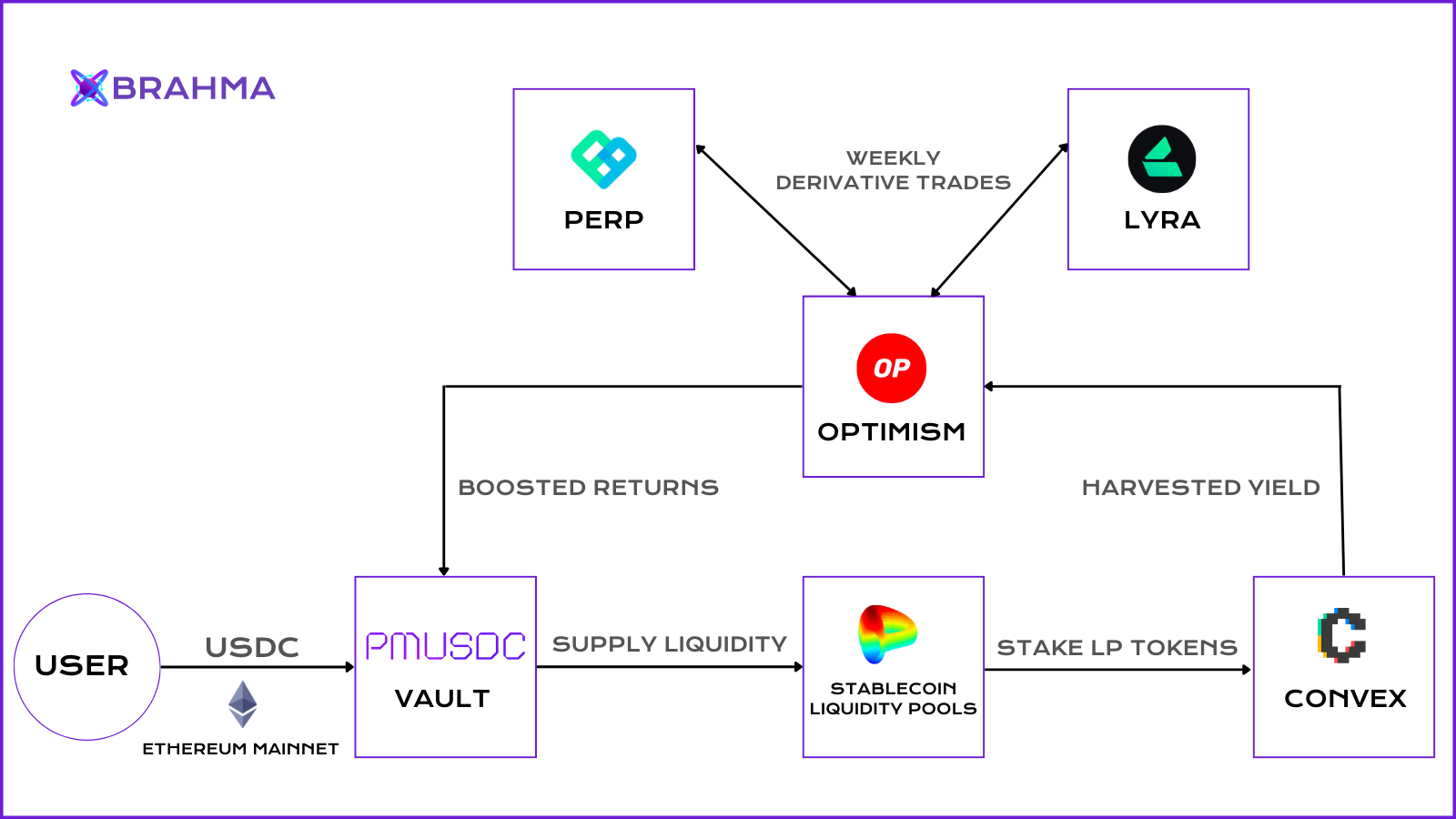

Mechanism of action of Brahma Vault

Step 1: Brahma Vault will operate by attracting user assets (currently limited to USDC) on the Ethereum network

Step 2: Vault will then automatically execute its strategy of providing liquidity on pools at Curve Finance:

- Frax3crv-pool: These are 3 legendary pools including USDC, USDT and DAI

- DAI – USDC – USDC – sUSD

Step 3: When participating in providing liquidity on Curve, Vault will receive LP Token and this LP Token will be brought to Convex to earn profit.

Step 4: The profits from providing liquidity will be sent to Lyra or Perpetual on the Optimism network to open leveraged orders with clear stoploss or take profit.

Step 5: Profits from opening leveraged orders will be brought back to the pool and shared with deposit-ers

Degen Vault

Dengen Vaults are tested vaults before becoming Brahma Vaults that are used by people with a lot of experience in DeFi, but their effectiveness has not been clearly evaluated.

Degen Vault currently includes 3 vaults: TopGear, Polygains, ETHMaxi.

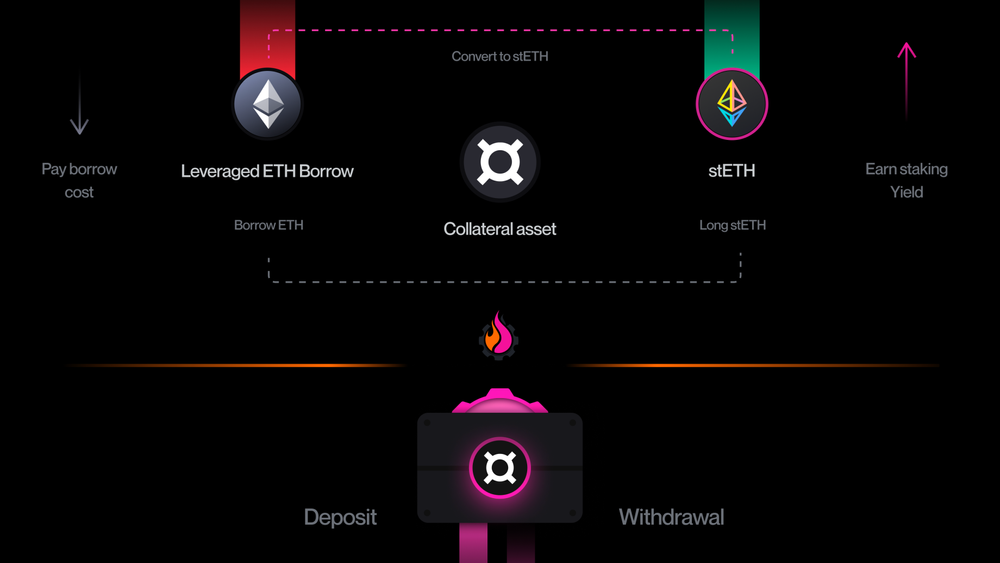

TopGear

How TopGear works is as follows:

- Step 1: User will deposit FRAX (stablecoin) into the vault.

- Step 2: FRAX will be mortgaged.

- Step 3: Vault will borrow ETH then hold this ETH and swap it into stETH through Curve Finance.

- Step 4: The profit from holding stETH at the present time is about more than 5%, minus the ETH loan interest rate and returned to the vault.

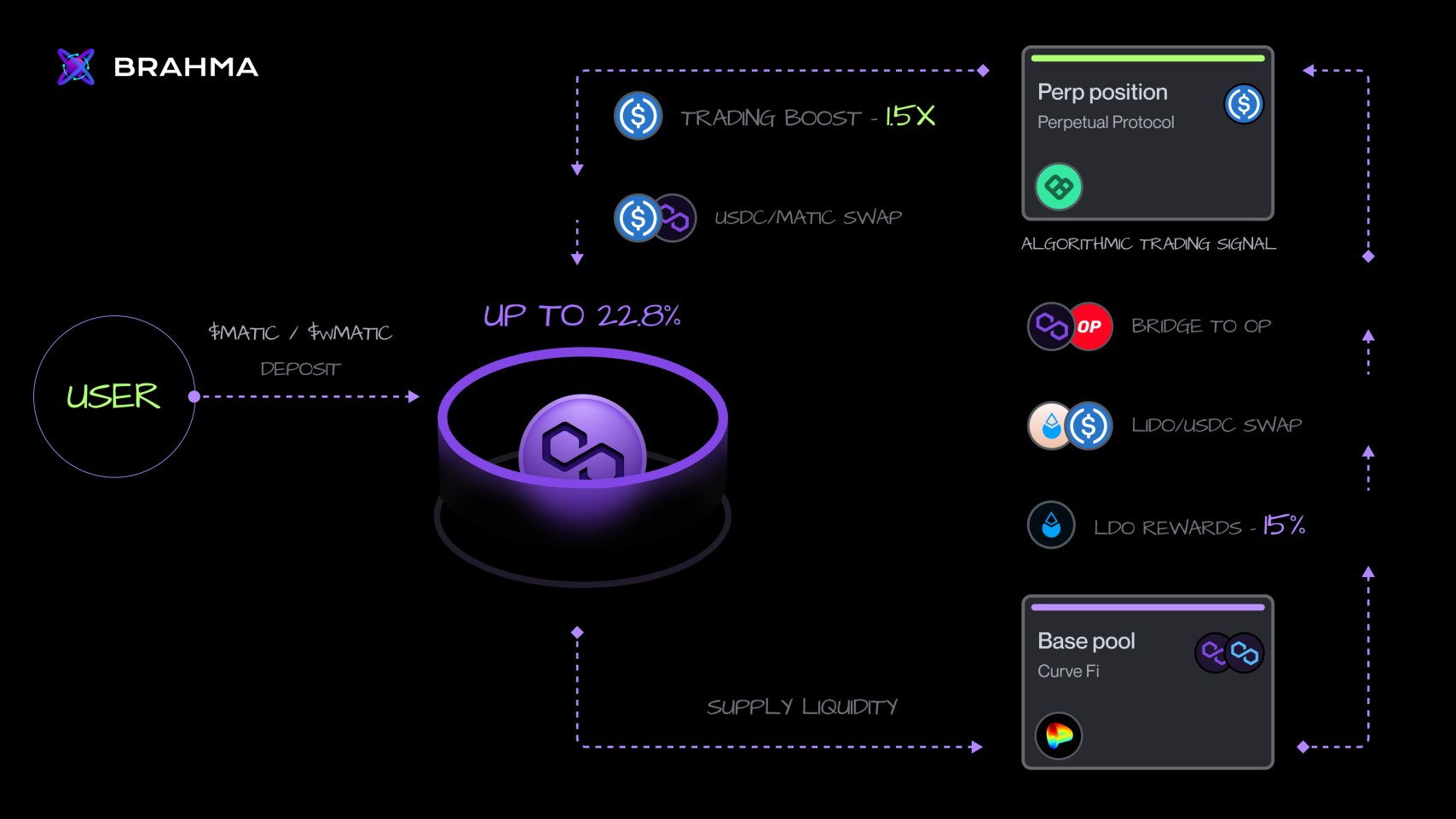

Polygains

How Polygains works is as follows:

- Step 1: User will deposit MATIC into vault.

- Step 2: MATIC will be included in Lido Finance to receive the vault to receive stMATIC.

- Step 3: Vault will bring stMATIC to Curve Finance providing liquidity for the stMATIC/MATIC pair

- Step 4: Profits from farming holdings will be converted into USDC. This USDC will be brought to the Optimism network.

- Step 5: At Perpetual, the vault will plan a strategy to go long/short on Perpetual with clear take profit and stop loss.

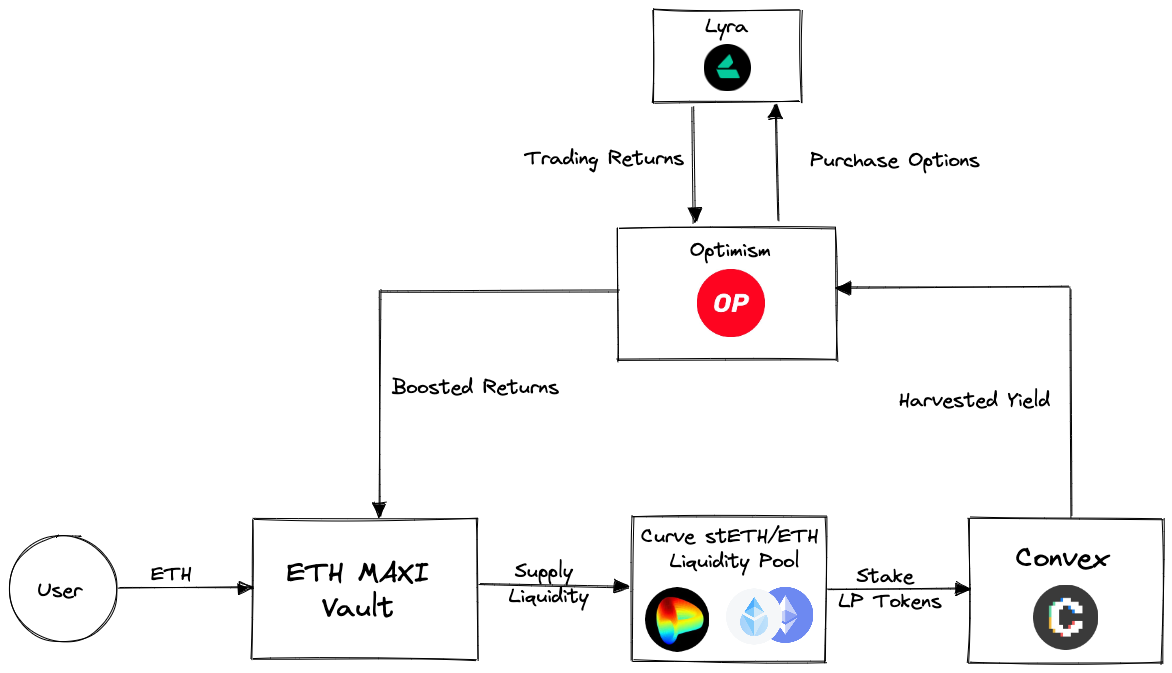

ETHMAXI

Ethmaxi’s mechanism of action is as follows:

- Step 1: User deposits ETH into EthMaxi Vault.

- Step 2: Provide liquidity for the stETH/ETH trading pair in Curve Finance and the vault receives LP Tokens.

- Step 3: This LP Token will be sent to Convex by the vault to get profit. All these profits are converted into ETH and sent to the Optimism network.

- Step 4: Vault will plan a strategy for opening Option orders on Lyra.

- Step 5: Profits earned from opening Option orders will be returned to the vault.

Investor

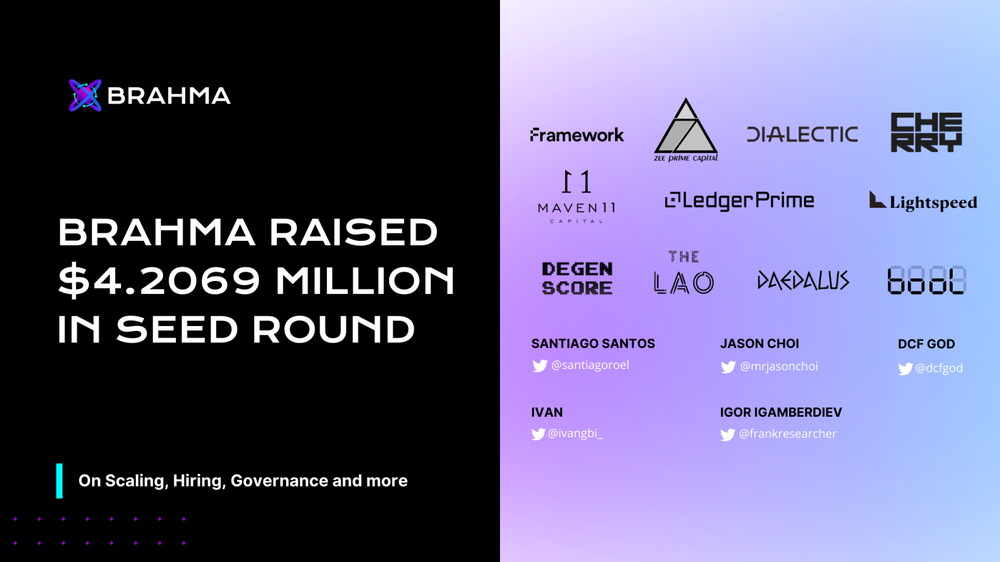

February 22, 2022: Brahma successfully called for $4.2069M in Seed round by many investment funds such as Framework, Ledger Prime, Cherry, Lightspeed, the LAO in addition to many large KOLs in the crypto community such as Jason Choi of Dragonfly Capital, DCF GOD,…

Project Information Channel

- Website: https://app.brahma.fi/

- Twitter: https://twitter.com/brahmafi

- Blog: https://blog.brahma.fi/

- Discord: