What is Astaria? Astaria is an NFT Lending platform deployed on Ethereum with the aim of helping users have a seamless experience in borrowing and lending with NFTs. Let’s find out what is special about this project with Weakhand in this article.

Before jumping into the article, you can learn more about some of the following projects to gain more knowledge about the NFT Lending market.

- What is BendDAO? BendDAO cryptocurrency overview

- What is NFTfi? Overview of NFTfi cryptocurrency

- What is Arcade? Arcade cryptocurrency overview

- What is OpenSky? OpenSky cryptocurrency overview

What is Astaria?

Overview of Astaria

Astaria is an NFT Lending platform deployed on Ethereum. The Astaria Protocol allows Strategists to create loan terms through Vault, which can accept capital from Lenders to lend to Borrowers. Competition between Strategists ensures that Borrowers have access to market competitive terms and interest rates.

What is Astaria?

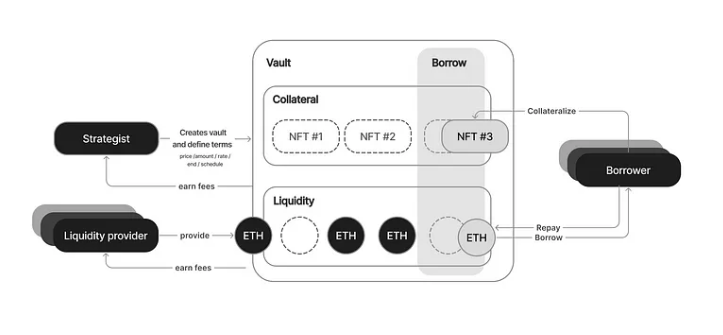

The Astaria protocol uses a three-agent model to provide instant liquidity to Borrowers and competitive returns to Lenders. The model is built around the following three user classes:

- Strategists: Create Vaults with a list of lending terms suitable for supported NFTs. For example: A Strategist can allow a loan of 10 ETH at 10% interest to be withdrawn against a specific NFT for a month.

- Borrower (Borrower): Deposit NFT into the platform to receive a loan with loan terms provided by Strategists.

- Lender (Lender): Deposit ETH into Vaults to earn passive income.

Mechanism of action of Astaria

Astaria’s mechanism of action takes place according to the following steps:

Astaria’s operating model

Step 1: Strategist creates Vaults with terms such as: Loan amount, loan term, interest rate. These terms can be continually updated as the market fluctuates and Borrower can refinance to take advantage of more favorable terms. Any Strategist can deploy it PrivateVaults – provide one’s own capital to finance a loan or PublicVaults – Receive money from provided Lenders.

Step 2: Lenders search for suitable PublicVaults and deposit ETH to receive passive income. Astaria also mint 1 amount VaultTokens to represent Lender’s deposit.

Step 3: Borrower searches for suitable loans provided by Strategists and deposits NFTs into the platform to receive the corresponding amount of ETH instantly. Astaria also minted an NFT called CollateralToken represents Borrower’s loan.

Step 4: Borrower can return the loan at any time before the maturity date to receive the collateral NFTs back. At that time, CollateralToken is also burned to clear the user’s debt.

Sale: When the loan term has passed and Borrower has not paid back the debt. Borrower’s collateral is auctioned and any actor can trigger asset liquidation to receive a liquidation fee.

Note: Astaria implements the Epoch mechanism to limit Lender withdrawals. Lenders can withdraw their ETH at any time, but they will receive the funds at the next epoch.

For example: An Epoch for PublicVault lasts 15 days, Lender can place a withdrawal order, Astaria will burn VaultTokens and mint withdrawProxy corresponding to the amount received. After the end of the current Epoch, Lender receives back his corresponding amount of ETH, Astaria also burn withdrawProxy.

What is the Astaria difference?

Astaria stands out from other lending protocols with its innovative approach and features tailored to the needs of the NFT and DeFi markets. Astaria’s highlights include:

- Instant liquidity: No more time-consuming bid and ask negotiations. Choose from any of the existing Vaults on the platform provided by Strategists.

- Competitive interest rates and loan terms: Strategists compete for capital from Lenders and access to Borrowers, ensuring both parties have access to competitive market interest rates.

- No compulsory liquidation: Borrowers can only be liquidated if their loan expires or the debt remains unpaid. Astaria eliminates forced liquidation upon price changes, protecting Borrower from market turmoil.

Core Team

Justin Bram : Co Founder & CEO

- He graduated with a master’s degree in business from USC Marshall College of Business

- He has been an Advisor at Brink – a Defi infrastructure building platform since May 2020.

- In March 2022, he founded Astaria. Currently he is also the CEO at Astaria.

Chandler De Kock : Head of Growth

- He graduated with a bachelor’s degree in commerce and economics from Stellenbosch University.

- He has worked at Luno in many different roles such as: Payments Associate, Country Launch Specialist since August 2017.

- In January 2021, he quit his job and moved to UMA as a Growth Strategist.

- In July 2022, he quit his job and joined Astaria. Currently he is Head of Growth at Astaria.

Investor

June 20, 2022: Astaria announced its successful call for $8M from many investors such as: True Ventures, Arrington Capital, Ethereal Ventures, Wintermute, Genesis Trading,…

Tokenomics

Update…

Astaria Project Information Channel

- Website: https://astaria.xyz/

- Twitter: https://twitter.com/AstariaXYZ

- Medium:

summary

Astaria develops an intermediary component to act as a bridge between Borrower and Lender, helping to provide a fair and beneficial loan to all parties involved in the loan. However, the current project is still in Beta mode so the effectiveness of this method cannot yet be proven. Hopefully the information I have provided has helped people gain interesting knowledge about Astaria.