Aries Makets is a decentralized exchange built on Aptos that aims to aggregate and simplify the user experience on DeFi. Aries Markets with main products are Lending & Borrowing, Magin Trading. So what is Aries Markets? How does it work? Let’s find out below in this article!

Before entering the article, please refer to the following related articles:

- Overview of Lending & Borrowing What is it?

- Aptos cryptocurrency overview

Overview of Aries Market

What is Aries Market?

Aries Makets is a DeFi platform with a variety of products provided to users such as AMM, Lending & Borrowing, Bridge and Trading to users on the Aptos ecosystem. Through Aries Market, users can trade many types of Crypto Assets in addition to earning passive profits from the Lending & Borrowing segment.

Not only that, Aries Market allows users to move assets from many different blockchains to Aptos and vice versa.

Operating mechanism of Aries Markets

Lending & Borrowing

This is the most outstanding feature of the platform, users can borrow and lend to earn more profits from idle assets. Here, users who need to lend will deposit their assets into the platform, then users who need to borrow will deposit their collateral into the platform, then they can borrow other assets approved by Aries. Markets.

For the assets that Aries Markets supports, there are the following parameters:

- Loan to value (LVT): LVT is the dollar value of the collateral the user can borrow and can borrow up to a maximum of 80% of the collateral value.

- Liquidation threshold: Liquidation threshold is the ratio between the loan amount and the collateral that the user must liquidate. The liquidation threshold at the platform is usually 75%. For each asset, the liquidation threshold is calculated as the average of the liquidation thresholds of the margin assets and their values

- Liquidation bonus: The liquidation bonus is the additional collateral the liquidator will receive for taking on the liquidation risk.

- Flash Loan Fee: Is the percentage fee charged for the Flash Loan.

- Borrowing capacity: Borrowing capacity is the total value of assets you can borrow with your deposit.

- Borrowing capacity available: Available borrowing capacity is total borrowing capacity minus risk-adjusted loan value.

- Value of liquidated loan: Total risk-adjusted loan value at which your account could be liquidated.

- Risk factors: When your account risk exceeds 100%, your account will be liquidated.

Loan interest rate: Aries Market uses Aave’s tailored loan rate model to manage liquidity risk and optimize utilization. The rate is determined automatically by the protocol usage.

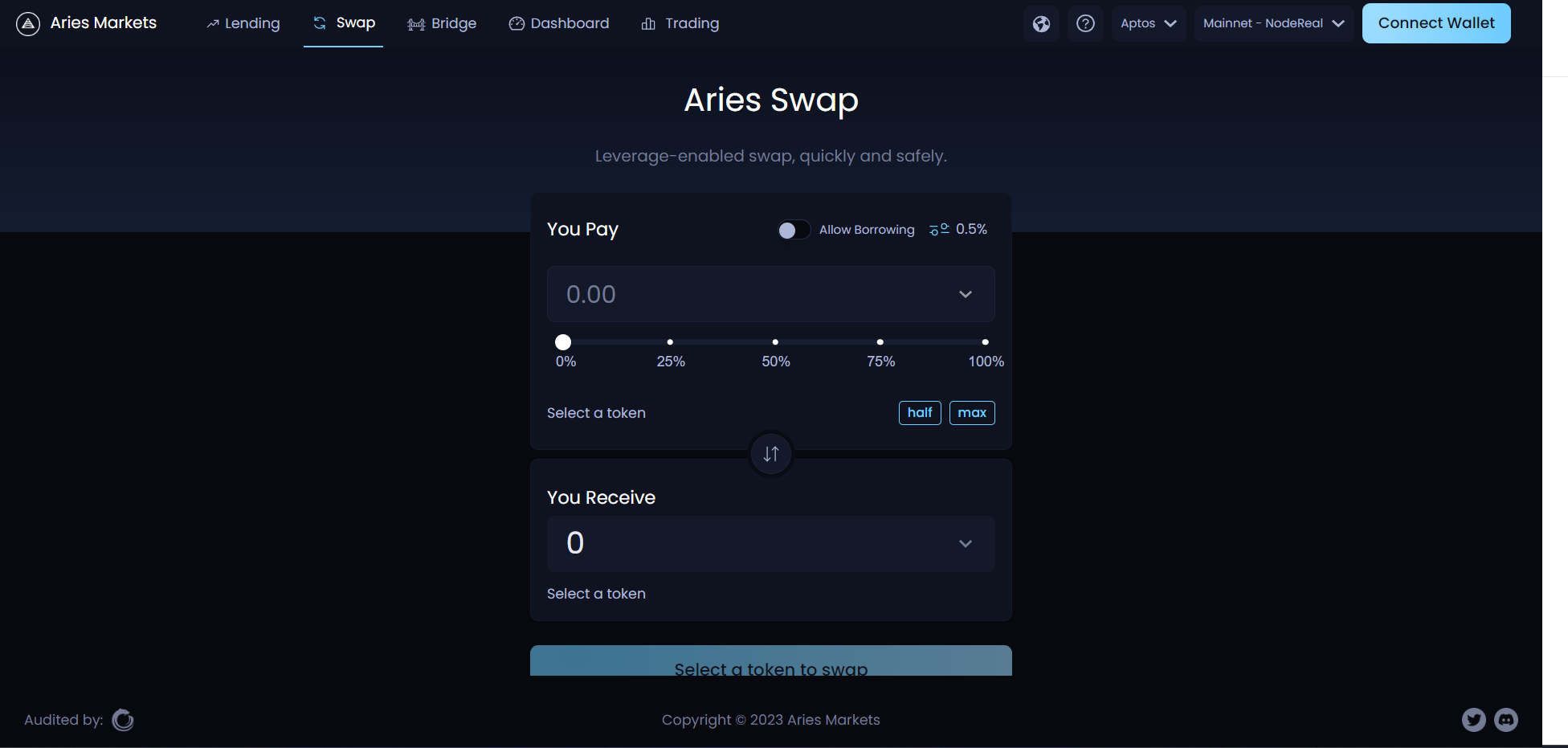

Aries Swap

Aries Swap is built on the project’s Aries Lend. Funds deposited into Aries can also be swapped and traded on various AMM markets.

- Swap directly from deposit: Aries Markets guarantees users to swap tokens on AMM with the highest liquidity and best exchange rates.

- Swap supports leverage: Users can use Aries Swap to gain leveraged exposure to assets through swaps. It is based on Aries Lend’s general margin assets. That is, you can swap assets you don’t yet hold, but are available on Aries Lend.

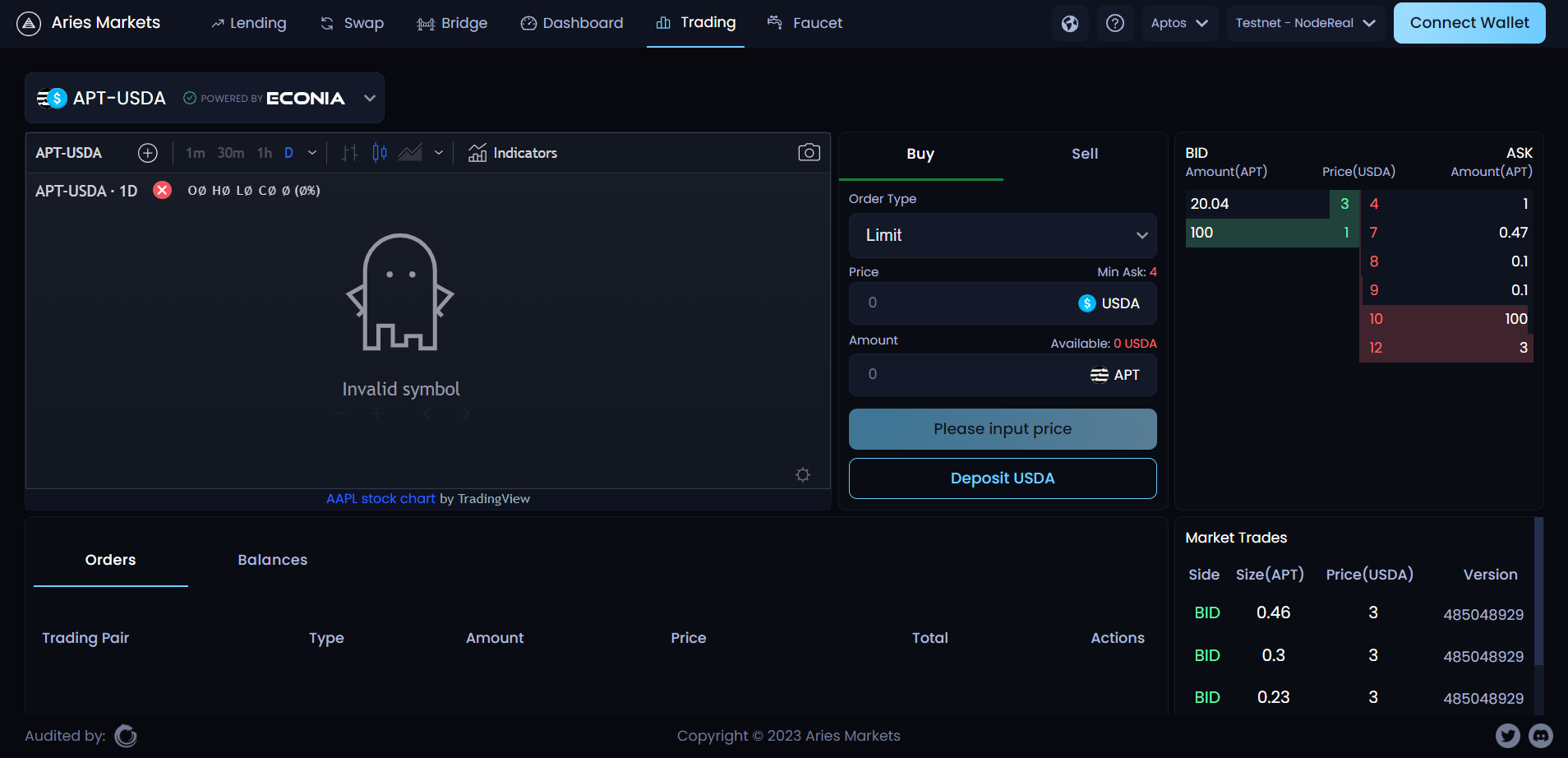

Magin & Trading

Aries Trades is the activity of actively buying and selling major assets to profit from price differences. Aries Trades also offers cross collateral. Users can margin trade through a single unified margin account with many types of deposited assets.

Aris Trades uses a decentralized Oder Book mechanism where users can execute both market and limit orders. This feature is currently under development and is coming soon.

Development Roadmap

Update…

Core Team

Update…

Investors

Update..

Tokenomics

Update…

Project Information Channel

Summary

The new Aptos ecosystem is completing the pieces of the ecosystem puzzle and needs time to thrive in the future. However, the project has not yet launched tokens, core team information is still anonymous, so more monitoring is needed!