The Arbitrum ecosystem is one of the ecosystems with many outstanding activities and the number of new projects with many innovations is increasing. Along with many rumors that Arbitrum will soon deploy tokens in the first quarter of 2023, almost 80% of the crypto community is paying great attention to this ecosystem.

And in times like these, let’s look back at the TOP 10 outstanding and potential projects on the Arbitrum ecosystem.

TOP 5 Outstanding Projects on the Arbitrum Ecosystem

GMX – The biggest pillar in the ecosystem

GMX is the most prominent Perpetual platform on the Arbitrum ecosystem. With a series of outstanding parameters such as:

- GMX is the platform with the largest TVL on the Arbitrum ecosystem, when Arbitrum’s TVL always accounts for about 40% of the total TVL of the whole system.

- A series of projects were built to supplement liquidity and solve the Impermanent Loss problem on GMX such as Umami Finance, Rage Trade, Vesta Finance, Vovo Finance,… GMX plays a large part in building the strategy. Delta Neutral on Arbitrum.

- Leading the Real Yield movement by sharing real platform profits with its token holders.

In addition, we can make a broader comparison when GMX has surpassed Perpetual, a platform that was born much earlier than GMX. Besides, GMX is also working with dYdX to create a two-horse race in the Perpetual segment. Many people at the present time are expecting GMX to create history by surpassing dYdX.

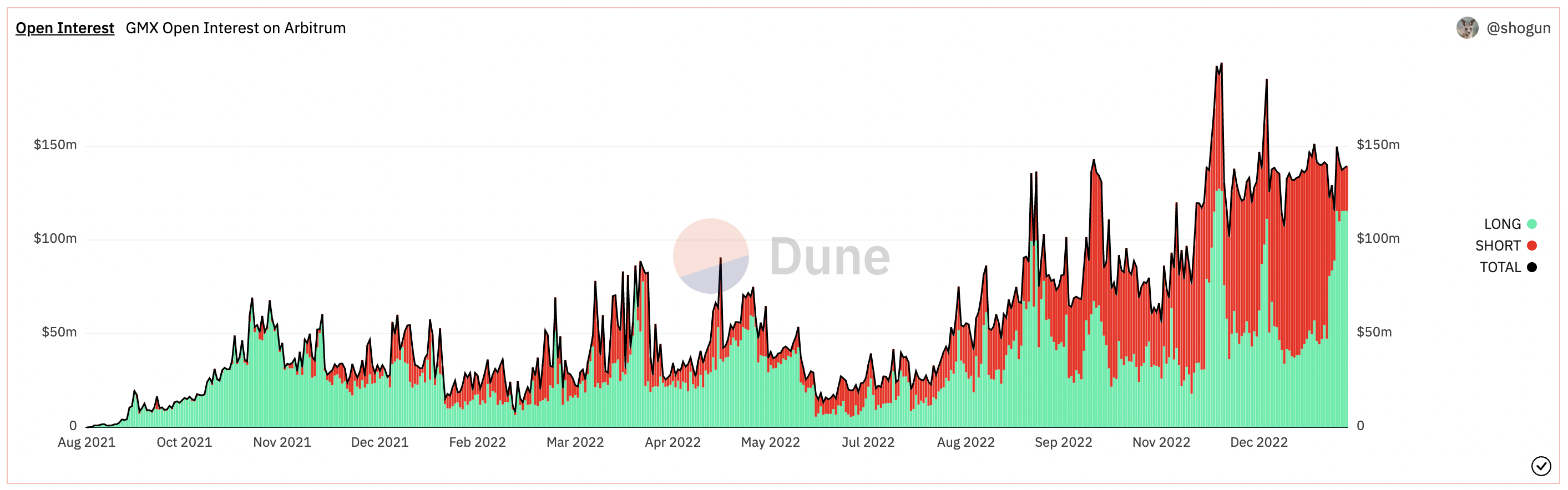

Volume of leveraged orders on GMX

The volume of leveraged orders on GMX has seen clear average growth since the project’s inception. There was a period of slowdown in June and July 2022, but at the present time the volume of leveraged orders is even higher than in November 2021 – the time when Bitcoin peaked.

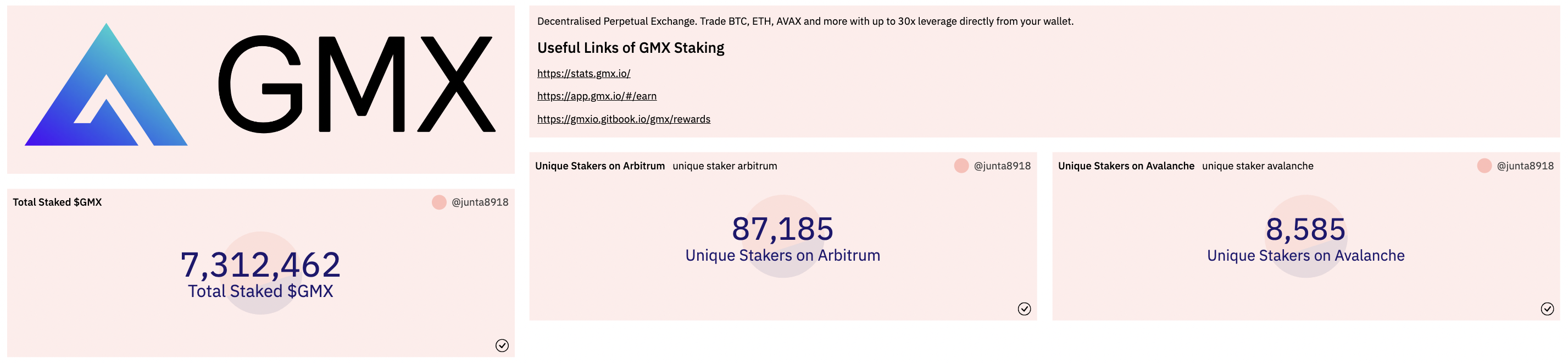

Overview of GMX Staking

Besides, with the extremely smart tokenomic design, the amount of GMX tokens staked on the platform is an extremely large amount. Up to now, the total supply of GMX is about 8.3M GMX tokens according to Coingecko, of which up to 7.3M GMX tokens are being staked, equivalent to nearly 90% of the total supply.

Some articles people can refer to when researching GMX and the Arbitrum ecosystem include:

- What is Delta Neutral? When The Game Is Built Around GMX

- What is GMX (GMX)? Overview of GMX Cryptocurrency

- On-chain Analysis of GMX Project (GMX)

- What is Real Yield? New Breeze For DeFi Market

Some Whale wallet addresses holding large amounts of GMX that people need to keep an eye on include the following wallet addresses:

- 0x3d3323F905077d799A33F62d4800ba7CF11b4408

- 0xEAD57b86f16Bd573b0b37D2b5524812Bfbfd10A5

- 0xddDc546e07f1374A07b270b7d863371e575EA96A

According to on-chain observations of the Weakhand team, a large portion of GMX whales are holding this token at prices below $30 at most.

Dopex – An ambitious project

Dopex is a quite impressive Option platform on Arbitrum’s ecosystem. It can be said that Option products are not suitable for retail or traders like Perpetual, so it is understandable that Dopex is somewhat inferior to GMX. However, with more and more users accessing and learning about Option products; VCs and Whales also use Options in DeFi to hedge their positions. In addition, protocols open Option orders on other protocols to implement the Delta Neutral strategy. We have the right to hope for the future. Option protocols may become even more popular in the future.

Returning to Dopex’s story, there are a few growth drivers in the near future including:

- Launching stablecoin DPXUSD is the next native stablecoin on Arbitrum in the context of the Vesta Finance project’s VST continuously losing peg. Everyone can read more carefully in the article The Mystery Behind rDPX’s 305% Growth. Will rDPX continue to grow?

- Option products are increasingly popular in DeFi.

- Many projects were born to solve liquidity and tokenomic problems for Dopex such as Jones DAO, Plutus.

What impresses me about Dopex is also Dopex’s development team, which is regularly active on social networking platforms and constantly launches new products.

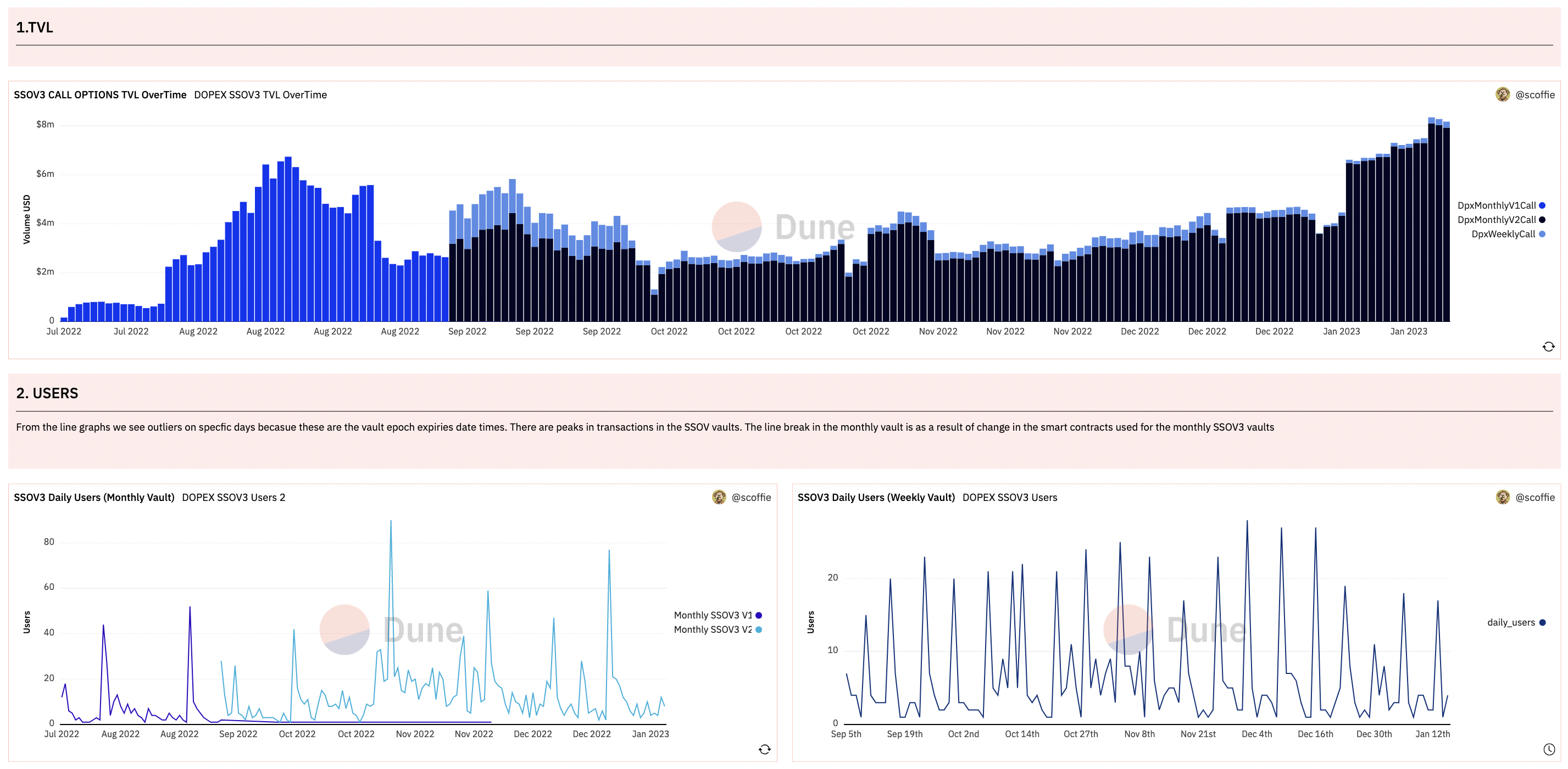

Basic parameters of the Dopex project

Dopex products such as SSOV are experiencing TVL growth recently. Besides, the number of Daily Users is also at an average level but the number is not too impressive.

Rage Trade – Leading the Delta Neutral movement

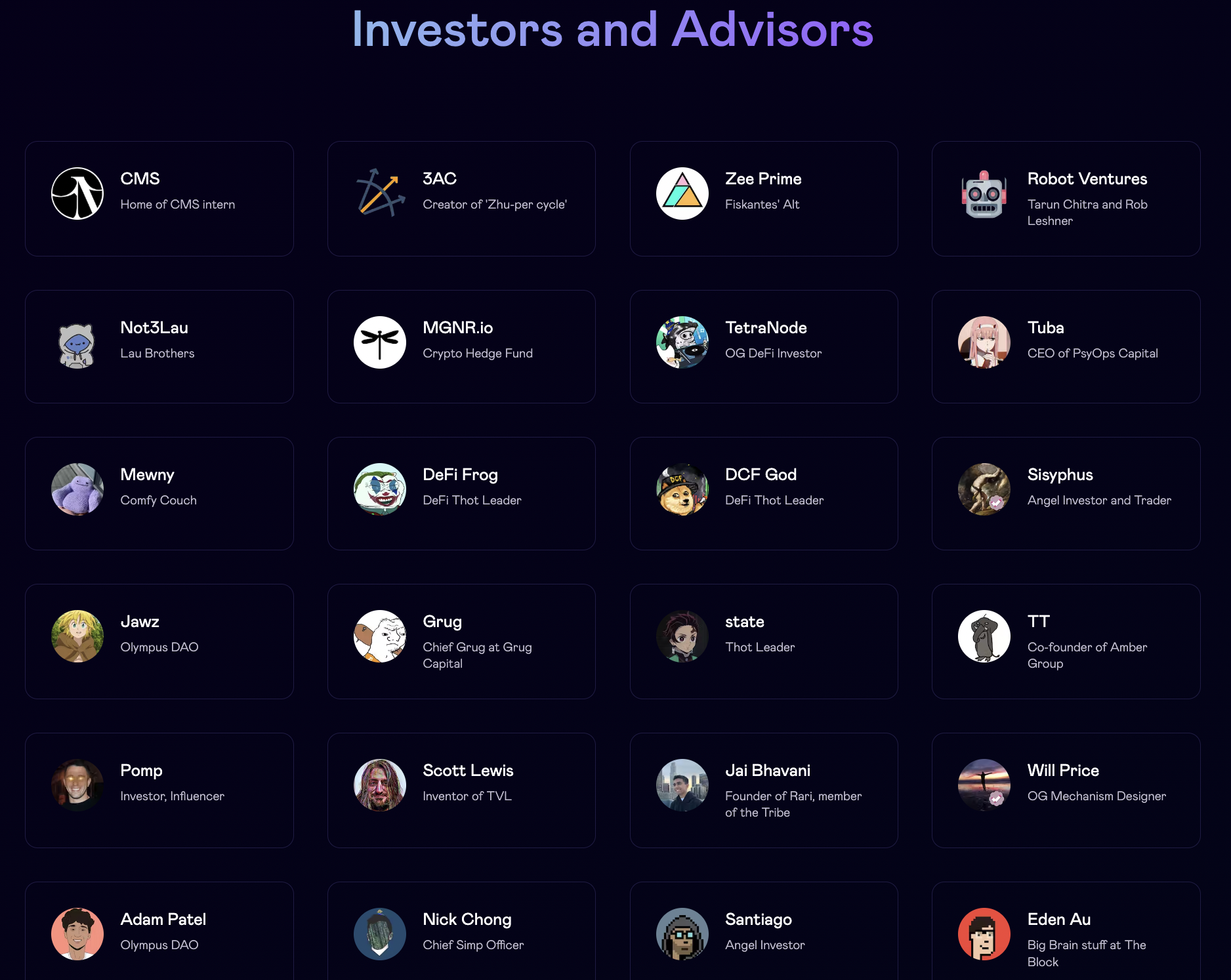

The first thing when I learned about Rage Trade is that Rage Trade’s Investor & Angel Investor team is really special, mainly big names and voices in the crypto community with many products that have conquered the market. market like SushiSwap, Olympus DAO.

Currently, Rage Trade offers two main products to users and liquidity providers:

- Is a Perpetual platform dedicated to ETH with deep liquidity and highest leverage of x10.

- Is a platform that offers Delta Neutral strategies for liquidity providers on GMX and GLP holders.

The most recent product is the announcement of the Delta Neutral strategy to eliminate IL risks for LPs when participating in providing liquidity on GMX with 2 vaults, Risk-on and Risk-off, which has received great reception from community.

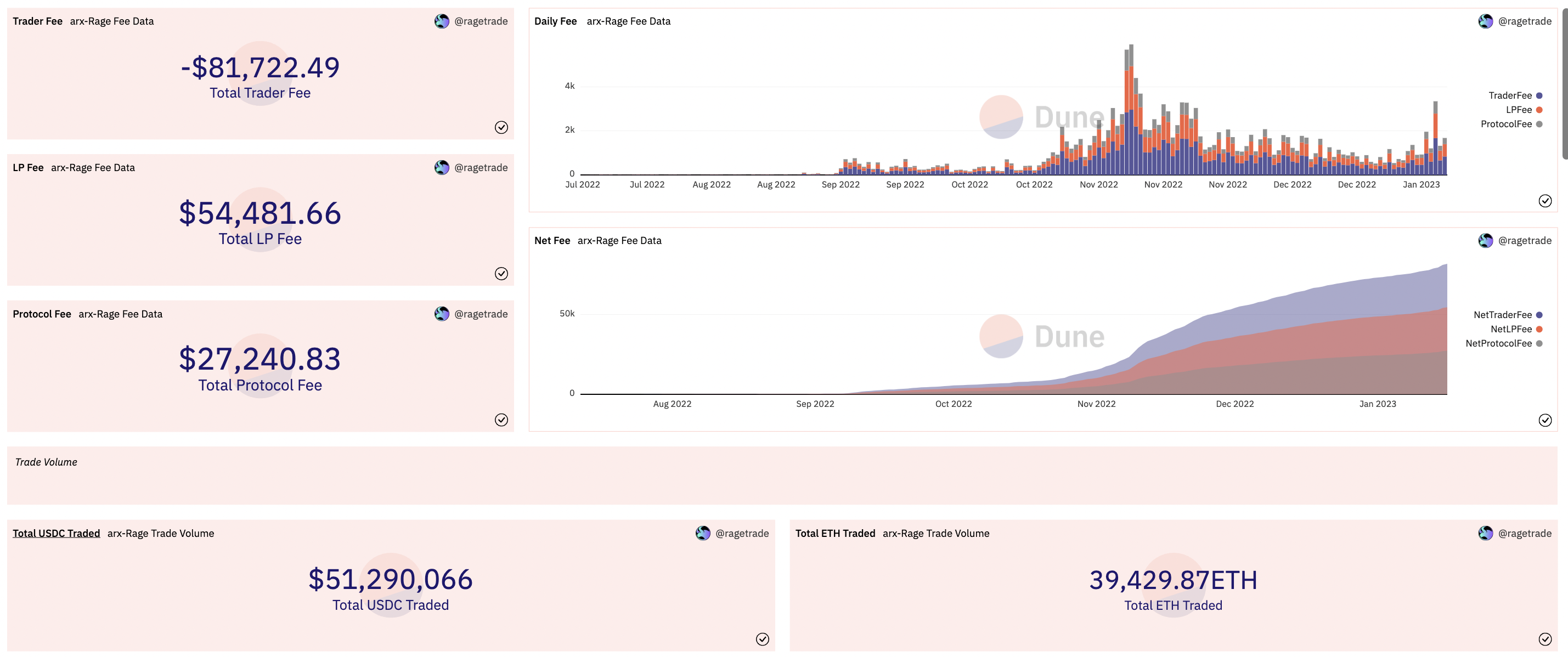

Some parameters of the Rage Trade platform

The number of user activities on the platform has grown again since the beginning of 2023 until now. However, when the market is rising strongly like now, the Delta Neutral strategic product is not working effectively as it continuously shorts BTC, ETH and some other altcoins.

Note that for Rage Trade, this protocol already has a product but has not yet launched a token, so it still has the ability to be retroactive to users.

GammaSwap – AMM carries the Delta Neutral strategy

GammaSwap was born with the mission of using the Delta Neutral strategy in eliminating Impermanent Loss for Liquidity Providers when providing liquidity on AMMs. This project also received very careful attention and care from Arbitrum’s development team.

GammaSwap has also launched the product but it is only in testnet so there is still a chance for you to have skin in the game to have a chance to receive an airdrop from the project.

From my perspective, after Uniswap V3 with its story of liquidity concentration, applying the Delta Neutral strategy for LPs can be considered an innovation for AMMs in the near future.

Orbital – Project backed by Dopex & Plutus

Orbital is a new generation AMM developed on Arbitrum with the backing of Dopexx and Plutus. This project does not have any information yet, but with 2 reputable projects on Arbitrum, this project is also worth looking forward to in the future.

Vesta Finance – The only CDP in the giant Arbitrum ecosystem

Vesta Finance has a similar operating mechanism to Maker DAO where users deposit accepted crypto assets into the platform to be able to mint stablecoin VST. Currently, Vesta accepts collateral types such as ETH, gOHM, GMX, GLP.

However, Vesta Finance is facing a lot of noise with the community when the platform’s stablecoins often depeg slightly at the price of 0.98 or 0.97, so the platform has come up with many options to solve this problem. it has not been thoroughly resolved to date.

Besides, Vesta is also backed by some big names in the crypto market such as Olympus DAO, 0xMaki – Co Founder of SushiSwap, DCFGod and the Darren Lau brothers.

Summary

Above are some outstanding projects on the Arbitrum ecosystem that need to be observed and paid attention to in the near future. There are projects that have launched tokens with relatively clear growth drivers, and there are also a number of projects that have not yet launched tokens with skin in the game opportunities to receive retroactivity.