Dopex is known as an Options project built and developed on Arbitrum’s ecosystem. Dopex used model dual tokens with DPX acting as a governance token, and rDPX acting as a token that rewards losses of Liquidity Providers on Dopex’s platform.

With its mere role as a loss-covering token, rDPX’s growth momentum is very weak, making it inevitable that it will be liquidated by LP. Therefore, Dopex has built a roadmap to add new use cases to rDPX and that also creates growth driver for rDPX now and future.

So what is the construction roadmap and whether rDPX will continue to explode in the future? Let’s find out through this article.

Overview of rDPX

The Mystery Behind rDPX’s Over 300% Growth

In just less than 1 month, rDPX has had a remarkable growth from $15 to more than $45, equivalent to about 305%, even while the market was on a general downtrend. Another special point is that rDPX has steadily decreased from more than $300 to a bottom of $11 throughout 2022 before creating this reversal, so what is the reason behind it? And Do we still have a chance with rDPX?

What is rDPX?

First we need to understand what rDPX is? Then rDPX is a token minted from the Dopex platform that is considered a reward for liquidity providers who suffer Impermanent Loss.

The rDPX problem that Dopex solves

rDPX is minted but does not have a use case, so LPs will often sell to earn stablecoins, creating a steady discharge that causes the price of rDPX to decrease from the beginning of 2022 until now. The biggest strength of rDPX is small supply, small inflation rate, However, because there is no total supply, it also leads to worries among LPs, so it is understandable that LPs do not hold rDPX.

Dopex itself also understands this problem because if rDPX does not have a use case, there will always be selling pressure and the smaller the price of rDPX, the larger the amount of mint issued from rDPX, leading to an increasingly higher inflation rate or if the amount of mint remains unchanged, because the value of rDPX is getting smaller and the rewards are getting less and less, LPs will definitely leave the platform.

Conclude: If rDPX does not change, the Dopex protocol may be at risk of collapse.

Solution for rDPX

It can be said that rDPX’s strong growth in recent times comes from the fact that Dopex’s development team was able to launch rDPX V2 in the near future, possibly in Q1/2023.

In the past, the Dopex development team never mentioned when they would release rDPX V2, but recently, after the Dopex team announced a new product, Metavaults, the community is trusting together again. that rDPX V2 will be released soon and then rDPX increased 300% from its recent bottom.

So what is so special about rDPX V2 that helps rDPX grow so strongly? Everyone, please continue reading with me to the next parts.

Overview of rDPX V2

Launch of stablecoin DPXUSD

All of rDPX’s key use cases will be built around a new native stablecoin, DPXUSD. DPXUSD is built based on the lessons that Dopex’s development team learned from Olympus DAO’s OHM stablecoin building model but with adjustments to suit the current market situation.

Working mechanism of DPXUSD

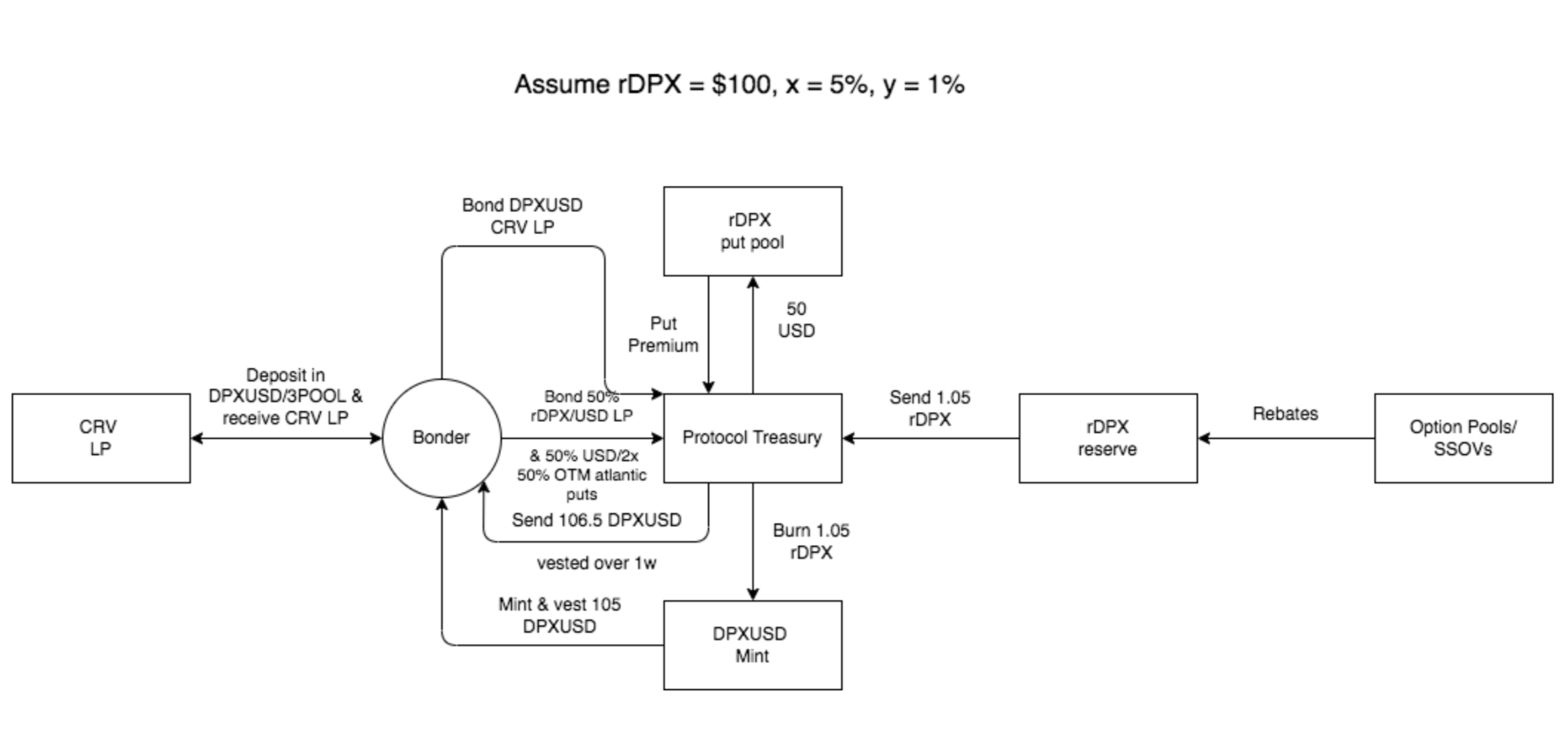

Mechanism of action of rDPX V2

- Users will deposit their collateral into Tresury to be able to mint the stablecoin DPXUSD. Mortgaged assets are divided into 2 types as follows:

- 50% is LP token representing the liquidity pair of rDPX – USD that you offer on Curve Finance, besides that 50% is USD. USD is stable coins such as USDT, USDC, DAI, MIM,…

- RDPX Atlantic OTM put option contract (Not touching the strike price) at a rate 2 times higher than depositing stablecoins according to case 1 above. These rDPX Atlantic put options contracts will be committed to being bought back in stablecoins by the Atlantic Put Pool, eliminating the risk of price drops or loss of liquidity.

- It can be seen that 75% of the total Tresury is USD (the major stablecoins in the market). These stablecoins will be brought to Curve Finance by the platform to provide yield-earning liquidity for Tresury. This strategy is similar to Olympus DAO with the popular term POL (Protocol-Own-Liquidity).

- Besides stablecoins, if the collateral is rDPX Atlantic OTM Put Options Contracts, premiums and profits will be earned from the Dopex platform.

- Tresury will have different strategies to generate maximum profits.

- The DPXUSD minted by users will be discounted with a certain %, depending on the business situation of the protocol at the time of minting. DPXUSD will also be paid in 5-day installments. DPXUSD will also have many different use cases so that holders can generate more profits from DPXUSD.

We will go through two examples to understand the activities and operations of DPXUSD.

Mint DPXUSD using rDPX LP as collateral

- Let’s say rDPX price is at $100.

- A user deposits 1 LP token and 200 USD (can be USDT, USDC, MIM, DAI,… or any stablecoin agreed to be used in the protocol through community voting).

- 1 LP token will include an equal amount of rDPX and USDC. If 1 rDPX is at a price of $100 then the LP token will consist of 1 rDPX and 100 USD.

- In total, users deposited a total of $400 worth of Tresury assets including $100 in rDPX and the remaining $300 in stablecoins. Total user assets deposited into Tresury are equivalent to 4 rDPX.

- The protocol will offer a discount of x%, for example 5%.

- So from $400 equivalent to 4 rDPX with a discount of 5%, the user will receive 4.2 rDPX.

- The protocol will burn 4.2 rDPX and send the user 420 DPXUSD, but will be paid in installments over 5 days, equivalent to each day the user can request 84 DPXUSD.

Share revenue from holding DPXUSD Curve LP

- After the user successfully receives DPXUSD from Protocol Tresury, the user can bring DPXUSD to provide liquidity on Curve Finance to receive DPXUSD Curve LP.

- With DPXUSD Curve LP, users can choose 1 of 2 cases:

- Will merely hold.

- Continue to bring keys in Protocol Tresury.

Both cases receive a revenue share from Protocol Tresury, but locking liquidity in Protocol Tresury gives you more than double the revenue compared to holding it normally. However, this revenue will be paid in DPXUSD and paid in installments within 7 days.

Some Questions Raised With Stablecoin DPXUSD

Is DPXUSD development effective?

Up to now, there are a total of 3 projects working on stablecoins on Arbitrum’s ecosystem including: Vesta Finance (CDP with stablecoin VST), Sperax and Dopex (Option platform issuing stablecoin DPXUSD based on the model operation of Olympus DAO).

Overall, each native stablecoin on the Arbitrum ecosystem still has its own shortcomings, such as Vesta Finance’s VST, which has been de-pegged many times, making investors not really feel secure in this project. SperaxUSD is not really outstanding, there are not many use cases, the background of investors holding stablecon of this project is still quite vague.

Stablecoin VST regularly loses peg

So Arbitrum’s ecosystem still needs a truly strong native stablecon and there needs to be diversity in different types of stablecoins to suit user needs.

The lessons of Olympus DAO remain

Apparently DPXUSD is learning how to build the Olympus DAO product and in the best case the entire amount of DPXUSD Curve LP will be locked in Protocol Tresury to share in the project’s revenue.

So for this model to work effectively, Protocol Tresury must have a large and sustainable amount of revenue. Dopex’s Protocol Tresury revenue source comes from 2 activities:

- Provide liquidity on Curve Finance: This will be a sustainable, steady and safe source of revenue for Tresury.

- Providing liquidity on Dopex: This will be a source of revenue with sudden and strong growth, but is more risky than providing liquidity on Curve.

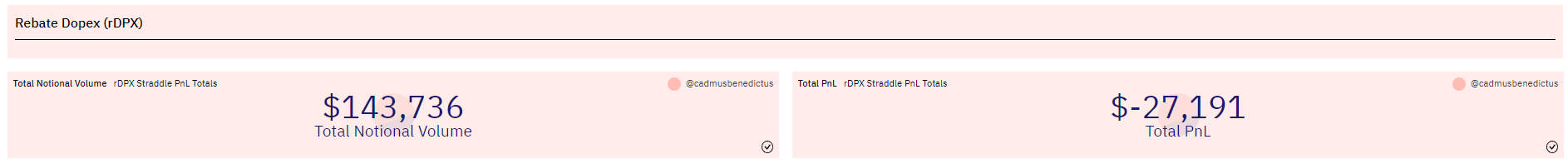

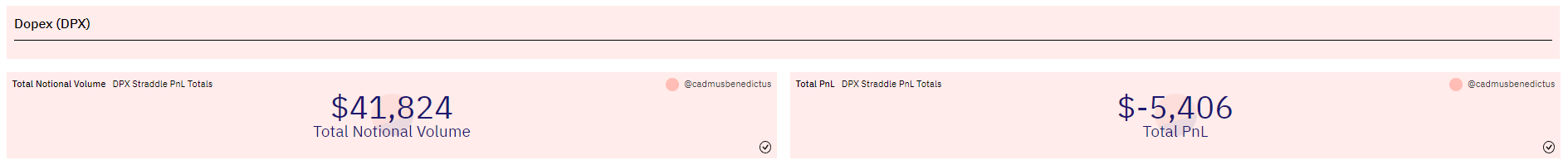

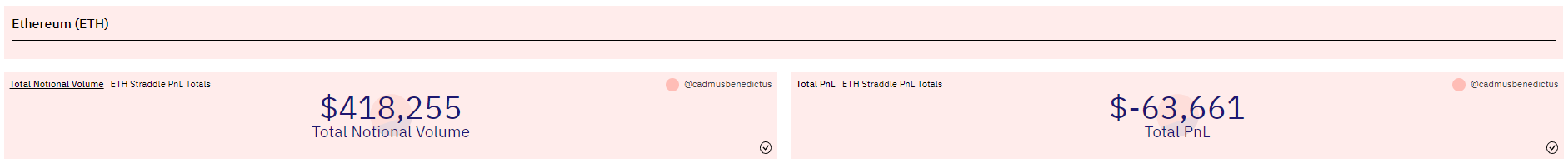

Let’s take a look at some information about Dopex products

Some information from Dune Analytics gives us some temporary conclusions such as:

- The number of users on Dopex products is there but Trading volume is still low Because Option products are often not suitable for retails like Perpetual, they are suitable for investment funds, organizations or whales that need to hedge large investments.

- Contracts opened on Dopex are still mostly at a loss The LP or platform still makes a profit from contracts continuing to be open.

- Dopex’s revenue is definitely not as abundant as other platforms like GMX or Curve Finance.

So that Dopex’s revenue is still a big question mark And when that problem has not been completely solved, it will be relatively difficult to ensure the success of DPXUSD.

What will rDPX’s growth scenario look like?

We will have 1 flyweel as follows:

- At launch, Dopex’s Protocol Tresury offers an attractive APY. The reward here could be the native DPX token itself as up to now there is still more than 50% of DPX that has not been unlocked and Tresury is still holding a large amount of DPX tokens without a plan. Or if it’s even more coincidental, the launch of DPXUSD coincides with Arbitrum deploying the project token, then Dopex can use this token (if any) to deploy incentives for users. There must definitely be an incentive at the beginning to attract investors similar to Olympus DAO with APY up to thousands of percent.

- After users find an attractive yield source, they will purchase rDPX to provide liquidity on Curve Finance, leading to a strong growth in rDPX price thanks to fomo from the community.

- At this time, Protocol Tresury needs to use a truly ingenious strategy to create a large and sustainable yield source and share it with DPXUSD Curve LP holders. The more regular the yield source, the longer DPXUSD Curve LP holders will make DPXUSD’s liquidity sustainable, without selling pressure on rDPX.

- Not only will they continue to reinvest in DPXUSD or buy more rDPX to put into Protocol Tresury, leading to rDPX becoming increasingly scarce in the market and rDPX continuing to increase in price.

Of course this is the best case scenario of a similar protocol to Olympus DAO however here remains the difference of Dopex compared to Olympus DAO because OHM uses itself as staking and rewards for users.

If Dopex used another token with a more moderate APY, there wouldn’t be as much selling pressure as Olympus DAO. However, at the moment there is no official information from the project, so we still need to wait for information to have more accurate projections on how to deploy and attract Dopex users with DPXUSD.

Not clear in terms of use cases

Up to now, with the available information, Dopex’s new product will revolve around Protocol Tresury rather than stablecoin DPXUSD. Therefore, there is not much information about what the use cases of this stablecoin are and what projects it can be integrated into.

Compared to Olympus DAO, most OHM or gOHM are integrated into projects that they directly invest in, so although they operate relatively effectively, their scalability is very poor compared to other stablecoins on the market.

Summary

It can be said that DPXUSD is a completely new game and the dealer this time will not be GMX but Dopex – The next project is likely to list Binance. But whether it’s a game of GMX or Dopex, the people these two platforms focus on are the LPs because LPs bring liquidity and liquidity is the lifeblood of the protocol.

If LP’s risks are minimized, they will continue to provide liquidity to the platform and the platform will continue its development momentum.

It can be said that with DPXUSD, expectations are opening up for a new growth cycle for rDPX or a new profit-making channel for LPs instead of discharging rDPX.