Bitcoin, Ethereum, Altcoin are very familiar phrases in the Crypto community, but what is Altcoin, is it a coin in the Crypto market or not? This is still a question that newcomers always ask when starting out. Enter the Crypto market.

In this article, we will learn together what the difference is between Bitcoin & Altcoin.

Overview of Altcoins

What are altcoins?

Extremely simple and easy to understand, Altcoin (short for Alternative Coin) is a term that refers to all other cryptocurrencies except Bitcoin. This means that the world of cryptocurrency is divided into two types: Bitcoin and Altcoin. Altcoins here include cryptocurrencies such as Ethereum, Tron, Cardano,…

The reason we have the appearance of Altcoins is that the initial goal of these coins is to replace or appear to improve the bad aspects of Bitcoin such as scalability, transaction fees. translation,… However, over time, Altcoins are increasingly separated from their original goals, but because they have a long history, they still continue to be used.

Altcoin classification

In the current Crypto market, there are many different types of Altcoins, which include:

- Platform coins: These are coins issued on private Blockchains. In the past we had a number of currencies that used their own Blockchain such as Litecoin (LTC), Monero (XMR) or Dash (DASH). Today, we also have many names such as Solana (SOL), Avalanche, (AVAX), BNB Chain (BNB), Polygon (MATIC),…

- Memecoin: Memecoin can also be considered a foundation coin as it uses its own Blockchain. Some typical examples are Dogecoin (DOGE). Later Memecoin coins are often issued on Blockchain networks and the most popular is Ethereum.

- Stablecoins: These are stable coins that are often anchored to the prices of fiat currencies. The most popular ones today are USDC and USDT which are pegged to the price of the US Dollar.

- Utility Tokens: Also known as Utility Tokens, these tokens are often used as a means of payment, solving problems on the network.

- Gorvernance Token: Also known as Governance Tokens, these tokens are often used by holders to participate in voting and proposals on the network.

Not only classified by characteristics and functions. In the Crypto market, there are 3 different types of Altcoins based on their capitalization including:

- Coin Top: Top Coins are usually cryptocurrencies with a market capitalization of $1B or more along with an abundant source of liquidity.

- Altcoin Mid Cap: Coin Mid cap are usually cryptocurrency projects with market capitalization from $100M to $1B.

- Altcoin Low Cap: Low Cap Coins are typically cryptocurrency projects with a market capitalization below $50M.

In fact, the concept of Coin Top, Mid Cap and Low Cap has no clear regulations in the Crypto market. Each organization and individual has its own definition. Some people believe that being in the TOP 10 is Coin Top, from TOP 1 to TOP 50 is Coin Mid Cap and outside the TOP 50 is Coin Low Cap.

What is Altcoin Season?

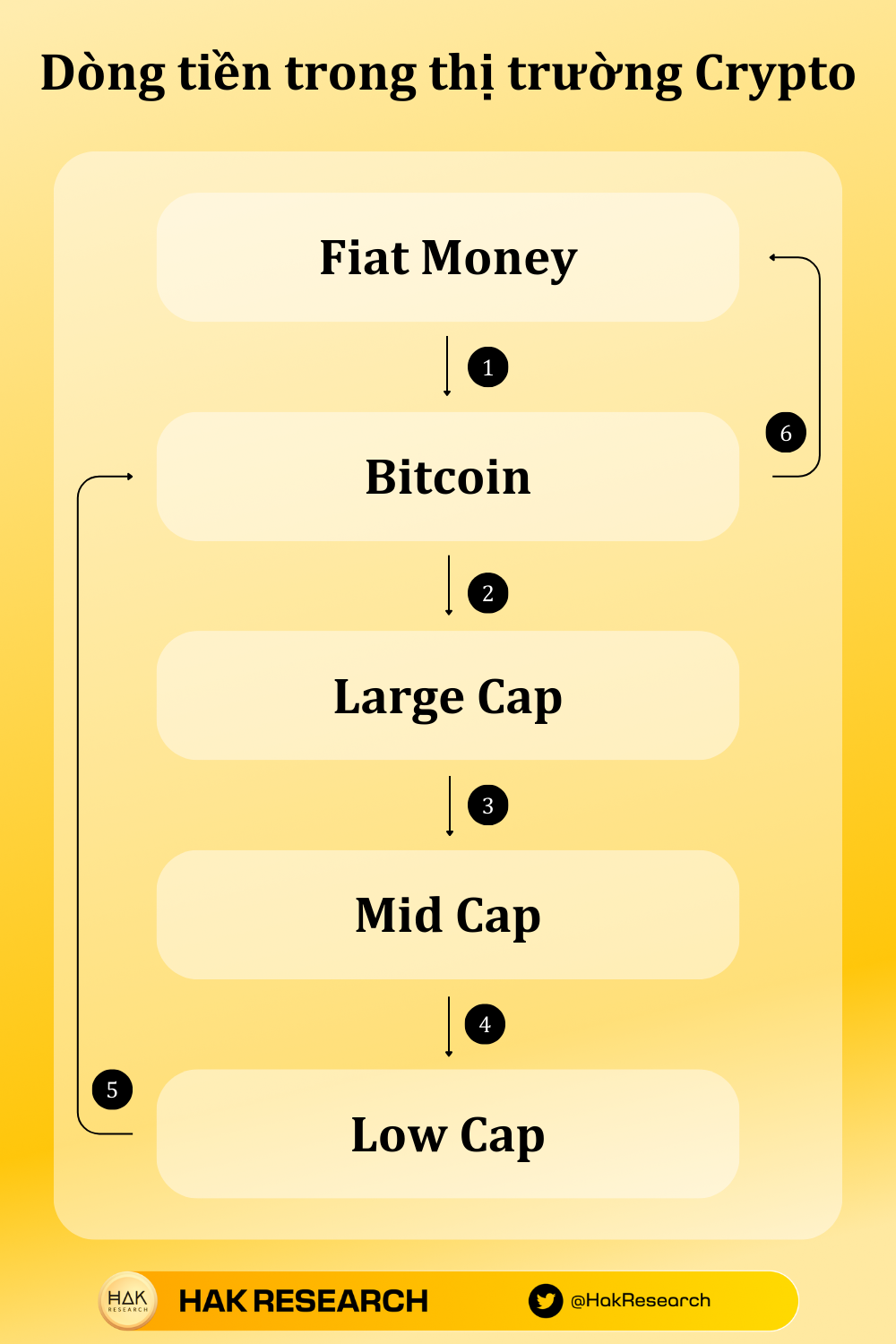

Altcoin Season is the time when Altcoin coins have strong growth in price. If you look at a broader perspective when money flows into the market, it will move from Fiat to Bitcoin then the cash flow gradually moves from large capitalization coins to small capitalization coins. And when the money flows to Mid Cap and Low Cap coins, that is the time of Altcoin Season.

In the past, when trading, Bitcoin was paired with most Altcoins, so if you want to enter the Altcoin world, you must own Bitcoin. Now, as Stablecoins become more and more popular, when money flows into the market, it will flow from Fiat to Stablecoins and from Stablecoins to Bitcoin & Ethereum and then follow the model above.

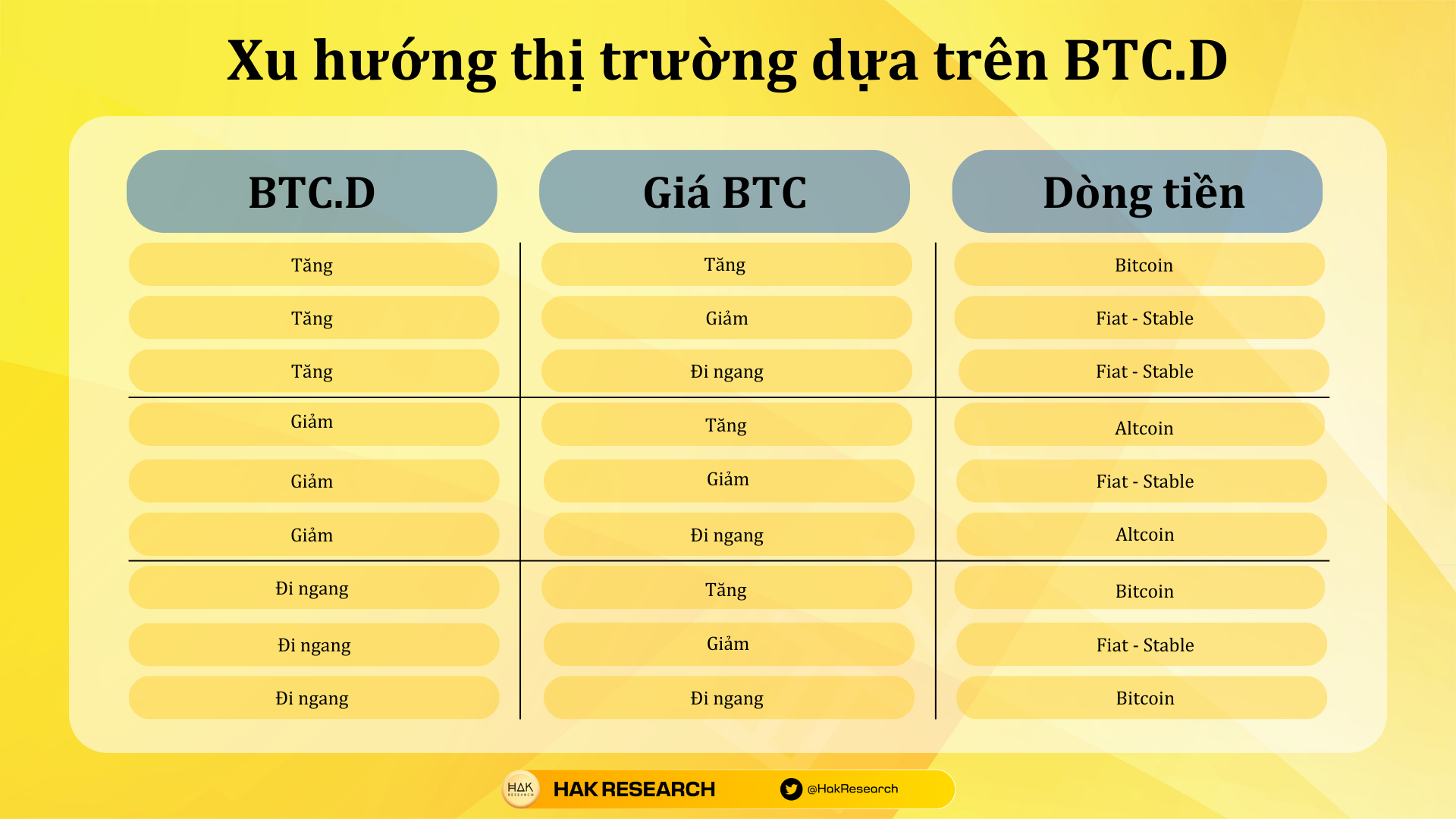

Altcoin Season not only depends on the money flow in the market, but it also appears on the chart of BTC.D when there are some signs below:

- When Bitcoin price increases but BTC.D decreases, this shows that money is flowing to Altcoins. Imagine that when the price of BTC increases, BTC.D should also increase, but BTC.D decreases, showing that Altcoin is increasing more, proving that money is flowing to Altcoin.

- When Bitcoin price goes sideways but BTC.D decreases, this shows that money is flowing to Altcoins. Imagine that when BTC went sideways, BTC.D should have also gone sideways but it decreased, proving that money flowed to Altcoin.

Advantages & Disadvantages of Altcoins

When looking at the difference between Bitcoin and Altcoin, we can certainly see the advantages and disadvantages of Altcoin such as:

- Bitcoin has high liquidity, but on the contrary, Altcoins have lower liquidity. The lower the capitalization, the lower the liquidity of Altcoins. This will be evident when buying and selling in large quantities. However, the difference will lie in Stablecoin, although it is an Altcoin, the liquidity of Stablecoin is also extremely high.

- Bitcoin has high liquidity & high capitalization which means price fluctuations will be small leading to low profits. Quite the contrary, Altcoins have more price fluctuations which means higher profits. The lower the capitalization, the greater the volatility, leading to greater profits. Remember that profits come with risks.

Some special notes when investing in Altcoin are:

- Must research deeply about the general picture of the market and understand concepts from basic to advanced.

- Must have knowledge and information about the industry and project you want to invest in.

- There must be a clear strategy for short, medium and long-term holding, in addition, Take Profit or Stoploss must be specific, accurate and disciplined.

- Invest with money you can afford to lose.

Summary

Altcoin is still a game that brings smiles and tears together. Hopefully through this article everyone can understand more about what Altcoin is?