What is AAVE? AAVE is one of the very potential projects in the DeFi market, a decentralized custody liquidity protocol where users can participate as depositors or borrowers. So, if there is anything interesting about AAVE, let’s find out together with us in the article below.

To better understand AAVE, people can refer to some of the articles below:

- What is Lending & Borrowing? The Essential Puzzle Piece in DeFi

- What is Compound (COMP)? Compound Cryptocurrency Overview

Overview of AAVE

What is AAVE?

AAVE is a project in the Lending & Borrowing segment. Unlike Maker DAO, which is a CDP platform that receives collateral and issues Stablecoin DAI, AAVE is a Lending Pool platform. Allows users to deposit collateral and receive interest from borrowers.

With a multichain development orientation, AAVE has become one of the largest Lending & Borrowing forces and has widespread influence in the Crypto market. Not only stopping at Lending Pool, AAVE also plans to launch many new products in the future.

How It Works

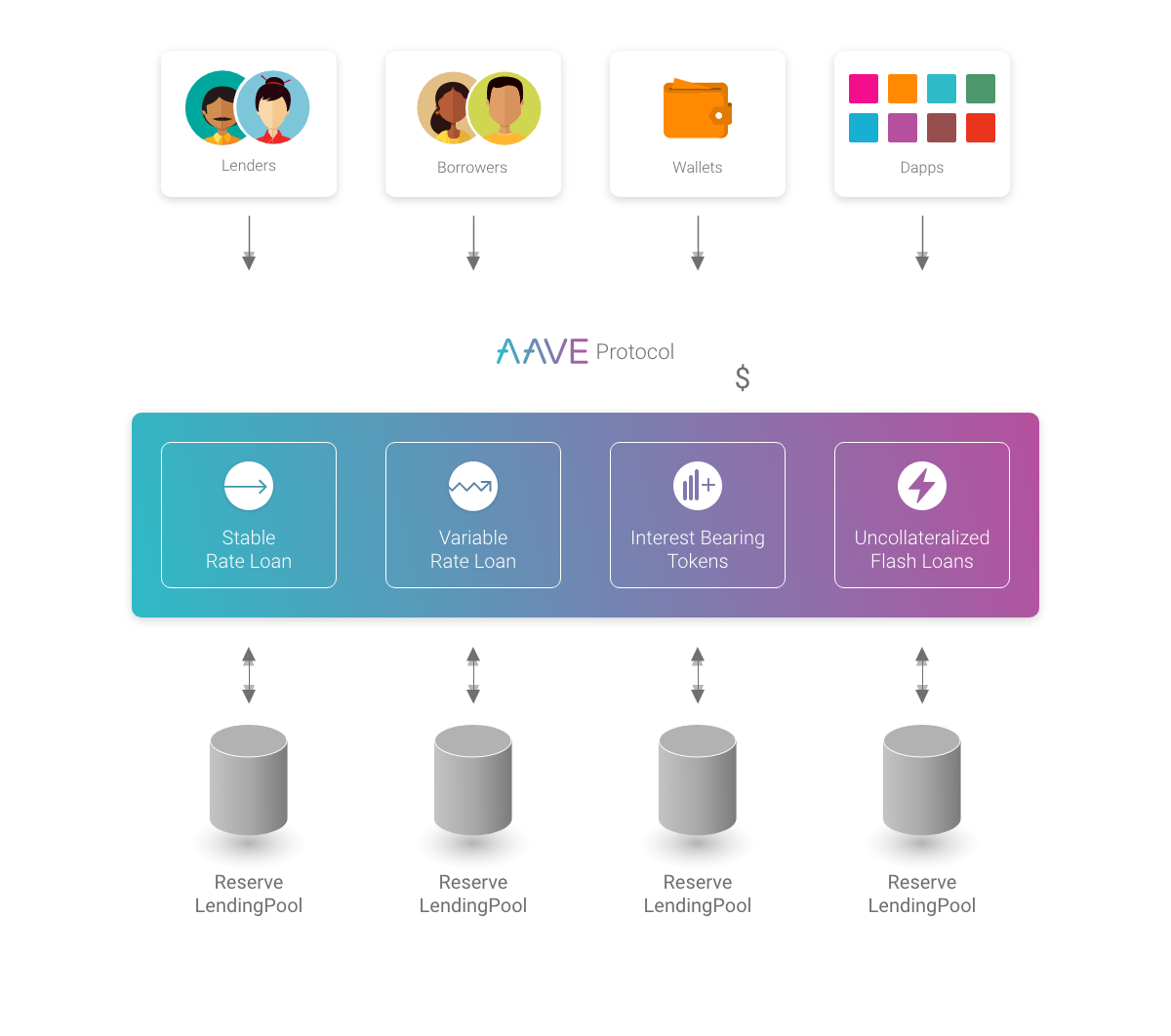

- AAVE allows borrowers and lenders (liquidity providers) to participate in the platform through pools. Borrowers can borrow from the asset pool they desire but must lock up an amount of collateral.

- The amount a person can borrow depends on the deposited currency available in the pool. Each reserve in the pool has a specific loan value. Loans have no term, and no repayment schedule, and can be partially or fully repaid at any time.

- In the event of price fluctuations, the borrower’s collateral may be liquidated. Liquidation occurs when the price of the collateral falls below a threshold, known as the “liquidation threshold”. When the liquidation condition occurs, your collateral will be liquidated on the market. Each mortgage has a specific liquidation threshold.

- For the lender, this interest rate corresponds to the earned rate, with the algorithm protecting liquidity reserves to ensure withdrawals at any time.

AAVE Products

- Lending: allows lenders to lock assets (provide liquidity) to the AAVE platform and earn profits per pool

- Borrowing: allows borrowers to borrow assets from the platform through collateral.

- Flash Loan: A feature that allows borrowers to borrow without collateral but it will last for a block, for example the Ethereum network is about 12-13s and will create a new block, if the borrower does not pay the loan. the transaction will be reversed.

- Staking: allows investors to lock tokens in each pool (1 token or multiple tokens) to receive greater incentives.

Development Roadmap

AAVE will be releasing a number of products in the near future that could drive additional revenue and efficiency to the protocol. These include Aave V3, stablecoin GHO, and Lens Protocol.

- Aave V3 added new features to the core protocol, largely aimed at safely maximizing borrowing thresholds (also known as increasing capital efficiency). To understand more about AAVE V3, people can refer to the article What is AAVE V3? Overview of AAVE’s Latest Updates.

- Lens is AAVE’s great potential to increase capital efficiency. Lens acts as the social base layer on which developers can build social apps with custom monetization models. To understand more about Lens Protocol, people can refer to the article What is Lens Protocol (LENS)? Lens Protocol Cryptocurrency Overview.

- The GHO token will presumably be used in Lens and creator monetization features. When social commerce is conducted using the GHO token, it creates demand that stems from real-world applications. To understand more about Stablecoin GHO, people can refer to the article What is GHO? Overview of Stablecoins Released by AAVE.

Core Team

Stani Kulechov is the founder and CEO of Aave. He is a seasoned entrepreneur with extensive experience developing technology in the cryptocurrency, blockchain and fintech space. Stani is also an advisor to many founders and advisors of ICOs and blockchain projects and has spoken at many FinTech, Blockchain and cryptocurrency events, especially on topics related to smart contracts. Ethereum.

There are also many previous core members such as: Jordan Lazaro Gustave (COO), Mika Söyring (CFO), Maria Magenes (CMO)……

Investors

AAVE has successfully called for 4 rounds with a total of 49M$, details:

- Initial Coin Offering Round 1 on November 25, 2017: Raised 16M$ but it is unclear which funds invested in this round

- Initial Coin Offering Round 2 on July 8, 2020: Raised 4.5M$ but it is unclear which funds invested in this round

- Initial Coin Offering Round 3 on July 15, 2020: Raised 3M$ with 2 investment funds and led by Framwork Ventures

- Venture Round on October 12, 2020: Raised 25M$ from large and reputable funds such as: Blockchain Capital, Blockchain.com Ventures, Standard Crypto

Tokenomics

Information about AAVE tokens

- Token Name: Aave

- Code: AAVE

- Blockchain: Ethereum

- Token Standard: ERC-20

- Contract: 0x7fc66500c84a76ad7e9c93437bfc5ac33e2ddae9

- Token type: Governance, Utility

- Total Supply: 16,000,000 AAVE

Token Allocation

- The total supply of AAVE is 16 million,

- Of which 13 million can be used by LEND holders at a ratio of 100 LEND to 1 AAVE.

- The remaining 3 million will be allocated to the Aave Reserve and controlled by AAVE token holders, to encourage the growth and development of the Aave Ecosystem.

Token Use Case

AAVE has 4 Main Use Cases:

- Administration: AAVE holders can use it to vote on events or vote on a certain issue.

- Stake: AAVE can be used to participate in stake pools to earn more profits.

Exchanges

Currently, AAVE is listed on most large and reputable exchanges in the market such as: Binance, Coinbase, FTX, Kucoin, Huobi,…. decentralized exchanges such as: Uniswap, Sushiswp,…

Project Information Channel

- Website: https://aave.com/

- Twitter: https://twitter.com/aaveaave

- Discord: https://discord.com/invite/aave

- Telegram: https://t.me/Aavesome

- Github:

Summary

AAVE is one of the platforms in the very potential Lending Borrowing segment with huge development during the Defi boom in 2020 and 2021. The project is a leading project in this field and will the future bring more Let’s wait and see what other products the project launches!