AaDA Finance is a decentralized borrowing and lending protocol built on the Cardano ecosystem. So what is AADA Finance? Let’s find out through the article below.

To better understand what AaDA Finance is, people can refer to some of the projects below to get an overview of AaDA Finance.

- What is Muesliswap? Overview of Muesliswap Cryptocurrency

- What is Minswap (MIN)? Minswap Cryptocurrency Overview

What is AaDA Finance?

Overview of AaDA Finance

AaDA Finance is a non-custodial decentralized borrowing and lending platform built on the Cardano ecosystem. By supporting assets from ERC-20 and adopting the eUTXO model, AaDA supports borrowers and borrowers to access a variety of asset types. Also supported by the stability and safety inherited by the Cardano ecosystem.

The AaDA Finance difference

- AaDA V1 revolutionizes DeFi by introducing an NFT bond feature that allows users to transfer and trade loans as NFTs.

- Depositors can provide liquidity by depositing funds into any liquidity pools to earn additional income automatically. Meanwhile, borrowers can borrow with collateral.

- Allows borrowers to use leverage by using borrowed capital to trade cryptocurrencies.

Components that make up AaDA Finance

- Borrower/Lender: A group of people who need to provide assets for lending and borrowing.

- Stakers: People who stake their assets to earn passive profits.

Mechanism of action

- Shorting: Allows users to borrow fungible tokens (FT) to sell and buy back the asset to increase their position.

- Leverage: Allows users to use leverage to increase buying or selling power

- Farming: AaDA allows people to maximize profits by borrowing desired assets without owning them.

- Hedging: Hedging helps protect against price fluctuations in cryptocurrencies. If the price increases the loan is liquidated with a profit, if it decreases the borrower only needs to pay interest.

Development roadmap

Updating…

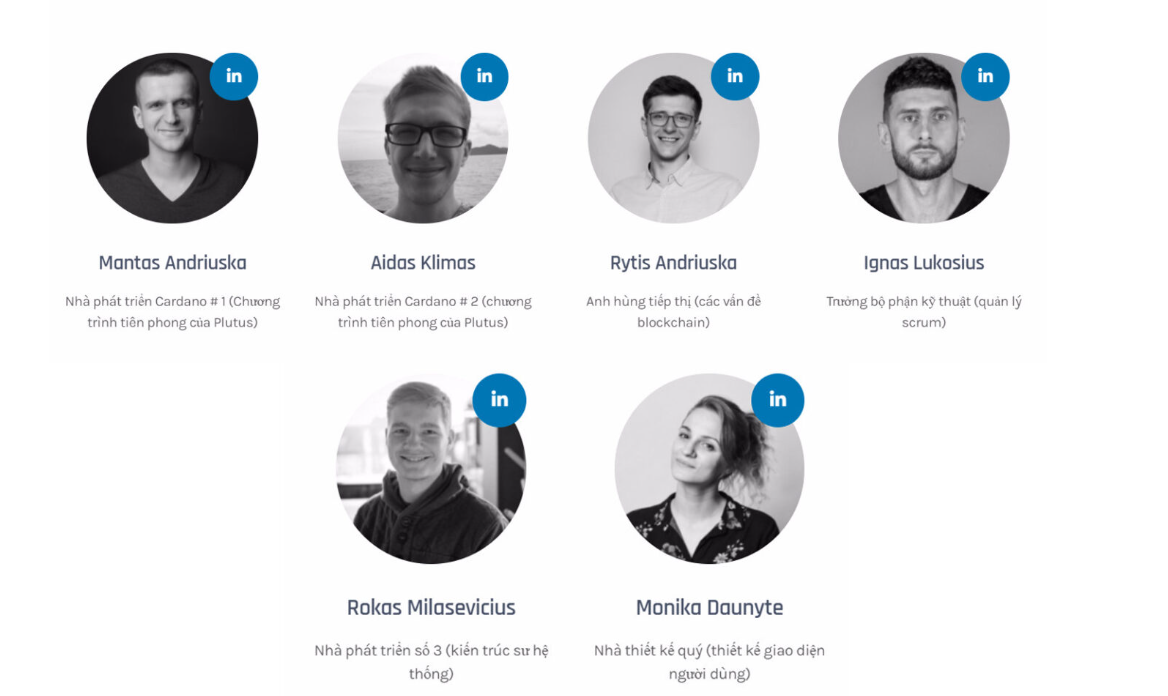

Core Team

- Mantas Andriuska (Co-Founder): He studied programming engineering at Vilnius University – Lithuania’s oldest and largest higher education institution. He worked as a data analyst for technology companies such as Neil Patel Digital and BuildFire.

- Aikas Klimas (Co-Founder): He holds a bachelor’s degree in Computer Science at Kaunas University of Technology – the largest technological university in the Baltics. He used to be the technology director at e-commerce company Ekomlita.

Tokenomics

General information about AaDA Finance

- Token Name: AaDA Finance.

- Ticker: $AADA.

- Blockchain: Cardano.

- Token Standard: Updating.

- Contract: 8fef2d34078659493ce161a6c7fba4b56afefa8535296a5743f69587.

- Token Type: Governance.

- Total Supply: 29,500,000 AADA.

- Circulating Supply: Updating…

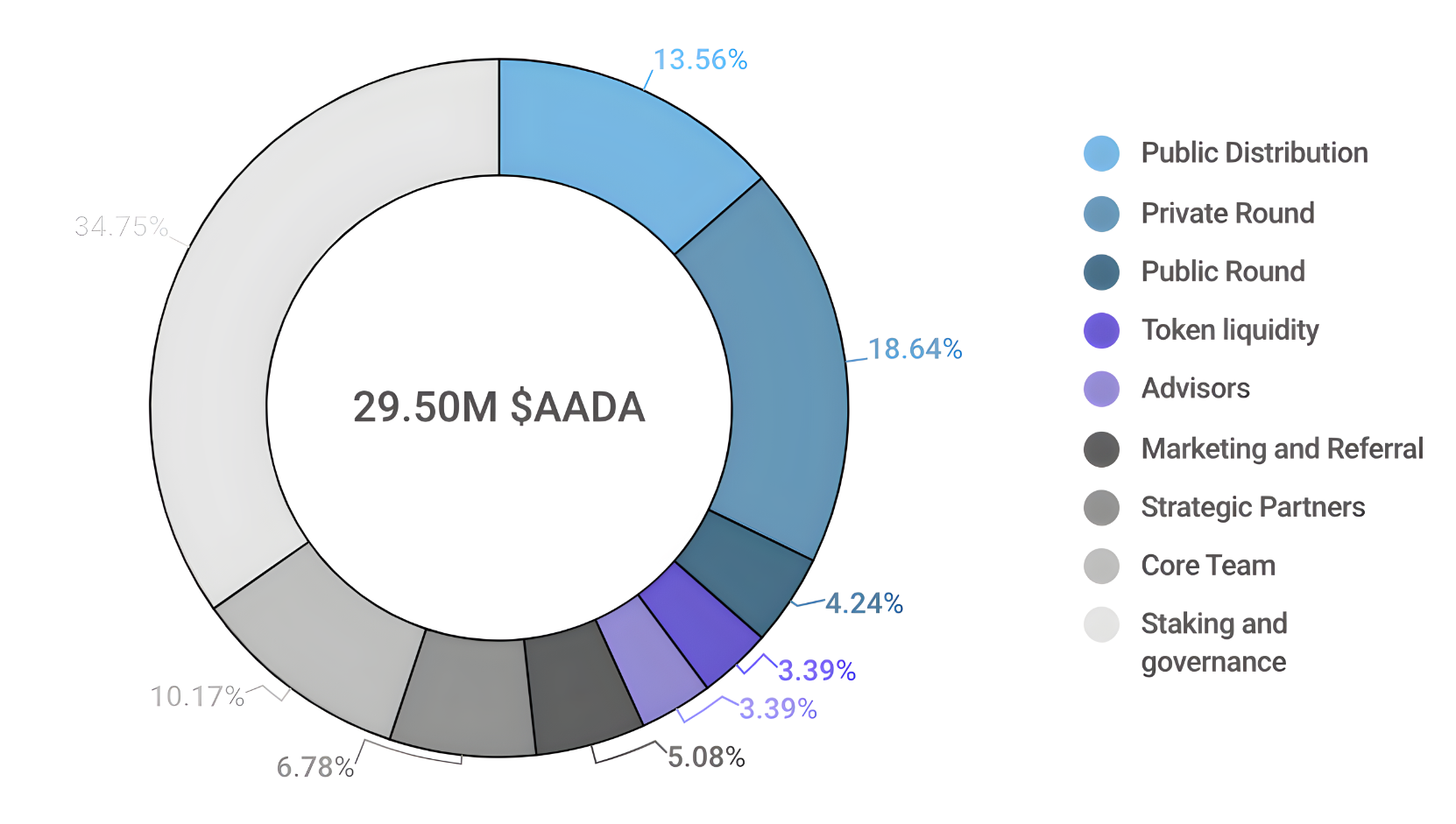

Token Allocations

- Public Distribution: 13.5%

- Private Round: 18.64%

- Public Round: 4.24%

- Token Liquidity: 3.39%

- Advisors: 3.39%

- Marketing and Referral: 5.08%

- Strategic Partners: 6.78%

- Core Team: 10.17%

- Staking and Governance: 34.75%

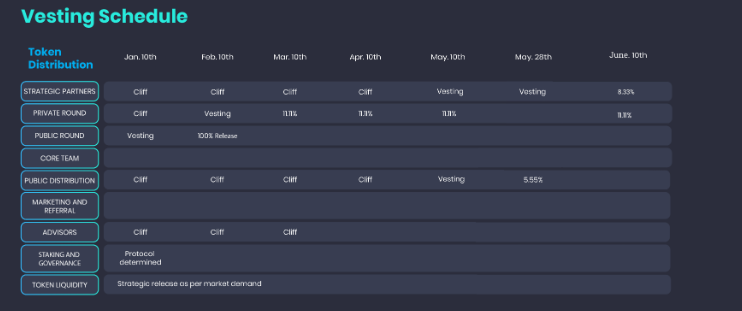

Token Release

Token Usecase

- Used for mortgage and interest payments

- Voting rights in DAO

- Holders can provide liquidity and receive ADA and MIN rewards on Minswap

- Farm on Wingriders

- Stake and stakers are eligible to receive a % transaction fee.

Exchanges

As well as the majority of projects on the Cardano ecosystem, they are almost not listed on centralized exchanges. Currently, AADA can only be exchanged on the Minswap and WingRiders platforms.

The infomation channel

- Twitter: https://twitter.com/AadaFinance

- Telegram: https://aada.finance/

- Discord:

Summary

It can be said that the entire Cardano ecosystem is a unified block that is quite well interconnected, but the projects in the system have not exploded in the past cycle. Will the recent updates to AaDA make a difference in the upcoming cycle? Please leave comments!