What is Binance Launchpad? Binance Launchpad is a launchpad for new projects to sell tokens to retail investors for the first time. So why are people flocking to join Binance Launchpad? Let’s find out together in this article.

To understand more about Binance Launchpad, people can refer to some of the articles below:

- What is OKX Jumpstart? Change Your Position With Jumpstart

What is Binance Launchpad?

Overview of Binance Launchpad and its History

Binance Launchpad is a platform and launching pad for projects that sell Public Sales to the community for the first time and list on Binance.

It can be said that Binance was the first exchange to create the IEO trend after the collapse of the ICO. IEO stands for Initial Exchange Offering, which means a method of publicly raising capital for new projects through exchanges.. IEOs are organized by exchanges and are supported by them in terms of technical and risk management. Investors can purchase new tokens through that exchange.

The new form of IEO capital raising appeared in 2019. In the past, there have been two other methods, ICO (Initial Coin Offering) and STO (Security Token Offering), used to raise capital for new projects, but both unsustainable or not well received by the community.

One of the first IEOs was Tron Foundation’s BitTorrent Token, held on Binance in January 2019. Since then, IEO has become a popular method for new projects to raise capital and attract investor interest.

Why is everyone fomo to join Binance Launchpad

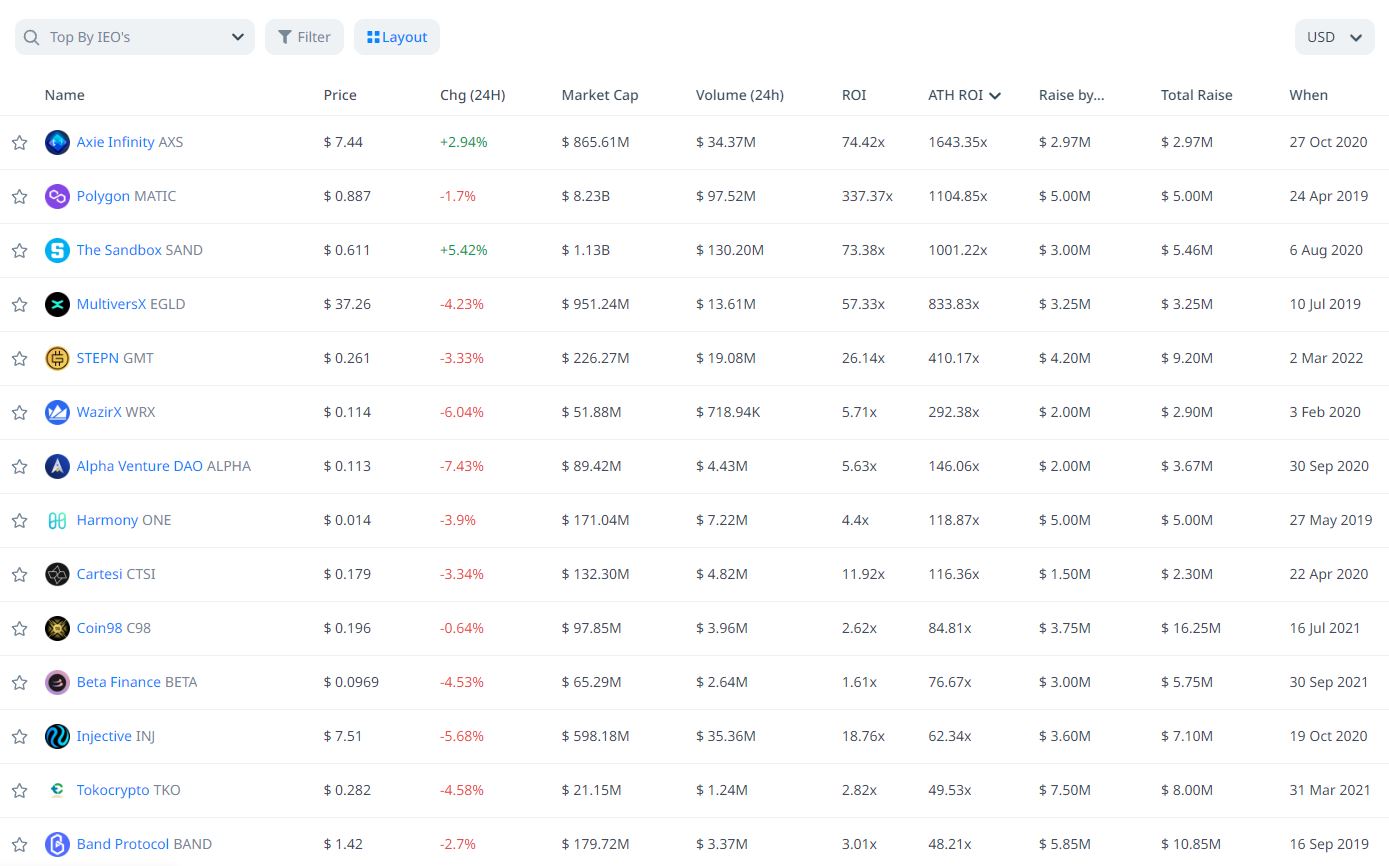

The reason why everyone is so excited to join Binance Launchpad is simply because the IEO projects on Binance are carefully selected, are all quality projects, and the projects all grow many times after being officially listed. on Binance. Some of the projects that have been trending on Binance include:

Projects with the highest ATH ROI ever launched IEO on Binance Launchpad

- Axie Infinity: 1643 times growth

- Polygon: 1104 times growth

- The Sandbox: grew 1101 times

- EGLD: 833 times growth

- StepN: 410 times growth

- WazirX: 292 times growth

- Alpha Finance: 146 times growth

- Harmony: 118 times growth

- Cartesi: 116 times growth

- Coin98: 84 times growth

That means if you buy $100 of the above odds, with Axie Ifinity you will earn $164,400 if you sell at ATH, with Polygon it will be $110,400, with The Sanbox it will be $110,100, with EGLD it will be $83,300, with StepN would be $41,000, with Alpha Finance being $14,600,…

With the data above, we can ask ourselves: “Do we have fomo?”. Of course it doesn’t stop there, the key to joining Binance Launchpad is that BNB has strong growth, it can be said that this is the 8th wonder of the world, “compound interest”.

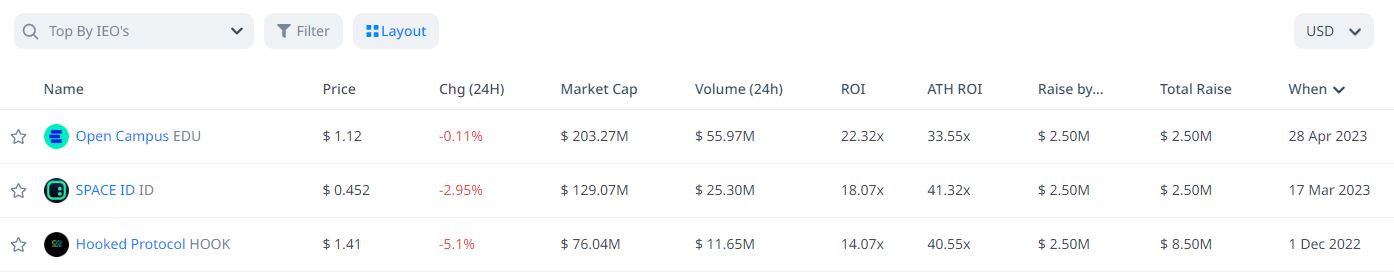

Specifications of recent IEO projects on Binance Launchpad

Above are the projects deployed IEO on the latest Binance Launchpad that also bring an attractive ATH ROI such as Open Campus with 33 times, Space ID with 41 times and Hooked Protocol with 40 times. That has proven to us that, in the eyes of investors, Binance is still an open land even in the current downtrend.

Some advantages & disadvantages of Binance Launchpad

|

Advantage |

Defect |

|---|---|

|

High profitability makes more people participate => quality projects want to deploy on Binance Launchpad => return to step 1. Good loop. |

BNB’s price is getting higher and higher, making it difficult for retail investors to participate. |

|

Important in creating use cases for BNB, thereby helping BNB grow well in the long term. |

For those with little capital participating, the profits received are not high. Difficult to motivate new participants. |

|

Create quality trends that attract cash flow into the crypto market. |

– |

Instructions for Joining Binance Launchpad

Step 1: Register an account

To join Binance Launchpad, the first step is to prepare a KYC account (the KYC process requires CCCD, Passport, Selfile,…). If you do not have a Binance account, you can support Weakhand with the link here.

When registering for a Binance account, you should complete all the steps to increase the security of your account such as:

- Register the owner’s phone number.

- Register for main email.

- Use Google Autheciator.

- Using Face ID on iPhone avoids losing your phone.

- Use withdrawal password.

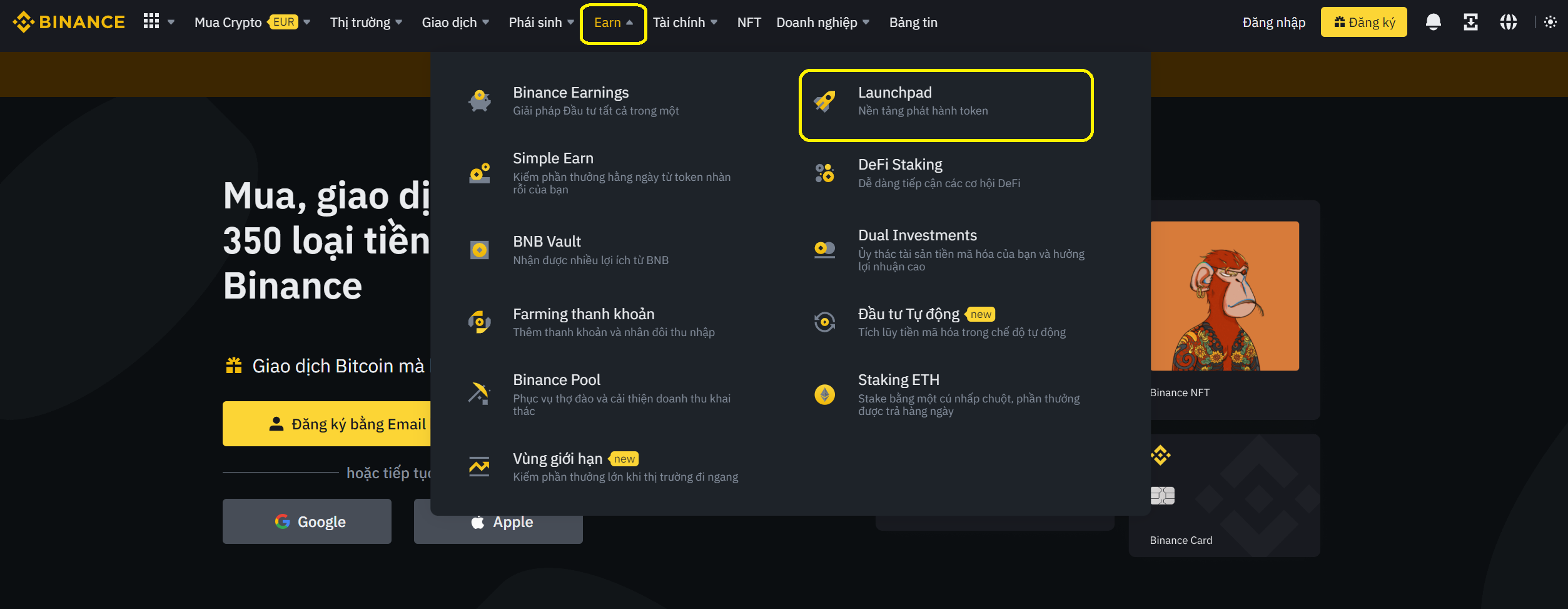

Step 2: Search for Binance Launchpad on Binance

After logging in to Binance, you choose to move the cursor to the Earn section and select Launchpad. After clicking, you will see projects being launched on Binance and projects that have been launched previously.

Step 3: Hold BNB to join Binance Launchpad

At this step Binance will ask you to hold BNB for 7 days. BNB balances will be snapshotted across all your accounts on Binance. As of now, Binance will divide the project’s tokens among BNB holders. The more BNB you hold, the more project tokens you will get. However, there is a maximum per account.

There will be many of you who don’t have BNB, so here are some ways for you:

- Borrow BNB based on the assets you own such as USDC, USDT, ETH, BTC,… after the event ends, return the BNB, part of the interest and get your collateral back. However, don’t let the loan rate get too high or you will easily encounter liquidation

- Buying BNB but opening a short BNB order is possible, but you should choose low leverage to avoid the order being liquidated if BNB increases too much.

Step 4: Pledge BNB

Next after the snapshot, you need to commit BNB, which means locking BNB in the pool. The more you lock, the more tokens you will receive and vice versa.

Step 5: Receive tokens from Binance

The token value you receive will be deducted from the amount of BNB you locked in step 3 when pledging BNB.

Step 6: List floors

At this step, you must be very careful in paying attention to the exact time to plan to take profit from the amount of tokens you receive. There have been many people who, because they didn’t pay attention or looked at it quickly, ended up spending too much time and at that time the position was no longer as good as when it was first listed.

The Future of IEO on Binance Launchpad

The future of Binance Launchpad certainly depends on Binance. If Binance continues to maintain its position, Binance Launchpad will certainly come back even stronger in the future when the uptrend market returns. I believe that Binance Launchpad is still a guide in determining long-term market trends.

Typical cases such as Polygon prove the Layer 1 or EVM Blockchain trend, Axie Infinity leads the Play to Earn trend, The Sandbox leads the Gaming combination Metaverse trend or the most recent case is StepN with the Move to Earn trend .

Summary

Binance Launchpad has become an important piece of the investment and profit puzzle for everyone participating in the crypto market.