What is Acala Network? Acala network is a decentralized Layer 1 Blockchain built on Polkadot’s ecosystem and compatible with EVM.

In recent times, Polkadot’s ecosystem has grown quite well and attracted a lot of attention from investors. Projects like Astar Network or Moonbeam have also grown strongly in recent days. So for Acala Network, the project that won Polkadot’s first Parachain auction, will it be able to shine in the future?

Let’s learn about Acala Network and make your own opinion!

What is Acala Network?

Acala Network is a decentralized Layer 1 Blockchain built on Polkadot’s ecosystem and compatible with EVM. This helps projects on Ethereum to easily grow to Polkadot’s ecosystem through the Acala Network.

Acala’s ecosystem includes products such as:

- AMM exchange: Allows users to trade different types of assets and seek profits

- Liquid Stacking: Users can provide liquidity and receive L-Tokens in return.

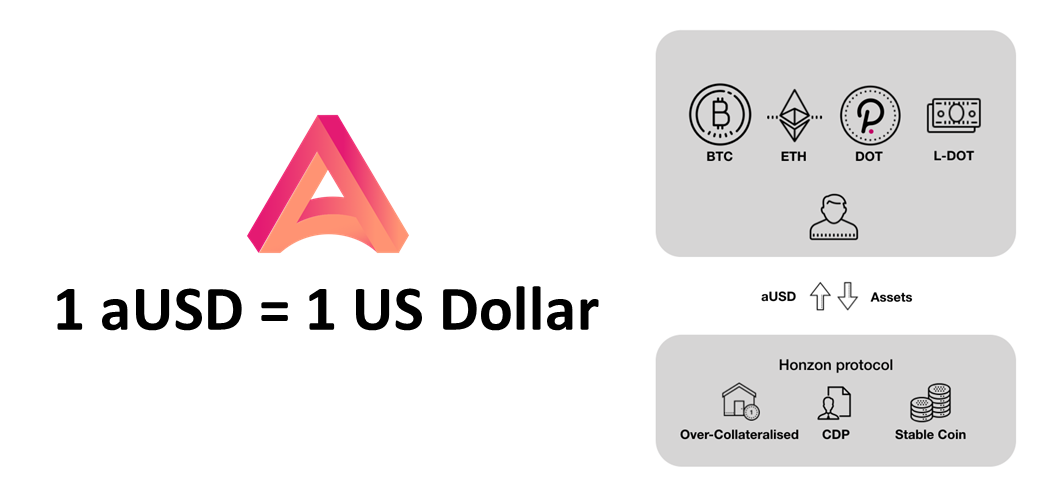

- Stable Coin (aUSD): Acala’s stable coin has a price peg mechanism at a 1:1 ratio with USD

Acala Network’s Mechanism of Operation

Acala has two main operating protocols in its network as follows:

Honzon Stablecoin

Honzon is a Stablecoin protocol, this protocol uses aUSD with a 1:1 price peg mechanism with USD. Through this protocol, users can collateralize assets used to borrow aUSD and participate in DeFi activities within the network. The collateral provided to Honzon can be used in Dot, Bitcoin and Ethereum.

Compare 1-2 sentences about the story of Maker Knife

Honzon’s operating mechanism follows these steps:

- Step 1: Deposit collateral: Users will deposit assets into Honzon and this amount of assets will be locked as collateral

- Step 2: Open a CPD position and borrow aUSD: Users will borrow aUSD in an amount corresponding to the mortgaged assets

- Step 3: Refund aUSD: User closes CPD position and repays borrowed aUSD plus a fee (aUSD or ACA)

- Step 4: Withdraw the mortgaged assets back.

Homa: The Tokenized Staking Liquidity Protocol

Homa is Acala’s second protocol, which focuses on Liquid Staking. Homa Protocol allows users to Stake assets and receive L-assets in return (For example: Users who Stake KSM will receive L-KSM in return). Users can use L-Assets to participate in other DeFi activities within the network.

This protocol is inspired by Marker Dao. Acala’s aUSD can be used for exchange, staking, and borrowing similar to Marker Dao’s Dai

L-Assets use cases:

- Staking Rewards Distribution: Holders of L-Assets will receive rewards for Staking and providing liquidity

- Trading: L-Assets can be used to trade on all Polkadot chains

- DeFi : Users can use L-Assets to provide liquidity or borrow aUSD

- Derivates: Can be used in futures markets

What is the Difference of Acala Network?

- Compatibility with Ethereum’s network: Acala attracts cash flow from the Ethereum ecosystem, increases security and expands the network.

- Homa Protocol: Homa Protocol is an important liquidity problem that solves the problem of locked assets.

- aUSD: Acala Network’s decentralized stablecoin has the ability to stabilize and enhance the circulation of money in Polkadot’s ecosystem.

Acala Network’s Development Roadmap?

- 1/2023: Enable Token Transfers (Enable the feature that allows the exchange of Tokens)

- Enanble Primitive Protocol ( Primitive Protocol Operation )

- Boostrap Plan & Sequence (Boostrap Plan and plan sequence)

Core Team

Bette Chen: Co Founder

- She has 3 years of experience as a software engineer at First Data Corporation, one of the largest software companies in New Zealand.

- Next, she was a technology consultant for HIT from 2008-2010.

- During the period from July 2018 to August 2019, she worked as a product manager for Blockchain, dApps, Protocol for Centraly.ai, a leading Blockchain venture company in the world.

- She was Co-founder of Flowingo for more than 1 year from 2019-2020, this is an education and thinking training business.

- From 2019 until now, she is Co-founder of Acala Network and Laminar.

Dan Reecer: CGO

- He is a person with extensive experience in the field of business development at various large and small enterprises

- He has more than 4 years of experience working at a pharmaceutical manufacturing company, Eli Lilly and Company, from 2014-2018. Dan has held positions ranging from Product Marketing Specialist to high positions such as Product Marketing Strategy Director.

- Next, Dan pursued a career in the Blockchain field, starting with Wanchain and taking on the position of director of marketing and business development. He worked at Wanchain for more than a year from 2018-2019.

- After leaving Wanchain, in September 2019 Dan took on the position of community developer for Polkadot, Kusama and Web3 Foundation.

- Until January 2022, he will officially be the CGO of Acala Network and Laminar

Bryan Chen: Co Founder – CTO

- Bryan Chen graduated from the University of Auckland majoring in computer software engineering in 2013

- After graduating, he worked as a software development engineer from 2013-2018 at three companies: Motion, Kami and Compac Softing Equipment.

- Then Bryan worked at Centrality.ai for more than a year from 2018-2019 with the title of software engineer and product engineer.

- August 2019 until now he is an ambassador for Polkadot and co-founder and chief technology officer at Acala Network

Investor

- March 27, 2020: In Seed Round, Acala Network successfully raised 1.4 million USD invested by Polychain Capital

- August 27, 2020: In Series A round, Acala Network successfully raised 7.3 million USD invested by Pantera Capital

- September 8, 2021: Intial Coin Offering, Acala Network raised an amount of up to 61 million USD.

Tokenomics

Information about Acala tokens

- Token Name: Acala Network

- Ticker: ACA

- Blockchain: Polkadot

- Token Standard: ERC 20

- Contract: Updating..

- Token type: Utility, Governance

- Total Supply: 1,000,000,000

- Circulating Supply: 613.061.111 ACA

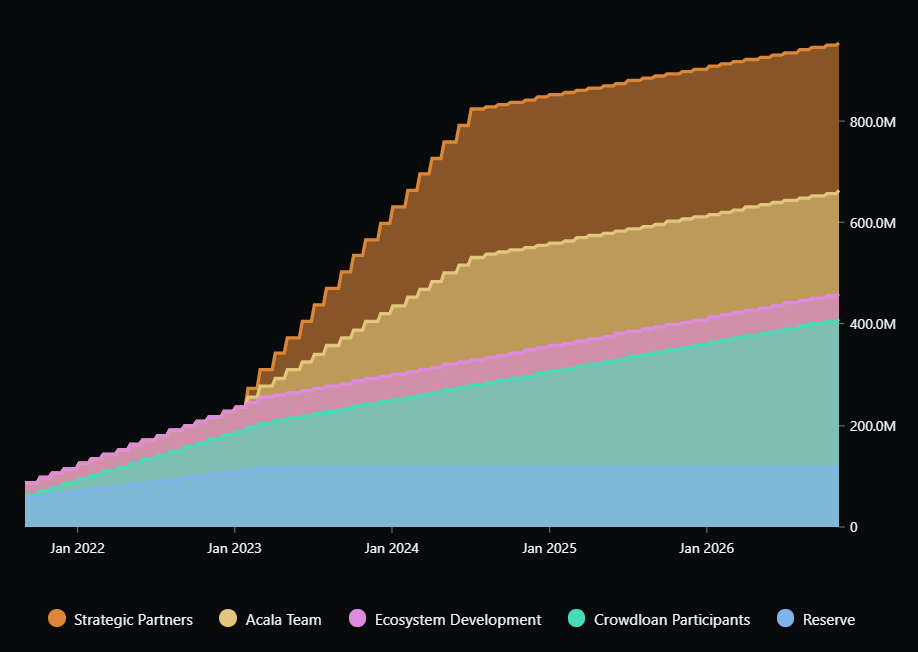

Token Allocation

- Reward: 34%

- Strategic investors: 29.7%

- Team: 20.3%

- Reserved: 11.6%

- Ecosystem: 5%

Token Release:

Token Use Case:

- Governance: Users can participate in voting on issues such as: Network Fees, Voting members for the project, next updates,…

- Utility: Users can participate in Staking and receive rewards.

Information Channel of Acala Network Project?

- Twitter: https://twitter.com/AcalaNetwork

- Website: https://acala.network/

- Github: https://github.com/AcalaNetwork

- Telegram:

Acala Network Exchange

Currently we can trade Acala Network (ACA) on exchanges such as Binance, Bitget, MEXC, Bybit,…

Summary

Acala Network is a potential project in Polkadot’s ecosystem. With Acala’s outstanding features such as aUSD or Homa protocol, especially the ability to connect with EVM, Acala in particular and Polkadot’s ecosystem in general can grow stronger and attract more cash flow in the future. future.

Hopefully through this article, everyone will understand more about Acala and understand what Acala is?