Base is a Layer 2 platform built on Optimism’s OP Stack developed by the Coinbase team that is having its beginnings in building a powerful ecosystem. So what stage is Base’s ecosystem in and what are its notable features? Let’s find out together in the article below.

To better understand this article, people can refer to some documents such as:

- What is Base? Base Cryptocurrency Overview

- Base – Potential Optimistic Rollup Platform Backed by CoinBase

- Velodrome: From Zero To Hero

Current Situation of the Base Network

July 13, 2023: Base officially launched the Mainnet for developers. Developers have begun building DeFi protocols and DApps on Base’s network with a number of available tools such as:

- Block Explorers: Basescan and Blocksout.

- Wallets: Safe Wallet.

- Data Indexers: The Graph, Covalent and Goldsky.

- Developer Tooling: Thirdweb.

- Node Providers: Blockdaemon, QuickNode and Blast.

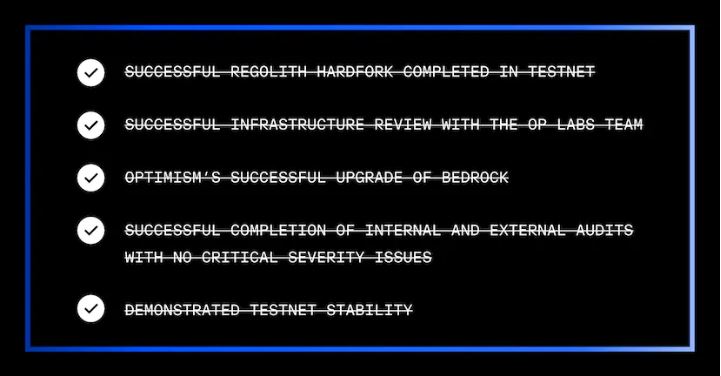

To be able to progress to mainnet for developers, Base has also gone through a number of notable journeys such as:

- Regolith Hardfork was relatively successful, but some incidents also occurred, which also helped Base’s team gain more development experience in the future.

- The Bedrock upgrade also has a positive impact on Base’s network in terms of scalability, withdrawal time, proof of transaction module,…

- Base also passed multiple audits by more than 100 different security researchers.

When participating in building Protocols and DApps, you will receive a number of NFTs representing active activities on the network such as Bronze Tier, Silver Tier and Gold Tier.

The Hopeful Beginning of the Base Ecosystem

The infrastructure pieces are relatively complete

Unlike the time of 2019 – 2020 when Blockchains needed a lot of time to build infrastructure, but now Blockchains, including Layer 1 or Layer 2, no longer take too much time to build infrastructure. infrastructure as integration is now faster and leaner than ever.

In addition to some of the outstanding infrastructure pieces above, there are a few projects on Base including:

- Wallets: Coinbase Wallet, Rainbow, Old Account, Metamask, Choko Wallet, Coin98,…

- Oracle: Chainlink, Pyth Network and UMA.

- Bridge: Hop Protocol, Axelar Network, Wormhole, Celer Network, Orbiter Finance,…

- Dev Tooling: Unlock Protocolm Stackup, Hardhat, BlockPI, SimpleHash, Blast API, Masa, EthOS,…

AMM

One of the most prominent AMMs on the Base ecosystem at the moment is Aerodome. It can be said that this is the Velodrome version on Base. Currently, we see Velodrome’s TVL dominance on the Optimism platform and it can be said that this is one of the most successful ve(3,3) versions to date. However, in terms of transaction volume, Velodrome is far behind Uniswap.

And competition will likely continue to take place on Base’s ecosystem when the Uniswap community has officially approved the proposal to deploy Uniswap V3 on Base. This will not only be a battle between Uniswap and Aerodome but will also involve Multichain AMMs such as Curve Finance, SushiSwap, KyberSwap and many Native AMMs such as Dackie Swap, Blue, Cloud Base, Horizaio, Astro Finance, Base, etc. .

There will be a number of directions for AMMs to develop on Base as follows:

- Use Liquidity Mining to attract liquidity and Release Tokens. This model brings the project up very quickly but also fades away very quickly.

- Use Liquidity Mining to attract and stimulate then plan to reduce incentives to protect protocols. In the long term, projects with reasonable Incentives are often more sustainable.

- Combined with Launchpad for protocol development.

Each model will have a different business model and investment method, so we must soon determine the direction of the project and then have appropriate investment strategies to avoid FOMO on projects with TVL. growing thousands of percent in just a few short days. I have seen a lot of people lose money this way on the Arbitrum ecosystem.

Lending & Borrowing

Among the Lending & Borrowing projects, the highlight I am seeing is the Moonwell project, which is a product of Moonbeam on Polkadot and Moonriver on Kusama. It seems that the Polkadot ecosystem does not have too many users, leading to Moonbeam having to develop multichain to find new opportunities.

Besides Moonwell, there is also the appearance of Decentrium, but this project is not too prominent. In my opinion, with the appearance of AAVE and some other prominent Lending & Borrowing platforms, it is quite difficult for other Lending Pool platforms to beat AAVE.

I only see a small opportunity in the CDP segment as Base will still need a DeFi Native Stablecoin. However, the project needs to push the piece from the beginning before USDC and USDT officially appear.

Derivatives

Currently, in the Derivatives segment, I see two outstanding projects: Volmex Finance and DePerp. However, I see that Volmex Finance has more highlights as this project has successfully called for two rounds, Seed and Pre Seed, during its time. 2021 and 2022 with the participation of IOSG Ventures, Robot Ventures, 3AC, CMS Holdings, Alameda Research, Coral and many other investment funds.

Regarding the product, while DePerp is a basic pure Perpetual platform and a Perp Native, Volmex Finance has some additional features such as:

- Hedging: Allows Traders to hedge Long – Short positions when needed.

- Market Indicator

- Speculation

DePerp’s advantage will be simplicity, convenience and reality. When trying out the two products, I see DePerp will have an advantage in UI UX. We still need to observe because currently Perp platforms play an important role in an ecosystem in retaining Traders like GMX does with Arbitrum or Kwenta does with Optimism.

Additionally, there are a few Derivatives Multichain projects including Panoptic, Cap, and Perenial.

Launchpad

Every time the ecosystem explodes, Launchpad is always at the center, which is how Camelot has attracted cash flow into the extremely strong Arbitrum ecosystem. Similarly, a SparkFi platform is also the first Launchpad project on the Base ecosystem, but in terms of operating model, SparkFi is not too special. We will continue to monitor the project.

Personal Comments About Base Ecosystem

The infrastructure pieces are relatively complete

It can be said that the infrastructure pieces are relatively complete to serve projects on Base. However, among the tools that developers can use at present, I see no presence of Chainlink or any other Oracle like Pyth Network or UMA. Oracle is an indispensable piece for all ecosystems and Base needs to quickly fill this gap.

There have been many Bridges that have begun to support Base, but Base needs support for transferring and withdrawing money directly from exchanges such as Binance, OKX, Bybit,… However, in the context of OKX, it is also building a platform. Layer 2 and Binance also have opBNB, will the competitors be willing to join hands?

Without support from exchanges like Binance or OKX, cash flow will be a real headache for Base in the future.

The DeFi puzzle pieces are still quite fragmented and not yet prominent

The presence of Uniswap V3 and AAVE is also a condition that ensures a good start for the Base ecosystem. However, besides Aerodome, I find it really outstanding, the other projects are mostly multichain projects and not too different from the rest.

In addition, Base’s ecosystem has not shown connection with projects. Looking back at recent outstanding ecosystems, we see that:

- Optimism bets on Perpetual with a lot of support from Perpetual and the Synthetix ecosystem with special projects like Kwenta, the remaining projects in the ecosystem do not stand out. In addition, Velodrome also became one of the leading projects on Optimism.

- Arbitrum is built around GMX because GMX’s design allows developers to build projects on top of GMX itself.

What direction do you think Base will develop in the future? How Base is projected to develop will affect the way we invest, so it is necessary to observe Base very carefully in the initial stages.

Summary

Base is off to a great start with the support of many leading DeFi and Infastructure projects on Ethereum. However, everything is still in the beginning process and needs more monitoring in the future.