What is Astar Network? Astar Network is a Layer 1 Blockchain built and developed on the Polkadot platform. Astar supports both EVM and WebAssembly (WASM) as well as the ability to interact between them using Cross-Virtual Machine. In this article or with Weakhand, we will have a clearer perspective on Astar Network.

To understand more about what Astar Network is implementing, people can refer to some of the articles below:

- What is Layer 2? Complete collection of Layer 2 solutions

- What is Cross-Consensus Message Format (XCM)? Will XCM Help Polkadot Overtake Cosmos

- What is Polkadot (DOT)? Overview of Polkadot Cryptocurrency

- What Are Relaychain, Parachain & Parathread? Overview of the 3 Main Components That Make Up Polkadot

Overview of Astar Network

What is Astar Network?

Astar Network is a Layer 1 Blockchain built and developed on the Pokadot platform. Developers can deploy smart contracts on Astar Network using many programming languages, including Solidity with high compatibility with EVM or several other languages such as Rust, ink!.

Astar Network is built on the Substrate Framework to become a Parachain on Polkadot. Becoming Polkadot’s Parachain helps data and tokens on Astar Network move easily between Parachains in Polkadot’s ecosystem easily and quickly while still inheriting security from Polkadot’s Relaychain.

What is Astar Network?

Highlights of Astar

Built to earn

Developers who build dAPPs on Astar will receive an income through a process called dAPP staking. The benefits that developers can receive when building dAPPs on Astar are:

- Income for developers.

- Increase your reputation, even if the product has a buzz, you will receive more rewards from Astar Network.

- Giari solves the problem of gas fees when building on Astar helps developers earn income, thereby reducing the burden in the process of developing dAPPs.

Compatibility

Astar Network solves the prominent problems of scalability and interoperability by supporting Dapp building in various programming languages such as Ethereum’s Solidity & Parity’s ink! by Polkadot.

For example: When developers want to deploy Dapps on Astar Network, they have 2 options:

- Ethereum Solidity: Astar Network supports both WASM and EVM, so developers can deploy Solidity contracts on Astar Network using existing Ethereum tools like Metamask and Remix. Additionally, developers can also deploy Solidity contracts on WASM with Solang.

- Parity’s ink!: ink! is a Native Language on Substrate created by Parity Technologies.

Development Roadmap

Update…

Investor

- February 2021: Astar Network successfully raised $2.4M for the first time led by Binance Labs and with participation from Monday Capital.

- January 2022: Astar Network continues to successfully raise $22M led by Polychain with the participation of GSR, ROK Capital, Vessil Capital, Garvin Wood,…

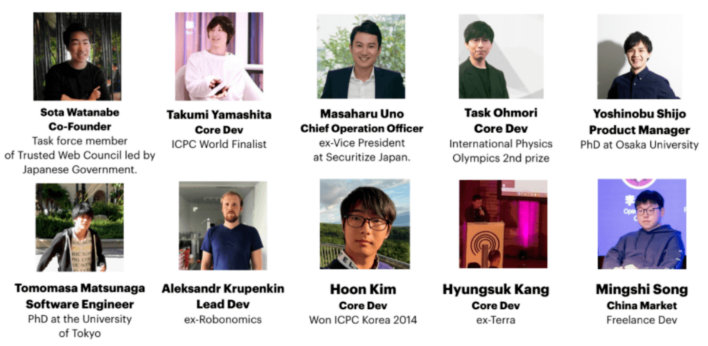

Core Team

Core Team Astar Network

Astar Network’s development team is a collection of people with many years of experience in high education in the traditional market.

Sota Wantanabe: Founder

- Sota Wantanabe graduated with a degree in economics from Keio University.

- Sota Wantanabe worked as an intern at Valuenex, Inc, SoftBank and Chronicled.

- In January 2010, Sota officially entered the Crypto market when taking on the position of Blockchain Researcher at the University of Tokyo.

- After that, Sota continued to hold the position of Director at Japan Blockchain Association and Advisor for many organizations such as Next Web Capital, Dentsu, GMO Internet Group, Inc.

- Currently, Sota is the Founder of 3 projects including Next Web Capital – an investment fund in Web3, Astar Network – Blockchain platform on Polkadot and Startale Labs – an infrastructure development project in Web3.

Tokenomics

Overview information about ASTR token

- Project name: Astar Network

- Code: ASTR

- Blockchain: Polkadot

- Token classification: Update ….

- Smartcontract: Update…

- Total supply: 8,255,930,700

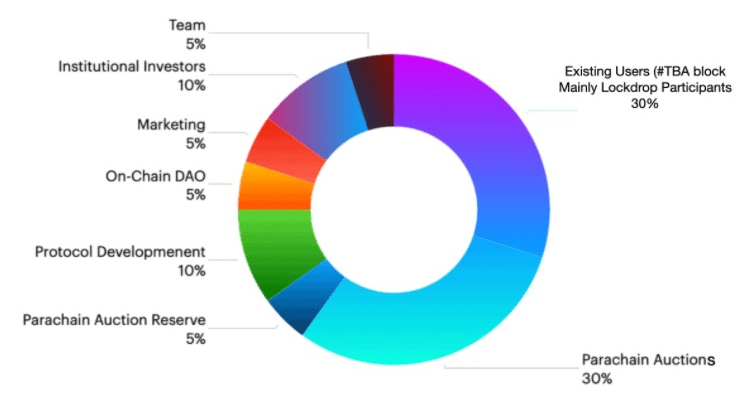

Token Allocation

Token Allocation Astar Network

- Users and Early Supporters (lockdrops): 30%

- Parachain Auction in 2021: 20%

- Protocol Development: 10%

- Early Financial Backers: 10%

- Foundation: 10%

- Parachain Auctions Reserve: 5%

- On-Chain DAO : 5%

- Marketing: 5%

- Team (Employee Incentives): 5%

Token Usecase

ASTR Token Usecase

ASTR tokens can be used for the following:

- Transaction Fees: Used as transaction fees on the network.

- Rewards: Block validation rewards for dApps operators

- Governance: Use for administrative activities such as voting.

- Staking: Rewards for Validators and Nominators.

Token Release

- Lockdrops (Astar Network): unlocked at TGE 10%, linear vesting 7 – 15 months depending on how long or short the time participating in lockdrops is.

- Parachain Auction: unlock 10% at TGE, the remaining 90% will be paid in installments over the next 22 months

- Early Financial Backers (Astar Network): pay 10% at TGE, 7 months linear vesting.

- Core Team: will be locked for 2 years, paid in installments over the next 4 years

Exchanges

Currently, ASTR can be traded on CEX exchanges such as: Binance, OKX, Bybit, Gate.io…

Project Information Channel

- Website: https://astar.network/

- Twitter: https://twitter.com/AstarNetwork

- Telegram:

Summary

Through the article, I have clarified for everyone what Astar Network (ASTR) is? With the information in this article, I hope to have provided the necessary clues for people to decide when investing in Astar (ASTR).