If you are borrowing money and are afraid that one day you will spend all the borrowed money and the mortgage amount will be at risk of being liquidated, then come to Alchemix, the project is a lending platform that if you With enough time and luck, the risk of liquidating assets is no longer a concern.

So how does Alchemix work and what are its outstanding features? Let’s find out with Weakhand through this article.

What is Alchemix

Alchemix is a decentralized lending platform, built on Ethereum. You will deposit collateral into the protocol and borrow money, and your loans will be gradually reduced over time. That’s exactly what Alchemix wants to do.

So let’s find out how Alchemix does that below.

Mechanism of Action

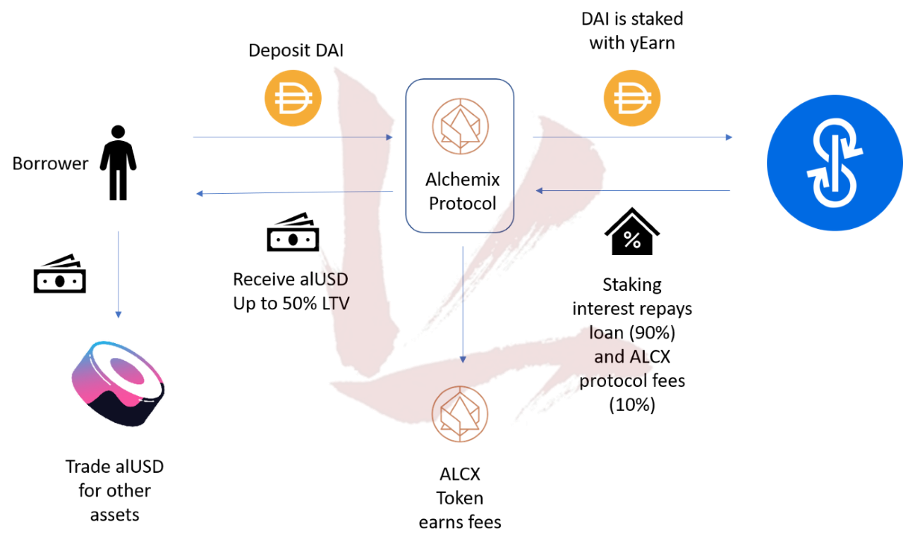

Unlike other DeFi protocols, the way Alchemix works is very simple. Essentially, Alchemix pools user deposits as collateral, deposits those funds into other DeFi protocols, and then collects profits to repay users over time.

When you want to borrow money, traditional banks will ask you to provide your credit history, identity card and occupation to see if you are eligible for a loan. Alchemix only requires a deposit to the platform in the form of stablecoins or ETH. After depositing to the platform, you will be able to borrow up to 50% of your deposit in synthetic tokens issued by Alchemix.

Currently, Alchemix has two lending options: alUSD with stablecoins pegged to USD (usually DAI), and alETH with loans collateralized with ETH. Here I will take the example of DAI, you understand the same with other collateral assets.

Alchemix ingredients: Alchemist, Transmute and Elixir AMO.

Alchemist: Is the heart of smart contracts in the Alchemix protocol. Contract AlchemistV2.sol is the energy for Alchemist. Alchemist accepts yield bearing assets as collateral. To make it easier to imagine, I have a specific example as follows:

- You deposit yvDAI into Alchemist (if you don’t have yvDai, Alchemist will deposit your DAI into Yearn to get yvDAI then deposit it into Alchemist).

- After depositing yvDAI into Alchemist you can borrow up to 50% of your deposit in alUSD. Your loan must have a minimum collateral ratio of 200%. This means for every 2 DAI you deposit you will be able to borrow 1 alUSD.

- Profits from yvDAI will be harvested periodically and paid for your loan in advance. When the protocol automatically pays off your debt, your borrowing power increases because you not only owe less, but you also regenerate the original value. Alternatively, you can start drawing down your mortgage once the debt pays itself off. If you deposit DAI but do not mint alUSD, then the protocol will carry your DAI deposit into Yearn, but instead of paying off your loan (because you don’t have any), you will receive profit and your borrowing capacity will increase.

- The profit obtained, the protocol will transfer it to Transmute.

- At any time you can repay part or all of the loan to unlock the mortgage. DAI, USDT, USDC are all USD regulated by Alchemist with alUSD at a 1:1 ratio. Therefore, alUSD debt can be repaid in alUSD, DAI, USDT, USDC. Repayment in alUSD is also a mechanism for price recovery.

Transmute: You may be wondering when you send DAI to the protocol and receive alUSD, what is alUSD secured by, is it really equal to DAI? This is absolutely true, to ensure that alUSD is always converted back to DAI whenever users need it, Alchemix has designed a Transmute, where you can convert any of your alUSD to DAI with the same value. together. Transmute is operated by profits when depositing DAI into yDAI Vault, profits on Yearn will be transferred directly to Transmute in the form of DAI. When you deposit alUSD into transmute, transmute will send DAI back to you and burn a corresponding amount of alUSD. When alUSD price < DAI in the market, people will be able to buy alUSD on AMM and deposit into transmute in exchange for DAI and vice versa. This will help the protocol maintain a value balance between alUSD and DAI in transmute.

Elixir AMO (Alchemix Algorithmic Market Operator): It is an open algorithmic market management mechanism designed by Alchemix. You can understand simply, the profit earned from depositing DAI into yearn.finance, instead of being transferred to Transmute, when the amount is large enough (about 500K$), it will be transferred directly to the Curve liquidity pool for Earn more profits in the form of CRV, CVX tokens. This additional revenue can be used to expand the protocol, increase incentives for pools, or be sold to increase your payout speed, etc.

Protocol Revenue

The protocol’s revenue comes from depositing DAI into the yDAI vault on Yearn.Fiance. 90% of profits will be put into Pool Vault and Transmute, the remaining 10% will be put into Alchemix Dao to support core development members of the project or pay servers,…

Development Roadmap

- Launching a bridge to Optimism Network (which is a layer 2 scaling solution of Ethereum)

- Launching a bridge to Arbitrum Network (which is a layer 2 scaling solution of Ethereum)

- Launch of AAVE vaults

- Launched Vault migration tool

- In the wake of the market disruption caused by the collapse of the Terra ecosystem, alAsset prices experienced volatility in Q2, but largely stabilized in Q3.

- Thirteen governance proposals were voted on during the quarter.

Core Team

Alchemix was created by a group of anonymous developers, the most active of which is a developer with the pseudonym Scoopy Trooples. The only source of information about Alchemix team members is Github, where 7 contributors can be found with the pseudonyms: Thetechnocrates, 0xfoobarN4n0, TheGreatGildo, 0x-stone, Fubhy (Sebastian Siemssen) and Hesnicewithit.

Currently Alchemix is operated and managed by Alchemix DAO.

Investors & Partners

In March 2021, the project’s founding team raised $4.9 million by selling 7,000 ALCX tokens at $700/token to a group of private investors, who agreed to buy and lock tokens within 3 months. The grant was used to pay the team for their work launching Alchemix.

Also this month, the project raised an additional $3.1 million when it sold 13,778 ALCX at a price of $225 per token to attract a group of strategic investors who agreed to a token lock-up for 6 months with gradual unlocking over the next 6 months. This capital is used to finance the project’s business activities.

According to some reliable sources, investors in Alchemix include big names such as: Binance Labs, Alameda research (collapsed), CMS holdings, Delphi Digitall, Genesis block, Spartan Group,…

Tokenomics

Information about Alchemix tokens

- Token name: Alchemix

- Code: ALCX

- Blockchain: Ethereum

- Token classification: ERC-20

- Total supply: Unlimited.

Token Allocation & Release

Alchemix does not have a maximum supply and the project will issue ALCX tokens within 3 years. With an initial mining token of 478,612 tokens, 22,000 will be distributed in the first week. token for the staking group, each week will decrease by 130 ALCX/week until the end of 3 years.

Total number of ALCX tokens expected to be issued in 3 years is approximately: 2,393,060 ALCX. Of these 2.3 million tokens:

- 15% equivalent to 358,959 ALCX will be allocated to the Tresuary Alchemix DAO. Decision-making power around the use of tokens This is determined by the ALCX token holder community.

- In addition, 5% or 119,653 ALCX is reserved by Tresuary Alchemix DAO as a bug bounty reward.

- The remaining 80% of tokens can be obtained by staking: Founders, developers on Alchemix will have access to an exclusive staking pool, which will receive 20% of the ALCX block reward. This number is equivalent to 16% of supply after 3 years. Stakers and liquidity providers are eligible to receive 80% of the ALCX block reward, equivalent to 64% of the supply after 3 years.

Token Use Case

ALCX is Alchemix’s native token, which allows you to influence protocol decisions, such as treasury management, liquidity mining distribution, and product deployment. Currently, ALCX can be obtained by staking within the protocol. With the release of Alchemix V2, it is expected that stakers will start receiving a portion of the profits generated by the protocol.

Exchanges

Currently you can buy ALCX tokens on centralized exchanges such as Binance, Coinbase or decentralized exchanges such as Sushiswap, Curve,…

Alchemix Project Information Channel

- Website: alchemix.fi

- Twitter: https://twitter.com/AlchemixFi

- Medium: https://alchemixfi.medium.com

- Discord: https://discord.com/invite/alchemix

Summary

Alchemix is one of the fast growing lending protocols and is continuing to expand to other ecosystems. The project has found a new way to help users repay debt without having to worry about the risk of asset liquidation. It uses future earnings from deposits to eventually repay users. If you are interested in Alchemix and the latest updates of the project, please follow me.