What is Amulet Protocol? Amulet Protocol is a platform and solution that protects users against unnecessary risks in the crypto market in general and DeFi in particular. Amulet Protocol attracts the attention of many large VCs such as Animoca Brands, DeFiance Captial, Solana Ventures,…

What is Amulet Protocol?

Overview of Amulet Protocol

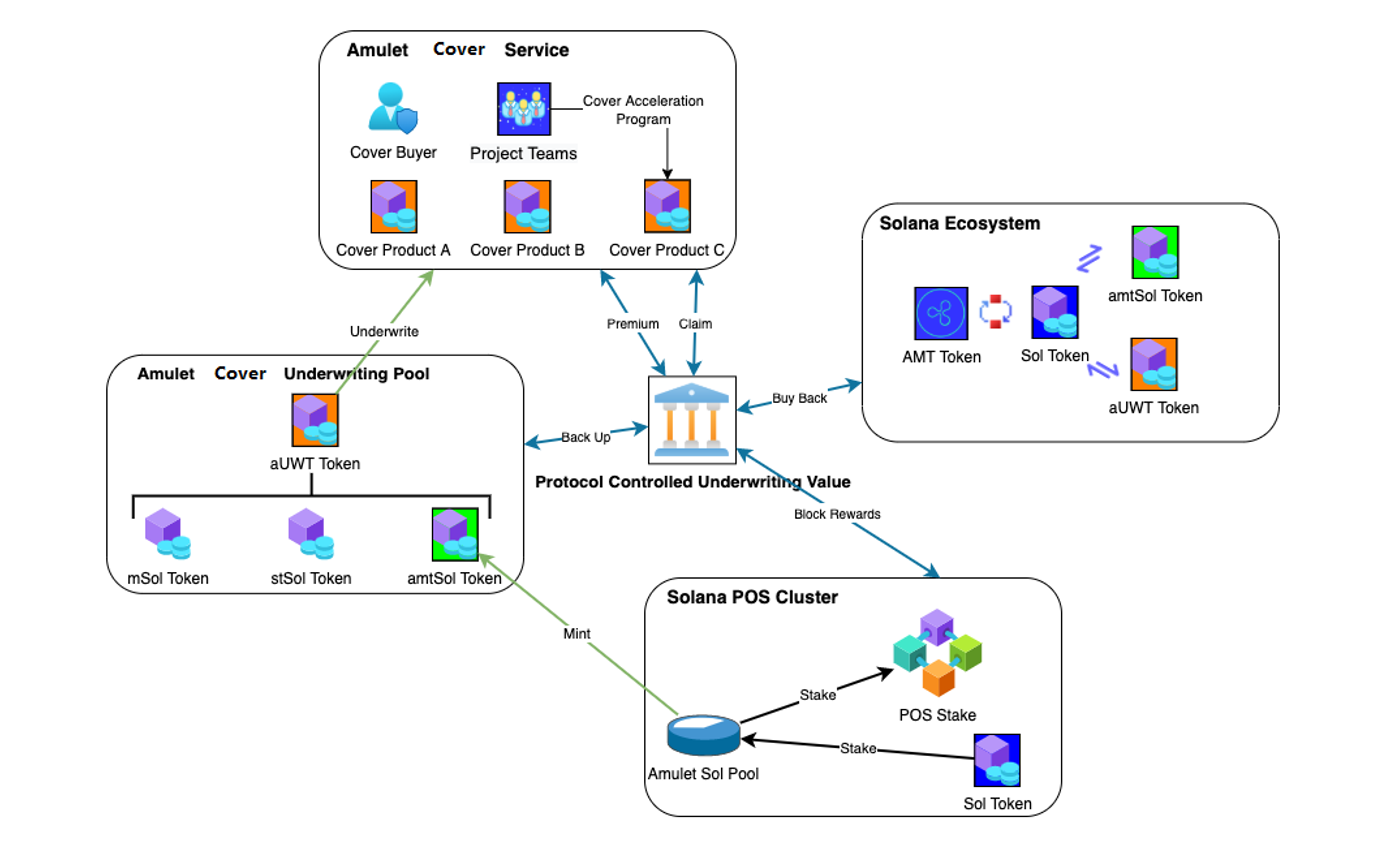

Amulet Protocol is an insurance project built and developed on the Solana ecosystem. According to Amulet Protocol, in 2021 alone, $3B was stolen in hacks, rugpool, stablecoin depeg,… Besides, only 2% of the TVL of the entire DeFi industry is insured, so the insurance sector The danger is still extremely potential ahead.

Solana has had remarkable development in recent times and that is the main reason why Amulet Protocol is built on the Solana ecosystem.

Components that make up the Amulet Protocol

The components that make up the Amulet Protocol model include:

- Risk Underwriting

- Product Offering & Distribution

- Capital Management

- Risk Management

- Claim Assessment

Development Roadmap

Currently, the project only has an updated development roadmap from early 2022 to early 2023 and there are no new updates.

Investor

May 16, 2022: Amulet Protocol successfully raised $6M led by Cryptos Capital with participation from Solana Ventures, DeFiance Capital, Animoca Brands, United Overseas Bank, Signum Capital, Mirana Ventures, NGC Ventures, LongHash Ventures,…

Not only that, Amulet Protocol also has a large number of reputable Partners in Solana’s ecosystem such as Port Finnace, Tulip, Solend, Orca, Hubble, Mango Markets,…

Core Team

Update…

Tokenomics

Information about Amulet Protocol tokens

Update…

Token Allocation

- Fundraising

- Team & Advisors: 15%

- IDO: 5%

- Initial Liquidity Bootstrapping: 2%

- DAO Reserves: 18%

- Business Incentives Reserve: 50%

Token Release

- Fundraising will be 10% unlocked at TGE then locked for 6 months and paid in installments over 3 years.

- Team & Advisors will be 10% unlocked at the time of TGE then locked for 6 months and paid in installments over 3 years.

- IDO depends on the IDO platform.

- Initial Liquidity Bootstrapping depends on the listing on DEX and CEX.

- DAO Reserves are dedicated to providing liquidity on exchanges, strategic partnerships, and marketing plans.

- Business Incentives Reserve is used for protocol development.

Token Use Case

Amulet Protocol uses the veToken model. Users can lock AMT for a maximum period of 4 years to receive veAMT with incentives such as:

- AMT inflation.

- Share revenue from the platform.

- Join Amulet Protocol’s exclusive programs.

Exchanges

Update…

Project Information Channel

- Website: https://amulet.org/

- Twitter: https://twitter.com/AmuletProtocol

- Blog: https://amulet.org/blog

- Discord:

Summary

The insurance segment is one of the indispensable pieces in TradFi, however, with DeFi, a piece of land that users automatically consider risky, so using insurance for users at this time is redundant. However, we can expect the insurance segment to grow as DeFi matures.