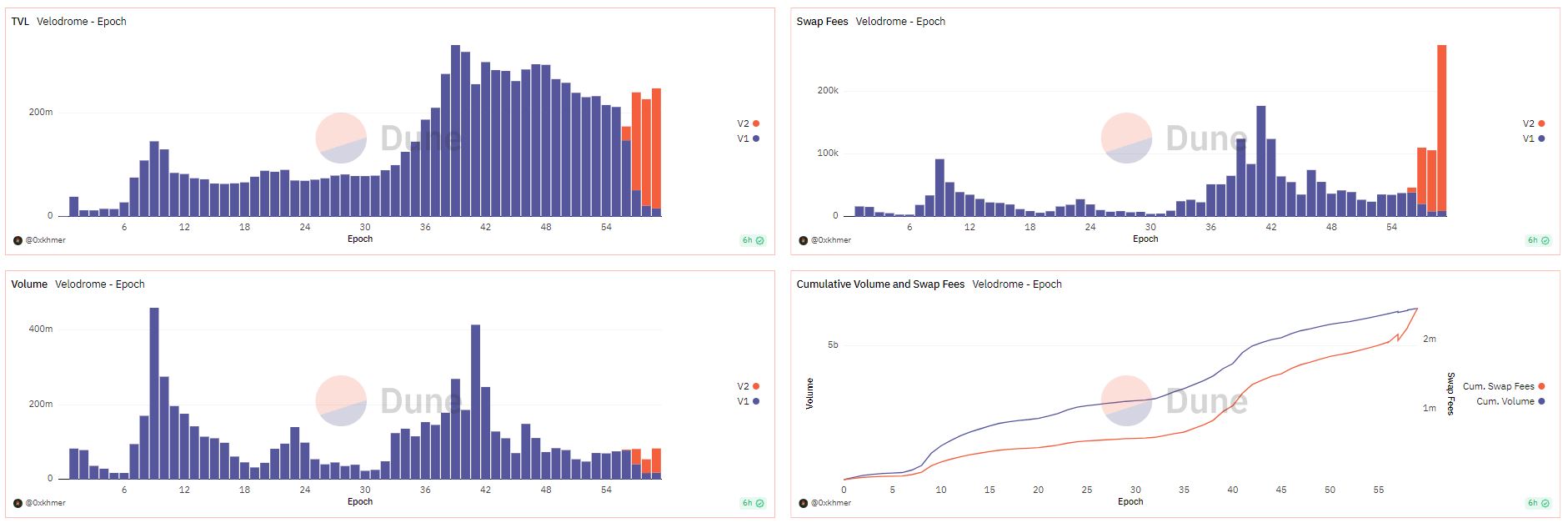

Velodrome has had certain achievements in deploying its V2 version, especially Swap Fees which have really grown. So what changes has Velodrome made in version V2 to achieve such achievements and what is different about V2 compared to V1? Let’s find out together in the next parts of this article. .

To better understand Velodrome V2, people can refer to some of the following articles:

- What is Velodrome (VELO)? Velodrome Cryptocurrency Overview

- Velodrome: From Zero To Hero

Outstanding Updates on Velodrome V2

Towards Concentrated Liquidity

Centralized Liquidity is an inevitable upgrade to current AMM models with many changes that are truly different from the conventional liquidity provision model. So it is completely understandable that Velodrome aims to become an AMM that provides centralized liquidity to users.

The difference here is that in Velodrome V2 the amount of VELO emission will also be optimized by factors such as liquidity range, volume, time. So centralized liquidity will help optimize transaction fees and reduce Impermanent Loss for the final user. veVELO holders will be the biggest beneficiaries.

Some other outstanding updates

June 15, 2023 Velodrome officially introduced to the community version V2 after more than 3 months of delay with a series of new improvements in user experience, enhanced protocol security and simplified structure of contracts. smart copper. With Velodrome V2, the development team targets both users and other developers who want to build on Velodrome itself.

Some of the important updates in Velodrome V2 include:

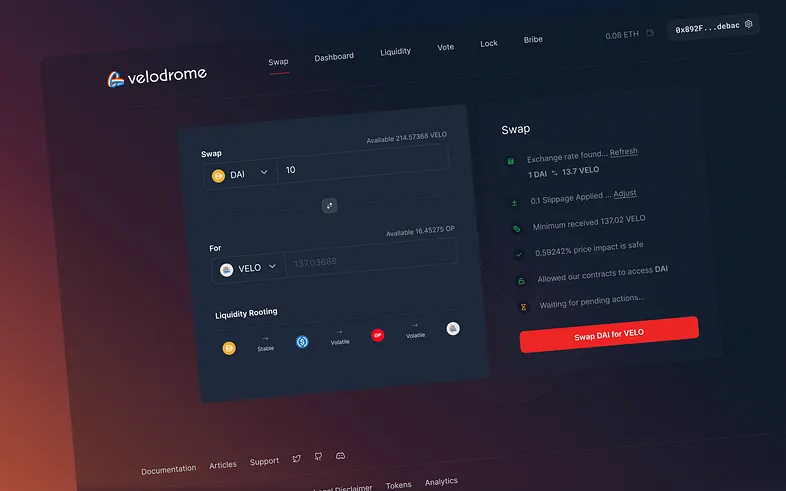

- Nightride dApp: Velodrome’s interface was rebuilt from the ground up to be even more user-friendly.

- Custom Pool Fees: Supports a variety of different transaction fees.

- Custom Pool Names and Symbols: V2 allows customizing flags, logos and changing names to avoid unnecessary confusion.

- Zapping into LPs: Provides liquidity from just 1 single asset.

- veNFT Artwork and Metadata: New veNFTs will come with on-chain artwork. Metadata allows users to know the underlying balance and unlock date of veNFT.

- Permalocked veNFTs: Allows veVELO to be permanently locked so that the quantity will never be reduced and returned to VELO again.

- Managed veNFTs: veNFT can be managed or monetized by third-party protocols other than Velodrome, thereby encouraging the building of an ecosystem on Velodrome.

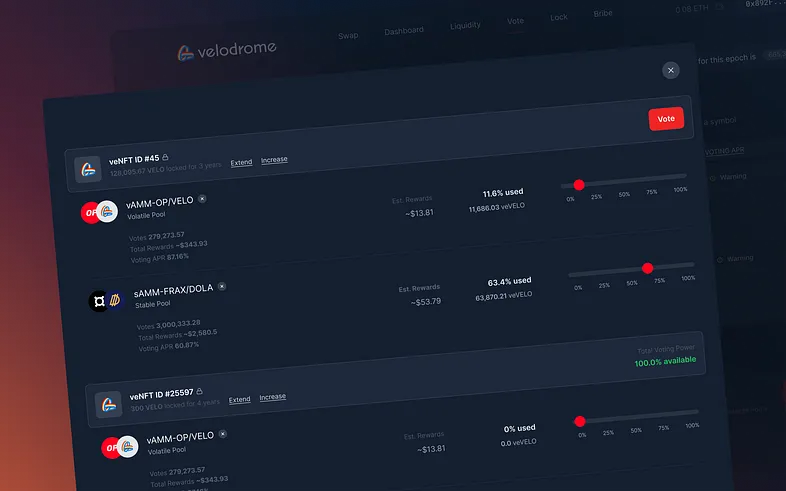

- Improved veNFT Transfers: This allows assigning and using votes in the same epoch.

- Velo Fed: This policy allows veVELOs to decide the inflation and emission rates of VELO in each epoch to suit the market situation.

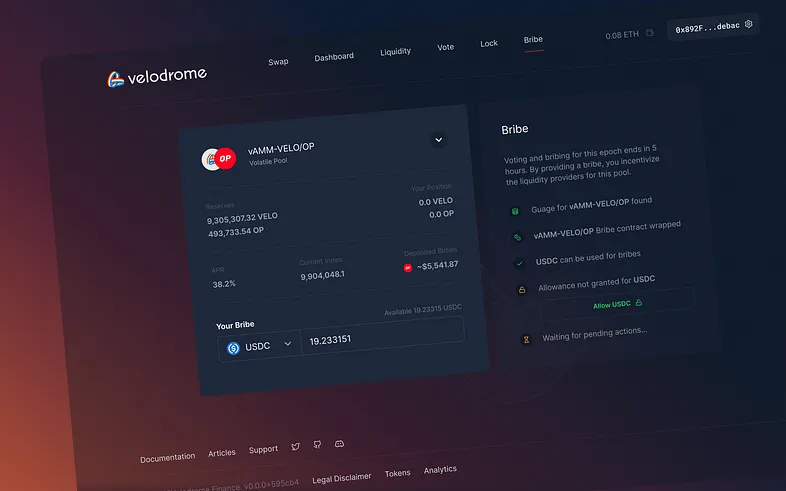

- Streamlined Voting Rewards: Revamped to become cheaper and more economical.

- New Governor Functions: veVELO Holder has control over more protocol functions such as Token Whitelisting.

- New VELO Token: Convert Native Token VELO and veNFT at a simple 1 to 1 ratio.

- Opt-In Upgradability: A stepping stone to deploy a centralized liquidity model more effectively.

- Governance Delegation: Authorization has been reworked to suit user needs.

It can be seen that the focus in the Velodrome V2 model includes a number of points such as:

- Increased benefits for veVELO Holder.

- With centralized liquidity, the amount of transaction fees generated will also be higher, so veVELO Holder will also benefit more.

- User experience is also significantly improved in version V2.

Some First Achievements With Version V2

Some outstanding achievements after a short period of operation of version V2 include:

- The amount of transaction fees generated by V2 is 6 times higher than V1.

- With CLMM, Velodrome has improved slippage.

- The veVELO Holder begins to demonstrate its power in regulating emission on the Velodrome.

It can be simply understood that the transition to the Centralized Liquidity model is a true revolution on Velodrome. However, this revolution is only in its early stages. With an equivalent amount of Volume and TVL, Velodrome V2 has created a much higher fee than the V1 version. However, trading volume on Velodrome has not been thoroughly improved.

Based on DefiLlama, the trading volume on Optimism is currently still concentrated on Uniswap and not on Velodrome even though Velodrome has a higher amount of TVL.

In addition to the change in the amount of transaction fees generated, veVELO Holder also has a strong impression in version V2 when it has adjusted the amount of emission to 1.5%, which is about 20% in 3 years compared to V1. This is quite understandable because Velodrome now needs many incentives to attract LPs to it, thereby continuing to improve liquidity and slippage rate.

Projection of Velodrome in the near future

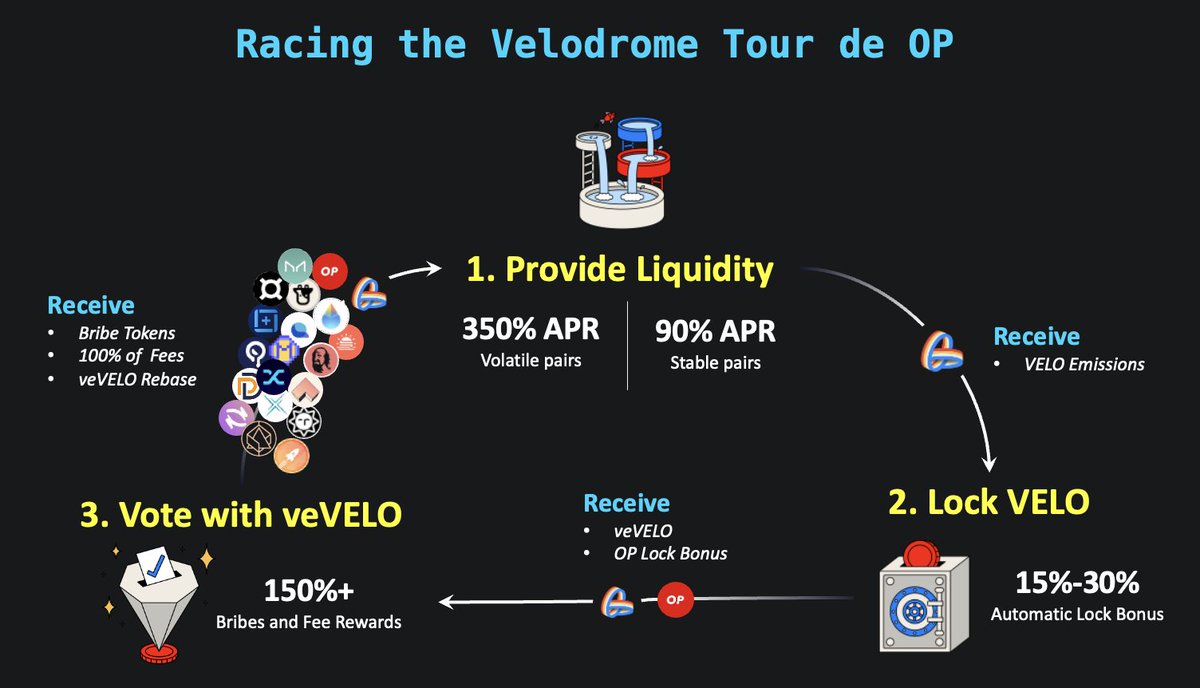

The potential Flyweel is centered on VELO

As far as I can see, the flyweel that Velodrome’s team and community is gradually completing is as follows:

- Initiation: The amount of transaction fees increases

- => Many people will want to hold veVELO including projects, LPs and Retails

- => Everyone will find ways to have more VELO

- => Participating in becoming an LP is one of the most optimal ways

- => Liquidity on Velodrome is thicker and more abundant

- => Impermanent Loss continues to decrease

- => Transaction Volume increased

- => The amount of transaction fees increased.

Obviously, Velodrome is improving its entire model quite closely, which reminds me more or less of GMX’s Tokenomics model. veVELO Holder will not only take 100% of the transaction fees on Velodrome but also Bribe, Incentive or liquidity coordination power. Therefore, in version V2, when the development team hands over more power to veVELO Holder, VELO becomes even more valuable.

However, to verify Velodrome’s flyweel, we continue to need time to monitor and evaluate the effectiveness of Velodrome V2 on transaction volume. Will the gap with Uniswap narrow or continue to widen?

Continued sponsorship from Optimism

The fact that Optimism continuously has grants for Velodrome is a guarantee that Optimism considers Velodrome as one of the key projects in its ecosystem. With a fairly Ponzi tokenomics model combined with a rich OP incentive source from Optimism, Velodrome will always be a leading DeFi protocol.

Create your own ecosystem

With updates on the Velodrome V2 version, this helps developers easily build DeFi on the Velodrome platform itself, which can be pieces of Yield Farming, Leverage Yield Farming or Lending & Borrowing.

If Velodrome can create its own ecosystem, it will be sooner or later that the Optimism ecosystem will expand and become more cohesive. Can Velodrome become the Optimism version of GMX?

Expand network to Base

Currently, Velodrome’s development team also gradually hands over power to the community and continues to build the Aerodrome project on Base’s platform. If nothing changes, Aerodrome will likely continue with Uniswap to create an AMM war on Base.

Expanding and pioneering on OP Stack platforms is completely good, but there is still a question: why Velodrome does not develop multichain but builds an Aerodrome fork on Base. Will each OP Stack be a fork of Velodrome? If so, then it is clear that these are independent projects with no connection or support to each other.

Can Velodrome and its versions dominate the Superchain?

Summary

Velodrome has gradually become one of the largest DEXs on Optimism. Can Velodrome beat Uniswap on its home turf to become the largest DEX on the Optimism ecosystem?