What is Archimedes? Lending and Borrowing are an extremely important piece of the puzzle in Defi (Decentralized Finance) that is increasingly attracting attention not only from retail investors but also from many large funds. However, there are still many issues that need to be resolved. So, what problem was Archimedes born to solve? Join Weakhand to find out the details of this project!

What is Archimedes?

Archimedes is a Lending & Borrowing project using leverage, built on the Ethereum network. Where users can provide liquidity to receive rewards and mortgage their assets to borrow Stablecoins from the project Pool.

Archimedes products

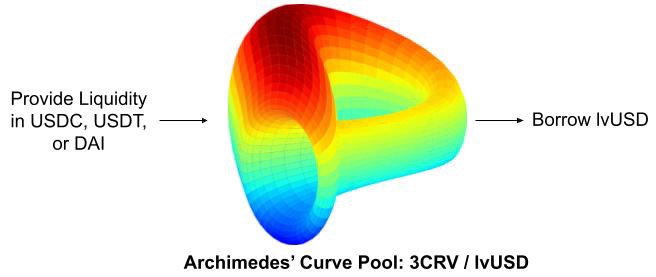

Lending: This is a product Archimedes created for liquidity providers. Users who provide liquidity into the 3CRV/lvUSD Pool (USDT, USDC, DAI) will receive sustainable APY thanks to the project’s Real Yield revenue stream.

lvUSD: The project’s stablecoin has a value of 1:1 against USD (US Dollar).

The project’s revenue comes from the following 3 fees: Leverage Fee, Origination Fee and Performance Fee.

- Leverage Fee: Fee when Borrower (Borrower) mortgages assets to open a leverage position to help borrow more assets.

- Origination Fee: The fee when Borrower opens a position for the first time is 0.5% of the loan amount.

- Performance Fee: When Borrower earns profit from his position, he will lose 30% of his earnings, which will be deposited into the project’s Treasury.

Taking Leverage: This is a product for borrowers, where users mortgage their assets and can borrow an amount of Stablecoin with a value greater than the collateral thanks to the project’s leverage mechanism.

Leveraged positions will be packaged into NFTs (Non-Fungible Tokens), which users can trade on the NFT Marketplace.

What Are The Highlights Of Archimedes?

- Leveraged positions are packaged into NFTs and can be traded on the NFT Marketplace. This solves the problem that in case of scarcity of leverage, you can buy leveraged positions from others.

- Users can borrow more than the value of the collateral.

- Open source projects demonstrate transparency and clarity.

- The project provides attractive, sustainable APY to help liquidity providers have stable profits.

How it works

Suppose: Borrower mortgages $1000 OUSD and uses x10 leverage.

- Step 1: Lenders provide liquidity into the 3CRV/lvUSD Pool on Curve.fi. Lender offers 3 asset types: USDT, USDC or DAI. The reward is ARCH – Project management token, APY will be limited from 0.3% to 6.7%.

- Step 2: Borrower mortgages $1000 OUSD using x10 leverage => $9000 lvUSD is minted => Automatically Swap at 3CRV/lvUSD Pool to take out $9000 (USDT, USDC or DAI) => Continue to automatically Swap on Curve.fi to take out $9000 OUSD => Borrower has a total of $10000 OUSD.

Development Roadmap

Q1 2023

- Launching protocol, Web App, Curve Pool, ARCH Token.

- OUSD becomes collateral.

- Add LUSD and sUSD as collateral.

- Add Earn feature.

Q2 2023

- Add WBTC and ETH as collateral.

- Supports many different Wallets.

- Launched Auto-Compounding.

Q3 2023

- Launching Cross Chain supporting many assets on other Layer 1 and Layer 2.

Core Team

OZ Rabinovitch: Co Founder and CEO

- He graduated with a master’s degree in business administration from MIT in 2017.

- Before joining Archimedes Finance, he spent more than 3 years as Director (Manager) at CBRE – a global real estate consulting company with more than 10,000 employees.

Tomer Mayara: Co Founder & CTO

- He graduated with a master’s degree in business administration from MIT in 2015.

- He has many years of experience in the technology field, and started working as a Freelance software developer in 2007.

- Before joining Archimedes, he spent more than 3 years in product management at Okta – a unicorn company in the field of software development in the US.

Investor

After 2 rounds of funding, Archimedes has raised a total of 7.3 million US dollars.

- Pre-seed Round: Raised $2.4 million led by Shima Capital with participation from Hack VC, NFR Ventures, BitScale, Kesha Ventures and a number of strategic investors such as: Origin Protocol, Halborn and Simplex.

- Seed Round: Raised $4.9 million led by Hack VC with participation from Uncorrelated Ventures, Psalion, Truffle Ventures, Cogitent Ventures, Haven VC, Palsar and several other investors.

Tokenomics

Archimedes uses 2 Tokens:

- ARCH: Project governance token.

- lvUSD: Project stablecoin has a value of $1.

Overview information about ARCH Token

- Name: Archimedes Finance

- Ticker: ARCH

- Blockchain: Ethereum

- Contract: Update…

- Total supply: 100,000,000

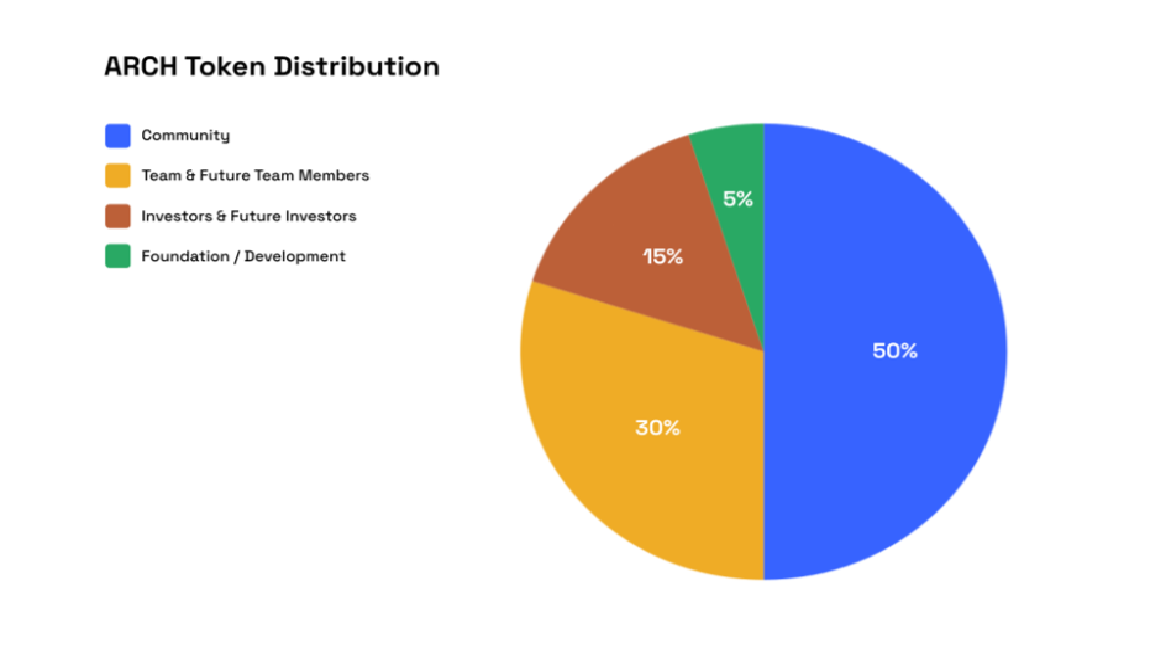

Token Allocation

- Community: 50% is for liquidity mining program.

- Team & Future Team Members: 30% for Team. Tokens are locked for 1 year then Vesting every 3 months.

- Investors & Future Investors: 15% for current and future investors. Tokens are locked for 1 year then Vesting every 3 months.

- Foundation/Development: 5% is for development costs, Audit, service providers, partners.

Token Use Case

ARCH is used for the following purposes:

- Project management.

- Pay rewards to liquidity providers.

- Used as a fee for the Borrower (Borrower).

Exchanges

Update…

Project Information Channel

- Website: https://archimedesfi.com/

- Twitter: https://twitter.com/ArchimedesFi

- Discord: https://discord.com/invite/s7Sxd2CfHW

- Medium:

Summary

Archimedes is a project with a new idea, they have also raised a total of 7.3 million dollars. For a Lending and Borrowing project, this is not a small number, showing that this is a very notable project in the near future.

However, the project still has many limitations in designing Tokenomics. The question is, will the project be able to retain liquidity providers? Does the project attract many Borrowers? Let’s join Weakhand in following the development of this project in the future.