What is a market cycle? Market cycle in the Crypto market is the fluctuation and change in the value of Crypto types over time. So how does the market cycle for Crypto work and how to grasp it? Let’s find out together in the article below.

To better understand the market cycle, people can refer to some of the articles below:

- What is Bitcoin? All About Bitcoin

- What is Bitcoin Halving? The Importance of Bitcoin Halving for the Crypto Market

- When Will Bitcoin Break Its Old Peak?

Overview of Market Cycles

What is a market cycle?

Market cycle is a description of the process of fluctuation, change or increase or decrease of one or a series of assets with similar properties. For the Crypto market, the market cycle is often described by the ups and downs of the Crypto market in which Bitcoin is the leader.

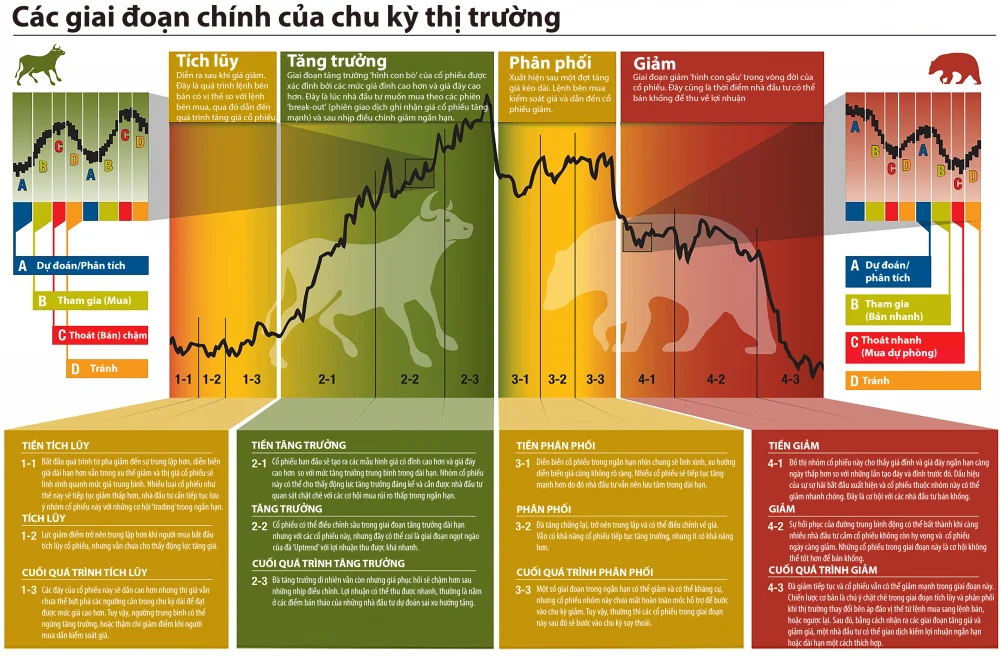

The 4 main stages in a market cycle in the Crypto market include:

- Bull Market: The market is bullish as the prices of many types of Crypto increase. Investors often buy during this period with the hope that prices will continue to increase. During this period, there will be many trends with huge profits motivating investors to pour money into the market.

- Distribution (Distribution): A phase in a market cycle when the price of one or more cryptocurrencies has increased and shows signs of starting to decline. During this period, investors are mainly those who bought in the previous stage (usually the bull market) and begin to sell for profit or to reduce risk. During the distribution phase, investors often feel worried and may decide to sell to ensure profits or minimize losses. The distribution phase is often a preparation step for the bear market when prices drop sharply.

- Bear Market: On the contrary, a falling market is a period of price decline, at this time the market will have a lot of collapses, negative news,… causing investors to feel worried, confused and even afraid. Fear leads to selling off assets to avoid losing money.

- Sideway: The period when the market begins to stabilize, assets neither increase sharply nor decrease sharply, causing investors to continue to feel discouraged. It is this boredom that makes investors not bother holding their Crypto assets.

Market cycles in the Crypto market

The Crypto market is an emerging market with a young age, so the life cycle is relatively fast. Usually, the Crypto market cycle will be calculated according to the Bitcoin Halving schedule that takes place every 4 years. Bitcoin Halving is an event where Bitcoin’s block reward will be halved, thereby reducing Bitcoin’s inflation rate and creating momentum for price increases.

Looking back at history we see that:

Bitcoin Halving took place in 2012

- 2012: Price increase

- 2013: Price increase

- 2014: Discount

- 2015: Recovery

Bitcoin Halving took place in 2016

- 2016: Price increase

- 2017: Price increase

- 2018: Discount

- 2019: Recovery

Bitcoin Halving takes place in 2020

- 2020: Going sideways

- 2021: Price increase with many trends such as DeFi, Layer 1, GameFi, NFT, Metaverse,…

- 2022: Price drop with Terra collapse – Luna, FTX,…

- 2023: Slight recovery with Layer 2, Retroactive,…

The importance of understanding market cycles

Understanding the market cycle will help us carefully prepare for a strong growth season with a series of different trends. For example, if we understand that the next stage of the Crypto market will proceed as usual starting with the Bitcoin Halving event expected in April 2023, the progression could be as follows:

- 2024: Flat if similar to 2020 and increasing if similar to 2016

- 2025: Price increase

- 2026: Discount

- 2027: Recovery

Usually before and after the Bitcoin Halving event will be a relatively good time for us to prepare a new position for the next cycle. Therefore, if we prepare well for 2024, we will have a brilliant 2025 and 2026 is the time to protect our wallets and lie low until 2027.

Obviously, knowledge of the market cycle helps us have a forecast of the market scenario from which we can make an appropriate investment plan. However, we must also have prevention plans to avoid changes in the market cycle.

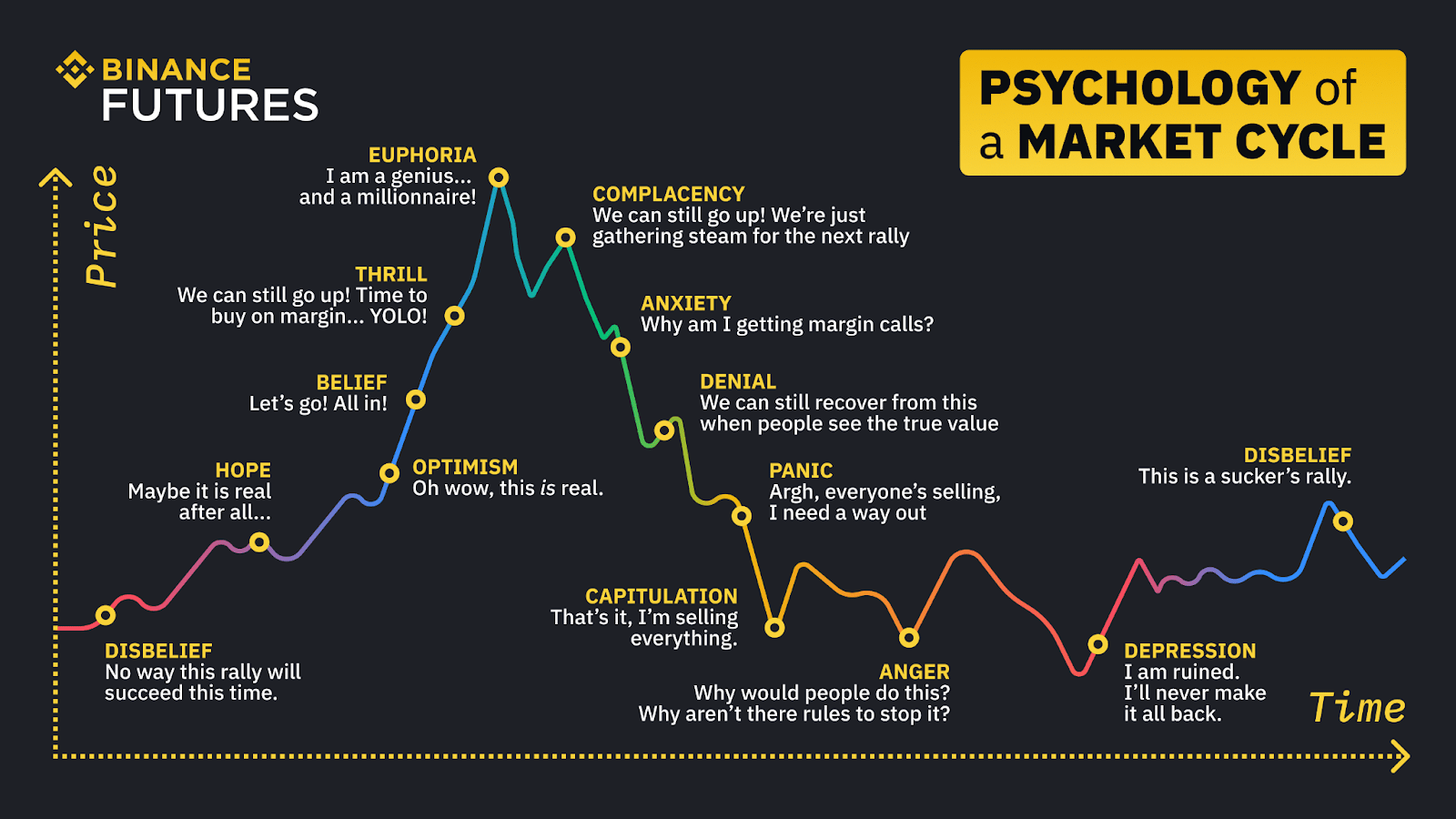

What is a Market Sentiment Cycle?

Besides the market cycle, we also have the market psychological cycle. Prices going up, down or moving sideways all create different emotions for investors:

- Sideways phase: Some of the psychological states of investors at this time are quite mixed, including positive such as skepticism, hope, optimism or negative such as anger, depression.

- Price increase period: Some of the psychological states of investors at this time are excitement, belief, euphoria and arrogance.

- Discount period: Some of the psychological states of investors at this time are concern, denial, panic, and surrender

With each different emotion, we can evaluate the community’s emotions, thereby determining where the market is and making appropriate investment decisions.

Summary

All markets, whether economic, stocks, bonds, gold, etc., are cyclical, this is immutable. When we understand cyclicality, we understand how the market operates and then have investment plans that are suitable for ourselves.

Hopefully through this article, people can understand more about what the market cycle is?